Hi again - it's Graham covering Monday updates.

Not too many names reporting today but I'll start with Sprue Aegis (LON:SPRP), FDM (Holdings) (LON:FDM) and Fidessa (LON:FDSA).

Edit: prioritised XP Power (LON:XPP) instead of Fidessa (LON:FDSA) following a request.

Cheers

Sprue Aegis (LON:SPRP)

- Share price: 232.5p (-3%)

- No. of shares: 45.9 million

- Market cap: £107 million

I was a a bit too cautious on this fire alarm manufacturer as the recovery continued and the share price has made great gains.

It's now nearly double the April 2016 low. (The high in 2015 was 350p).

Issues with suppliers and overstocking caused the problems in 2016, and appear to have been dealt with.

As such, the full year result is expected to be in line with expectations.

As announced on 15 June 2017, Sprue has made a positive start to the year and for H1 2017 expects to report sales of approximately £26.0m (H1 2016: £25.9m) and operating profit* of approximately £1.5m (H1 2016: operating loss of £0.9m before share based payments charge). The strong return to profitability has been achieved through a significant improvement in gross margin and a net reduction in overheads.

Sounds great. The problems did indeed prove to be temporary.

The operating profit figure is a bit misleading, however, as the company routinely adjusts for share based payments. It should stop doing this, in my view (or pay bonuses in cash instead of shares).

Sprue has been investing for the future and remains on track for its longer-term ambitions.

The StockRank is 74, thanks to good contributions from Quality and Momentum.

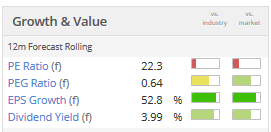

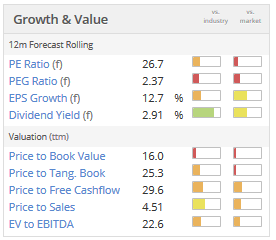

Value is a bit thinner and indeed I'd argue that the positive EPS Growth and low (cheap) PEG ratio below don't help, as last year's results were artificially lower (based on one-off problems).

If you trust the company, it could still be worth paying up for, of course. Maybe it's a QARP stock (quality at a reasonable price)?

XP Power (LON:XPP)

- Share price: £26.375 (+6.4%)

- No. of shares: 19.2 million

- Market cap: £506 million

This creeps over the half a billion pound mark thanks to another strong set of returns.

XP designs and manufactures a wide range of power components for healthcare, defense/avionics and railway/transportation industries.

From my notes earlier this year, I see that growth was reported to have accelerated during Q1., following on from a very solid full-year result (PBT up 9% in 2016).

So that brings us to the H1 2017 result.

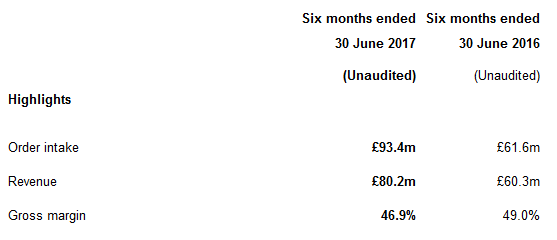

Top line is great and has indeed accelerated, with a slightly weaker margin:

Result: PBT up 12% to £14.4 million.

If you exclude the cost of aborted acquisition efforts, the result would have been a lot better (adjusted PBT up 32% to £17.3 million).

Results presentation is very clear: sterling weakness is responsible for about 45% of the revenue growth.

While there is an element of externally-designed products, own-design products are growing at a spectacular rate and are 75% of total revenues.

Given that it's an order-driven company, the diversification sounds ok: the largest customer is 10% of revenue and is spread over 120 different products and services. So hopefully it's not susceptible to huge shocks in demand.

Outlook is now ahead of expectations:

While we remain conscious of potential macroeconomic challenges, our strong order book, combined with designs won in 2016 and prior years entering production means that the Board now anticipates the Group’s performance for the full year will be comfortably ahead of its existing expectations.”

My opinion: I was impressed by this company when I first started covering it here and that hasn't changed. It's vertically integrated and appears highly competent in managing its own manufacturing lines in China and Vietnam. And the Vietnam site is being expanded in response to the heavy demand of late.

You also get a quarterly dividend stream, something not terribly common but which I'm in favour of.

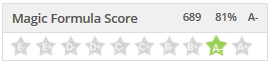

Joel Greenblatt would approve: the Magic Formula score is excellent (see returns on capital of 25%!) and the StockRank is 89.

So I'm going to continue looking very favourably at this.

FDM (Holdings) (LON:FDM)

- Share price: 871.1p (+9.6%)

- No. of shares: 107.5 million

- Market cap: £936 million

This is well outside our market cap limit but seems like one of the more interesting stories today with the shares up almost 10%.

FDM is an IT services provider in markets like PMO (project management office), business analysis, data and operations services, testing, etc. It says it is the UK's leading IT graduate employer.

The idea is to offer clients low-risk, temporary IT consultants to solve specific problems (these consultants, known as "Mounties", are permanent employees of FDM,).

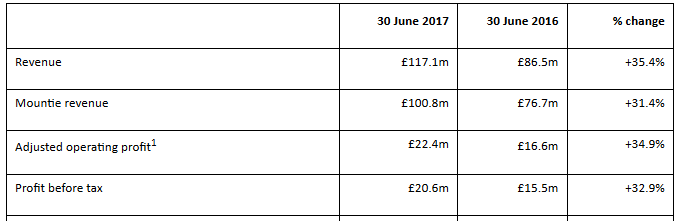

A nice table of highlights:

The currency tailwind fortunately was responsible for a minority of the gains. At constant currencies, revenues are still up by 24% and PBT 30%.

It appears to be outperforming the recruitment consultants on the quality scores, with mammoth returns on capital and on equity.

It's now a FTSE-250 stock and if strong growth in North America (56%) and APAC (137%) continues, it will almost certainly be remaining in the 250 for the foreseeable future. New geographical expansion in the latest period included Australia, Spain and Portugal.

Highly rated, given the premium on growth these days:

The number of permanent employees working at client sites has been growing steadily over the last year, from 2,452 (June 2016) to 2,705 (December 2016) to 2,947 (December 2016).

There are no balance sheet worries as far I can tell, due to a strong net cash position, cash conversion close to 100%, and very limited investment requirements (£2.6 million spent on investing activities over the past 18 months, financed by £44 million in net cash flow from operations!)

My opinion

Probably worth a look, despite the high valuation. StockRank is 97.

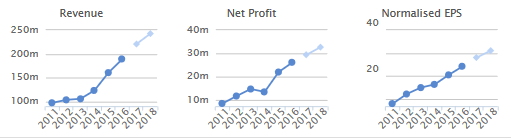

The long-term trends tell a great story: revenue, income and EPS all rising for the past several years. Rising EPS demonstrates how the growth has been achieved without any material change in the share count.

That's all from me for now. I hope you had a good day in the markets!

Graham

Stop the press:

Late announcement of a conditional cash offer for Revolution Bars (LON:RBG) at 200p per share (RNS).

The Board of Revolution Bars Group plc ("Revolution" or the "Company") announces that it has received a conditional proposal (the "Proposal") from Stonegate Pub Company Limited ("Stonegate") to acquire the entire issued and to be issued share capital of Revolution on a recommended basis at an offer price of 200 pence per share (in cash).

The shares were 125p last night so congratulations are due to those who've been buying in during the recent bout of weakness (even if the proposal doesn't go ahead, it's a good sign!)

Congratulations also to Paul, who six days ago said that it was worth "200-240p/share, based on a takeover multiple". Wow!

Hi, it's Paul here.

Just thought I would add a few more comments to Graham's excellent report above.

SRT Marine Systems (LON:SRT)

This share is down 22% today to 34p. The reason being a profit warning, caused by a major project being delayed.

Although the RNS doesn't specifically state this, I understand that this particular contract is the biggest one in the pipeline - being up to $100m, but back-ended to the 3rd year of implementation.

...postponement is due to internal project review and budget issues in their current fiscal year... is expected to recommence during the end customer's new fiscal year which begins on 1st March 2018... However with an indeterminate restart date and therefore payment date it is right that we maintain a prudent accounting approach and make a full provision at this time.

However I note the clear and formal commitment from the end customer to this project and to move forward with it during 2018. Thus this remains a very significant pending project for SRT."

I suppose this is an inherent risk with any company that relies on overseas contracts with Governmental bodies. Project delays are bound to happen, and very often, as nearly all Governments are subject to numerous competing demands on state spending.

In terms of financial impact, the company says this;

The net effect of this will be an exceptional profit and loss account impairment charge of £1.5m in the current financial year (Year ending 31st March 2018). This figure includes the write back of associated accrued project costs such as equipment as well as all Directors bonuses that were accrued but not paid in the last financial year. (Year ending 31st March 2017). The associated net receivable of 2.2m is written off within this impairment charge. Upon recommencement of the project these monies will be paid, contractual deliverables completed along with associated revenues.

The way I read that, it sounds like the Directors are foregoing their bonuses which were previously granted, but not paid. So that's a good thing, and a decent move by the Directors, if I've understood that correctly.

It also suggests upside in the accounts, if and when this project recommences.

My opinion (Paul) - it's interesting that when things go wrong, there is often some inkling given previously that something was up. In this case, I reported here on 7 Jun 2017 how the auditors had shown concern over a 14 month old debtor, and a contract delay. So I think investors must now be kicking themselves that they didn't use that as an exit point at 54p per share.

There have been repeated contract delays & problems with SRT, over quite a few years. Yes, I feel sorry for management, as these delays are not their fault, but that's life. Today's announcement seems material, and is likely to push back the supposedly major revenues (and hence profits) from a large contract, by a significant amount.

With such uncertainty, I cannot see the attraction of this share. It's always jam tomorrow, and then repeated disappointments. So why get involved? I like businesses where things are simple, and predictable, which is not the case with SRT. So I think the share still looks too expensive. There might be upside eventually though, if the big contract does re-start.

Utilitywise (LON:UTW)

It's yet another profit warning from this utilities cost consultant. The share price is down 19% today, to only 48%. Readers here will know that I've been very unhappy with its accounts for years. Our archive here contains the detail on my previous articles.

The latest problems have been triggered by a new accounting standard, called IFRS15. This relates to revenue recognition. The upshot is that UTW will have to adopt a more conservative approach - i.e. recognising revenue later, and at a reduced amount (80% instead of 85%). The company is adopting the new accounting standard early, it says.

It should be emphasised that these are bookkeeping & reporting differences, that won't have any impact on cashflow. There's a lot more detail given in the update today.

Dividends - the generous divis were probably the only sensible reason to hold this share, but it cannot now pay any divis until distributable reserves have been created;

Accordingly, the Board hereby announces that it will not declare a final dividend in respect of the year ended 31 July 2017, which would ordinarily have been payable in December 2017, subject to shareholder approval at the Annual General Meeting (AGM). This is due to the fact that the Group will have insufficient distributable profits out of which to pay a dividend. Furthermore, the Group will not be in a position to declare interim or final dividends in respect of subsequent financial years, until such time as it has sufficient distributable reserves out of which to make such payments.

This seems a glitch, which could be rectified by applying to the court to create a distributable reserve. This is an administrative matter, so should be fixable.

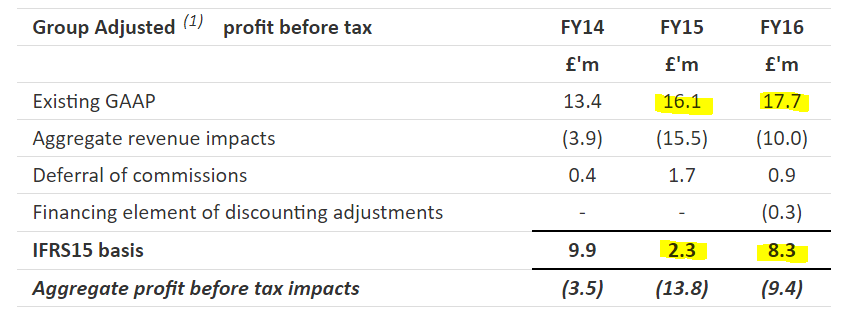

Impact on profits - various tables are given, to show the impact of these accounting adjustments. This one caught my eye;

As you can see above, the impact on FY15 profits is enormous - the originally reported £16.1m profit, is almost wiped out, to just £2.3m.

The impact in FY16 isn't quite so drastic, but still sees profits more than halved.

There will be corresponding reductions in the bloated receivables figures on the balance sheet.

Tax impact - sounds positive, and looks like the company won't have to pay corporation tax for a while, if I'm reading this right;

It is expected that the aggregate reduction in net assets as at 1 August 2017 will be tax deductible in the year ended 31 July 2018, being the financial year in which IFRS 15 is adopted by the Group. It is expected that the associated aggregate corporate tax recovery will occur during FY18 and FY19.

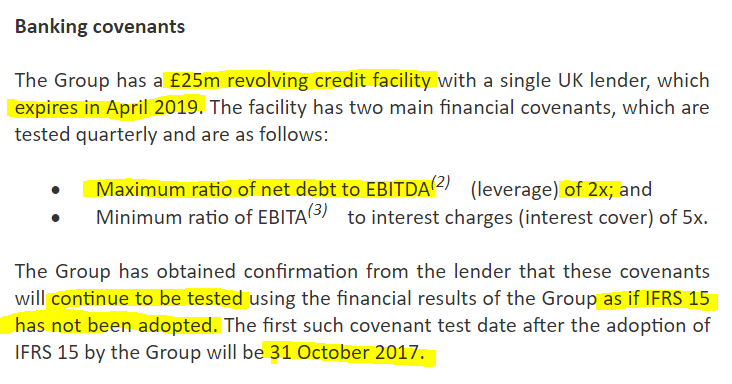

Bank covenants - my rule of thumb is to usually run for the hills, once companies start even discussing banking covenants. Maybe I'm too cautious, as it's extremely rare for banks to pull the plug on stock market listed companies?

This is what UTW says about its current banking position;

It seems helpful that the bank is prepared to disregard the new accounting treatment, but surely that is only a temporary measure?

That EBITDA multiple convent of 2x looks potentially problematic. Also, the bank facilities are due to expire in less than 2 years. Would a bank really want to renew facilities, when there's been a material question mark over reported profits? I don't know, but wouldn't particularly want to take that risk by owing this share.

Note that I reported here in Apr 2017, how some previous accounting issues were flagged as likely to cause a nasty cash outflow in H2, and hence a peak in bank borrowings.

My opinion (Paul) - it's difficult to avoid the conclusion that this company hasn't really made much money at all in the past. A lot of the historic profits seem to have come from imprudent accounting policies, which the company is now being forced to correct.

A lot of investors forget that profit is not a black or white figure. There is often a wide range of possible profit figures which any company could report. This is because profit depends often on a whole range of assumptions & estimates. So an aggressive FD can flex the numbers around to suit the requirements of the CEO, and shareholders.

Cashflow is much harder to manipulate. When a company Inflates its profits, it leaves a trail behind, for us to spot, and follow. Profit in the P&L is a Credit, so the way double-entry bookkeeping works, there has to be a corresponding Debit on the Balance Sheet. That will normally be cash - because the customer has paid for the goods or services. However, if no cash has been received, then the only alternative is to book the Debit entry somewhere else on the Balance Sheet.

Normally, this will be either somewhere in Receivables /Debtors, or Intangible Assets (or it could be a negative entry in creditors). So all you have to do, to spot inflated profits, is to carefully scrutinise all the Debits on the Balance Sheet. In both the cases of Globo and Quindell, it was blindingly obvious that the profits had been overstated, as their Balance Sheets were groaning with unusual, and out-sized assets - in receivables/debtors, and intangibles. Those debits were largely fictitious obviously.

Some of Utilitywise's receivables also turned out to be fictitious, which I reported on here in Jun 2017, when it had overstated assumptions about energy usage by clients.

Where does it end? UTW's profits have been shown to be at best, dependent on aggressive accounting policies, and at worst, could be considered largely fictitious. No wonder Directors overall have been massive net sellers of the shares, over the years.

Where do things stand now? As I see it, the company's profits are highly dubious. However, you could argue that its debtors should eventually be received, as the parties owing the monies are the large energy companies.

Will today's announcement be the last skeleton in the cupboard? Or could there be even more accounting issues to come? I might have been prepared to have a punt on it, as a special situation, if it was debt-free, and had a nice pile of cash in the bank. However, sadly that's not the case - it is heavily reliant on bank support. For me, that's a deal-breaker. Why risk a possible 100% investing loss, when you don't have to? Can the company & its management actually be trusted? I don't know (although I'm leaning towards a clear "no" to that question).

So where there's any doubt, I just don't get involved in things like this any more. This share has been a disaster to date, and you'd have to be brave or foolish, or both, to get involved now, in my view.

Revolution Bars (LON:RBG)

(at the time of writing, I hold a long position in this share)

Possible bid at 200p in cash, from Stonegate Pub Co - an acquisitive pub group. Funnily enough, I reviewed the accounts of Stonegate recently, as part of my work to check out the new CFO of RBG, Mike Foster. His previous employer was WalkAbout, the Aussie-themed bars, which did a CVA to extricate itself from some onerous leases. It struck me that Stonegate seemed to pay a very generous price for WalkAbout, although I didn't have complete information - i.e. what profits would be post the CVA.

It struck me at the time that RBG would make an obvious fit for Stonegate, and would be a lovely, cheap way for them to bolt on perhaps £15-20m EBITDA for £100m at a share price of 200p. So as mentioned in this report, I saw a takeover bid as a distinct possibility. Although it's always something of a bonus when these things actually happen. Luck is part of the outcome, and it would be wrong to deny that.

The question people are asking me on Twitter, is whether I'm going to sell in the market on the likely uplift in price tomorrow? Probably not, although I reserve the right to change my mind at any time, without warning.

I threw away a potentially magnificant gain, by selling Lavendon far too early, on the the initial bid. Only to watch it zoom up, on rival competing bids. That's unusual though.

RBG stacks up on 200p, in my view. The business is a fabulous cash generative, self-funding roll-out, which was dirt cheap. I have no idea why the stock market completely failed to "get it", but there we go.

Mind you, I can't be too smug, as this possible 200p bid could fall through (I doubt it though, it sounds reasonably well advanced). Also, it's only recouping losses from something that went wrong in a profit warning in May 2017. The profit warning wasn't too bad though, so selling was clearly the wrong thing to do back then. I don't mind mild, fixable profit warnings, at companies which have no net debt, as is the case with RBG.

A friend also reminds me that the 200p possible bid is only the same as the IPO price in Mar 2015.

I don't think there is any point in bars groups listing on the stock market - investors have too many preconceptions & bad experiences with the sector. So better to steer clear of the stock market, and achieve more value in a trade sale, as is likely to happen here.

I might sell half my shares in the market, but will wait to see what the share price does first. Arguably share price strength (say 190p+) might indicate that there's more upside to come? (a higher, competing bidder is not out of the question).

I'll leave it there fortnight.

Regards, Paul, and Graham, for the first half :-)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.