Good morning!

General Election day today. The bookies are saying that a minority Labour Govt is the most likely result, with the second most likely outcome being another Con-LD coalition, The market would obviously very much prefer the latter, rather than a lame duck Labour Govt which would be dependent on the SNP, whether they like it or not.

This shift in voting by the Scots towards the SNP is surely the most significant factor in this election, and it is likely to change everything - Scots MPs holding the balance of power semi-permanently, and thus having excessive influence/control over the whole of the UK, is not something that English voters are likely to tolerate for long.

Anyway, we're likely to see low market volumes today, and probably continuing until it becomes clear what the next Govt will look like. Longer term, it won't really matter, as these things always sort themselves out, and there's not really that much difference between the current crop of sub-standard politicians - it's not like the 1980s where you had an ideological & practical gulf between the two main parties.

SCS (LON:SCS)

Share price: 160p (down 27% today)

No. shares: 40.0m

Market Cap: £64.0m

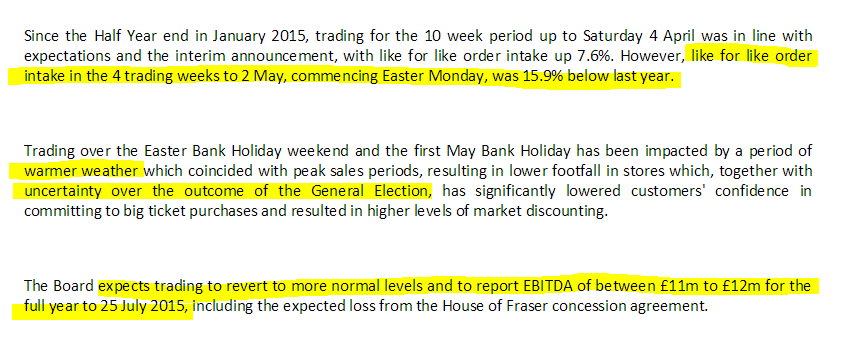

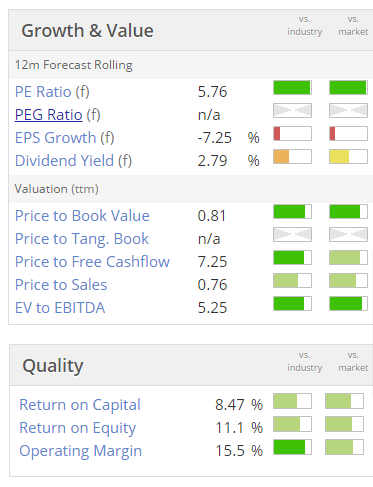

Trading update - this sofa & carpets retailer, which recently re-floated on the stock market, after a period in private ownership (after it went bust during the credit crunch), has put out what looks like a profit warning this morning;

In particular note the big fall in LFL sales in the last four weeks - down 15.9%, ouch. That's bound to hurt the bottom line quite badly.

The company should win a prize for not only managing to blame the weather, but also the General Election, in the same paragraph. Personally I'm sceptical about whether the Election would really make people defer the purchase of a sofa. A house maybe, but not a sofa. Particularly given the high level of voter apathy about this election, so these sound like excuses to me.

Valuation - the company mentions £11-12m EBITDA for this year, but doesn't say how this compares with market expectations. Stockopedia shows broker forecast net profit of £7.6m for this year. So it would be necessary to work through the numbers to make a comparison.

The shares have opened down 15% today, which looks sensible for a soft period of trading.

EDIT: they've fallen a lot further, and are now down 27% for the day (at 11:08), so I've amended the header above to reflect this.

My opinion - so here we have yet another recent IPO which has warned on profits. I think it's becoming increasingly clear that many IPOs of late have been grateful vendors selling at a toppy price into a frothy market, which laps up new issues.

ScS looked superficially attractive in the prospectus, especially the high dividend yield. However, it went bust in the last recession, and that reinforces what a highly cyclical business it is - consumers shelve big ticket purchases in recessions, and that often coincides with banks drawing in their horns, hence credit being difficult to obtain.

On the plus side, with economic recovery apparently becoming more established, and disposable incomes beginning to rise, there could be another say 5-7 years growth ahead for companies like this one, who knows?

Given the poor track record of many recent IPOs, it looks best to steer clear of new issues altogether. There might be the odd one which does well, but most seem over-priced, and you do wonder whether they are window-dressed for IPO - i.e. sold when they are showing nice, but unsustainable growth?

Trouble is, market confidence is badly dented on a profit warning, especially for a relatively new issue, and it can take a long time for confidence to return - especially if institutions try to offload their stakes into a thin market with little private investor interest. Companies are often floated to institutions, but that leaves no after-market. They need to involve PIs from day 1 in my view, to create a healthy after-market. The advisers are not bothered about that of course, they just want to generate a fat fee from the IPO, with the minimum amount of work, to pay all those big salaries & bonuses.

I see that DFS Furniture (LON:DFS) has fallen 7% this morning is sympathy, as people read across.

Proton Power Systems (LON:PPS)

I last looked at this £22m market cap (at 3.62p per share) this time last year, and concluded that it was a basket case (at 8.5p per share), and was insolvent, but propped up by large loans from its 93% shareholder.

It's a similar picture with results out today for y/e 31 Dec 2014. More heavy losses, £6.2m at the operating level, worsening to £10.1m once finance costs (interest on loans from major shareholder, and derivative movement) are included.

The balance sheet is a car crash - with net liabilities of £22.9m, and is dominated by £16.8m shareholder loans, and a £6.6m derivative.

So buying these shares is just a gamble on the major shareholder continuing to prop up the company. It reminds me of a Jim Mellon company in that regard, he tends to do the same thing. This type of situation rarely ends well. Even if by some miracle the company does survive, the major shareholder then has the power to dilute away other shareholders by converting the debt to equity at any price they like. Too risky by far.

The Stockopedia computers agree - giving it a resounding thumbs down too, with a StockRank of only 1.

Trinity Mirror (LON:TNI)

Share price: 182p (down 2.5% today)

No. shares: 257.7m

Market Cap: £469.0m

Trading update - the company reiterates that it is trading in line with expectations for the current year, ending 28 Dec 2015.

Revenue trends are somewhat alarming - reported revenue is down 10% for the first four months of 2015. Digital revenues are up 29%, but this seems to be having negligible impact on the overall figures.

The cash position is healthy now, with the prodigious cashflows generated by the newspaper businesses having been used to clear net debt, but not of course the giant pension fund's deficit, which is not mentioned in today's update. Phone hacking liabilities are not mentioned either, but that issue continues to rumble on.

My opinion - this is a classic cigar butt value share. Everybody knows that the business is doomed - the former chairman even admitted this openly at an AGM three years ago - saying that it was all about the business lasting 20 years possibly, not 10 years.

At some point, probably in the not-too-distant future, there is likely to be a tipping point, where cost cutting cannot go any further, operational gearing will really kick in on the downside, and profits will collapse. We just don't know when that will be.

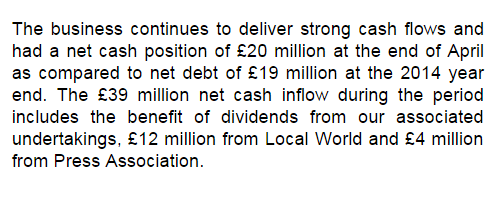

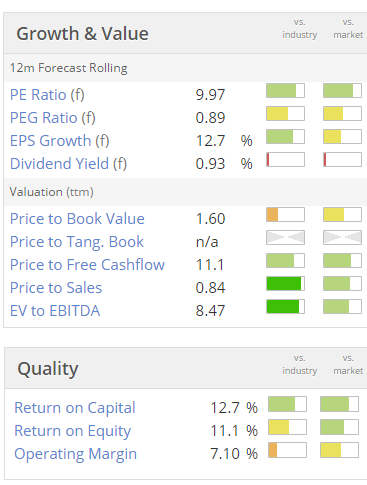

You could argue that this already baked into the price - see the strikingly low PER on the right.

However, a PER is only of any use if earnings are sustainable, which they are clearly not here.

Note that TNI is paying a dividend now, although it's not very much, at 2.79%. Another newspaper group which was also in decline, and has since de-listed, was Mecom group, and I remember the divi yield there got up to about 10% at one point.

That's the sort of level where the divis are worth chasing, as you might just out-run the decline in earnings, once you've had say 3 or 4 years' divis into your portfolio.

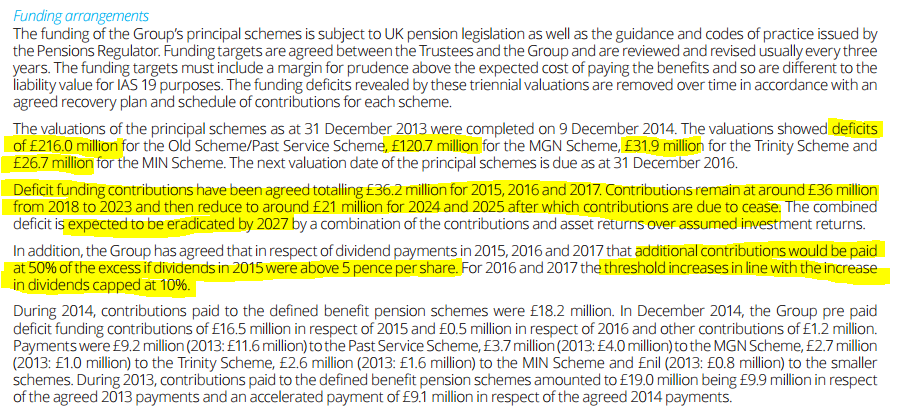

As you can see from the section below on the pension deficit, this is a major issue still. So TNI shares are facing three serious issues;

1) Pension deficit is massive & will continue to require large cash overpayments, and the agreement caps dividends for shareholders. However, this situation might improve once interest rates rise.

2) Phone hacking - evidence in the public domain is clear, that TNI was deeply involved in phone hacking, hence liabilities for legal costs & compensation could increase significantly.

3) The core businesses are in terminal decline, with circulation & ad revenues falling each year. This will inevitably cause the eventual failure of the business, unless it's able to reinvent itself in some way.

Overall then, at the current valuation, I'm not interested in owning this share. It was a cracking buy in 2012, when I bought heavily at 25p, but it's not a good buy now, at 182p, in my view.

Pension deficit - I've had a look through the 2014 Annual Report, and have highlighted below the key points from note 33 about the pension scheme arrangements. As you can see, these are highly material numbers. Note also that divis are effectively capped by the pension fund trustees. So anyone considering these shares would really need to get on top of this issue;

Rightster (LON:RSTR)

Share price: 19.5p (up 5% today)

No. shares: 194.2m

Market Cap: £37.9m

Final results - for calendar 2014 are published, and make scary reading. This group is something to do with online videos. It was explained to me last year, but I've forgotten.

I'm reading the blurb with today's results now, as the whole area of online video, bloggers, etc, is very interesting - there's been a dramatic shift amongst young people away from mainstream media, and the stars of today are just as likely to be completely unknown to most of us over 40's. We were discussing this yesterday, e.g. a reader pointed me in the direction of "Pewdiepie" (which has to be said in a very high pitched, American-accented voice!) yesterday, when we were discussing video bloggers, and how Boohoo.Com (LON:BOO) have really tuned in to this area, and employs influential bloggers to showcase its new ranges, very successfully.

Here is a link for a pewdiepie his & hers blogger "haul", showcasing BooHoo products. These videos reach massive audiences, and trigger big increases in online orders. So whilst they may appear utterly inane to us, they work commercially.

2014 results - back to Rightster, so we've established that it's operating in a potentially interesting growth area, and management seem pleased with how things are going;

All sounds quite positive, so let's have a look at the figures;

Good grief, what's going on here?! £8.7m turnover, and an £18.8m loss for the year! That's beyond bad, it's catastrophic! How come the narrative is so upbeat, when the figures are so terrible? It sounds to me as if they've got rid of one delusional CEO, and got in a new one who's even worse! Please see Exhibit A below;

Balance sheet - this is a car crash too. Net tangible assets are negative, at -£18.8m. The current ratio is very weak (especially considering the company is heavily loss-making), at only 0.5. Note that creditors includes £22.2m in deferred consideration for companies acquired. So it is essential to check the terms of this liability - if it's in cash, then the company hasn't got the cash, so they're in trouble. If it's payable in shares, then it means substantial dilution for existing shareholders.

The £8.5m net cash on the balance sheet at end Dec 2014 is likely to have been largely burned through by the interim stage at 30 Jun 2015. So it's nearly out of cash in all likelihood.

A £5m Placing is announced today, which doesn't look anywhere near enough, given the prodigious cash burn. So the company will almost certainly need substantial additional funds later this year, or early next year.

My opinion - this company seems to think it's operating out of silicon valley, with an unlimited budget provided by a VC. Whereas it's actually on AIM, and is almost out of cash. Investors on AIM are really not in the mood to keep putting money into this type of company right now. So unless they have backers with deep pockets, prepared to pour many more millions into the company, then in their shoes I would be slashing costs, and getting the cash burn under control.

There's no sign of that, so this one is going on my Bargepole List. Companies which intend running at a heavy loss, and hence burning cash, need to get all the cash they need into the bank, up-front, with a contingency reserve on top, before they start on that journey. Running out of cash is extremely dangerous. There might be something good here, but it's way too high risk to even consider investable, in my view.

Gresham Computing (LON:GHT)

Share price: 97p

No. shares: 63.2m

Market Cap: £61.3m

Trading update - this all sounds upbeat;

Valuation - it's forecast to do 3.7p EPS this year, and 5.1p next year, so the shares look fully priced, providing those forecasts are achieved - that's a PER of 26.2, falling to 19.0 times for 2016 forecast earnings.

My opinion - I'd be interested to know what the longer term upside case is, as if they can keep growing earnings strongly, then who knows it might be worth looking at? Although in the past, this company has always looked very expensive, and hasn't grown at anything like the pace that people hoped it would, about ten years ago.

HML Holdings (LON:HMLH)

Trading update - there's a reassuring update today from this micro cap (£13.3m mkt cap at 35.5p per share) property management group;

My opinion - The shares look fair value, on a forward PER of just under 10. Tiny companies should be cheap (because they are riskier), something that investors are perhaps forgetting at the moment in many cases, in a small caps market that I think is generally over-priced.

The bulk of the profits at HML come from commission earned from acting as an intermediary for the sale of insurance.

I like the business model of expansion from bolting on multiple small competitors. Although of course that means that the divi is only a nominal amount, since funds are reinvested into expansion. Longer term however, there should be scope for bigger divis.

We met management at a Mello Beckenham event, and I was impressed that they seem genuine, and hard-working managers, which is very much what you want at the micro cap level. So I can see a positive case for thinking about this share as a very long term (5 year+) buy & forget type of investment.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.