Good morning!

Today's SCVR is a joint effort.

First we have LoopUp (LON:LOOP) and WANdisco (LON:WAND) by Paul, followed by my sections.

Edit: I forget to mention that Paul added several sections to yesterday's report (click here), which now includes all of the following:

- Begbies Traynor (LON:BEG)

- Redstoneconnect (LON:REDS)

- Cambria Automobiles (LON:CAMB)

- XLMedia (LON:XLM)

- Lakehouse (LON:LAKE)

Cheers

Graham

(This section by Paul Scott.)

LoopUp (LON:LOOP)

Share price: 161.5p (unch.)

No. shares: 41.0m

Market cap: £66.2m

Preliminary results – for year ended 31 Dec 2016.

This is a very interesting growth company, which I’ve written about here before. It’s a single product company – providing an improved conference call (with screen-sharing) facility. There’s no doubt that the product is excellent – I’ve tried it out, and it works very well indeed. There’s plenty of competition though, which I’ll come onto later.

Results today are as expected, with the figures tying in with those given in the trading update on 18 Jan 2017. Although, as with a lot of trading updates from many companies, management tend to cherry-pick the best numbers. So in that January update, LoopUp presented the £2.1m EBITDA number, but conveniently forgot to mention that translates into only £0.4m operating profit! This is one of the reasons I often hold back on buying shares until I’ve seen the full results, and not just cherry-picked highlights in a previous trading update.

Anyway, here are the key figures today;

LoopUp revenue up 39% to £12.8m.

There is a small amount of sundry additional turnover, for a now defunct deal with BT, so that can be ignored.

Note that top line growth has been consistently growing at c.40% p.a. for several years now, so a very good, stable growth trend is in place.

Gross margin is very high, at 75.9%.

Strong organic growth + high gross margins is a lovely combination, which leads to explosive profit growth, if overheads are fixed.

Overheads are not fixed though – a lot of the additional gross profit is being reinvested in increased sales & marketing expenditure, plus other overheads such as development.

EBITDA of £2.1m is up 102%.

Maiden operating profit achieved of £0.4m (previous year was a £0.4m loss)

Diluted EPS of 0.5p, so the PER looks whacky at 323. However, PER is pretty meaningless at a fast-growth company which has just tipped into small initial profits.

Net cash of £2.2m – so the company probably won’t need to do any more fundraisings, which I always like to see.

“Pods” system for sales is working well.

Outlook comments are non-specific, but sound upbeat;

We remain focused on helping our customers have a fundamentally better experience on their important, day-to-day remote meetings. That's why LoopUp exists. We continue to see strong demand for our product; we're confident in the experience-led differentiation we've built into that product over the last 11 years and its ability to continue to take share from the large players in this £5 billion market. Looking ahead into 2017, we continue to see strong demand for the LoopUp product and are confident in our ability to deliver further growth.

Amazon Chime – this is the spanner in the works. I panic-sold my shares when I saw the announcement that Amazon has launched a conferencing product which looks remarkably similar to LoopUp.

It was this news which caused a big spike down in the share price. I’m surprised that the share price has recovered so strongly since, as I assumed that the Amazon threat would hang over the company for a long time.

My opinion – as I clearly stated in my earlier reports on this company, my main worry was that someone else would come along with a cheaper and/or better product. So when Amazon appeared with a very similar product, I became so worried that selling my shares was the only option to enable me to sleep at night.

If a serious threat arises to any company, I think it’s best to sell first, and ask questions later.

I’ve since discussed this issue with a friend, who reckons that Amazon Chime and LoopUp are going for different niches. So he remains bullish on LOOP. I’ve toyed with the idea of buying back in, but for the moment have decided not to.

I’ve seen some commentary that LOOP is ridiculously expensive, etc. It’s not. Actually, if the growth continues at 40% p.a., then profits would go through the roof, and LOOP would look cheap in a couple of years’ time. So the valuation all hinges on growth continuing at a strong rate. I’m not sure how much of a competitive threat Amazon will be. LOOP has an established, and very happy user base – evidenced by “negative churn” – i.e. existing users increase their use of the product by more than enough to offset client attrition.

Overall, a very nice little company, and I hope they continue to do well. Really good management too.

(This section also by Paul.)

WANdisco (LON:WAND)

Share price: 505p (down 5.3% today)

No. shares: 35.1m

Market cap: £177.3m

(at the time of writing, I hold a long position in this share)

Preliminary results – for the year ended 31 Dec 2016.

By any measure, these are lousy results out today. That’s to be expected though, as WAND has a terrible track record of losing money & burning prodigious amounts of cash.

So why is the market cap so high, and more to the point, why do I have a long position in this?!

Several reasons;

We’re in a bull market, and convincing jam tomorrow shares are mainly going up, sometimes by a lot.

WAND’s software does sound genuinely ground-breaking, and sales partnerships have been set up with major companies like Amazon, IBM, and Microsoft.

There’s strong growth in bookings starting to come through. Although sceptics point out that bookings are multi-year, so don’t translate into much increased turnover yet.

Cost-cutting means that cash burn is reduced.

It looks likely that another fundraising will be needed. I don’t see that as a problem – the company has raised money before quite easily, and the newsflow & share price are much higher now. So it wouldn’t need much dilution – say 10%, to push them over the line towards cashflow breakeven, I reckon.

My opinion – this share divides opinion like only a few companies can do. We’re currently in a big bullish phase. This was reinforced by very bullish articles a few days ago, including one in respected tipsheet, “Small Company ShareWatch”. It’s respected because the model portfolios it has run for many years now, have done extraordinarily well. SCSW has a rare ability to spot stellar growth stories quite early on.

Personally, I’ve already top-sliced my holding, and got my cost price back. So am happy to run with the profit, and see where it goes. The bull case is very convincing, but trouble is, so is the bear case! I’ve no idea which one will prevail in the long run.

CMC Markets (LON:CMCX)

Share price: 128.6p (+6%)

No. shares: 288.1m

Market cap: £370m

Relevant for investors in this space (of which I am one, via my holding in IG Group (LON:IGG) ).

This transaction marks a further combination of spread betting/CFDs with traditional stockbroking.

Half a million ANZ Share Investing customers will now be serviced by CMC:

"CMC will provide leading technology, customer service and execution via an ANZ-branded stockbroking platform."

"Gross revenue received from CMC’s stockbroking business is projected to increase by approximately A$40m."

"Leverages the scalability of CMC’s existing best-in-class stockbroking technology, providing ANZ retail stockbroking clients with access to leading technology, customer service and execution..."

Later in the statement, we read that "the forecast cost increase will be significantly lower than the revenue increase from the additional trading volume". So there should be a significant increase in profitability - perhaps the market cap should have risen by more than the £20 million it has increased today?

My opinion

This transaction makes a lot of sense although it's important to note that ANZ clients will continue to interact with the ANZ brand, not the CMC brand (if I understand it correctly!)

But it marks a further move by the more technologically-advanced and (in my opinion) user-friendly spread betting and CFD companies into the stockbroking space.

One of the reasons I'm excited by the future of IG Group (LON:IGG) is that I can see its Share Dealing service potentially turning into the default choice for the next generation of investors, who want a more high-tech platform and the option to use margin lending, derivatives, etc. There will still be space for conventional brokers, but I think they will be competing very much on price.

Valuation

Of course, the main issue facing CMC at the moment is the regulatory threat, which explains why the shares are trading at a PE ratio of 10x on much reduced earnings forecasts.

Breedon (LON:BREE)

Share price: 78.9p (+2%)

No. shares: 1411m

Market cap: £1,113m

Thanks for the reader requests to cover this, which is not a company I usually look at.

Executive Chairman comments:

'2016 was arguably the most eventful year in the Group's history. We completed our largest acquisition to date, invested a record amount in our business, began supplying our biggest ever contract and delivered an excellent financial performance - all against the background of an uncertain economic environment and challenging trading conditions in many of our markets.

'As we look ahead, the Government appears to have finally committed to substantial investment in the UK's infrastructure and this, coupled with anticipated growth in the private housing market, is expected to bring significant medium- and long-term benefits to our business.

"Considerable optimism" is mentioned - so no sitting on the fence as far as the outlook is concerned.

AIM versus Main Market

Interesting that such a large company sees no need to move to the main market. Some institutions do have rules against AIM investing but apparently this doesn't pose a significant problem from Breedon:

We have consulted over the past year with some of our major shareholders and advisers and, in light of those discussions, the Board sees no immediate urgency to do so, given that AIM currently provides us with a more than adequate platform from which to pursue our growth ambitions.

Acquisition

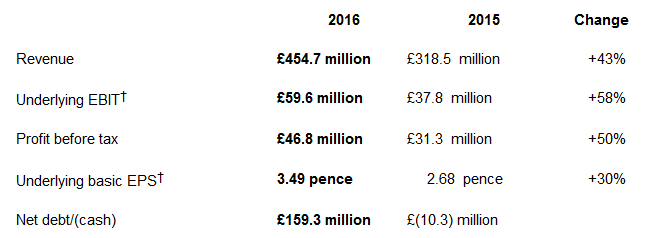

These results include the integration of Derbyshire-based Hope Cement, purchased in a November 2015 deal for £336 million (partially cash, partially in shares).

So the growth percentages in the table at the top aren't too important. More important on an underlying basis is the 8% growth in revenues at Breedon Northern (converted to 24% growth in underlying EBIT), and the 2.6% growth in revenues at Breedon Southern (converted to 26% growth in underlying EBIT).

My opinion

Modest changes in EBIT margin are converted to substantial changes in the bottom line, so you can look at that as a source of risk or opportunity.

Overall, I'm not seeing any red flags here and I'd like to start looking into this in a bit more detail.

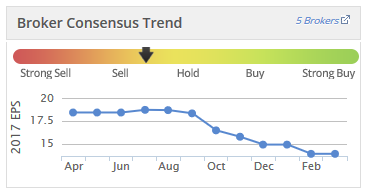

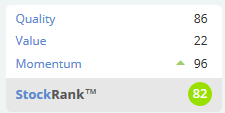

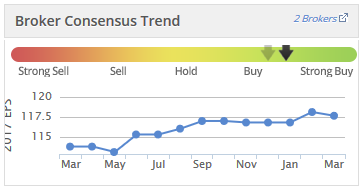

Although there is not too much raw value on offer, according to Stockopedia:

XP Power (LON:XPP)

Share price: 1945p (-0.3%)

No. shares: 19.2m

Market cap: £373m

This international provider of power products (power supplies and converters) has issued a very solid set of numbers.

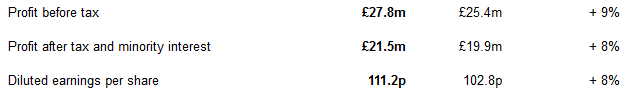

The adjustments are fairly small, so I won't bother with the adjusted results and go straight to the reported ones (left column is 2016, right column is 2015):

Orders were up 21% and revenue was up 18%. Gross margin fell 200 bps to a still-good 49.8% rate.

Dividends: XPP pays an attractive, quarterly dividend stream and the Q4 dividend is raised 2p to 26p.

The underlying quality of the performance appears to be improving with a record contribution from own-designed products (now 73% of total, up from 68%).

And as a small indicator of how China is moving up the value chain, the manufacture of lower complexity products is being moved out of China and into Vietnam.

Forex

I've been scouring the statement for information on FX effects, since the devaluation of sterling must have had a big impact on the reported 18% revenue increase.

Indeed, I find the following comment:

The average exchange rate for the US Dollar compared to Sterling was 1.38 in 2016 versus 1.54 in 2015 representing a 10% weakening of Sterling following the Brexit vote. This caused North America and Asia revenues to be inflated, due to translation, and all of our costs reported in Sterling to be inflated as our product costs are predominately denominated in US Dollars.

North America was 53% of revenue, and so since the costs are mostly in USD as described above, perhaps the true economic impact of GBP is limited. The UK is 13% of global sales.

Later:

Revenues set a new record and grew 18% over the prior year (7% in constant currency) to £129.8 million (2015: £109.7 million). Order intake grew by 21% (9% in constant currency) to £133.5 million (2015: £110.5 million).

So the 7% growth rate is the most useful measurement of underlying growth.

Cash flow/Balance Sheet

No concerns on this front.

We finished 2016 in a net cash position of £3.7 million compared with a net debt position of £3.7 million at the end of 2015. This position was achieved after returning £12.9 million to Shareholders in the form of dividends.

My opinion

I've developed a really positive impression of this company.

I also see on their homepage that they are in partnership with another industrial stock I like, the distributor Electrocomponents (LON:ECM) .

The trading momentum is positive, the quality metrics are good, and the PE ratio is not too scary (c. 17x.)

So I think this stock looks potentially quite interesting.

I'm afraid that's all for today - thanks for tuning in!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.