Good morning! Fairly quiet for results & trading statements today, but here's a review of what has caught my eye.

Staffline (LON:STAF)

These shares had done very well, along with most other recruitment & staffing agencies, on the back of a recovering economy. Staffline also does interesting work on the Government welfare to work scheme, where they are paid by results if they manage to re-train the long-term unemployed and place them in proper jobs.

On the downside, rightly or wrongly STAF has been implicated in several recent exposes of questionable practices by employment agencies, which introduces potential risk, and has certainly hit the share price quite hard since the >600p highs late last year. Also, there is now (rightly) increasing political pressure to raise Minimum Wage, and stop exploitation of unskilled workers (e.g. zero hours contracts) who are currently being paid wages which are too low to give a reasonable standard of living, certainly in the South East anyway where housing is so expensive.

Doing some Googling also throws up examples of other problems - such as workers at a Hovis factory striking because of the company's use of cheap temps from Staffline. So this could be an increasingly difficult area to operate in, as in a recovering economy workers might be more inclined to dig in their heels, rather than be exploited for Minimum Wage?

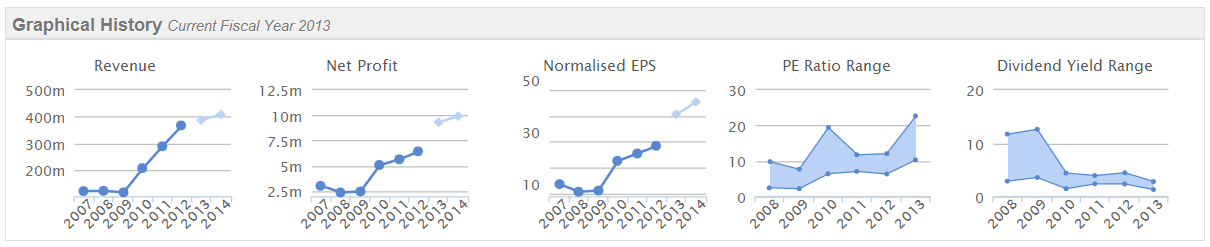

Staffline's results for the year ended 31 Dec 2013 are released today, and I'm impressed with their prompt reporting schedule - which is indicative of strong financial controls, being able to publish preliminary results just 29 days after the year end. The figures look good - adjusted operating profit up 15.6% to £12.8m, adjusted EPS up 21.6% to 46.1p, total dividends up 23.5% to 10p, and they moved into net cash of £4.9m (2012: net debt of £4.6m).

Therefore at 492p the shares look good value, on a PER of 10.7 and a dividend yield of 2.0%. The result for 2013 seems to be well above analyst expectations, so I would imagine these shares are likely to have a strong day today. Also, the company's financial track record in recent years has been impressive, and the welfare to work side of the business is a gradually increasing stream of income, as the up-front costs to Staffline being to pay off with subsequent payment by results.

Renew Holdings (LON:RNWH)

This is an infrastructure support group, which I've reported on positively in the last year, including a last mention here on their interim results published on 26 Nov 2013. It's a low margin business, and the main problem is the horrible Balance Sheet - current assets are £85.4m, whilst current liabilities are £117.6m, that's a yawning deficit of £32.2m. The percentage is 72.6%, whereas I normally look for 120%+. The additional £7.2m of long term liabilities is not helpful either.

Writing off intangibles takes their net tangible asset position to negative £26.7m, which is dreadful. Someone commented yesterday that I'm obsessed with Balance Sheets, which I took as a compliment, because it's the key way to measure risk. Nobody is saying that a company with a weak Balance Sheet is suddenly going to go bust, but it very much heightens the risk - so that if something else goes wrong, the existence of the company can be hanging by a thread (look what happened to Silverdell, which had a fairly weak Balance Sheet, although technically it was actually stronger than Renew's, with positive net tangible assets, but Silverdell relied on flaky bank financing, instead of customer financing that Renew uses). Similar sectors of operations too, in part.

The item of concern here is "trade and other payables" of £112.3m at the last reported Balance Sheet date of 30 Sep 2013, which looks extremely high, so I need to check what's in that figure in their 2013 Annual Report. The breakdown is given in Note 15, as follows;

The line that concerns me greatly is the £67.3m "accruals and deferred income". Accruals are costs that have been incurred, but not yet invoiced by suppliers. Deferred income is where a customer has paid cash up-front, in advance of a service being provided. So in an ideal world, you should see a corresponding £67.3m cash balance, but actually net cash is only £2.8m.

So what this means is that Renew is financing its business on up-front payments from its customers.

That's fine as long as they can keep it rolling. But if for any reason contracts change, and customers become less inclined to make large up-front payments, then Renew could face a disastrous cash crunch. I am very surprised that this risk has not even been mentioned in the "Principal risks and uncertainties" section of the Annual Report, on page 31, because actually it is by far the largest risk facing the business, in my opinion.

So before I could invest here, I'd have to find out which customers have made these large up-front payments, and what certainty there is that they will continue for the foreseeable future? We're in a bull market where many (most even?) investors are blissfully unaware or completely ignore risks like this, so I don't suppose it will stop the shares going up, but I think people are actually taking a lot more risk than they realise with this share.

This probably doesn't matter in the immediate future, as current trading is good, with the company saying in today's trading statement;

Trading for the first quarter of the year has been strong and well ahead of the comparative position last year. The Board expects this to continue through the second quarter of the financial year and, as a result, that the results for the year ending 30 September 2014 to be much more evenly weighted between first and second half than hitherto.

More colour is then given on the various divisions, all of which sounds positive. The order book is up 27% to £433m. The final flourish says;

Reflecting the profitable trading, cash generation in the first quarter has also been strong. The Group's net cash position together with its strong order book enables the Board to look forward with confidence to further profitable growth.

So all sounds great, and the shares are up 19p to 199p. The elephant in the room being the horrible Balance Sheet, is currently being completely ignored by the market, but it's too big an issue for me to consider investing here.

Mobile Streams (LON:MOS)

This is the biggest faller of the day, currently down 34% to 42.5p on a trading update.

I've commented before on this being uninvestable for me, because a lot of its operations & cash are tied up in Argentina, with restrictions on currency movements. They mention that in more detail in today's statement, and devaluation of the Argnetinian currency is causing them problems. They don't expect to meet market expectations for the year ending 30 Jun 2014.

It just looks dreadful to me, I cannot understand why anyone would take the risk of getting involved in an investment like this?

I see that Mulberry (LON:MUL) has tumbled 26% today too. It's not a small cap any more, but looks like it might be heading back down our way again if current share price trends continue - it's down 72% since May 2012 - I find it remarkable how so many high growth, fashionable shares subsequently fail to live up to elevated investor expectations. Which makes me more convinced than ever that keeping my feet firmly on the ground with solid, reasonably priced companies is far more sensible than chasing the latest growth story up to a bonkers valuation.

Gotta dash, heading into town again for more meetings. I'm turning into a commuter!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.