Good morning! Well no profit warnings for me this morning, so far, so that's a good start. Ramridge posted an interesting comment after yesterday's report, saying that he'd crunched the numbers, and according to an EY report, 2014 was a record year for profit warnings, and the rate is about 15% - so if you have a portfolio of 50 shares (roughly what I have) then you should expect 7-8 profit warnings per year.

If you invest more in small caps, then the profit warning rate will probably be higher, because smaller companies usually have less earnings visibility, and can be heavily dependent on a few contracts, customers, staff, etc (e.g. Thorntons (LON:THT) this morning saying that their fall in FMCG sales is down to one customer).

This got me thinking about the margin of safety. With markets now fully, or over-priced for many, maybe most, small caps, I am increasingly firming up my view that it's dangerous to pay such high prices for stocks, because you then have no margin of safety if/when something goes wrong.

Also, if 15% of your stocks are going to warn on profit, then you have to be sure that the other 85% have enough upside potential in them to more than make up the shortfall. So if you're paying toppy prices for fashionable stocks with strong momentum, where is your upside going to come from? More momentum? So what happens when momentum eventually breaks? I think it could get very messy when eventually buying the dips stops working.

With us only days away from the start of "Sell in May and go away", made worse by General Election uncertainty this year, I'm thinking about putting a self-imposed ban on opening any new long positions, and possibly trimming back a little on existing long positions, and maybe opening or increasing a few of shorts on over-valued stocks.

What do readers think? Do you follow the (statistically proven) sell in May approach? Comments in the comments, below.

Benchmark Holdings (LON:BMK)

Share price: 82p (down 26% today)

No. shares: 219.3m

Market Cap: £179.8m

Profit warning - if the share price drops sharply on a trading update, I rename it here as a profit warning, for clarity. Shares in this fish medicines group have dropped sharply this morning, although they've bounced somewhat from the initial spike down to 71p in early trading this morning. Bad luck to anyone holding this share - a lot of my friends are in this one unfortunately.

I reviewed the 2014 results here on 27 Jan 2015, for anyone interested, and concluded that it was too complicated and uncertain a situation to be able to value the share with any degree of certainty. Hence it didn't interest me.

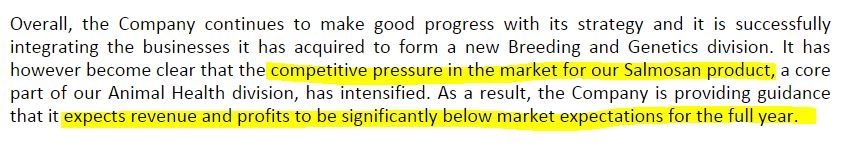

The key part of today's statement says;

Looking back at 2014 results, the other divisions were all loss-making, so if your cash cow is withering away, then there's a problem.

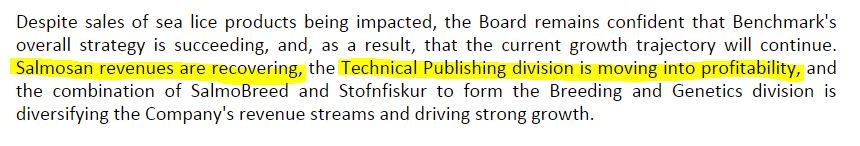

Outlook - the Directorspeak sounds a bit more positive;

My opinion - I remain of the view that it looks way too complicated for me, and would need a lot of detailed research to understand all the moving parts, and then try to estimate what their prospects are. That's far beyond my pay grade - I usually like simple, easy to understand, profitable companies, on a reasonable PER, so I'll pass on this one.

Thorntons (LON:THT)

Share price: 80p

No. shares: 68.9m

Market Cap: £55.1m

Trading update - as is usual when reading updates from this chocolate company, I'm wondering "is this another profit warning, or not?" as I read it. Today's update came close, but I think on balance is not a profit warning - because it gives no comment on trading vs expectations. So that usually means a company is near enough to expectations.

Although it is sufficiently downbeat for me to wonder whether this is a deferred profit warning, if Q4 doesn't perform well (it's a 28 Jun 2015 year end).

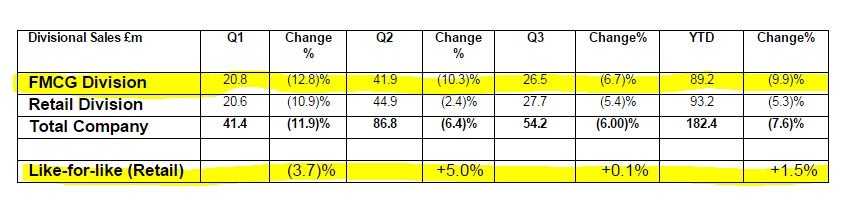

The company provides a useful table, which I have highlighted for the two key rows;

(please also note the recent reduction in highlighter wobbliness. This has been achieved by adjusting my mouse to move a lot more slowly!)

As you can see, the problematic FMCG division saw sales down 6.7% in Q3, but is showing an improving trend, from heavier falls in Q1 (-12.8%) and Q2 (-10.3%). Interestingly, the narrative says that the Q3 fall is entirely down to reduced orders from just one customer.

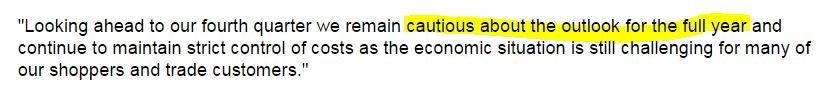

Outlook - re-reading this, it does sound like a deferred profit warning to me, so I'm expecting them to miss the full year forecasts;

My opinion - this company is really only marginally profitable - forecast for this year is £210.3m turnover, and £4.4m net profit, and it sounds like they might not even manage that.

The balance sheet is weak, and the strategy of diversifying into FMCG doesn't seem to be working - not surprisingly, those pesky supermarkets are squeezing out the profits - that's what they do! More so now, than ever, as their own profits have collapsed.

There are no divis, and it has too much bank debt, plus a pension deficit.

I can't see any appeal to these shares at all, unless you think some kind of new turnaround strategy might emerge? I'd be surprised if this company still exists in 5-10 years' time - just my opinion, as always please DYOR.

Servoca (LON:SVCA)

Share price: 24p (up 14% today)

No. shares: 125.3m

Market Cap: £30.1m

Trading update - another good update from this staffing company;

Checking back to interims to 31 Mar 2014, they weren't great, with a profit before tax of only £410k (before £73k amortisation, and share based payments), £337k after. So I would very much hope that a £30.1m market cap company would be significantly ahead of those figures at half time this year!

The full year last year was much better, with £1,703k profit before tax & amortisation/share based payments, so it seems a heavily H2 weighted year, 24%:76% last year, so a very heavy seasonal weighting to H2.

Therefore it seems to me that shareholders shouldn't get too carried away with today's statement, since it's effectively saying that they are a long way ahead of a small number in H1 of last year.

There is no comment about full year expectations, others than the generic "continued progress", so that suggests to me that broker forecasts are probably best left alone. That puts it on a PER of 15 times this year's forecasts - seems pricey for a small staffing company.

I'm not sure why you would buy this on 15 times, if you can buy Staffline (LON:STAF) on about 11 times revised forecasts? So I suppose that buyers/holders must presumably expect earnings to rise a lot more in future.

Real Good Food (LON:RGD)

Share price: 41p (up 28% today)

No. shares: 69.6m

Market Cap: £28.5m

Major disposal - this food business has announced the disposal of its Napier Brown subsidiary, for £34m cash + working capital. This is a highly material deal, and seems to fix the group's wobbly finances - eliminating net debt.

The company announced on 1 Apr 2015 that Napier Brown was up for sale, together with a profit warning. Since NB was 60% of group turnover, the big question is what will be left behind after it's gone, and will it be any good? Will the buyer be taking some or all of the pension deficit with it?

Ah, I've just found the answers - Part 4 of today's document gives pro forma accounts excluding Napier Brown, which is very helpful. The pro forma balance sheet looks pretty good actually, with a healthy current ratio of 1.89, and £5.0m debt which will no doubt be repaid from the £28.1m pro forma net cash.

So it will be debt free, but the £4.7m pension fund deficit remains.

As regards profitability, the pro forma company made an operating profit of only £93k for the 6 months to 30 Sep 2014, but made £2.7m profit for the year to 31 Mar 2014. Presumably there could be cost savings by reducing the central overhead too.

Anyway, at least shareholders won't now have to worry about this company going bust, nor dilution from a fundraising.

My opinion - overall the pro forma figures look quite reasonable actually, much to my surprise! So I am taking this share off my Bargepole List, since it has now fixed its wobbly balance sheet, and is something I would no consider investable.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.