Morning!

Yesterday was a fun day out at Mello South, as expected. I was too busy to attend the morning sessions, as I was preparing notes on Revolution Bars (LON:RBG) for my own presentation. But I was pleased to attend the afternoon sessions from Titon Holdings (LON:TON) and Non-Standard Finance (LON:NSF), and in particular very happy to hear the presentation by actuary, investor and author Guy Thomas.

Guy's book Free Capital was inspirational to many of us in the investor community. It had a big impact on me, too. It showed that a determined individual, if they put their mind to it, could succeed in the stock market. Furthermore, it showed that there was no single path to success. While successful investors may have certain traits in common, their "edge" tends to be unique to them.

Guy gave a strong presentation on a new topic: fund manager selection. This is more commonly discussed among professionals in wealth management than among the typical private investor who is interested in picking their own stocks. But in the field of finance it is a key issue, and one which has been relevant to my own career. So it was terrific to hear the considered thoughts of Guy Thomas on the matter.

Many other strong presentations were given - too many to mention them all here. Equally as important, however, was the chance to network and to put faces to names. Well done to all concerned.

Right, time for some stock analysis.

Due to the business of the week, I've not covered quite as many I hoped by now.

For today, I'd like to cover:

- Record (LON:REC) - final results (I hold this one)

Stocks with news this week I haven't covered yet:

- Norcros (LON:NXR)

- B.P. Marsh & Partners (LON:BPM)

- GYM (LON:GYM)

- N Brown (LON:BWNG)

Quick personal note on my own portfolio: I've been nibbling up some more shares in Ranger Direct Lending Fund (LON:RDL). I've realised that this is ok since it should be properly categorised as a fixed income-type of investment, not an equity investment.

While it's far riskier than cash, it's not giving me all that much more additional exposure to equity risk. So buying it doesn't break my own internal rules about having too much equity exposure at this point in time.

Also, while RDL does expose me to GBPUSD fluctuations, the recently strengthening dollar has, I believe, helped to widen the NAV discount by another few percentage points.

Perhaps the general point to make is that we shouldn't forget the role that fixed income instruments can play in our portfolios. It's all too easy to forget the opportunities in this asset class, especially when interest rates are so low. Let's not forget the wise words of Andrew Mellon: gentlemen prefer bonds.

Record (LON:REC)

- Share price: 45.55p (-2.3%)

- No. of shares: 199 million

- Market cap: £91 million

(Please note that I own shares in REC.)

This has some surface-level similarities with Park (LON:PKG), which I also own. They are both niche financial stocks, which I think I understand reasonably well, and have really strong balance sheets, but aren't growing very fast.

Record is a specialist asset manager providing currency management services: hedging products and return-oriented products.

Nobody is going to get too excited by these results. But I'm satisfied with them.

Key points:

- PBT down, but EPS up (because of the share buy-back last year).

- Lower share count allows for 10% increase in the full-year dividend

- Special dividend to bring the full-year dividend to 2.8p (versus EPS of 3.03p, i.e. a 92% payout ratio). Historic yield including the special dividend is c. 6%.

Operationally:

- Net outflows of $1.6 billion from Assets under Management Equivalent (AUME). Dynamic Hedging continues to lose ground. Currency for Return experiencing small net inflows.

- AUME increases 7% in USD terms thanks to exchange rate and other market movements. Down 5% in GBP terms.

...largely attributable to the 11% growth in personnel costs due to continued investment in additional headcount in order to maintain innovation and enhancement of our services

Balance sheet equity has reduced from £37 million to £26.6 million, thanks to the share buybacks. ROE should therefore improve, assuming stable performance, thanks to this more efficient balance sheet. Stocko currently calculates Record's ROE to be 22%.

The company is facing into a period of some earnings uncertainty as it switches to a more performance-based fee structure on its Passive Hedging product (responsible for about half of all management fees in 2018).

Performance fees on this product "over time are expected to match or exceed foregone management fees". Whether or not this turns out to be the case is a key question.

I am planning to continue holding a stake in this one. Founder and Chairman Neil Record has a 31% shareholding, and my overall impression of his stewardship and of the company as a whole is that they are extremely disciplined. So I think this makes for a nice hold.

Incidentally, it might share a nice feature with another stock which I hold, IG Group (LON:IGG). IG benefits from financial market volatility, as volatility tends to stimulate trading activity.

In the same way, volatility in the currency markets may help to stimulate new client activity for Record. As it says in today's outlook statement:

"...financial markets, including foreign exchange markets, will continue to be impacted by ongoing geopolitical developments and instability.

Such developments provide opportunities for the Group to engage with both current and prospective clients, and to use our innovative and flexible approach in tailoring our products to meet specific client objectives."

So if the macro environment becomes more uncertain, this may prove beneficial for Record.

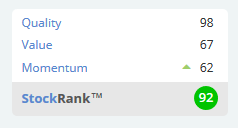

Stocko algorithms are very impressed, particularly by its Quality:

Norcros (LON:NXR)

- Share price: 225.5p (+1%)

- No. of shares: 80 million

- Market cap: £181 million

On April 11, Paul wrote:

Maybe this share might suit very patient investors, who might eventually be rewarded with a re-rating;

The share price that day was 182.5p.

Two months later and the share price has increased by 24%. A nice re-rating, but the shares are still rather cheap-looking:

Momentum is very strong, too. The re-rating is underway.

To recap what this company does:

Norcros is a market leading supplier of high quality and innovative bathroom and kitchen products with operations primarily in the UK and South Africa.

A £59 million acquisition was made in November 2017 - very material relative to the pre-existing group. It made 4-5 months of contribution to these results (for the year ending March 2018).

As usual, I want to find the pace of organic growth rate at constant exchange rates:

Group revenue for the year was £300.1m, 10.7% higher than the prior year on a reported basis, 8.6% higher on a constant currency basis and 4.4% higher on a like for like constant currency basis.

4.4% is the answer.

Actual sales growth, with the help of the acquisition and exchange rates, is 10.7%.

Strategy

I covered this stock a year ago, and was turned off by its acquisition strategy and complicated accounts.

In particular, I didn't like the fact that it set such huge sales targets. I like profit targets and especially ROCE targets, not aggressive sales targets.

Norcros has failed to reach its 2018 sales target of £420 million, set in 2013.

Actual revenue is £300 million, far short of the target and it would be very short even if GBPZAR (the South African rand exchange rate) was unchanged compared to 2013.

Ironically, I would view this as a blessing in disguise, as it means that acquisition activity was more moderate than planned.

The new strategic objectives are as follows:

- We aim to grow revenue to £600m by 2023 (previously £420m by 2018);

- Maintain approximately 50% of Group revenue derived outside the UK (no change); and

- Deliver an improved and sustainable ROCE of over 15% (previously a 12-15% range) through the economic cycle.

Doubling revenue over the next five years is not as dramatic as it sounds. A compound growth rate of 15% p.a. would be enough. So hopefully the acquisition activity will be moderate over the next five years, too.

Note that Norcros also has a return on capital employed target of over 15% - that's a very positive sign. It has recently been achieving ROCE (using its own measurement approach) of about 18%, better than its strategic objective set in 2013.

Something that's probably not a coincidence is that Norcros fell very short of beating its sales target, but was ahead of target in terms of ROCE. It made better-than-expected use of existing assets, perhaps because it didn't expand its asset base as much as originally planned.

Balance sheet

The balance sheet is now carrying £47 million of net debt. This looks manageable, relative to operating profit of £20 million.

However, note that not all of this operating profit translates to free cash flow. There has been about £8 million in capex during each of the past two financial years.

The company has also been paying £2.5 million each year into its pension deficit (these payments are about to be renegotiated).

The ongoing acquisition strategy will also bring with it plenty of exceptional and one-off cash costs.

So I think there are a lot of demands on the company's cash, and so I don't see the debt levels reducing very much.

My opinion

Probably quite a cheap stock, even taking into account the re-rating over the past few days.

I'm not overly impressed by the like-for-like rate of sales growth at constant exchange rates, and tend to stay away from companies seeking to grow rapidly via acquisition. I'm also not sure if ROCE is quite as good as the company claims, as there are a lot of adjustments in the calculation.

But overall, the outlook for shareholders appears favourable from the current share price. StockRanks agree:

B.P. Marsh & Partners (LON:BPM)

- Share price: 281p (unchanged today)

- No. of shares: 29 million

- Market cap: £82 million

I missed covering this on Tuesday.

B.P. Marsh & Partners Plc (AIM: BPM), the niche venture capital provider to early stage financial services businesses, announces its audited Group final results for the year to 31 January 2018.

This investment vehicle produced a huge return for shareholders in the financial year. The total return is 25.5% (a small portion of which was distributed as a dividend). Nearly all of the gains arose from revaluation of the existing portfolio.

New additions to the portfolio during the year included stakes in both Lloyd's brokers and US-based insurance brokers.

Outlook statement is confident. BPM management think that it is well-placed to deal with further Brexit uncertainty.

The Group's model of making equity investments in financial services intermediary businesses with a partnership approach and a long-term view continues to deliver attractive opportunities.

Definitely worth noting that its track record is top-notch over a very long period of time. It has significantly outperformed the equity market as a whole.

The directors note that the Group has delivered an annual compound growth rate of 12.0% in Group net asset value after running costs, realisations, losses, distributions and corporation tax since 1990.

Placing and open offer - BPM is also raising £15.5 million in a Placing, and up to £1.5 million in an open offer..

The Directors intend to use the net proceeds of the Placing and Open Offer received by the Company to grow the Company's existing portfolio as well as to continue investing in early stage financial services intermediary businesses with the aim of becoming the capital provider of choice for the sector.

My opinion - I think BPM's achievements justify it being given more capital to grow.

One strange feature of the deal is the issue price for the placing: 252p. It's nearly a 26% discount to the most recently reported NAV.

Management only a few months ago said that they might buy back shares whenever shares traded at a more than 20% discount to NAV. So it seems rather odd to be willing to sell shares at a level where actually buying them back instead would create value for shareholders.

The Executive Chairman, after whom the vehicle is named, is reducing his stake but will continue to own the majority of the company. He is 76. Key man risk may explain why this continues to trade below NAV.

Indeed, that factor gives me some doubts as to whether I should want to invest in this. At least the BPM board looks very strong, so the risk might not be as severe as it first appears. Readers who have studied this over a longer period of time might be able to make a firmer guess as to what the future has in store.

GYM (LON:GYM)

- Share price: 282.5p (+7%)

- No. of shares: 128 million

- Market cap: £362 million

Trading Statement & Acquisition

This low-cost, 24/7 gym operator continues to do well.

Trading in the first five months of the year is in line with expectations. Members are up 32% year-on-year.

It reiterates expectations for 15-20 new organic site openings this year (starting at 128).

In addition, it is buying 13 gyms from easyGym for up to £24.7 million.

According to healthclubmanagement.co.uk, easyGym is switching to a franchise model, and wants to expand overseas. So it doesn't need to own these sites any more.

I covered GYM last year when it acquired 18 sites from Lifestyle Fitness. The update this week informed us that the conversion of these is sites is going according to plan and "we are seeing strong member uplifts in the sites where the full GYM (LON:GYM) model has been implemented".

I like the business model and I like the way management keeps achieving everything it sets out to do. The valuation is not ridiculous, given how well it is doing.

N Brown (LON:BWNG)

- Share price: 182.4p (-0.2%)

- No. of shares: 284.5 million

- Market cap: £519 million

This is a niche retailer operating through the JD Williams, Simply Be and Jacamo brands, among others.

Big news today for the company:

Given continued very disappointing footfall, and despite significant cost efficiencies being achieved, we are today entering into a consultation with store colleagues to consider closing our 20 stores ahead of lease expiry. In FY18 these stores generated £15m revenue (2% of Group revenue) and an EBITDA loss of £3m.

The 20 stores may end up being closed. Sad news for employees, and it is very important that they are treated fairly.

For investors, this may have read-across to other retailers whose high street presence is already a drag on results or who might wish to transition online at some point in the future. Think French Connection (LON:FCCN).

Results guidance at N Brown is unchanged, except for potential store closing costs (£18 - £22 million, of which approx. half will be cash).

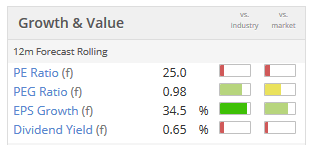

Its brands don't seem to be doing particularly well, except for Simply Be (one of its three "Power Brands"):

Online revenue is up 3%. Not bad but I think most retailers are doing considerably better than that online.

Revenue from Financial Services (lending to customers) is doing a lot better than product sales, and is up 9% year-on-year.

My opinion

I'm not too familiar with this company's brands, so I'll have to reserve judgement for now on their value and their reputation among customers.

The shares are extremely cheap, and I'm not immediately sure why this is the case. The company had balance sheet equity of £460 million in the most recent results, nearly all of it consisting of retained earnings.

So the shares are priced at only a small premium to book value for a company which is apparently solvent and profitable. Definitely worth looking into. I also recommend the detailed comment #39 in the thread below, from a reader who owns shares in this.

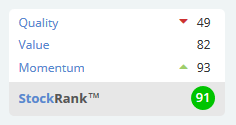

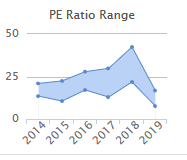

Earnings have admittedly been volatile, but the earnings multiple has collapsed:

Right, that's me done for this week. Looking forward to watching Spain vs Portugal with assistance from the local Chinese takeaway.

See you next time!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.