Good morning!

I was tempted to have a duvet day today, as it's fairly quiet for news. Although rummaging through the RNS, there's enough of interest to justify putting fingers to keyboard.

Johnson Service (LON:JSG)

Share price: 92.3p (up 0.3% today)

No. shares: 330.6m

Market cap: £305.1m

AGM statement (trading update) - the key message reassures:

"As announced on 29 April 2016, all of the Group's businesses continue to trade in line with management's expectations...

The group is growing through acquisitions:

We are particularly pleased to have completed the earnings enhancing acquisitions of Portgrade Limited (Afonwen) and Chester Laundry Limited (Chester Textiles) at the end of April 2016, which will complement the acquisitions of Ashbon and Zip that have also been completed since our last AGM. The integration of all of these businesses is well underway and in line with our plans.

Although the balance sheet is becoming stretched, with (in my view) too much debt, and an inadequate tangible net asset base (it was negative when last reported). See my report here on 1 Mar 2016 for more details.

Although I note that the most recent acquisition was part-funded with a placing to raise £28.5m.

The outlook comments sound fine:

We remain confident in the prospects for the full year and in the longer term outlook for the Group.

My opinion - it's easy to grow earnings through acquisitions, especially when debt is cheap, and the economy reasonably buoyant, as it is now. However, when the next recession strikes, things might become a lot more difficult.

The main business is now supplying linen on hire to the hospitality sector, so it's a fairly cyclical business, with many customers going bust in recessions.

When you take into account the debt, the valuation looks about right to me.

Trinity Mirror (LON:TNI)

Share price: 120.5p (up 6.6% today)

No. shares: 283.5m

Market cap: £341.6m

Trading update - covering the 4 months to 1 May 2016.

The trading environment for print advertising continues to be volatile. We continue to focus on the delivery of our strategy, namely growing our digital audience and revenue, coupled with tight management of the cost base. At this stage, the Board anticipates performance for the year will be in line with market expectations.

Whilst it's good to see an "in line" expectation, the use of the phrase "At this stage..." introduces a note of doubt. That suggests to me that trading might deteriorate.

You can't get away from the fact that this is a cigar butt stock - newspapers are in relentless decline:

Group revenue fell on a like for like* basis over the period by 8.6% with a 9.3% decline in the first quarter and an improved rate of decline of 6.4% in April.

Although TNI remains highly profitable & cash generative, through a mixture of continuous cost-cutting, and acquisitions.

New Day - introducing a completely new newspaper was a bizarre decision. It hasn't worked, and the paper has been shut after only 2 months in existence. This has to call into question management judgement. It reinforces to me that they are thrashing around for a future strategy.

Net debt - has come down to £64m. That's easily manageable, but the pension fund deficit is much more of a problem, now interest rates are likely to stay low for a long time. Note also that dividends are restricted by the pension fund - larger divis triggers larger cash injections into the pension fund. So there's a limit to how high the divi yield can go.

Phone-hacking - this issue is another ongoing drain on cash.

My opinion - funnily enough, I looked through the last results of this company last night, not knowing that it was reporting today. The balance sheet, in particular the pension fund, scared me off.

For me this share would have to be very, very cheap to tempt me back in. Remember last time we multi-bagged on this share, buying at 25p? It was on a PER of 1 then, but had much more debt. The fwd PER is now 3.1, but of course that reflects the various issues above, particularly the pension deficit, which will suck out a lot of the future earnings.

So, I'd probably be looking for a re-entry price of c.50p. I basically don't want to own the shares, because of the issues above, so the price would have to be so cheap that it couldn't be ignored, and we're not at that level yet, given all the issues with this company.

Goals Soccer Centres (LON:GOAL)

Share price: 97.1p (up 2.2% today)

No. shares: 58.5m

Market cap: £56.8m

(at the time of writing, I hold a long position in this share)

AGM Statement & NED appointments - I last reviewed this company in detail here on 3 Mar 2016, where I concluded that it is starting to look interesting, despite various problems.

NEDS are usually of little interest, however the appointments today look interesting. Scott Lloyd has very relevant experience. Christopher Mills of Harwood Capital (which holds 17.6% of GOAL) is even more interesting. He has a track record of picking good value situations, and agitating for unlocking shareholder value. Unfortunately this has in the past sometimes involved him grabbing the upside for himself, with opportunistic takeover bids for companies - e.g. Essenden - where I was annoyed to have my shares taken away by him at too cheap a price. That said, I made a profit, so am not complaining too loudly.

My main worry with GOAL is that its UK expansion has ground to a halt, as new sites were not working. One issue seems to be cheaper alternative soccer centres being set up by local authorities. I cycled past one of these in North London last weekend. I was struck with how large, and well-equipped it looked. Also it was packed. So the risk is that GOAL's UK centres might gradually decline. Maintenance capex is also a big issue. Superficially the company is highly cash generative, but how much of that cash needs to be reinvested in just keeping the sites in a decent state of repair?

Expansion plans seem to now be focussed on the USA. That could be interesting, if it works.

Today the company says:

The review of the Company has included a wide ranging view of the market, the performance of the Company in recent years and an assessment of all assets that the Company operates, along with consumer insights. We are drawing it to completion by next week and we will announce the results of this review together with the strategic plan shortly afterwards.

Our near-term operational improvement plan is being implemented which is solely focused on overall performance of the Company and we are encouraged by the early signs.

On current trading, I can report that like for like sales are marginally negative for the first 18 weeks of the year. However, the significant decline in last year's second half has been eroded. This first quarter of trading in 2016 compares against positive sales growth in the same period last year".

The strategic review worries me. Could this mean big asset write-offs, and/or provisions?

LFL sales first 18 weeks of this year (as reported today) - "marginally negative".

LFL sales first 9 weeks of this year (as reported on 14 Mar 2016) - "very modest(ly) positive".

So the trend looks to have deteriorated in the last 9 weeks, but not alarmingly so. This is certainly better than the badly negative performance towards the end of 2015.

Takeover potential - Harwood Capital is acquisitive, and owns 17.6%. Also note that Sports Direct owns 5.8%, with there being a very obvious fit there. Although Sports Direct owns many stakes in sports-related companies.

My opinion - I think there might be upside here, so am dipping my toe in the water with a modest purchase. There are too many worries & negatives to make me want to buy in any size, so this will just be a small punt, not a conviction buy.

I'll wait to see what the strategic review says in a week or two time.

Empresaria (LON:EMR)

Share price: 84p (unchanged today)

No. shares: 49.0m

Market cap: £41.2m

AGM statement (trading update) - things sound like they're going fairly well at this staffing group:

...The Group remains on course to meet market expectations for the full year."

Broker forecasts look undemanding to my mind, so I would hope to see the company update with an out-perform statement later this year. It seems well-managed, and performed well last year.

More detail is given today about different countries - Empresaria has an unusually wide geographic footprint for such a small cap, but it seems to work:

"The Group has made a good start to the year, with growth in net fee income compared with this period in 2015. We have seen particularly good trading in our Continental Europe and Rest of the World regions, especially in Germany, Japan, India and Chile. The investment we made in October 2015 in US based Pharmaceutical Strategies is performing well and recent new client wins give us confidence it will deliver full year profits in line with our expectations.

As part of our stated strategy to develop leading brands with sector expertise we continue to look for further investment opportunities.

So more acquisitions to come.

My opinion - the valuation looks reasonable, on a fwd PER of only 7.65. However, note that the balance sheet is quite weak, so the market is correctly pricing in a discount for that.

I've noticed that there seems to be a bit of a buyers' strike on sensible shares like this at the moment. Maybe it's the "Sell in May" effect? Or people sitting on their hands until the Brexit vote has happened?

Personally, I see buying opportunities, and I don't worry about political factors - because things always work out alright one way or another. Even if there is a Brexit vote (extremely unlikely in my view), so what? Business will carry on largely as before. It's ridiculous to suggest that trade between the EU and Britain will stop, or even be curtailed. A way will be found to make things pretty much carry on as they are now.

So if I can buy shares at perhaps a 10-20% discount, because other investors are too cautious to buy now (but will probably be buying in a few months' time, and pushing the price up, then that's an opportunity for me to make money, which is a good thing.

I think generally people are too scared of volatility. We have to embrace volatility to be successful investors in the long term - it's just what markets do.

Anyway, I'm tempted to pick up a few EMR, but the wide spread is putting me off a bit. Also, I don't see massive upside, so is it worth it, in terms of risk:reward? Possibly, but I'm not entirely sure.

It has a high StockRank of 97.

Best Of Best (LON:BOTB)

Share price: 206.5p

No. shares: 10.1m

Market cap: £20.9m

(at the time of writing, I hold a long position in this share)

Trading update - an in line update today, for y/e 30 Apr 2016:

Best of the Best plc, which runs competitions to win luxury cars online and at retail locations, is pleased to announce that trading for the year to 30 April 2016 has been solid with both revenues and profit before tax in line with market expectations.

The rest of the announcement concerns a potential VAT rebate:

As previously reported, following a VAT decision at the First-tier Tribunal concerning Sportech Plc, a company with similar activities in our sector, the Company submitted a protective claim to recover overpaid VAT. Sportech Plc announced yesterday that the Court of Appeal Judges have ruled in favour of Sportech in its appeal case relating to a VAT repayment claim on the "Spot the Ball" game.

Her Majesty's Revenue and Customs ("HMRC") has been given until 13 May 2016 to apply to the Court of Appeal for permission to appeal to the Supreme Court. At present, therefore, this VAT litigation has not been concluded and it remains uncertain whether the Company will receive any repayment from HM Revenue & Customs, but we will update shareholders as this matter progresses.

It is indeed still uncertain, but things seem to be moving in BOTB's favour. So there looks an increasing possibility that BOTB may recover c.£2.2m in overpaid VAT. After costs, that would equate to about 10% of the market cap - so a potential bonus of about 20p per share.

Note that BOTB has been very good to shareholders - paying out surplus cash in special divis - a 14.5p special divi was paid out in Dec 2014, and a further 19.5p was paid out in Mar 2016. Therefore, based on this track record, I reckon that if BOTB does indeed recover the overpaid VAT, then it is probably likely to pay out another special divi of about 20p. I see that as a bonus - great if it happens, but not the main reason to invest in this share.

Valuation - Stockopedia is showing broker forecast of 8.0p EPS for the year ended 30 Apr 2016. Therefore the shares at 206.5p are on a high PER of 25.8 times.

Is this high rating justified? I think it is, because the company currently does 2/3 of its revenues online. Therefore a big push to drive more traffic to its website has the potential to see profits strongly increase. Its costs are fixed, so any incremental revenue through the website is 100% profit. Although revenue-sharing deals may be the best way to drive growth, through third party marketing companies.

My opinion - I am hoping that the company will really step up a gear, and aggressively drive traffic to its website, using third party marketing. To date, I think management have perhaps been a bit too slow, and cautious in expanding the business.

If the growth takes off as I hope it might, then this stock could potentially be a multi-bagger in the future. In terms of downside risk, I suppose the main risk is that growth stalls, and the premium rating unwinds. So maybe 50% downside risk in a negative scenario.

As a reminder, here is the link for my audio interview with the CEO, which has lots of interesting info about the company in it. He also comes across very well I think, as obviously a competent, trustworthy, safe pair of hands - very important with small caps, as it's often not the case.

Note the decent StockRank of 82.

Robinson (LON:RBN)

Share price: 155p (down 11.4% today)

No. shares: 16.4m

Market cap: £25.4m

AGM trading update - this looks like an H1 profit warning to me, but it's not entirely clear what the overall impact is. The company should have given an indication of how performance is compared with market expectations, but it has omitted this crucial information.

"In the first quarter of 2016, revenues were 10% down on the previous year of which 4% was due to lower resin prices.

The lower volumes were mainly as result of lower demand for our customers' products in the market which is a continuation of the trend in the second half of 2015.

Resin prices are increasing which will reduce margins in the short term before prices are adjusted.

Previously reported new business gains have come on stream slower than expected and will benefit the second half.

Furthermore, the build-up of additional new contracts commencing in the latter part of the year is very encouraging.

I have split the announcement into 5 paragraphs above. Paras 1-4 are clearly negative for H1. However, paras 4-5 are positive for H2.

Therefore, expect poor interim results, but a possibly better H2.

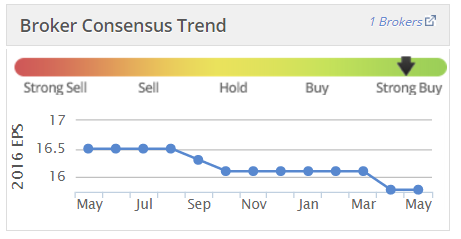

Note that brokers have been reducing forecast EPS for this year:

Given today's statement, I would be inclined to assume that the company might miss forecasts for the year. It might be safer to value the company on a multiple of say 12-14p EPS for this year, rather than the 15.8p EPS currently forecast.

Property - note that there is hidden value in surplus freehold land owned by the company, which is alluded to today:

A planning application has been submitted to redevelop 24 acres of land previously used in our former healthcare business in Chesterfield. It is anticipated that the application will be determined in the summer, which would allow for negotiations to take place with prospective developers during the second half of 2016."

It would be useful to estimate the potential value of this to Robinson.

Earn-out - a significant payment is due:

The final payment for the acquisition of the Madrox business in Warsaw has been agreed at £4.3m in line with the 2015 financial statements and will be settled during May 2016.

My opinion - whilst I quite like this company, which seems well-managed, I am wary of the sector it operates in. Packaging for suppliers of food & drink products are inevitably going to be under constant, severe pricing pressure from their customers.

So it might be difficult for Robinson to defend its margins.

EDIT - I see that FinnCap has today reduced its forecast for 2016 adjusted profit from £3.4m to £2.7m, about a 20% reduction. This should have been made clearer in the RNS I think, as it's a material drop in forecasts.

Costain (LON:COST)

Share price: 326p (up 1.3% today)

No. shares: 102.1m

Market cap: £332.8m

AGM trading update - this looks reassuring:

Looking ahead, he will confirm that current trading is in line with expectations and that, with a record order book and the visibility it provides, the Board remains confident in the future and looks forward to reporting on further progress in 2016.

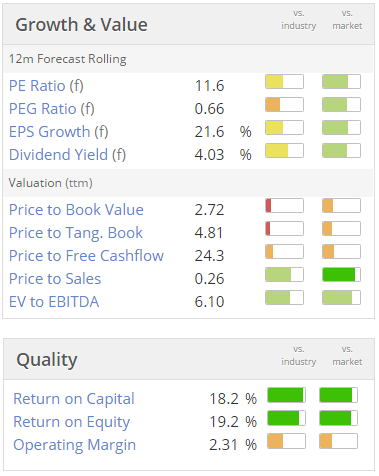

Valuation - this looks good value to me, especially when you consider that Costain has a much stronger balance sheet than many competitors:

My opinion - this looks good value to me, and is worth a deeper look, as the shares have come down significantly in recent months.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.