Good morning!

This is the placeholder article, published the night before, to enable early comments and suggestions from readers.

Best,

Graham

Paul has interviewed the CEO and CFO of Tracsis (LON:TRCS) on his personal website. following the publication of their 2017 results. It's available at this link.

Castings (LON:CGS)

- Share price: 435p (-5.4%)

- No. of shares: 43.6 million

- Market cap: £190 million

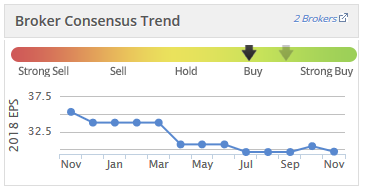

Checking my notes on this industrial group, I've generally made positive noises on it over the past year, while the market cap has been c. £200 million. Sadly, the outlook has been gradually deteriorating - see how the consensus 2018 EPS forecast has reduced from 35p to less than 30p:

The group has two parts - casting and machining. The machining plant came to the conclusion of a large contract about a year ago, resulting in a lot of excess capacity which needed to be filled again.

This part of the business has failed to recover yet, as today it reports a loss of £1 million (compared to a profit of £0.8 million in the previous year).

If I've interpreted this correctly, it would have achieved breakeven were it not for some one-off costs which have been included in the result:

Following a detailed review of the operation, additional short-term costs have been identified and included in the result for the period. The main areas impacted are stock obsolescence and the recoverability of tooling costs which, when taken with the director severance cost, have reduced group profits by £1.0 million.

The company is straightforward enough not to use any adjusted or underlying measures in these results (something I like about it). That said, perhaps we should bear in mind that stock obsolescence, etc. are somewhat unusual and that without those costs, it would have been approximately breakeven in this side of the business? The lack of an MD remains a serious concern, however.

The foundry part of the business performed fine, revenues up 8% and profit up 10.5% to £6.9 million.

Outlook

I'm a little disappointed with this, as they could have explicitly said that the outlook is now lower than prior expectations. Instead, it is implied:

Demand from our commercial vehicle customer base remains steady and therefore the full year result for the foundry operations is anticipated to be in line with market expectations..

The previously reported replacement work for CNC Speedwell has been reassessed in response to the issues experienced during the period. As a result of this review, the decision has been taken to exit certain non-core projects. Whilst this will most likely delay the revenue growth of the group, the directors believe there are sufficient opportunities available within the core customer base to replace this in the medium term.

So the bottom line is that sufficiently attractive replacement work arising from the end of the major contract at the machining plant has failed to materialise.

This is the world of B2B contracts and industrial companies - business comes in large chunky blocks and it can be really hard to replace good clients. It's why the likes of Terry Smith prefer investing in companies whose sales come in the form of small, easily predictable transactions.

My opinion

I still have a high overall opinion of Castings. it has barely diluted its shareholders in over 20 years. It's also paid out a gradually rising dividend for over twenty years, and even paid out a special dividend last year.

Where it fails to excite me is with its quality scores:

I'd describe these numbers as "acceptable", but would hope for more in the stocks which I personally invested in, especially when they are in their mature phase.

It remains a low-risk play from the financial point of view. The balance sheet is still bullet-proof showing entirely tangible net assets of £124 million, of which property, plant and equipment is £75 million. The perfect example of a big, heavy industrial company.

Volex (LON:VLX)

- Share price: 76.5p (+5.5%)

- No. of shares: 90.3 million

- Market cap: £69 million

This is a power cord supplier which is apparently on the turnaround track after a couple of years in the doldrums.

The share price has doubled from its low earlier this year, resulting in a mammoth momentum score and an excellent StockRank:

Momentum is proven to "work" (i.e. there are trends which persist in share price movements) so I can fully understand why people incorporate it into their investment strategies.

But even the worst companies can have superb momentum sometimes, so let's see what's going on here:

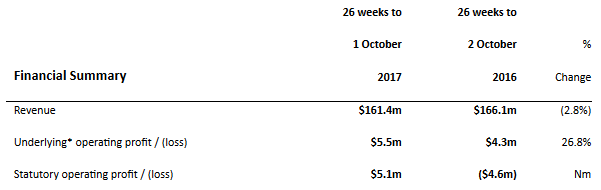

The operating margin of 3.4% (underlying) is very weak, but this is the best result achieved by the company in some time:

A statutory operating profit of $5.1 million is the best result in the past 5 years, reflecting an improved underlying operating performance and an absence of one-off restructuring costs.

Group revenue is down by $4.6 million on the prior period primarily as a result of a further $11.0 million decline in our largest Power customer's revenues.

Not entirely dissimilar to Castings, then - vulnerable to the one-off hit from large/profitable customers withdrawing. Is it true that the largest customer is still Apple?

I've just opened up the 2017 Annual Report. At the time, the Chairman said the company believed that sales to its largest customer "have now stabilised". Interestingly, he said "over investment in production capacity for our largest customer had resulted in excess capacity [at the Shenzhen facility] for a number of years."

The report also said that Volex "for the past five years has focussed on six long-standing key customers, failing to generate any new significant markets or accounts". Fairly damning stuff! The top ten customers accounted for 64% of revenue, and the largest one was 18%.

In today's report, the Chairman uses exactly the same phrase - "has now stabilised" - in relation to sales to the largest customer from Volex's Power Division, which fell another 25%. I'm not sure how reliable that claim is, since sales to that customer were supposed to have stabilised at year-end?

Digging further into the report, I see that gross margin in the Power Division is really weak, at just 15.5%, resulting in an underlying operating margin of only 3%.

There is a strategy to turn things around, but it sounds far from easy:

With Volex's traditional PC and peripherals markets set to continue their decline, competition here will only intensify. Therefore it is vitally important, if the Power Cords division is to turnaround its recent performance, for it to seek out new end markets that value Volex's expert knowledge in the manufacture of high power distribution cables and its reputation for quality and safety.

It might be safer to assume that the Power Division is not going to improve from here.

The Cable Assemblies Division is a bit more interesting, with gross margin of 21% and underlying operating margin of 7.4%. Sales are on the increase here, too. And it gives the impression of being a lot more diversified. With operating income of $5.2 million here in H1, I'd attribute most of Volex's value to this division.

Move to AIM: The company is getting off the main market and moving to AIM, citing the increased flexibility with which it will be able to make acquisitions, etc. It also mentions its current market cap. Makes sense to move to AIM, I think.

Outlook is in line with expectations.

My opinion

The Cable Assemblies Division looks interesting with some slightly more interesting, value-add activities which might prove to be a more sustainable source of profitability than the Power Division.

Given the very high StockRank, I'm inclined to think the outlook here is better than average, with a few caveats. Customer concentration risk is still a huge issue - that's the sort of risk which I manually and deliberately avoided when I was managing a Greenblatt Magic Formula-oriented portfolio.

The balance sheet isn't the prettiest I've ever seen. Receivables and inventory both appear to be on the high side, although the company has some stated reasons for this.

Conclusion: I wouldn't hold it long-term. But it looks like it will continue to re-rate in the short-term.

IQE (LON:IQE)

- Share price: 162.25p (+16%)

- No. of shares: 687 million (before placing)

- Market cap: £1,115 million (excluding value of placing shares)

Proposed Placing of up to 67 million new shares

Placing of new shares raising £95 million

Readers have prodded me into commenting on this widely-followed manufacturer of wafers for the semiconductor industry.

I first commented on it here nearly a year ago, when I said the rating it was on seemed a bit cheap. The share price was c. 38p!

With the share price now elevated, it has elected to raise money - intuitively, that makes perfect sense to me. Companies should sell shares when the shares are expensive, and buy them back when they are cheap. That's good for the company itself and it's good for long-term holders.

Of course, many existing holders do not think that the shares are currently expensive, as they expect it to grow into this valuation over time.

Certainly, it has a fantastic track record of growing sales and profits. Today's placing is justified in a number of different ways - not just to increase capacity to meet growing demand for existing products, but also to develop new products and technology and to de-gear the balance sheet. Debt and defcon had grown to £42 million by June 2017, versus H1 adj. operating profit of £10.6 million.

That level of debt doesn't seem onerous to me, but again, if I was running a business and felt that the share price was sufficiently generous, that is the point at which I would sell some shares to reduce borrowings and incur minimal dilution. The new shares will represent just less than 10% of the current share count.

You might wonder why the company is in debt at all, given its track record of profitability for the past ten years. The answer is that it has made very significant investments:

If you can read the numbers in the above graphic, you'll see that capex and other investments have been significant and have generally surpassed the cash inflow from operating activities (the above data are for 2011-2016).

It's another capital-intensive business, though it does apparently have a unique offering in terms of the mix of compounds used in its wafers. This has created for it #1 and #2 positions in the growing markets in which it operates.

At some point, the investing activities need to generate free cash flow in order to justify them (i.e. at some point, cash from operations needs to surpass cash from investing activities). Free cash flow generation is the only way that dividends can ever be paid, and IQE has never paid a dividend.

For now, investing activities will probably remain significant. The rationale for the placing includes the following:

IQE is seeking funding to enable it to scale the business to capture multiple high growth mass market opportunities.

This placing will allow IQE to expand its capital expenditure programme in its new foundry, with the purchase of up to 40-60 new MOCVD machines over the next three to five years.

(GN Note: MOCVD machines are used in "Epitaxy", the process which IQE uses to deposit thin films of material on its wafers.)

According to the January 2016 talk at Mello Beckenham, capacity utilisation at IQE was about 55-60%.

Wafer revenue in H1 2017 was 17% higher than H1 2016, so that should still have left a comfortable amount of spare capacity, but with the company talking about "multiple high growth mass market opportunities", it's understandable that they'd want to increase capacity. At some point, hopefully, the increased scale and prior investments made will lead to FCF generation.

According to shorttracker.co.uk, at least 6.5% of IQE shares have been sold short (not including short positions of less than 0.5% of the company, as they aren't published by the FCA).

A decent-sized short campaign is a red flag, for obvious reasons. I'm guessing that the funds involved are thinking about 1) the high valuation against conventional metrics, 2), the lack of free cash flow, and 3) the reliance on a small number of customers.

Loss of a share with a significant customer and customer concentration risk are listed as key business risks in IQE's 2016 Annual Report. Checking the footnotes, I see that two customers together accounted for 45% of IQE's sales (24% and 21%, respectively). Of course, there is no sign of overall demand slacking in the short-term.

I'm not going to draw any hard-and-fast conclusion here. If I was absolutely forced to take sides, I'd probably go short, for the above named three reasons.

The only difficulty with this position is that fighting against momentum is usually a mistake, and IQE currently enjoys a very high Momentum Rank of 83.

That's all I've got time for today. My favourite company mentioned today was certainly Castings (LON:CGS), but they were all interesting in their own way.

Have a great weekend and see you next week!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.