Good morning! It's Paul here.

Today's report will be a quick early post, which I'm doing now. Then more detail added later, this afternoon. The reason for this is because I'm heading into central London in a moment, to attend the G4M analyst meeting. So I'll report back to you about that later. Please note that G4M is my 2nd largest personal long position - so clearly I am biased in favour of the company, or I wouldn't have bought so many shares in it!

Waterman (LON:WTM) - congratulations to holders here, as a recommended 140p cash offer has just been announced. It's a share I've covered extensively before, so nice to see a decent outcome for shareholders. It's interesting to see that the bidder is Japanese. I seem to recall that another Japanese company bid for some other UK building consultancy company, but can't remember the name. If any readers can recall that, maybe you could drop a comment in below this article?

Gear4Music (LON:G4M)

Share price: 620p (up 3.7% at 11:15 - likely to be volatile today)

No. shares: 20.2m

Market cap: £125.2m

(at the time of writing, I have a long position in this share)

Preliminary unaudited results - for year ended 28 Feb 2017.

I've been covering this company for about 14 months now. Reading the archive to refresh my memory, it's interesting how my view on it has greatly changed. Initially I saw it as just a low margin box-shifter. However, several game-changing announcements last autumn - of stellar growth being achieved, and European expansion, made me much more bullish.

Meeting management last year also helped. Meeting management isn't complicated for me, as I'm only really looking for one thing - entrepreneurs. It doesn't matter to me if the presentation is a bit wobbly in places, as giving presentations is a completely different skill set from creating a successful business. Management seemed more relaxed & confident today than when I saw them last year. I suppose that having floated in Jun 2015, they're familiar with the whole process now. Plus, reporting on good progress must be quite enjoyable.

First some numbers & my comments;

Revenues up 58% to £56.1m - this is stellar growth, and is all organic. I don't think it pays to over-analyse the precise figures, because there are several overlapping factors at work - e.g. UK growth inevitably slows in percentage terms (but is still very good), whereas international growth is looking fantastic, as it's coming from a low base. Remember also that, this time last year, the revenue forecast was £49m, so today is a £7.1m beat (14.5%) against original revenue expectations - impressive. I very much like companies which out-perform against forecasts, as that gives upside on the share price.

International growth - this is the most exciting part, and is up 124% to £21.3m. Remember that the 2 European hubs were only opened quite recently, so didn't contribute that much to these numbers. We should see really strong growth in Europe in the current financial year & beyond. So personally I'm hoping that the £79m revenue forecast for this year could also be beaten.

Global growth - as I read the RNS this morning what struck me the most was the new emphasis on global growth (as opposed to just UK & Europe). G4M is now selling into 190 countries. The CEO emphasised that it's "very early days", but is clearly excited about the growth potential. He said the company is concentrating on further developing the IT platform, to handle more languages, and delivery options.

Market opportunity - I think the new, global ambitions could trigger another re-rating of this share at some point (no idea when, and there's no certainty I'm right). In the past, the company talked about a total market size of 4bn - I'm not sure if that was Euros, sterling, or dollars. Whereas the slides today showed a market size of $17bn - being the global markets of course. I think that could trigger interest from investors who previously dismissed G4M as being too niche.

Underlying operating profit rose 192% to £2.6m. Margins have improved a lot, but are still quite low. However, it's important to put this in context;

This is a growth business, so higher margins come later, once it's mature

Gross margin has improved from 25.9% last year, to 27.0% this year. Better buying & increased scale, mean this should continue rising.

Some other online businesses (e.g. those in the fashion sector) achieve much higher gross margins than G4M, but their average transaction value is usually much lower. G4M achieves an average order value of £124, so the apparently low gross margin actually delivers about £33 gross profit per order - a lot higher than BooHoo, for example.

IT development spend is capitalised, and this is flattering profit in the short term. The CEO commented that the IT platform is the main driver of the business, so it is money well spent, and makes sense to capitalise it. Some investors may want to reverse this policy though, it's up to you.

Inventories have increased a lot, but it was emphasised that this is done deliberately - e.g. order sizes for (higher margin) own brand products mean that each line has to be bought in depth - i.e. considerable quantities. Also, deals are often done, to take more stock than they necessarily want for now, in return for a discount.

There are no stock obsolescence problems, as the products are not fashion items, and don't physically deteriorate when in stock. Stock turn is unchanged. "We could squeeze working capital if we need more cash" was a key comment.

I've got information overload here, so this section is not very well structured, apologies for that.

Website conversion - a key number for any internet business. This has risen very strongly - up from 2.28% last year, to 2.75% this year. Note that Europe is much lower, so there's an opportunity to increase European sales a lot more, by driving up its conversion rate.

Operational management - CEO & CFO were keen to emphasise that it's not all about the plc Board. So we were shown a slide of the wider operational management team. Several have been recruited from competitors in Europe.

European hubs - management are very pleased with how these (new sites in Sweden & Germany) are going. Scandinavian growth has been excellent since the new hub opened, and it's also allowing G4M to buy locally - and thus become exclusive distributors for specific products, etc. All great for margins.

I commented that they seem to have handled the growth into Europe very well. This was explained as being thanks to high quality local, operational management, and the whole team. So I think it's clear that G4M is genuinely building a great team of people - essential for such a rapidly expanding business.

New Head Office, in York. This looks a clever deal, to acquire a freehold site, which gives them a lot more flexibility, and is very cost-effective when interest rates are so low. Debt funded by HSBC. Also, half the site is being rented back to the landlord for the first year.Remarkably, this rental income covers the entire cost of the whole site in year 1.

H2 weighting - for current year - this is normally a red flag of course. The reason why I'm not worried about this, is that management has chosen to increase particular costs, in order to drive growth. That's a conscious, and positive decision. Very different from companies which blame an H2 weighting on delayed contracts, which is the usual excuse.

However, I do think the next interim results might spook some investors, which could potentially limit the short term upside. For long term holders like me, this is just background noise. I think it's important for me to emphasise to readers here that the next interim results are likely to look disappointing to anyone not aware that this is a deliberate policy decision to drive future growth.

Management confirmed they're comfortable with the full year forecasts for this year. They want to drive the growth as their main priority, and that inevitably involves some up-front costs. This is a good thing in my view - management should absolutely be prioritising long-term growth, and not chasing short term profit targets by restricting spending on useful things that drive future growth but take a few months to kick in.

Product - now have 38,000 product lines (although not all held in stock by G4M). Surprisingly, the CEO said there's scope to increase this considerably. They're finding niche products that sell surprisingly well, often quite expensive ones. So there's more to go for, in terms of product range.

Direct sourcing - there is a margin opportunity for taking out middle-men, and buying direct from factories. This is a growing opportunity as G4M achieves more significant scale.

Marketing spend - I asked a question about this. My pet theory is that ecommerce companies are often priced very aggressively (on a PER basis) because they will have scope to increase margins a lot in future. The CEO confirmed this is indeed a long term aspiration, but that in the shorter term G4M is gunning for growth as its main priority. However, once the business is mature, then it can talk to customers direct, instead of needing to spend a fortune on marketing. So definitely a profit opportunity in the long run. That (and stellar growth) goes a long way to justifying why the shares look superficially expensive at the moment.

Thomann - by far the market leader in Europe. I asked about them. CEO said their business model is different - they operate from a single site in rural Germany. G4M is adopting a different approach, of smaller regional hubs, allowing it to get closer to customers.

Amazon - this topic did not arise today, but is often a worry with investors. Previously though, G4M have said that Amazon are not targeting musical instruments particularly, as it's too niche, and needs specialist advice & expertise to help customers. So it's that high service differentiation by G4M which hopefully will protect its niche. Also, the margins are low already, whereas Amazon seems to prefer attacking markets where incumbents are making fat margins.

My opinion - no surprises here! I see this as a fabulous, entrepreneurial growth company. Management are exactly what I look for - hard-working, hands-on entrepreneurs. They're building a great team around them. The organic growth being achieved here is stellar, and with Europe growing very strongly, plus the wider global opportunity, I think there's plenty more to come here.

Now the tricky bit - how do we value it?! For me, PER is a very poor tool when trying to value growth companies. Sales and margins are likely to be so much higher in a few years' time, that it's nonsensical to value the business on historic figures, or even using (usually too cautious) broker forecasts.

This might sound crazy, but my view on this company is that I'm not being too scientific in how I value it. All I know (or at least am pretty sure about), is that this is heading to be a much bigger company in a few years' time than it is now. Also, having "achieved scale", the company should be able to keep pushing its margins up from increased buying power.

In time, the heavy marketing spending can be reduced, once customers know about the company and its brand already. Put those factors together, and it could maybe achieve a 10% operating profit margin long term? On sales of perhaps £500m p.a. (I'm looking a long way ahead here). If that happens, we could be looking at a market cap of say anywhere from £500m to £1bn+? Who knows? It depends how growth companies are valued in future. The market might become more conservative about them, I don't know.

As long as nothing serious goes wrong, it seems to me there is very good long term potential for this company. To a certain extent then, I'm not that bothered about the short term share price. Although when explosive moves up do occur, it's so tempting to bank the profits. Many of us sold way too early on Boohoo.Com (LON:BOO) and I'm determined not to make the same mistake here.

This share won't suit everyone for sure. However, I remain of the view that it's one of the best growth companies on the UK market. That's reflected in a valuation which looks high, but could look cheap in a few years' time, if international growth continues to be strong.

It's very unusual to find a UK company which is pushing into Europe, and further afield, and almost making it look easy. I'm tremendously impressed with that, and hence am really keen to hang on to as many shares as I can.

Treatt (LON:TET)

Share price: 412p (down 1.9% today)

No. shares: 51.9m

Market cap: £213.8m

(at the time of writing, I hold a long position in this share)

Half year report - for the 6 months ended 31 Mar 2017 - an impressively quick reporting timescale. Fast reporting usually means that a company has good financial systems and controls, in my experience.

This company describes itself as a;

manufacturer and supplier of innovative ingredient solutions for the flavour, fragrance, beverage and consumer products industries

Please refer to my report here in Feb 2017, which contained some useful links (kindly provided by readers) to background info on the company. In particular, the John Lee audio interview is very interesting indeed, as he explains the big upside potential of this share.

I see that in last weekend's FT, Lord Lee (a regular columnist there) mentioned Treatt very positively indeed. Amazingly, this stock is now 40% of his famous ISA, and he firmly stated that he has no intention of selling any. A very strong endorsement, from such a successful investor.

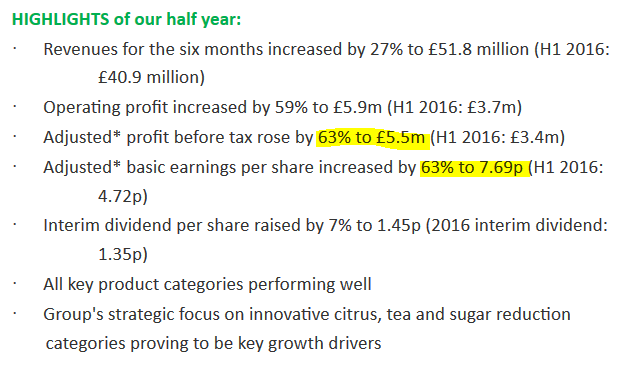

The highlights section today looks very impressive indeed;

Forex - I really like that the company has explained the benefit from forex moves so clearly, which all companies should do;

The effect of foreign exchange has been materially positive during this first half. The Group has a hedging strategy in place which aims to ensure that the impact of significant exchange rate movements on the income statement over the course of a full financial year is mitigated as far as possible.

However, the US Dollar's relative strength against Sterling over a prolonged period has positively affected Group revenue by £3.0m (6% of Group revenue) and profit before tax by £0.8m (15% of Group profit before tax).

So this is a big factor to take into account, as it could be a one-off impact, or even go into reverse if sterling continues to recover against the dollar. We cannot predict these things, but it's important to at least understand that profits are being boosted by this factor, which may not continue to boost future profit in the same way.

Inventories & net debt rose in H1. However, as explained before, this is the normal cycle for its cashflow, and these movements tend to reverse in H2. So not an issue, in my opinion. Higher ingredients prices have also caused some of the increase in inventories.

Capex - there's lots of it in the pipeline. A new site in Bury St Edmonds should come on stream in late 2019, but costs will of course be incurred well before that. Outline planning consent has been received.

There's also $11-14m of capex required for expansion of Treatt's US operations.

This business is rather more capital-intensive than I would like in an ideal world. However, I'm more relaxed about capex at companies which are trading exceptionally well already, like this one. New facilities can clear bottlenecks, and open up capacity for potentially even faster growth in sales & profits.

On capex, Edison says today;

...we continue to expect both the UK relocation and the US expansion projects to be debt-funded. Management, however, has not ruled out equity funding for the UK site relocation, though a decision has not yet been made.

Outlook - investors here have become accustomed to hikes in forecasts. So just being in line today is perhaps why the share price has come off a little (after a big move upwards from Feb 2017):

The strong performance for the Group in the first half of the year has continued into the third quarter with Group order books remaining materially higher than this time last year as the benefit of some significant new business wins continues to show through.

Whilst there is still much to do to complete the year, and unexpected exchange rate movements can impact results, the Board is currently confident that the Group will meet its revised expectations for the financial year ending 30 September 2017.

Balance sheet - overall looks alright to me. Although, as mentioned before, inventories are high, and fixed assets are set to increase in future, very considerably. Therefore, personally, I would like the see the company raise a modest amount of extra equity. It's not a problem though, as companies which are performing very well tend to find it easy to raise finance.

Note there's a pension deficit, although quite small at £6.3m

Cashflow - the stand out item is the increase in inventories. The company has explained this, but it's something to keep an eye on. There can be nasties within very high inventories - requiring a future write-off. So I see this as an amber flag - something I'm not entirely comfortable with.

Forecasts - the company did 7.69p in adjusted EPS in H1. So the full year consensus forecast of 18.7p requires at least 11p in H2. Looking at last year, there seems to be a strong seasonal bias to H2, so hopefully the newer, greatly increased forecasts can be achieved. It would be embarrassing if greatly revised upward forecasts were then missed.

Edison has today revised up slightly its forecasts for next year & the year after. They will obviously have got a steer from management, so that's reassuring.

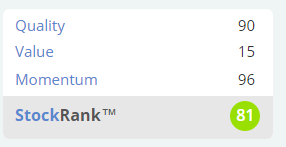

StockRank - this neatly encapsulates that the stock is rated quite highly, but that's very much based on strong momentum (in share price and earnings), and quality scores. However as you can see the value score is now very low.

The computer-generated classification for this share on Stockopedia is:

Balanced, small cap, high flyer.

If you're not sure what that means, then Ed's latest webinar explains all. High flyer is one of the successful investing formats.

Alternatively, there is a 20 page eBook available here, explaining the new classifications system. I'm going to download it onto kindle, and read it in the bath shortly. Hopefully this will not be the second electronic device that is destroyed by water this week in my household (my iPhone met a watery death on a 1400 rpm spin cycle last weekend).

My opinion - I'm in this one for the long-term. We've had a fantastic move up in price this year, so maybe it needs to pause for breath in the short term?

The company feels to me like a long-term winner, as it's exploiting a niche where these is strong demand - especially for reduced sugar drinks. It should be seen as a specialist, scientific company - doing clever things to formulate ingredients specifically to client requirements, which can't be easily replicated.

It's delivering excellent organic growth, and good margins. Major capex is required now, so that's a bit of a nuisance (as things can go wrong), but it should lay the ground for considerable expansion longer term.

So I think this is very much a long-term growth stock. One which I remain positive about, although I'm not expecting any further immediate gains, after such a good run. You never can tell though, as we're in a bull market, and prices of growth stocks can run well ahead of what seems reasonable at the time.

That's it for today. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.