Good morning! This morning's small caps space is dominated by news from three smaller recruitment companies.

Filtronic (LON:FTC)

Share price: 17p

No. shares: 106.9m

Market Cap: £18.2m

Profit warning - not again?! Yes, unfortunately it's yet another profit warning from this maker of telecoms equipment. The investors who stumped up £2.1m in a 22p Placing in Nov 2014 won't be best pleased, one imagines. Repeated disappointments will probably make it more difficult for the company if it needs to raise money again.

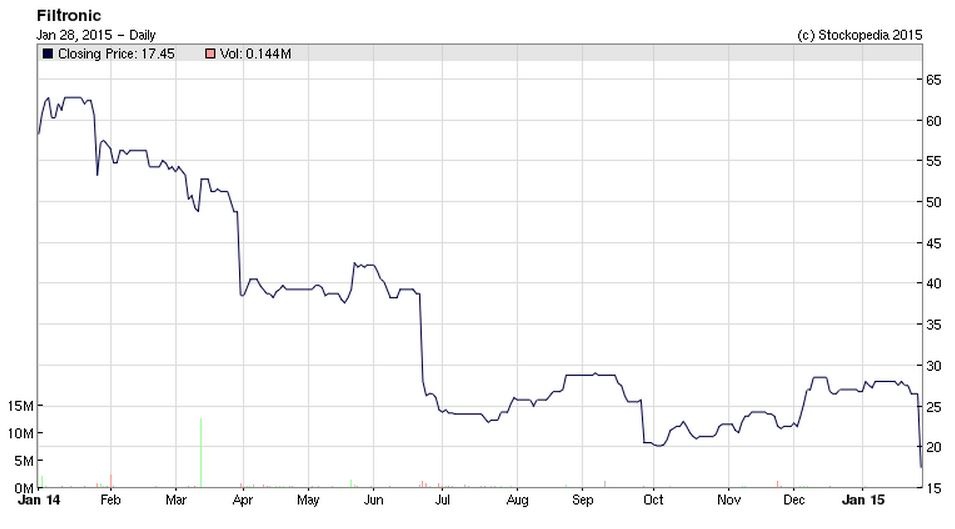

The chart looks a bit like a descending staircase, with each step down being a profit warning - so it looks as if there have been five disappointments in the last year;

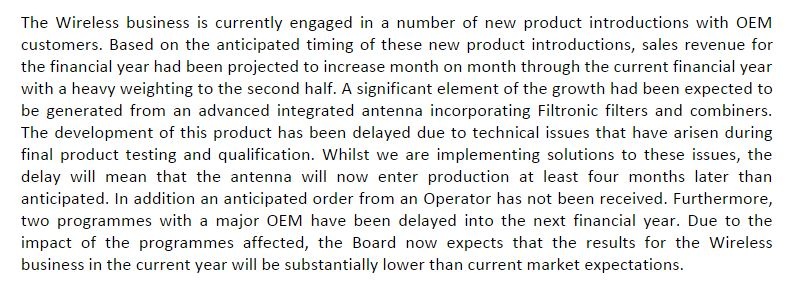

The wireless division has had production delays for a number of new products, so production is starting four months later, plus other contracts have been delayed or orders not received. This has resulted in the company today saying that;

"...results for the Wireless business in the current year will be substantially lower than current market expectations."

This is bad news because, checking back to the last set of full year results (y/e 31 May 2014), the Wireless division is by far the more important of the two divisions, generating 70.4% of group turnover, and all the profit.

Their Broadband division has traded "slightly below the level we had expected", so that's not too bad.

Outlook - the company tries to sound upbeat in its outlook statement today, but given serial disappointments, I'm not sure how much faith can be put in this statement;

"Despite these setbacks, we remain confident in our strategy and the sales growth potential from the qualified OEM products we are supplying and are continuing to develop. This should lead to a much improved trading performance over the medium-term."

My opinion - I've been sceptical about this company for a while now, as it seems so accident-prone. The balance sheet looks OK though, although it was surprising that they needed a £2.1m Placing in Nov 2014.

It's not clear to me that there is a viable business here, based on current performance. However, if the company's confidence in its medium-term prospects turns out to be well-founded, then who knows, the disappointments of the last year could be a buying opportunity?

It's too much of a gamble for me, I'd rather wait until the first positive trading statement, and pay a bit more, than try to catch a falling knife.

Networkers International (LON:NWKI)

Share price: 62.5p (up 13.6% today)

No. shares: 84.1m

Market Cap: £52.6m

Trading update - a positive-sounding trading update today says that H2 was "much improved" compared with H1. This seems to have been expected, as overall the company says that performance was "in line with management expectations".

Takeover bid - more importantly, a separate announcement from competitor Matchtech (LON:MTEC) indicates that they have agreed with the board of Networkers a bid valuing it at 67p - representing a 22.5% premium over last night's closing price, or a 28.6% premium to the last month's average share price.

The bid is half in cash (34p) and the balance in MatchTech shares.

It's a done deal, as agreement has already been secured from holders of 72.9% of Networkers shares.

My opinion - Is 67p a fair takeover price? I would say yes it is, but only just. It's about 13.4 times 2014 forecast earnings, which is about the right price that most smaller recruiters are valued at (or below). Owning some MatchTech shares instead is better, as the enlarged group will have more liquidity in the shares, and Matchtech is a good business in my opinion, so it's no hardship swapping some Networkers shares for Matchtech shares, and getting half out in cash is a nice compromise in my view.

Matchtech (LON:MTEC)

Share price: 505p (down 4.3% today)

No. shares: 25.0m

Market Cap: £126.3m

Trading update - as well as bidding for Networkers today (see previous section), Matchtech has also updated on its own trading. This company seems to focus on engineering staff, so there is a worry that it might be affected by the downturn in the oil & gas sector, which I think also affects Networkers too, but am not sure how major (or not) a part of their businesses are O&G related?

Anyway, Matchtech today says that it has continued to see strong demand for engineers in the UK, and worldwide. It confirms that trading is in line with full year expectations (note that the year end is 31 Jul 2015, so they are half way through).

Valuation - Stockopedia shows broker consensus earnings expectations at 41.0p for this year, so at 505p the shares look reasonably priced on a PER of 12.3. It's key to look at net debt too, as some recruiters have a heavy burden of debt, which can make the low PER look unduly flattering (because a company with lots of debt should have a low PER).

Balance sheet & net debt - modest net debt of £3.1m was reported at the last year end of 31 Jul 2014. The balance sheet is one of the best I've seen for a smaller recruiter - with £39m net tangible assets, and a £37.5m surplus on net current assets (working capital). The current ratio is very good, at 2.06, and there is no long term debt.

Therefore the cash element of the Networkers acquisition, of £28.6m could probably be funded through debt, without unduly stressing the balance sheet. I've checked the takeover document, and in note 11, the company confirms that it is financing this deal with a £30m term loan from HSBC, which looks fine to me, as the two businesses combined should generate enough cashflow to handle this level of debt.

This is a good example of how a strong balance sheet can be geared up a little, and thereby enhance returns for shareholders - since this acquisition will be earnings enhancing.

My opinion - overall this deal, and today's trading update, look encouraging to me. Matchtech has a StockRank of 95, which helps give me confidence that my positive analysis is probably on the right tracks.

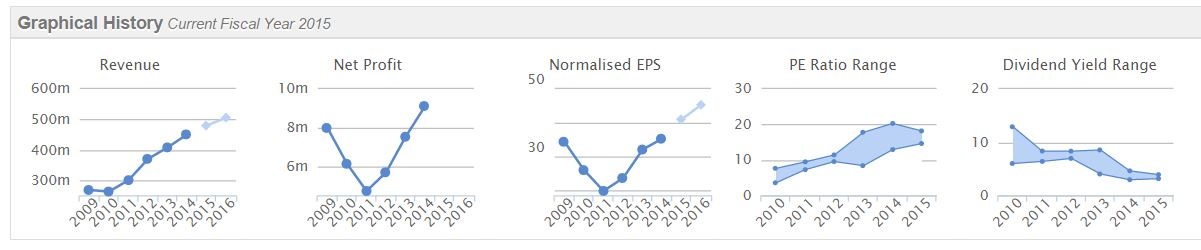

It seems anomalous that MTEC shares are at a 12-month low this morning, despite positive trading, and a sensible acquisition having been announced. MTEC pays a decent divi too, of about 4%. As you can see below, the company has a good track record in the last 4 years anyway, and this has been achieved without the issuing of many new shares, so the benefit of growth is flowing through to decent increases in EPS;

Staffline (LON:STAF)

Share price: 788p (up 8% today)

No. shares: 27.7m

Market Cap: £218.3m

Full year results - for the year ended 31 Dec 2014. The figures look very good - adjusted EPS has come in at 60.0p, a whisker ahead of broker consensus at 59.6p.

The outlook & Directorspeak sounds positive to me, and a strong start to 2015 is flagged.

Political uncertainty - with a general election looming, and issues like zero hours contracts, low pay, etc being (rightly) high up the agenda, I think it's probably safest to keep this share on my watchlist at the moment. Although on a conference call this morning management emphasised that they see opportunities whichever Government is elected.

Balance Sheet - is weaker than I would like, with net tangible assets negative by £15.8m. That's not necessarily a problem, as debt is being reduced quite rapidly after a large acquisition (of Avanta) in mid-2014.

My opinion - whilst things are going well at Staffline, and the shares are reasonably priced, I can't shake off my unease about this whole sector - staffing agencies are effectively assisting employers in driving down wages, and undermining employees' conditions & rights. The taxpayer ends up picking up the tab, whilst companies increase their profits, and the overall impact of these trends are socially divisive and unpleasant. That just doesn't seem right to me.

I'm not blaming Staffline for this, but it seems to me that at some point, staffing agencies are likely to be whacked with legislative changes which will swing the pendulum back towards companies being forced to pay people proper wages that are adequate to live on, and give employees back the basic rights & protection that they should have. So you have to wonder about the long-term sustainability of earnings at staffing agencies, and price the shares accordingly (i.e. on a low PER).

On the other hand, the Employability division of Staffline seems to be successful at Govt sponsored schemes to get the long-term unemployed back into work, and the company has plenty more work that it is tendering for on that front.

Staffline seems well-run, and is delivering on the planned growth. Shares have fallen back somewhat in the last six months, probably because of the political concerns which I refer to above. Although the company's financial results have been strong.

Share-based remuneration - one other detail which I should point out is that substantial amounts have been paid in share-related remuneration. These are ignored for the purposes of adjusted profit, which is wrong in my view.

Share awards are remuneration (a form of bonus), so they should be accounted for as such. Once you adjust for that, then profit comes down a considerable amount - these are material figures - nearly £3.7m in 2014, and £2.2m in 2013, which look excessive to me. That is 19%, and 17% of profit, respectively, that is being paid out to Directors & staff in share-based payments. That's too much in my view.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in MTEC, and no short positions. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.