Good morning!

What an extraordinary week, with a panic market sell-off, followed by several days of extremely volatile moves up & down, and now it seems a strong recovery (for now anyway). A big upward revision in US GDP figures certainly helped, and also I noticed that the price of oil jumped sharply, which has triggered oil shares having a good bounce - which is positive for the main Indices of course.

On the trading front, it's been a very successful week for me - when things started looking wobbly, I protected myself with some large cap short positions last week, closed them at roughly the right time early this week, and went heavily long of good quality, oversold US large caps. It's worked a treat, but I closed off all my large cap US longs last night, as they have rebounded as I expected, so the purpose of the trades has been achieved.

Of course if you really are still nervous, then now is the time to be selling stuff - after prices have recovered, not panic selling when prices have crashed. So I'm having a thorough review of my portfolio, and chucking out bits & pieces that I don't have conviction in. That's a really good discipline, and it frees up money for new, better purchases.

Large caps

I must admit, my recent short-term trading in liquid US stocks, has really got me interested in doing more work on US large caps. They are wonderfully liquid, and the great thing is that you can take bigger than usual positions, then sell them at any time, if you change your mind, or if the market takes a turn against you. With IG Index you can trade US large caps from 9am UK time, to about midnight (or a bit beyond, I think), and I have found that these much longer trading hours greatly improve opportunities to react to newsflow.

Liquidity

Contrast that with the lack of liquidity in small caps. When the market went really wobbly on Monday, a lot of small caps were almost impossible to deal in any size. So the big risk with small caps is that you may not be able to exit, even if you want to. That's fine if markets recover, and it might actually be helpful, in preventing you from panic selling at the bottom! But what if markets had continued plunging? It would have been absolute carnage in small caps, once the selling began in earnest, once heavy selling meets little to no buyers.

I've been pondering this overnight, and of course it dramatically skews risk:reward in favour of large caps, especially in volatile markets. However, the illiquidity of small caps can also work to your advantage - when they put out really good news, it can be impossible to buy in size. So the people who really benefit are existing holders, as the price shoots up.

Gearing in volatile markets

I was damaged most in 2007/8 by combining gearing with illiquidity in small caps, so it's a mistake I'll never make again. I cannot emphasise enough, or too frequently, how it can be financial suicide to gear up in illiquid & speculative stocks, as when things go wrong, the door is bolted shut from the outside - you can't sell. So if you hold the shares on typical 25% margin, a 25% fall in share price (which can happen in one day in a big sell-off!) will wipe out 100% of your equity. A 50% price drop ... well let's not even go there, but you'll be selling your house fairly soon after.

This week has reminded me in a powerful way that we cannot rely on markets being stable. At times they go haywire, and this week was nothing compared with a real major sell-off, such as 1987, or some of the worst days in 2008. I vividly remember the panic sell-off when Bear Sterns ran into trouble, then Lehmans was absolute carnage in the autumn of 2008 - just violent across-the-board selling which fed on itself, and destroyed any remaining geared longs.

People often ask me what my memories were like of the market meltdown in 2007/8. What I remember most clearly, is the frustration of not being able to sell my big positions in small caps. It was impossible. Then margin calls forced me to sell in dribs & drabs, which drove the prices down 10% each day at the worst points, which then in turn created an even bigger margin call! So it was really a death spiral created by having over-sized, geared positions in small caps, and then being a forced seller. The only way to shift large positions was to negotiate with a buyer, via my broker, who would be demanding a 10-20% price discount, if you could find a buyer at all.

Also, bear in mind that in severe market turmoil, the Spread Bet and CFD companies will often jack up their margin requirements. So you can be onside one morning, with your positions margined at 25%, only to wake up with a gigantic margin call, as they've hiked you up to 40% margin, or more, on small caps. That happened to me several times in 2007/8.

Also, as market caps fall, shares can drop down into a lower mkt cap banding for margin, so if stocks of over £100m market cap are margined at say 20%, but ones below £100m at 40%, then you become a forced seller once the mkt cap drops to say £110m, as you need to get out of the stock before they double your margin requirement on it, on the next 10% drop in price.

So the trick is not to gear up on small caps. Instead, if you own them outright, you can ride out any market downturn.

I think it's also a very good discipline to set yourself a limit for position sizes. I now do this by looking at the Normal Market Size (NMS) for every share, and only buying a maximum of between 5-10 times the NMS. Alternatively, look at the typical daily volume in a share, divide it by 5 or 10, to reflect a very quiet day, and then use that as a limit for your maximum position size. That way, if markets turn ugly, you should still be able to exit in one or two days, and live to fight another day.

Overall, gearing is best avoided altogether. Or if you must use it, then manage the risk very carefully, and only ever on very liquid shares. For most people gearing is the road to ruin, sooner or later, so it's really best avoided. Better to get rich slowly, and survive the downturns, than to shoot for the stars and blow yourself up.

Lavendon (LON:LVD)

Share price: 176p (up 6% today)

No. shares: 169.6m

Market cap: £298.5m

(at the time of writing, I hold a long position in this share)

Interims to 30 Jun 2015 - this company's last trading update was on 17 Jul 2015, which I wrote about here, concluding that it was reassuring but unspectacular, when the shares were 187p. That was shortly after both Speedy Hire (LON:SDY) and HSS Hire (LON:HSS) had warned on profits (and of course HSS has warned on profits again this week). So equipment hire seems to be a surprisingly wobbly sector at the moment - when you would have expected it to be buoyant, what with the building sector doing well.

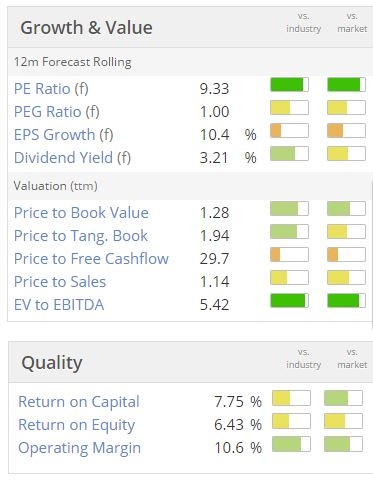

I was a bit sceptical on 17 Jul 2015 about the more cautious tone of LVD's update, which made me feel they were not as confident as previously. This has been reflected in small forecast reductions from brokers, as presumably the company has briefed them to be a bit more cautious? Here is Stockopedia's neat little graphic on broker forecasts - note the falls in Jul & Aug 2015;

Revenues are up 1%, which is in line with the trading update last month.

Operating profit is more impressive, being up 13%, driven by a "notable improvement" in UK margins, up 220bps to 15.2%. UK is the most important country for Lavendon, being 47% of turnover.

Growth should come from investment into increasing the rental fleet, which is mentioned several times in the narrative. I like the emphasis the company places on achieving ROCE targets for new capex - a disciplined approach which would please Warren Buffett, who places great emphasis on management being efficient at capital allocation.

ROCE is quoted as 12.7%, up a strong 210bps against H1 last year, which is encouraging. Given how cheap bank debt is, it's clearly worthwhile expanding if you can achieve that reasonably good return on capital.

Balance sheet - what a difference to the ropey, debt-laden balance sheet of HSS Hire (LON:HSS) which I looked at yesterday. Memo to the PE boys & their advisers who floated HSS at an over-valuation, and with a lousy balance sheet earlier this year: look at Lavendon's balance sheet - this is how you should have done it.

Net assets of £221.5m reduces to £149.2m after taking off intangibles, so the mkt cap is a P/NTAV of exactly 2.0, which is a sound valuation in my view.

Current ratio - looks healthy to me at 1.38

Debt - for hire companies, I like to see net debt at no more than half of tangible fixed assets (i.e. like a Loan To Value (LTV) calculation for buying properties). In this case, net debt is £96.8m, which is only 39.4% of tangible fixed assets. That seems a nicely conservative level of funding, and leaves scope for spending more on capex without stretching bank borrowings beyond a safe level.

Overall then the balance sheet gets a big thumbs up from me. There's no risk of this company getting into financial trouble, in my opinion - which is very different to HSS Hire (LON:HSS) whose debt position is excessive, and potentially dangerous in my view.

Outlook comments sound fine, with the key bit confirming they are trading in line with expectations;

Trading since the half year has been in line with our expectations and, whilst mindful of the re-emergence of some uncertainty in the economic outlook, the Board remains confident that the Group is well positioned to deliver both its expectations for 2015 and substantial shareholder value over the medium term.

Valuation - it sounds as if the company is likely to achieve broker forecast, although they've left a bit of wiggle room with the comment above about "re-emergence of some uncertainty", so I think there might a risk of a mild profit warning later this year perhaps? That could be why the shares are on a relatively modest rating;

Given that it's got a strong balance sheet, the PER of 9.33 looks good value, although there is that risk of the company not quite hitting those earnings estimates.

Divi yield seems reasonable at 3.2%, and should grow over time - there's been a smashing progression of divis since 2010, rising in big jumps each year, although those increases are now moderating, but still good.

ROCE - note that the Stockopedia computers have a much lower ROCE than noted today in LVD's narrative, so they must be worked out differently.

My opinion - I like it (that's why I own some!). It looks a sensibly-priced, cheap even, equipment hire company, which concentrates on a niche in powered access equipment. We do have to be mindful that this type of business is cyclical, and is benefiting from a buoyant UK construction sector. Although it should at some point also benefit from improved conditions in Europe.

It's surprising that the shares haven't re-rated in the last couple of years, as the company's performance has been reasonable over that time, and the outlook sounds OK.

I think this looks a reasonably good time to buy actually, but I am a little worried about the outlook comments, so it's not one I'll go into too heavily.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.