Good morning! It's Friday the 13th.

There aren't a huge number of exciting news announcements today, so I'll probably circle back to announcements from earlier this week. Paul is also doing a bonus report to cover Trakm8 Holdings (LON:TRAK) and some stories he missed during the week. His report is at this link.

Announcements today:

- XP Power (LON:XPP) (trading statement)

- Low & Bonar (LON:LWB) (trading update)

Announcements from earlier this week for financial stocks:

- Impax Asset Management (LON:IPX)

- Ramsdens Holdings (LON:RFX)

XP Power (LON:XPP)

- Share price: 36.50 (+4%)

- No. of shares: 19 million

- Market cap: £701 million

XP Power makes and supplies a wide range of AC-DC power supplies and converters worldwide.

It has been a high-performing stock and is now beyond our traditional market cap limits for this report. Some of our readers continue to hold it from lower levels, so I like to keep an eye on it!

This is just a short update for Q1, keeping us updated for progress to the end of March. The most important point is probably that expectations for the full year remain unchanged.

The Company has made a good start to the new financial year as the strong order intake reported in 2017 continued into 2018. Order intake in the first quarter of 2018 was £51.2 million (2017: £47.0 million), 9% ahead of Q1 2017 on a reported basis or 19% ahead in constant currency.

On a “like for like” basis, removing currency effects and the impact of the Comdel acquisition, orders increased by 12%.

All of these growth rates remain encouraging. I think the 12% number is the most important one - this is the organic growth rate at constant currencies.

We can see that a strengthening pound is hurting the reported figures, with a 10% negative disparity between reported growth (9%) and constant-currency growth (19%).

Let's compare the above statement on order intake with the equivalent one from a year ago, in April 2017:

Order intake in the quarter was also very encouraging at £47.0 million (2016: £30.3 million), up 55% on the same period in the prior year. In constant currency order intake was up 36%.

What a difference. Last year, currency movements increased the growth rate by almost 20%! And that was on top of a constant-currency growth rate which was already very large (36%).

Long-term, I think that most companies can shrug off currency movements by adjusting their prices. But in the short-term, as you can see, currencies can make a huge difference to reported growth rates. Worth bearing in mind, if it distorts the growth rates you are extrapolating into the future.

The book-to-bill ratio is now 1.1, indicating continued rising demand but perhaps at a slightly more moderate level than before. The book-to-bill ratio for all of 2017 was reported at 1.11.

So there are no signs of explosive growth coming in the short-term, but the business looks as solid as ever and continues to offer a rising quarterly dividend stream, for those seeking income.

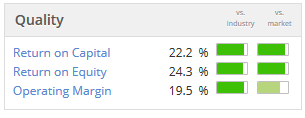

Stockopedia algorithms agree that it looks good, and is worthy of further research. I would draw your attention in particular to the quality metrics:

Needless to add, I maintain my positive impression of this stock!

Low & Bonar (LON:LWB)

- Share price: 52.4p (-7%)

- No. of shares: 330 million

- Market cap: £173 million

This is another Q1 update. I have a heavy bias to cover results rather than trading updates, but we are light on results today.

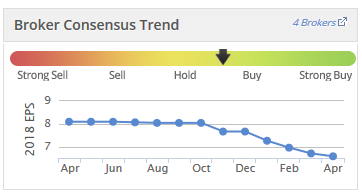

This is a performance materials manufacturer, with a new CEO since last month. Earnings forecasts, and the share price, have been weakening for a while:

Before I get into today's update, I should mention there are actually two announcements today from Low & Bonar. The other one concerns the appointment of a new CFO. So we have a completely refreshed pair of executives at the top of the company now.

As with XP Power, Low & Bonar also says that its expectations for the full year remain unchanged. So why are the shares down, you might ask? It's the dreaded H2-weighting again, which you find in the final sentence of the statement:

In light of the above factors, whilst the Board's expectations for the full year remain unchanged, it expects the Group's financial results to have a much greater weighting to the second half than in the prior year.

As we know, this is often the precursor to missing expectations. It's a mini-profit warning, in effect. There is still a chance that expectations will be met, but it depends on things picking up.

These are the main negative "factors" I can find in the statement:

- A slightly unfavourable product mix

- Raw material cost increases

- Production at some manufacturing sites has been reduced in order to better manage inventory levels, which has had a negative impact on cost recoveries

The third of these factors relates to the company's attempts to strengthen its balance sheet.

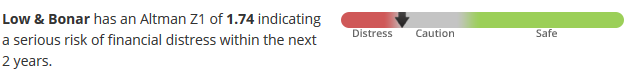

Stockopedia algorithms cleverly pick on financial weakness, using the z-score:

Net debt was sitting at £138 million at November 2017, bigger than the current market cap and relative to historical earnings.

So we need to value this using EV/EBITDA, EV/EBIT or other metrics taking into account the debt pile.

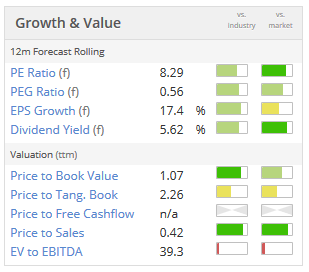

Take a look at these value scores. The PE ratio, PEG, dividend yield and Price to Book measures are all light green or green, indicating that they are cheaper than the market as a whole.

The EV to EBITDA score, on the other hand, is red, indicating that it compares very poorly to other companies on this measure.

In other words, as soon as you add the debt load to the market cap to get the EV (Enterprise Value), the shares no longer look cheap.

So far, I haven't found anything which makes me want to investigate this stock in any greater detail. Maybe the new managers will inject new life into it?

Impax Asset Management (LON:IPX)

- Share price: 161.5p (unchanged today)

- No. of shares: 130 million

- Market cap: £210 million

This is an environmentally-focused asset manager which released its latest AUM figures earlier this week. It looks like there was a small positive reaction to the news.

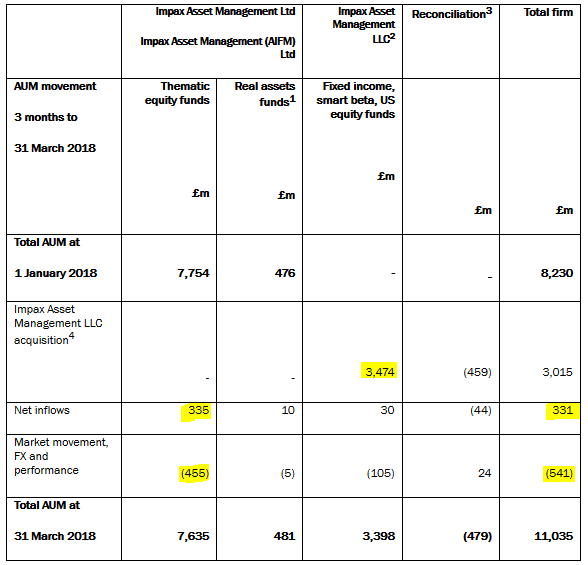

I'm pasting the most important table here, with the big figures highlighted in yellow. Hopefully it is legible:

Key numbers are:

- Acquisition: the US deal has completed, and the US company Pax (based in New Hampshire) was renamed Impax Asset Management LLC. This is represented by the additional $3,474 million shown above.

- $335 million inflows to the core UK business

- $541 million in negative market movements. Environmental stocks were evidently not immune to the overall sell-off in calendar Q1.

So inflows to the core funds were 4.3% of the starting figure ($335 / $7,754), a modest percentage, but remember that this is only for a single quarter. Maintaining that quarterly rate for an entire year would be a fine result.

If we scroll back to the same update a year ago, inflows were $428 million from a $4,627 starting position, i.e. 9% growth in a single quarter. There's no way we could have expected growth rates like that to continue indefinitely.

It's a much bigger company now, but still small in the context of the asset management industry. For comparison, Schroders (LON:SDR) AUM is $590 billion, while Jupiter Fund Management (LON:JUP) AUM is $72 billion.

The combination with Pax makes a lot of strategic sense, as the companies had a similar focus and had already been cooperating with each other for many years.

In fund management, it's expensive to build a platform but then there are few limits to the scale you can achieve. Scaling up quickly and accessing the US market with a credible acquisition makes good sense to me.

A research note by Equity Development was published last month. It forecasts operating profit of £19.9 million in financial year 2019 (ending September), resulting in net income of £15.7 million.

This is based on certain assumptions, including about £1.3 billion in net inflows annually and £0.4 billion in positive market performance.

These assumptions are conservative, with scope for the company to beat them, but can never be predicted with any certainty. Institutional mandates, which I think still account for the majority of Impax's business, tend to be lumpy. And a general market sell-off would no doubt produce another negative contribution in market performance.

On balance, at 14x next year's forecast earnings, the stock appears reasonably priced. It is likely to be carrying some debt now, having used a $26 million borrowing facility to fund the acquisition of Pax. That nudges the valuation a little bit higher, when you take that into account.

I wish I'd bought shares in this when I first discovered it last year! For now, I'll just be keeping it on my watchlist for a potential purchase at a future date.

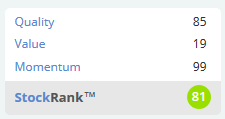

Stockopedia also has a favourable view:

Ramsdens Holdings (LON:RFX)

- Share price: 182.5p (+2%)

- No. of shares: 30.8 million

- Market cap: £56 million

This pawnbroking/financial services group reported as follows on Tuesday:

The Board is pleased to announce that Group trading in the second half of the year has remained strong and, as a result, it anticipates reporting results for the year slightly ahead of expectations.

I've been a shareholder in rival H & T (LON:HAT) since 2013, so it's good for me to keep an eye on Ramsdens, too. Fortunately, both companies have been performing well.

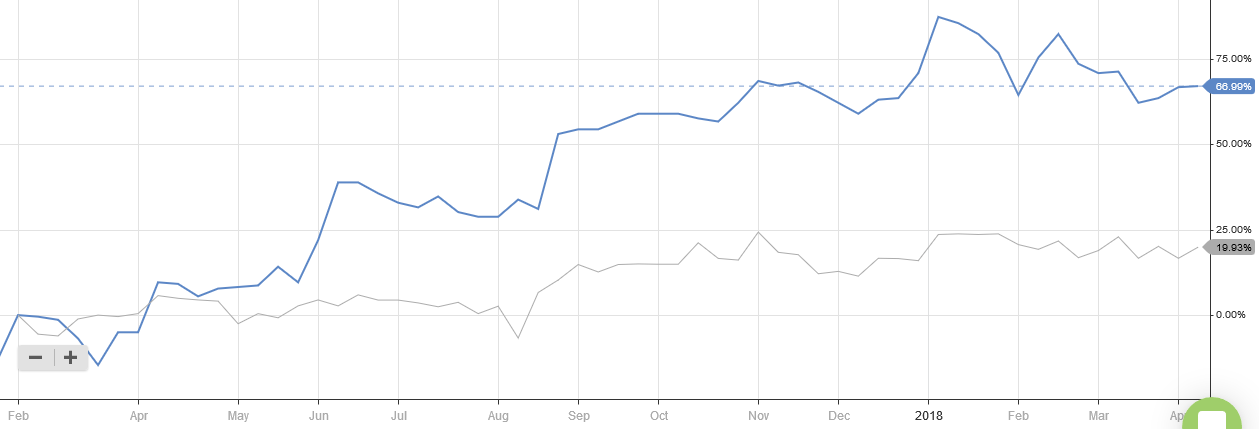

Since flotation in early 2017, the Ramsdens share price has significantly outperformed H&T's. I've plotted them together using Stocko charts (RFX in blue, HAT in grey):

Analysts had been forecasting EBIT of £6.4 million for the year ending March 2018, so we are on track for a small beat against that expectation. Net debt was forecast at £12.5 million.

This remains one of my favourite sectors, for multiple reasons.

We have an efficient means of gold price exposure, for those of us who expect the gold price to rise over time.

We also have counter-cyclicality in terms of High Street exposure. If consumers are struggling to afford other outlets on the high street, they are more likely to need a cash advance from one of these outlets. Or for those customers feeling flush, Ramsdens can also be a jewellery retailer.

Finally, we get to participate in a special part of the consumer credit market catering to those shunned or ignored by high street banks. It is possible to generate reasonable returns in this sector over the long-term, although it does require some prudence on the part of management, to avoid ending up like Albemarle & Bond did.

Ramsdens is generating very good returns and also enjoys a StockRank of 83:

I'll continue to stay alert for any sign of change, but conditions remain benign for pawnbroking and related services. There is a minor risk of additional regulation, but I think the regulators can see that these businesses are some of the more responsible lenders in the marketplace.

That's it from me! Have a great weekend.

Thanks

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.