Good morning, it's Paul here!

Here is the (now usual) placeholder article for readers to discuss the morning's trading updates & results statements, from 7am.

By the way, please see the header for the stocks I am intending to write about today. Yesterday's article fizzled out, so I shall be revisiting that this afternoon, to finish it off.

H & T (LON:HAT)

Share price: 333p (pre market open)

No. shares: 37.3m

Market cap: £124.2m

Trading update - this is a pawnbroker chain of stores. Graham is keen on this one, and often covers it. Things are going well;

H&T is pleased to announce that the strong trading performance of the first half of the year has been maintained. The gold price has also remained broadly in line with the first half which benefits the Group's pawnbroking scrap and gold purchasing segments.

As a result, we expect that our full year profit before tax will be above current market expectations.

The CEO says that he's confident about the future outlook.

It's a pity that the company has failed to explain by how much it is exceeding current market expectations. Plenty of other companies report specifics, by giving their own projection for full year profit - so this really needs to become standard.

Instead we have to play the silly game whereby the company will brief analysts on the numbers, who then publish updated forecasts which many private investors can't get hold of. An utterly crazy system, badly in need of reform. Companies can & should be pushing for more openness, so that all shareholders are made aware of the numbers, not just institutions & professional investors.

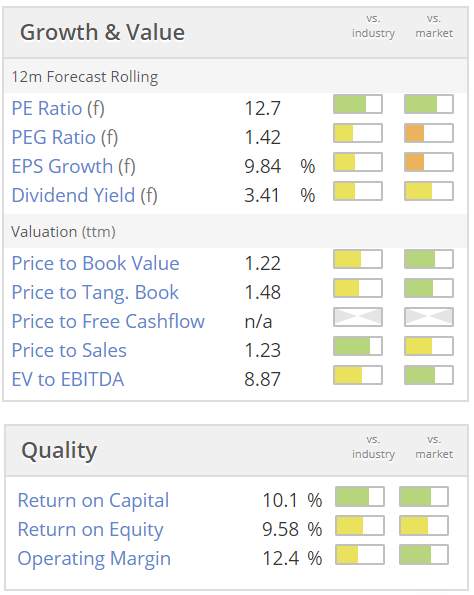

Valuation - based on the existing forecasts, the valuation looks quite good value;

A lowish PER - although this type of business rarely receives a high PER.

Moderate dividend yield.

Note the Price to Tang(ible) Book (Value) - at just 1.48 this is excellent - demonstrating that the company has a solid balance sheet, with strong asset backing.

In the "Other ratios" box, note the green (positive) blob next to current ratio - which is outstandingly high, at 12.6 - again confirming that this company is very soundly financed, so won't be going bust like listed competitor Albemarle & Bond did a few years ago.

I would always want to do my own research on the balance sheet, but looking at a few key numbers on the StockReport is an initial shortcut.

My opinion - an analyst flagged this company to me a while ago, saying that its personal loans product was gaining traction, and could become much larger. However, when I checked the product online, I was appalled by the high interest rate, so declined to invest in this company. The numbers don't really matter to me, I just don't want to own shares in a company that exploits people in financial distress.

Based on the numbers though, and today's encouraging update, I can see why this share looks attractive to investors.

Stockopedia likes it too - a StockRank of 98, and "Super Stock" classification. I imagine the shares would rise maybe 10%-ish today - but that rise will depend on what revised forecast numbers brokers put out. I've requested broker notes, so will update this article with the figures, if anything comes through.

EDIT: I've now seen one updated broker note this morning. Its profit before tax (PBT) forecast for 2017 has been raised from £11.6m to £12.8m, an increase of 10.3%. So that backs up my hunch that we might see a c.10% share price rise today. I see the share price is currently up 6.1% today, at 353p (at 08:30).

In terms of EPS, the updated forecast is for 28.4p in 2017, with a 10.0p divi. That gives (based on the current share price of 353p) a 2017 PER of 12.4, and a divi yield of 2.8%. When you take into account the strong balance sheet asset-backing too, I think this share still looks reasonable value.

Today is the third time this year that analysts have increased forecasts, so the company is clearly on a roll.

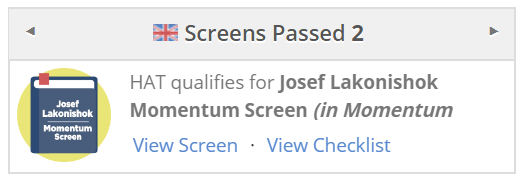

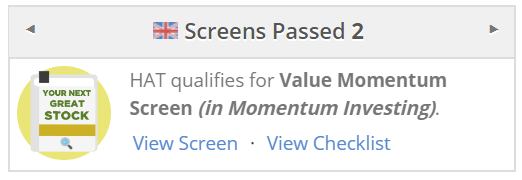

I see from the StockReport that HAT qualifies for 2 guru screens;

I often click-through to the guru screens which a share that I like qualifies for (NB. I like the numbers at HAT, but not the business activity, just to clarify!)

In this case, the Josef Lakonishok momentum screen (which I've never heard of before) has performed really well this year, and since inception, and also seems to have had very little in the way of drawdowns along the way. I like this look of this, so will do a bit more digging. This can often be a very good way of finding similar stocks to the one you originally liked.

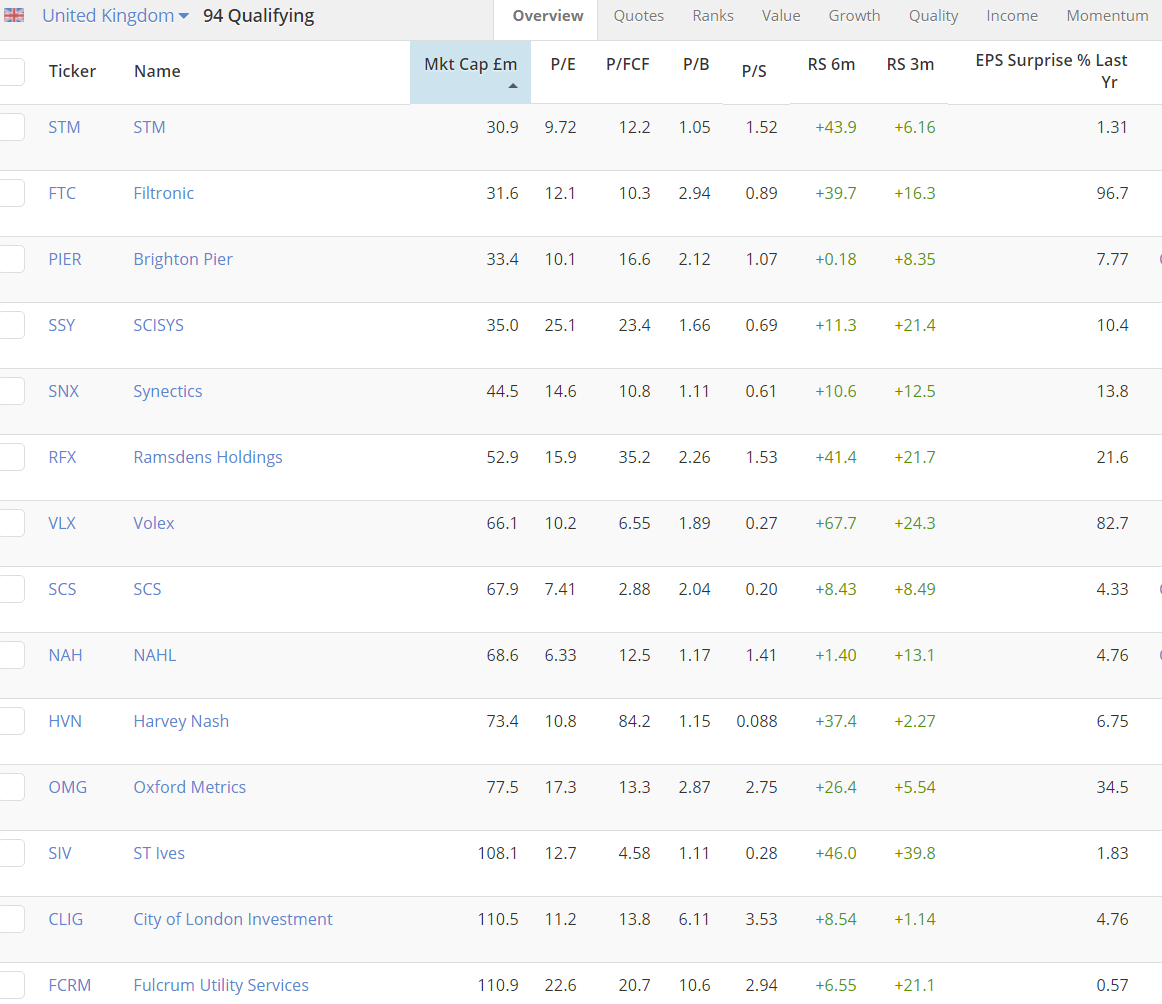

I've sorted the list of qualifying stocks in the Josef Lakonishok momentum screen, into ascending market cap order (to identify the small caps). I see that the screen is set up to £30m+ market caps. This can easily be amended by clicking on the "Duplicate" button at the top right of any guru screen page. I often do this to reset the market caps to just small caps (in my case I tend to use a £10m to £400m range). This could throw up more interesting stock ideas between £10-30m, which are not shown on the existing screen.

Here are the qualifying small caps over £30m. Some interesting companies in there. I like forecast earnings upgrades as a stock screening criterion, as it homes in on companies which have wind in their sails re earnings, which usually causes a rising share price.

These guru screens are very good tools for finding new stock ideas, in my experience.

Management Consulting (LON:MMC)

Share price: 5.75p (down 20.7% today)

No. shares: 511.1m

Market cap: £29.4m

Trading statement (profit warning) - this is a professional services group. I've not looked at it for a long time, but Graham covered its most recent interim results here on 18 Aug 2017. He missed one important point - that the group had sold a subsidiary, allowing it to repay all its debt, and pay £75m to shareholders - a payment of 14.673p per share. So the overall shareholder return has not been as bad as the share price fall suggests.

Its financial performance looks dreadful - see the graphs below. My question is not "why is it listed?", but rather, "why does it exist at all?" This looks like a business that could be in terminal decline, if the trends shown below cannot be rectified;

Although it's got pots of cash. So this might be potentially, a value/turnaround type of share? At the most recent balance sheet date of 30 Jun 2017, it held net cash of £28.4m - very close to the current market cap. Before getting too excited about that, I note a £9.9m pension deficit, and £5.4m of long-term provisions in creditors > 12 months. So in a wind-up situation, those liabilities would need to be settled. The pension scheme might require considerably more than the liability shown on the balance sheet to shut it down. So it looks problematic as a break-up, or shut-down type scenario. Sorry, I'm rambling off the point.

Trading update - this seems like a straightforward case of not winning enough business from clients & potential clients;

As announced with our interim statement on 18 August 2017, changes were made to improve our operations in North America given that revenues were not at levels to restore profitability. This change process has continued; however, it is taking more time than originally anticipated for revenues to reach required levels, in particular some large potential engagements failed to materialise in North America including the second phase of an existing project not moving forward. This has impacted the second half trading and as a result Group revenues for 2017 will now be below our previous expectations.

We have made significant progress on reducing costs but this will only partially offset these lower revenues.

The level of proposals in the US has now started to improve and the Global Natural Resources practice continues to show positive progress through new client acquisition.

There's some hope in the last paragraph.

Again, we're in the usual position of being largely in the dark about how much trading will be impacted. So this is yet another unsatisfactory announcement, which omits the specific details that investors need, in order to make informed decisions.

My opinion - I'm not going to bother searching out revised broker notes, as this looks such a lousy business, I wouldn't be interested in buying shares in it. H1 2017 saw an underlying loss from operations of -£4.6m, on £21.6m revenues.

The only redeeming feature is its strong balance sheet, and plentiful cash. That at least buys time, for management to sort out the business. As Graham quipped last time, maybe the company should hire its own management consultants, to tell it how to improve profitability!

In my experience of using management consultants, they're totally clueless, so it's money down the drain for companies whose management are so inept that they can't run their own business. As a recent TV show demonstrated, management consultants are also adept at relieving the public sector of taxpayer funds.

The other potential upside on MMC shares, is that the company achieved a very high exit price when it sold former subsidiary Kurt Salmon. So there's always the chance that the company might also find a buyer (at a premium price) for its remaining business. Stranger things have happened. So I can see a bull case here - that the cash underpins the market cap for now, giving them time to sort out the losses. Also potential upside from a possible takeover approach? Therefore this could be an interesting special situation, for people prepared to do deeper research on it.

Sosandar (LON:SOS)

Share price: 20.0p (floated at 15.1p on 2 Nov 2017)

No. shares: 106.8m

Market cap: £21.4m

(at the time of writing I hold a long position in this share, as I participated in the recent placing at 15.1p)

First day of dealings - this is from yesterday. I participated in the recent placing (at 15.1p per share) of this company. Sosandar is a fashion eCommerce company, which has only been trading from a start-up, for about a year. When I researched the company whilst the shares were suspended, my feeling is that joint CEOs Ali Hall and Julie Lavington have achieved a remarkable amount operationally, in so little time. So I see considerable potential here. However, it is important to realise that this is very much a jam tomorrow share - as you would expect at a start-up, the financial results so far have been poor - with tiny turnover, and losses of around £250k per month.

It reversed into what was formerly Orogen Gold, then Orogen, and it's now been renamed Sosandar. Orogen was a cash shell, having failed to commercialise its resource project. So the Chairman, Adam Reynolds, had the good sense to cease existing operations, turn it into a cash shell, and find something more interesting to reverse into the shell. The advantage of using a cash shell, is that it comes with ready-made liquidity from the existing shareholders. That said, given that some shareholders must have held the shares all the way down, as its gold project failed, they're perhaps not the sharpest knives in the drawer!

With the shares having been suspended for a while, I suspect there must be pent-up sellers, who are now using the first couple of days resumed trading to exit. There seems to be plentiful supply of shares in the market anyway. That's quite surprising given that the placing was heavily over-subscribed - my broker tells me that some people only got 30% allocation, and others got 0% allocation. So I was lucky to receive an allocation in the placing. To reflect this, I've added an opening position in SOS to BMUS. I'll monitor the company's performance, and add more if it does well, or ditch them if growth fails to live up to expectations.

Just to reinforce how small this company is, here are some more figures;

Thread achieved total gross sales for the 11 months ended 31 July 2017 of £847,000 and net sales (after returns) of £478,000.

That works out at a returns rate of almost 44%. That sounds high, but I've been making enquiries, and apparently the industry average returns rate these days is about 40% (which is what QUIZ (LON:QUIZ) told us at an analyst meeting recently). The returns rate historically for mail order, and eCommerce used to be about 30%. However, apparently shopping habits have changed more recently, and women especially tend to over-order website purchases, then send back the items that they least like, or which don't fit very well. As Sosandar's CEO told me on a recent telecon, "customers use their bedroom as the fitting room now".

After the fundraising, the company should have plenty of cash for 2+ years of cash burn.

Growth plans are for £1m sales in year 1, then £3m, and £9m in years 2 & 3. Those are ambitious targets, but management told me they feel the budgeted numbers are achievable.

Marketing - to date the company had little cash for marketing, but now it has raised fresh funding, it can drive growth by upping its marketing spend. Note that the company has used the contacts of the fashion magazine editor CEOs to promote the company. Sosandar punches way above its weight in terms of magazine & TV coverage. The TV show Loose Women are keen brand ambassadors, and wear Sosandar clothes all the time. Apparently a new pair of shoes launched by Sosandar sold out within 90 seconds when it was highlighted on Loose Women.

The idea is to develop the Sosandar website to become a hybrid between a fashion magazine and an eCommerce site.

My opinion - this is highly speculative, and expensive given that it's only been trading about a year. It's loss-making, and it will take a lot of work to develop this into a viable, profitable business. I very rarely buy any shares like this. However, I see real potential here, long term. It's really all about backing management. In my view, the two ladies are very backable - exactly what I would want, for an eCommerce fashion brand. Some people say, oh they're just journalists, but I think that doesn't reflect the depth of their fashion industry experience - which includes designing clothing ranges. Also, there is a procurement head with a background in sourcing at Matalan.

Anyway, despite being a highly speculative situation, I couldn't resist it. If the website & brand really take off, then this could be a 10-bagger (or more) over time. Or, if growth disappoints, then the share price could easily halve overnight, and then possibly need another fundraising in 2 years' time.

£FOOT

Share price: 198.5p (floated at 164p on 2 Nov 2017)

No. shares: 104.5m

Market cap: £207.4m

Admission to AIM - this is another interesting new listing. It's a rapidly expanding chain of sports fashion shops - appealing to the yoof market, of 16-24, with a rather tacky "gangsta" type of slant on things - which personally I loathe & think is very damaging to society (glorifying gangs & crime when so many teenagers are murdering each other with knives in London [over 30 deaths this year alone apparently] strikes me as irresponsible), but it's clearly profitable.

The interesting angle on things, is that FOOT is run by the founders of JD Sports - which dominates the sports fashion market.

For more information on the company, its AIM admission document is here.

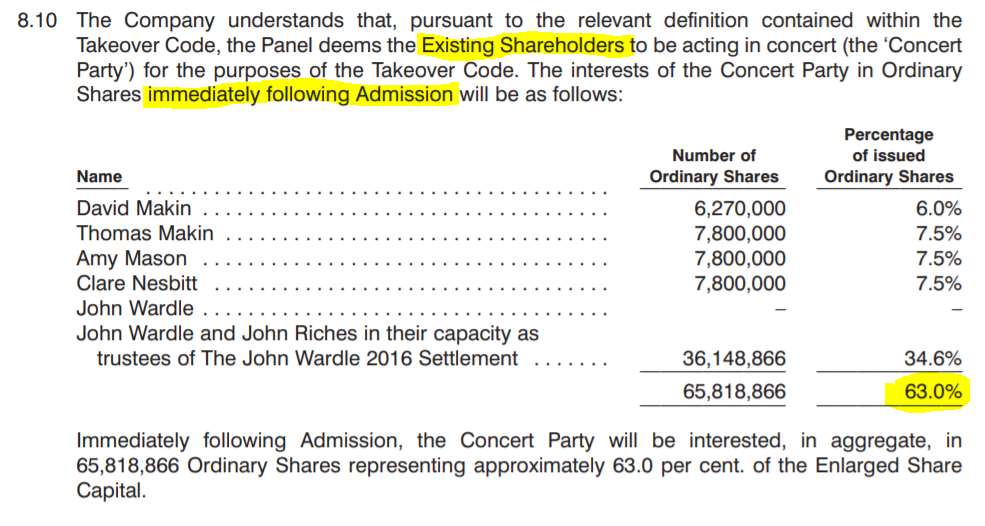

When reviewing any admission document, I don't read all of it, but am seeking out certain bits of key information. In particular, I want to know how much equity the existing shareholders will own after the float. In this case, it's still very high, at 63.0%;

This reassures me that the float is not a mechanism for shareholders to cynically exit at a favourable price, before the business blows up (e.g. as happened with Entu, and Accrol). In this case, FOOT's major shareholders retain control & loads of skin in the game.

The purpose of the float seems to be to restructure the balance sheet, by paying off the shareholder loans (preference shares). That seems fine to me.

My opinion - this looks a promising growth company. I applied for some shares in the IPO, but got an allocation of zero! So clearly this company is in high demand, evidence by the premium to the listing price since achieved.

Overall, it looks one of the best IPOs this year (I know IPO is technically the wrong term, but it's just shorthand for a new listing, and everyone knows what I mean).

I'm reluctant to cough up 200p per share now, knowing that someone else paid 164p for them yesterday! Industry trends worry me a bit too. The big brands are apparently considering selling direct to the public, through Amazon & other routes. Could that mean this type of physical store has a limited shelf life? Possibly, but with their emphasis on creating an edgy store environment, to entice yoof into the shop, then maybe this would remain an important sales channel ? I just worry that kids would use the stores as a showroom, then buy cheaper online, direct from the manufacturer. FOOT has its own online presence, which is growing fast, but for how long, if manufacturers decide they want a fatter margin by cutting out the middlemen?

FOOT does also design some own-branded trainers, including "Glorious Gangsta" - I'm not joking. What sort of message is that sending to kids in deprived areas, who are tempted to get involved in gangs? It stinks, as far as I'm concerned.

So really it's another one where the figures look good, but there are ethical concerns.

Other IPOs (or not)

I see there are three "Intention to Float" type announcements today.

BOKU - looks interesting, and sounds similar to Bango (LON:BGO) . The valuation of BGO looks bonkers to me, as it relies on heroic growth assumptions. Why pay up-front?

Bakkavor - it's pulled the IPO. The reasons given sound weird to me, and doesn't make sense;

Whilst the company received sufficient institutional demand to cover the offering, the Board has taken the decision that proceeding with the transaction would not be in the best interests of the company, or its shareholders, given the current volatility in the IPO market.

Reading between the lines, that suggests to me either that Instis pushed back on price & wanted it cheaper. And/or they possibly demanded some other conditions that the company didn't like, perhaps?

Arqiva - says something similar today;

Arqiva announces today that it will postpone its proposed initial public offering. The Board and Shareholders have decided that pursuing a listing in this period of IPO market uncertainty is not in the interests of the Company and its stakeholders, and will revisit the listing once IPO market conditions improve.

That sounds like there wasn't enough appetite from investors to buy the shares.

Overall then, is the IPO market cooling? Or is it perhaps more a question that Instis are becoming more selective in what they back, and what price they're prepared to pay?

FOOT and (much smaller) SOS listing successfully, suggests to me that investors are happy to buy new issues that are decent quality, and sensibly priced.

All done for the day and the week. Have a lovely weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.