Hello there! Graham here. Huge thanks to Paul for doing the entire SCVR effort by himself for the last couple of weeks.

This is our placeholder, published the night before, so that comments and suggestions can be made both now and first thing on Monday morning.

Best wishes

Graham

Comment on IPOs

I recently answered some interview questions on IPOs, where I tried to explain my perspective on them. Since then, I've been wondering whether my answers, and indeed my thinking on them, were sufficiently clear. This also follows up on Paul's recent comments/questions on the IPO landscape, after a couple of deals were cancelled at the last minute.

In a nutshell, I do follow IPOs. I think they're an important part of the financial landscape. They're a key indicator of the temperature of investor sentiment. They also tell us something about business and sector conditions, since most companies would prefer to float when they are doing well rather than when they are doing badly (or at least when prospects look good rather than when prospects look poor).

Do I invest in IPOs? Generally speaking, no. Most traditional value investors will warn you not to take part in a transaction (as a buyer) which has been heavily marketed and which takes place at the time of choosing of the vendor, as is the case with the typical IPO.

For the risk-averse investor, it makes sense to avoid IPOs, since by definition the company (and usually also the management team) lack a public track record with which to judge their past behaviour. But for every year that goes by without mishap following IPO, we can trust the management and the company that little bit more. I've also seen good statistical evidence to the effect that older stocks generally outperform newer ones.

For the more enterprising investor, however, it does make sense to focus some attention on IPOs. This is the more difficult task, but potentially a very lucrative one, of finding the diamond in the rough. For an example of someone who does this in a US context, I recommend Ian Cassell of MicroCapClub.

A fellow investor recently explained this to me with a brilliant analogy. From his horse-racing background, he explained that it was much easier to gain an edge against the bookies with respect to young horses with a limited track record, as against the mature horses which had already been analysed to death and which everyone was familiar with.

The financial counterpart to the young horse might be the stock of a mature company which has recently listed, or the stock of a young company which has been listed for six months to two years. The key is that there is still enough information to analyse it and to make an intelligent decision, but the edge might come from the fact that very few other investors (whether because the market cap is still too small, risk aversion or simply the newness of the issue) have analysed it yet.

So, in summary: I think IPOs and new-ish stocks have a substantially different risk profile compared to mature ones, but they're essential viewing for those of us who make a living in the stock market. As my own understanding of risk and my risk management strategy has evolved, I've tried to tackle my own long-standing reluctance to invest in any recently-issued stock, and indeed I've personally purchased some shares in a company which listed less than six months ago.

The City Pub Group

This owner-operator of 34 pubs announces its intention to float by the end of this month (November).

It's looking for £30 million (gross) to "accelerate its acquisition strategy and expand its high quality estate of pubs." It wants to double the size of the estate over the next 3-4 years.

As is mandatory these days, it announces high CAGR (compound annual growth rate) in revenue and EBITDA:

The City Pub Group has a consistent track record of strong revenue and EBITDA growth, with a three year CAGR from FY14 to FY16 of 34.9 per cent. and 44.8 per cent. respectively, and an EBITDA margin of 14.7 per cent. in FY16

That EBITDA margin for last year (14.7%) is rather low in my book, but that's one of the reasons I'm prejudiced against the pubs and bars sector - low margins. The reported margin performance from City Pub is actually superior to Revolution Bars (LON:RBG) which, according to my figures, has only achieved EBITDA margin within a 7%-11% range in recent years.

19 of the sites are freehold, increasing margins and reducing risk but also making it more capital-intensive. The portfolio is worth c. £82 million.

Demonstrating the higher return on leaseholds versus freeholds, "the Directors target 15 per cent. EBITDA return on capital invested for freehold pubs and a 25 per cent. EBITDA return on capital invested for leasehold pubs."

This management team does have a strong industry track record, including the formation of another pub company which was subsequently acquired by Greene King (LON:GNK).

Their timing seems good, too. Three years ago, when it had 18 sites, one of the founders said that City Pub "is likely to be sold to a rival or floated on the Aim market in around 2018." They are two months early, then!

Unique Selling Proposition?

My major gripe with investing in pubs is that I can't understand what long-term competitive advantage they can achieve, so from my perspective they appear to mostly compete against each other on price and on commoditised features.

The City Pub strategy is to offer "premium individualised pubs which have a product range appropriate for their local market" - so each pub is different. I guess you can look at this as a positive or negative: there is no unifying offer which might motivate customers to use City Pub in whichever location they happened to be in at the time, but instead there are unique local reasons why someone might become a regular in their nearest City Pub property.

Overall, sounds like a stock we will want to keep our eyes on here. I'll reserve final judgement on the attractiveness of the IPO for when we get word on valuation and some more detailed financial information.

Shefa Yamin

I'm putting this here for the sake of completeness since we are on an IPO theme today, and to show the extremes of the risk spectrum. Coming to us from Northern Israel:

The Company's principal assets are an exploration permit and two prospecting permits where the Company has carried out an extensive exploration programme, and has delineated several potential primary sources and secondary deposits that host gemstones.

Permits to explore and to prospect for minerals in a faraway land - while not as common as they were before, there is obviously still some level of demand for these stocks. Needless to say, these go in the "lottery ticket" category.

Sportech (LON:SPO)

- Share price: 102.9p (+1.6%)

- No. of shares: 185.6 million

- Market cap: £191 million

Q3 Trading Update, Update on Strategic Review

This is a special situation involving litigation with HMRC and a formal sale process of this gaming technology supplier. I last reported on it in September.

Since then, the outlook for a large additional successful claim against HMRC has deteriorated. Sportech has reclaimed historic VAT overpayments but is also seeking compound interest on these payments.Some companies with a similar claim for compound interest have now lost their case.

So let's assume that there will be no further legal judgements in favour of Sportech.

Growth here continues despite the lack of a CFO and the imminent departure of the CEO:

- Q3 Revenue increased by 7.6% to £18.3m (Q3 2016: £17.0m)

- Year to date revenue increased by 5.8% to £54.7m (YTD 2016: £51.7m)

The company seems ready to end its life as an independent entity, however, because it has no intention of replacing the CEO/CFO team and looks for bids for the operating parts of the business.

Cash at 31 October was £68 million, and up to £55.6 million will be available for distribution as special dividend after court restructuring.

My opinion

I'm increasingly leaning towards the view that an attractive positive return could be achieved in the short-run here.

While not all of the £68 million can be distributed to shareholders, the excess will doubtless be of interest to potential trade buyers.

The enterprise value is therefore £123 million, versus estimates in the market for EBIT of £8.9 million this year, reducing to £6.3 million next year before rising again from 2019. Today's update confirms that the current full-year outlook remains in line with expectations.

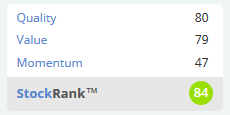

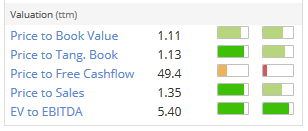

The StockRank is excellent, incorporating a really low EV/EBITDA ratio and very high returns on capital (very few tangible assets required to run the business).

My personal favourite metric, the Greenblatt Magic Formula Score, gives it an A+ according to Stockopedia, too.

So I'm inclined to think there is a good business here and that a decent bid could be achieved in the formal sale process.

Beximco Pharmaceuticals (LON:BXP)

- Share price: 62p (+1.6%)

- No. of shares: 405.6 million

- Market cap: £251 million

Results for the 12 month period ended 30 June 2017

I last covered this Bangladeshi manufacturer of generic pharmaceutical products in April, noting that it had strong momentum, a cheap-ish valuation and was trading at a big discount in London (BXP shares are "global depositary receipts" or GDRs) versus its local Bangladeshi listing in Dhaka.

Share price momentum has slackened since then but the discount/premium remains in force, as the local share price is now 99.3 Bangladeshi Taka, or 91.3 British pence, versus the 62p share price on the LSE. So the premium remains nearly 50% in Bangladesh versus London.

The shares are not fungible, however, so you cannot buy shares here and send them to Dhaka to sell at the higher price.

We know that foreign companies usually receive more interest in their home market compared to when they sell shares abroad, but we don't usually get such a clear demonstration!

In this case, the fact that the home market likes the shares so much more should, I think, be a form of reassurance to us that the company is genuine and trustworthy. With 3,500 employees claimed and FDA approval for a variety of products, it's hardly a fly-by-night organisation!

The corporate highlights for this year sound impressive to me.

- Became the first Bangladeshi pharmaceutical company to commence export of pharmaceutical products to the US

- Received approvals for two ANDAs from the US Food and Drug Administration (US FDA)

- Launched 15 products in the domestic market,four of which were launched for the first time in Bangladesh

- Registered 71 new products in 20 countries

Among the financial highlights, sales increased 12.5% to £147.5 million, within which exports rose 25%. PBT rose at about the same pace as sales, reaching £27.5 million (although the company has changed its accounting year-end date, making this less obvious).

A dividend of 1.25BDT is announced, worth c. 1.15p for a yield of nearly 2% on the current share price. Beximco restarted paying divis in 2015 and that's certainly a good way to win the trust of foreign investors.

The accounts, being in foreign currency, and also showing the change in year-end date, are a bit of extra work. But extrapolating in a very simple way from the Jan 2015-Jun 2016 result (18 months), the growth in PBT for the July 2016-June 2017 period looks to me about 18.5%, which is even better than the company itself has reported.

Either way, the arguments for investing here remain unchanged and may even have strengthened given the softness in the share price this year, continued improvement in performance, and the latest dividend announcement.

My opinion

For me, the best argument is that we know Bangladeshi investors themselves would love to be able to buy the shares at our London prices. It's completely different to, for example, the Chinese frauds, where it was safe to assume that Chinese investors would consider them to be worthless (otherwise, they would have listed in Shanghai).

The Bangladeshi SEC may have created for us a gift and I am tempted to purchase a small number of these shares for my personal account.

I'm out of time for today, see you later in the week!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.