Good morning!

It's a similar pattern to yesterday - the FTSE100 is down slightly, but small and mid caps are down a lot today - MCX is down 2.6% to 15.695 at the time of writing (mid-morning).

Housebuilders & property were hit yesterday by poor June construction figures. I'm no expert on this, but surely the mostly very poor weather in June would have contributed to this? Answers on a postcard please, from any statisticians out there. Would builders suddenly down tools and stop building a house, just because of the referendum? London still resembles a giant building site - with an extraordinary amount of construction underway. It doesn't make sense to me, that construction activity would suddenly stop, but maybe I'm missing something?

I note that Persimmon (LON:PSN) (in which I hold a long position) has released a positive-sounding trading update today. With an average selling price of £206k, combined with ultra-cheap mortgages, and strong demand, personally I really don't see a significant downturn in this type of housing as being at all likely. Mind you, as Persimmon says today, it's too early to tell what impact the current political turmoil is going to have.

IG asked me to pop into their office above Cannon Street last Friday, and waffle on about small caps in their in-house TV studio. The video is here, for anyone interested. As anyone who knows me will verify, I very much enjoy waffling on about small caps, without seemingly the need for drawing breath, for hours, given half the chance! One small error needs correcting - I meant to say that Somero Enterprises Inc (LON:SOM) has a share price in sterling, but I mis-spoke and said incorrectly that it reports in sterling.

I've got investor lunches every day this week, so am not going to be able to cover all the results statements, but will do my best. Also, sometimes I update the articles later in the day. So last night I added a new section on results from Plastics Capital (LON:PLA) to yesterday's report. Here is the link to review that report.

Staffline (LON:STAF)

Share price: 802p (up 0.3% today)

No. shares: 27.7m

Market cap: £222.2m

(at the time of writing, I hold a long position in this share)

Trading update - covering the 6 months to 30 Jun 2016. This staffing group is a recent addition to my portfolio, at around the current price. As mentioned in my IG interview, I cannot see any valid reason for the shares having halved from their peak in Nov 2015. The business model here is mainly supplying temporary, blue collar workers, to large clients. It also does welfare to work programmes. I really don't see this business model suffering particularly, as would be suggested from the brutal sell-off in the shares. So it looks a potential bargain to me.

Thankfully, this idea is reinforced by a solid trading update today;

The Group has made excellent progress in the first half of 2016, with trading in line with expectations.

That's all very good, but what's the outlook like? We've already had several staffing companies warn on H2 profits - Prime People (LON:PRP) and Interquest (LON:ITQ) for example.

Outlook comments sound strong to me;

As noted at the Group's AGM in May, Staffing has continued to perform well with strong demand for its services from both new and existing customers.

Furthermore, to date, there has been no change in demand following the recent EU referendum vote and the Group continues to source record numbers of workers to supply this demand.

Our Employability division, PeoplePlus, has achieved an encouraging performance, with the improvement of the Work Programme contracts now clearly showing through.

The Board continues to view the Group's growth prospects positively...

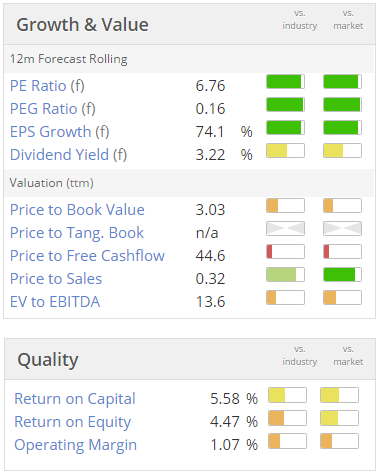

Valuation - the PER looks strikingly cheap, for a well-managed group.

Although I would draw attention to the flimsy balance sheet, with negative NTAV, following an acquisition spree last year. That's not ideal.

Overall though, I think this one looks overdue a decent rebound in share price, following a sector-wide sell-off recently. FinnCap's latest forecast (out this morning) is for 111.1p EPS in 2016, and 116p in 2017. Their forecast also shows cash generation reducing debt quite rapidly, and the group moving into net cash in 2018.

Perhaps the market is worried about labour availability drying up, with E. Europeans returning home? Personally I think current market nerves could be a good buying opportunity.

The key question with all shares at the moment, is whether the recent falls in share prices correctly factors in a slowing economy? It only takes a small downturn in the economy to potentially do a lot of damage to company profitability, due to the effect of operational gearing. Nobody knows to what extent the economy is likely to slow. Opinions widely differ on this.

Connect (LON:CNCT) - an update today from this distributor says that it's trading in line with expectations. It reassures that its markets are "large and resilient". Brexit has introduced some uncertainty, and this company also says that it's too soon to judge the impact on their business.

Johnson Service (LON:JSG) - an encouraging update today, from this group which is now mainly textile hire (with dry cleaning being a much smaller part of the now larger group);

We will deliver another strong result for the first half of the year reflecting both an encouraging underlying performance together with the benefit of acquisitions over the last twelve months. We expect the full year results for 2016 to be slightly ahead of expectations.

I was a bit concerned that debt was getting too high, but it sounds as if the position is improving on that front;

Net debt at 30 June 2016 was slightly lower than management's expectations, following the purchase of Zip, Afonwen and Chester. We remain on target to return to gearing of not more than 2x by the end of the first quarter of 2017.

(2x presumably means 2x EBITDA)

Shares in this company absolutely collapsed in the last recession, although it was a very different group then. If we are heading for a deep and/or prolonged recession, then textile hire for the hospitality sector is probably not a good area to be in. Therefore I would exercise caution with this one, especially if you are bearish about the economy overall.

The problem with textile hire, is that if it's branded, then it becomes worthless when the customer goes bust. So in a downturn there could be some big write-offs, which I've seen before with textile hire companies. So it's not for me.

£G4M (I hold a long position in this share) - interesting stats from this online retailer of musical equipment today;

· 191% increase in European like-for-like sales in the first full week following the UK's EU Referendum vote, from Monday 27 June to Sunday 3 July.

· Compares favourably to a 120% increase in European like-for-like sales in the week preceding the EU Referendum vote, from Monday 13 June to Sunday 19 June.

· European sales supported by favourable exchange rates and responsive pricing.

That's only a snapshot of 2 weeks' figures, and I don't know what the geographic split is. Although on the face of it, this looks positive.

Sorry, run out of time for now. I'll try to update with a few more sections later today.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.