Good morning. Recruitment group Hydrogen (LON:HYDG) has been hovering near the top of my watch list for a while now, so I read their trading update today with interest. However, it doesn't really tell me much of interest. It keeps referring to "Net Fee Income", but this is just another word for gross profit. It doesn't tell me anything about overall profitability, or how the group is performing against market expectations - yet those are the key things one needs to be told in a trading update! Reading between the lines it sounds as if their profitability is probably flat or slightly down, but there's an element of guesswork in that. There shouldn't be, the RNS should be a lot more specific, so a thumbs down to whoever wrote that one - a half year trading update has to refer to profitability vs market expectations, or it's virtually useless.

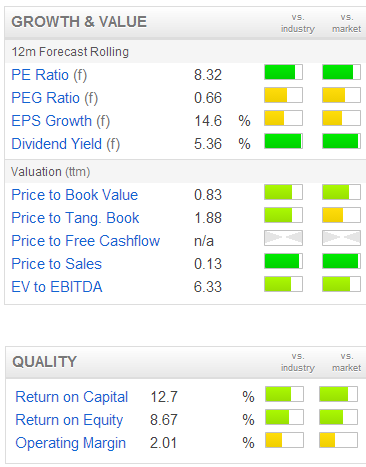

There's quite a lot of green on the growth & value graphics on the StockReport for Hydrogen, in particular the PER and dividend yield look attractive, which is often a good starting point, providing net debt is not too high.

At the last reported Balance Sheet, of 31 Dec 2012, net debt was £2.8m. That looks to be fairly typical, since the full year P&L interest charge was £167k, so if we assume a typical interest rate of say 5%, then that equates to an average debt figure throughout the year of £3.3m, which is near enough to the £2.8m year end net debt figure.

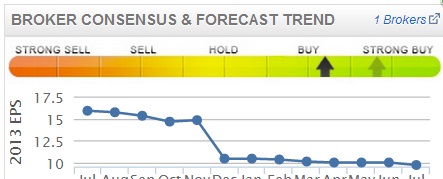

Broker forecast consensus is for a slight rise in normalised EPS this year (ending 31 Dec 2013) to 9.7p, so assuming they are on track for that (pity the RNS today didn't specifically say so though), then the PER is a fairly attractive 9.4.

You might be wondering why the table above right shows a forward PER of 8.3 then? Well, the Stockopedia system rather cleverly works out a blended 12 month forecast as from today, so it uses part of the 2013 forecast, and part of the 2014 forecast, so that all companies with different year ends are comparable at any point in time. Clever, eh?!

So on the face of it, Hydrogen looks potentially good value, although I am a bit concerned by the extent that broker forecasts have reduced this year, see small chart to the right. That doesn't look particularly healthy.

That said, the 5.2% dividend yield this year is very attractive, and it's twice covered. Furthermore, recruitment should benefit from an upturn in the economy, so there's scope for long term earnings growth too. I quite like this one.

FTSE 100 futures are indicating a strong open, up 35 at 6,483. It's impressive how quickly the main Indices have recovered from the (necessary) but sharp one month correction we saw from 22 May. Perhaps this will reinforce the idea that dips are for buying, not panic selling - all good bull market stuff!

The Stockopedia page for the FTSE 100 Index (FTSE:UKX) shows a forward PER of 13.9, and forward dividend yield of 3.1%, which are not expensive by historical standards. However, I note that the resource stocks & certain other large caps, such as Astra Zeneca, are on low valuations, so it would be interesting to strip them out to see what the rest of the FTSE 100 is rated at. There seem to be quite a lot with a PER of around 20, which is getting a bit pricey, although it depends where we are in the economic cycle, and we're not really sure at the moment.

What's next? NetPlay TV (LON:NPT) have issued a positive trading update for Q2, with their "KPIs significantly increased on a year on year basis" (for anyone not aware, "KPI" means Key Performance Indicators, and are what businesses use internally to measure performance & often pay staff bonuses. They are also sometimes used to muddy the water & create the impression of a business that is doing well. The only KPI that matters to me is profit!).

Crucially, Netplay say they are "confident of meeting full year market expectations". Stockopedia shows normalised EPS broker consensus for year ending 31 Dec 2013 of 1.5p, so at 17.25p the shares actually look quite good value, on a PER of 11.5 - not bad for a growth business.

A 2.6% dividend yield is forecast. This one might be worth a look, if you can stomach the sector - I don't like online gambling companies, because players tend to have a short lifespan before they run out of money & realise it's a mug's game. Also for me, there are ethical considerations - I would just rather not invest in gambling companies, and they tend to make volatile investments too. Very competitive sector too.

Well, a very buoyant morning so far, the FTSE 100 is now up 73 points, to 6.523, a very spirited recovery from the recent low just above 6,000. These are pretty volatile moves, everything seems to have sped up recently, with large moves occurring more quickly than in the past, not just with shares, but also with Bonds, and Gold. It must be because of all the electronic trading & the leverage. Let's hope the financial system doesn't shake itself to pieces again, but one does have the general uneasy feeling that things are running somewhat out of control generally in financial markets. The speculative forces are just too large (says he, as a market participant!).

The Dangers of Spread Betting

I note with interest that the recent, and bizarre price moves at Iofina (LON:IOF) seem to be subsiding. There was an extraordinary plunge on their shares on 20 June which took them from about 200p down to an intra-day spile on 22 June to not much over 100p. They then shot back up & found a floor around 145-150p, and are now back up to 185p. The company issued a statement on 24 June saying they knew of no reason for the erratic share price movements.

I asked around as to what had caused this, and the reason is that several spread betting firms had heavily geared clients with large positions in Iofina. As the price began falling, apparently several large clients were not able to meet margin calls, and so the spread betting companies began liquidating their positions. This was clearly done clumsily, and triggered further rapid & large falls in the share price.

The falling price therefore wiped out more spread betting clients, who were also over-leveraged, which triggered more client positions to be dumped (remember that spread betting companies will hedge their bets literally, so when they close out client long positions, they will usually be sellers of the physical stock, or CFDs anyway, which amounts to the same thing).

So what are the lessons to be learned from this? The key lesson is that speculative shares (whose value is based on expectations of future profits/cashflows, as opposed to existing profits/cashflows) are totally unsuitable for spread bets. As I discovered to my cost in 2007-8, gearing is extremely dangerous in a plunging market, as it magnifies the losses. Liquidity can dry up to a point where you can't get out, even if you want to. So geared positions, combined with lack of liquidity in the underlying share, and/or a particularly volatile share price, is just an accident waiting to happen.

So in my view the key rules for spread betting in equities go like this;

My Top 10 Rules for Spread Betting

1) Above all, only use a moderate amount of gearing (less than 2 times equity).

2) Diversify the account into at least 10 positions, so that no one share plunging will do serious damage to your portfolio.

3) Don't let any one position become overweight more than (say) 10-20% of the total account.

4) Don't spread bet at all on illiquid, or highly speculative shares.

5) Don't spread bet on anything where there are loads of other people also spread betting on it - so this means pretty much all shares that are very popular with private investors!

6) Think very carefully about using automatic stop losses - you are just presenting bear raiders with an easily guessable target price to attack.

7) Don't use gearing all the time - it should only be used in short bursts, when the market is in an upward trend. Easier said than done, this one!

8) Top-slice profits on the way up, not the way down! This allows you to buy the dips, rather than being forced out on the dips.

9) Above all, always calculate the underlying position value, and make sure that is appropriately sized relative to your overall personal wealth. There is a real danger of over-sizing positions, which can be disastrous if something goes wrong.

10) Calculate how much money you would lose if the company's share plunged by say 30-50% on some serious bad news. If that potential loss would be seriously damaging to your wealth, then the position is too big.

One final one, if I may;

11. If you don't know what you're doing yet, as an investor, then don't spread bet at all - it is the road to ruin for inexperienced and cocky investors, and should only be undertaken by investors who have a track record of consistently making money & managing risk well.

I've been looking at XP Power (LON:XPP) this morning, and like what I see. The shares are up 7% to 1304p today, on a positive trading statement. With a whisker over 19m shares in issue, that makes the market cap currently £248m, so relatively large in my universe of minnows!

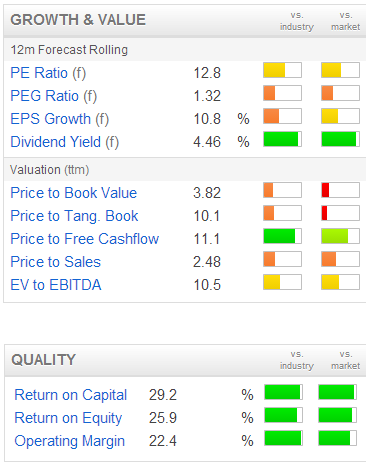

They are a maker of power supplies based in Singapore. I don't usually touch overseas companies Listed in the UK, as there is often something wrong with them. In this case I'll make an exception though, as it's a decent-sized, consistently profitable business, consistently paying decent (and rising) dividends, and has been Listed in the UK since 2000. So an excellent track record.

The historic financial track record is excellent, with really good operating profit margins, in a 21-24% range over the last three years, which is highly impressive - such a high operating profit margin indicates considerable pricing power - i.e. products in demand, and not much competition. So I'd want to understand what their niche is, and whether there are competitive threats, but the historic figures say they have a strong market position in a profitable area.

There's been tremendous growth in the dividend, from 22p in 2009, to 33p, 45p, and 50p, in the three subsequent years. It was 1.63 times covered at 50p too.

The balance sheet looks fine, with no pension deficit, and only £10.6m net debt, so all fine OK there.

Today's trading statement says that H1 trading was in line with expectations, so that's good. Group revenues were up 5%, so not terribly exciting growth really, which probably explains why the forecast PER is fairly reasonable, at 14.3 (I've adjusted for today's share price rise). That's not a bad price for a quality business that generates high margins, and pays a 4% dividend.

To my mind, the crux of the matter is whether there is upside on earnings from a cyclical economic recovery? If so, then the shares could be a very good long term bet. XP Power mention in their outlook statement today that their markets remain subdued, and indicating a fairly flat outlook for 2013. So I don't think there's necessarily any rush to buy the shares, but it looks potentially interesting as a long term investment. Would need more research on their products, markets, competitive position, etc.

There is a positive trading statement from Billington Holdings (LON:BILN) today. I've had a look, and think it looks potentially interesting. Can't get any shares though - the spread is absurd, at 70p Bid, 85p Offer, and there's nothing inside the spread, so a total waste of time it being Listed really. Pity.

I can't help feeling that a good idea would be to package up a group of say 5 good companies, and fuse them together into a mini conglomerate, with a single Listing. This would allow certain costs (such as the Listing, Non-Execs, etc) and even some back office functions like Accounts, to be shared, and thus profit margins increased.

More importantly, by bundling together five illiquid shares into one, you would create a much more liquid share, and something that overall would be a better proposition for everyone.

The stumbling block to this is obviously that management would resist it, but you could easily set up arrangements whereby the operating companies are autonomous, providing they perform at or near to budget. Interference only comes from the other constituent parts if any individual company under-performs. You wouldn't even need a top level Board, you'd just make each CEO of the operating companies a main Board member, and then have an independent Chairman.

Good idea isn't it?! If I wasn't so busy, I'd work on putting together something like that myself, but realistically it's not going to happen from my end, so thought I'd chuck the idea out there & see if anyone runs with it.

I could easily make up several lists of 5 good companies that would fit well together, and would be a more sensible Listed entity if fused together, rather than soldiering on as unloved, totally illiquid micro caps with a load of superfluous costs, and no significant benefit from being Listed. Forming such a mini conglomerate would be a much better bet than de-Listing, which destroys shareholder value & upsets everyone.

I've got to dash now, to prepare for a company meeting in London shortly. Just a quick mention of good results from 1pm (LON:OPM) today, which has found a profitable niche in asset financing, an area where the Banks have largely withdrawn from it seems. They have apparently good underwriting rules (requiring Personal Guarantees from small business borrowers), and it's easy to see this growing into a much larger business over the next few years. I missed the recent run in the shares, so probably won't be chasing it up.

Bah! 5 typos today, sorry about that, just run spellcheck to correct them. When I type fast, sometimes things go wrong, my apologies.

See you from 8 a.m. tomorrow morning.

Regards, Paul.

(of the shares mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.