Good morning!

Redcentric (LON:RCN)

Share price:89.75p (+3%)

No. shares: 148.9m

Market cap: £134m

For my previous (bearish) analysis of Redcentric, see the 23rd Dec SCVR at this link.

At the time, I had the impression the company had responded professionally to the discovery of accounting errors including the overstatement of historic profits and understatement of net debt.

But I still thought the episode raised such fundamental questions that I would have marked the shares down even lower than they were.

Today's trading statement for the year ending March 2017 says performance was in line with expectations, with "good sales momentum".

There was no evidence of theft in the accounting fiasco, and customers are apparently still happy, so it seems as if the effect of the errors was limited to giving shareholders a false impression of profitability.

Net debt reduces to £39.5 million from £42 million, and the banks have played ball:

Our lending banks have remained supportive over recent months and the Company is pleased to announce that amended debt facilities are now in place. Waivers in relation to historic covenant breaches have been secured such that the Company is fully compliant with its facilities.My opinion

The shenanigans which took place here are a real shame, as it looks to have some quality services and a strong ability to win contracts (including a major NHS contract in January).

And it is probably my own fault, but I still can’t see how a market cap around the current level can be justified. Statutory PBT came in at just £0.3 million in H1, it’s under FCA investigation, the previous year was heavily loss-making after restatement, and the debt load is substantial (£39.5 million).

Even with the greatest of efforts and professionalism by staff and senior management in the current circumstances, I don’t see how a market cap of >£130 million makes any sense. An enterprise value of over £170 million, operating in the very competitive space of diversified IT services. Perhaps someone can help me to understand!

T Clarke (LON:CTO)

Share price:88p (+12%)

No. shares: 41.8m

Market cap: £37m

Many new projects have been secured so far in 2017 by this building services contractor (mechanical and electrical contracting and similar services).

Interesting names on the list include Dyson, Thomson Reuters and Gloucester Royal Hospital.

Order book is at the highest ever level:

As a result of new project wins our replenished order book has for the first time surpassed £400 million and as at the 30th April stood at £402 million an increase of 22% since the beginning of the year.

With fantastic implications for profitability:

As a result of the strengthening order book and based upon current project programmes we expect revenues and profits for 2017 to be ahead of current market expectations, which are revenues of £300 million, underlying profit before tax of £6.1 million and underlying EPS of 11.3p.

Given the c. £37 million market cap, that obviously makes for a superficially cheap share price, but there are a couple of things to bear in mind:

- There can be a material difference between "underlying" PBT and actual PBT.

See the 2016 and 2015 results. You have to trust the idea that amortisation of intangible assets and non-recurring costs don't matter very much, to place a lot of value on the "underlying" numbers. I prefer to use the statutory results in general.

- This has proven to be a low-margin business in recent times.

Since 2012, TClarke's operating margin has been stuck in the range of 0-2%. Pricing power seems to be difficult in labour-intensive contracting.

Perhaps the operating margin is recovering now thanks to the recent burst in activity, but there is always the risk that it will weaken again in future under labour and material costs, and general conditions in the construction industry. So this could be a great time to get involved with an investment here, but if it was me, I would be thinking about my exit timeframe. Not a stock I would hold forever, in other words!

The shares have doubled since 2014, and are up by 50% since November, so perhaps those more willing to jump in and out of stocks might find an opportunity.

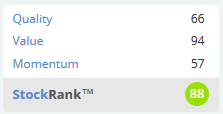

The Stockopedia StockRank currently likes it from all three angles, which is usually a good sign:

Frontier Smart Technologies (LON:FST)

Share price:91p (+9%)

No. shares: 42.7m

Market cap: £39m

I thought it would be fun to take a look at something different. This company makes chips, modules and software for digital and smart radios. It traded under the "TMZ" ticker until last November, after it had sold a loss-making healthcare business.

Today's announcement is the second time so far this year it has reported trading ahead of expectations.

Looking through the archives, I see that Paul covered it when it was trading under its old name, and thought it was a bit of a cash-guzzler.

I wonder if it can possibly avoid raising more money going forward. Today the company says it expects the 2017 result will be "materially ahead" of the £1 million EBITDA expectation.

That EBITDA calculation also excludes share-based payments, but those payments do of course impact profitability and existing shareholders (although at least they shouldn't impact the cash position).

At December 2016, FST had a cash balance of £3.4 million and a bank loan of £4.1 million. The results statement guided for reduced levels of capex going forward and included the following statements:

The Board believes that with the Group trading at a positive EBITDA level and generating positive cash flows in 2017 and beyond that this is sufficient for the immediate needs of the business.

And:

Given the continuing business's improved financial performance, the Board is confident that no further funds from shareholders will be required to support the existing business.

That being the case, the company still needs to do a lot to justify the current market cap, but it looks possible to me that it could do so, e.g. the Digital Radio segment saw sales up to £22 million in 2016 which brought EBITDA for that segment up to £8.7 million (the other segment must have made a large negative contribution).

It's easy to forget that companies have the flexibility to improve, downsize or sell loss-making parts of their business. Perhaps FST is on track to achieve this and become a profitable, successful entity!

Quantitatively, it is not looking too good, qualifying for the "Highly Speculative" Stockopedia Risk Rating, and with a very poor StockRank. So do your own research!

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.