Good morning!

I finally finished Thursday's report very late in the evening with a couple more sections added.

It has seven stocks mentioned in it now: Venture Life (LON:VLG), On The Beach (LON:OTB), 7digital (LON:7DIG), Rank (LON:RNK), Ashley House (LON:ASH), Filtronic (LON:FTC) and Tribal (LON:TRB). You can catch up with it by clicking here.

Thanks

Graham

What's happening today?

- Airea (LON:AIEA) - half year results. We will have a post from Paul about this.

- PV Crystalox Solar (LON:PVCS) - settlement agreement. See Gus' comment in the thread below.

- QUIZ (LON:QUIZ) - forgot to put its final dividend in notice of AGM, and is calling it an interim dividend instead.

This is sort of funny. QUIZ only listed last year, and this is its second dividend. You don't expect rookie mistakes like this from any

company.

It doesn't really matter, but it does raise a question

about what the purpose of the rule is. If companies can get around

it by calling their final dividend something else, then maybe the rule

should be scrapped?

- Thalassa Holdings (LON:THAL) - update re: Norwegian Tax on its disposal. I'm writing about this below the section on AIEA.

This section from Paul Scott.

Airea (LON:AIEA)

- Share price: 62p (up 13.8% today, at 10:41)

- No. shares: 41.4m

- Market cap: £25.7m

(at the time of writing, Paul holds a long position in this share.)

Interim results - for the 6 months to 30 June 2018.

The principal activity of the group is the manufacturing, marketing and distribution of commercial floor coverings.

I've written positive pieces here about this company before. In a nutshell, it's a turnaround situation - its heavily loss-making residential carpet manufacturing business had to be closed down. This has transformed the profitability of the group, which is now focused on a decently profitable & growing niche in commercial flooring. To get a feel for its products, here is the group website.

An unsolicited takeover bid approach was made by larger flooring distributor James Halstead (LON:JHD) but that fell through in May 2018. The company may not currently be in play, but in these type of situations a takeover bid is often the long-term outcome. Which is great, if the acquirer coughs up a generous premium price.

Revenues - up 13% at £9.1m (this is continuing operations only - i.e. excluding the closed carpet division). Good, but not stellar growth.

Operating profit - up only 1.6%, which strikes me as a little disappointing.

Profit before tax - benefits from a lower finance charge, so is up 15.2% to £1,323k - still not a bad result, for just 6 months.

Tax charge - note this is very low, both in H1 this year, and in the prior period comparatives. This flatters EPS somewhat. I haven't looked into why the tax charge is low - probably due to b/fwd tax losses.

Basic EPS in H1 is 3.18p. There aren't any broker forecasts, so the only thing I can do is to simply double that, to get to a rough idea of full year EPS of c.6.4p. That puts the shares on a PER of about 10 - seems good value for a company producing reasonable organic growth.

Dividends - the release of working capital from closure of carpets division gave rise to a special dividend of 5p, paid on 23 May 2018. The interim divi this time is maintained at 1.75p. I don't know what the final dividend will be, but looking at the history, the trend is upwards.

So we might get maybe 2p-ish as a final divi? That's just my guess. Put that together with the interim divi, and we're probably looking at something like 3.5p to 4.0p full year divis. That gives a bumper yield of c.5.6% and 6.5% - very pleasing.

Balance sheet - generally very good, with an excellent current ratio of 2.46.

Note there is an investment property of £3.15m, very nice to have.

Pension deficit - this is undoubtedly a fly in the ointment. It's only shown at £2.1m on the balance sheet, but the recovery payments are quite significant at £200k in H1, so £400k p.a. It's not a deal-breaker, more of a nuisance.

Outlook comments - pleased with progress, but uncertainties remain (e.g. Brexit).

There's some more positive-sounding commentary in the main body of the narrative, e.g.

Strong growth in the order book and increased sales both in the UK and internationally was largely driven by the success of new product introductions. The launch of further new products is transforming our offer in the medium and premium price sectors and our sales force has a growing portfolio of attractive complementary products to grow our share within this market sector.

Our international sales grew by 30% in the period, driven by the new products, increased penetration of existing markets and the ongoing development of the distribution network.

Sounds encouraging!

Paul's opinion - I like it. These results don't bowl me over, but they're good, and the valuation looks modest. The commentary sounds upbeat too.

I imagine we'll get a takeover bid as the exit - I'd be disappointed with anything below 100p.

In the meantime we have a lovely & growing dividend yield.

Therefore, risk:reward seems good, and I'm happy to continue holding for another 6 months.

Thalassa Holdings (LON:THAL)

- Share price: 89.5p (+1%)

- No. of shares: 19 million

- Market cap: £17 million

Sale of WGP - Update re Norwegian Tax

I've refreshed all of my calculations in relation to this holding company, and strongly considered making a purchase today.

It's an awkward one. I'm certain that it's undervalued. On the other hand, there are a bunch of imponderables.

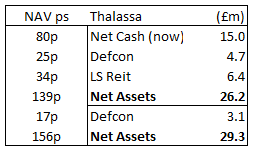

Firstly, the good stuff. This is what I think the company is worth.

My calculations are probably wrong so make sure to verify them yourself:

Let me explain each item:

- Net cash. I start with the $20.3 million of net cash reported at Dec 2017. I add the $700k tax release announced today (note that there could be more tax releases coming).

Now I have $21 million. I convert this to GBP at the latest exchange rate and subtract £1.5 million, since the company has spent £900k on share buybacks this year and I pessimistically assume that it has spent £600k on administrative expenses. That's how I get £15 million.

- Defcon. A $6 million earn-out was announced recently, i.e. £4.7 million value.

- LS Reit. The value of Thalassa's 25% holding in Local Shopping Reit (LON:LSR) at the latest share price.

That gives us £26.2 million of net assets, which is worth 139p at the latest share count.

Thalassa expects to earn a further earn-out of $4 million from a disposal, worth £3.1 million or 17p per share. That brings us to £29.3 million of net assets or 156p per share.

It is "cautiously optimistic" that more tax releases will be coming its way, so we might get a lift from that source, too.

Also, I am completely ignoring the value of its operating subsidiary, Autonomous Robotics Ltd (ARL). I have no idea if it is worth anything. Thalassa had spent something like $7 million on it at the last count.

Finally, we should get a small increase in NAV per share from the completion of the current share buyback programme (buybacks increase NAV per share when they occur at a discount).

So I think this looks very promising in terms of the value available.

The Chairman is well-incentivised as he owns 3.6 million shares.

My concerns are unchanged:

- What on earth is ultimately going to happen to shareholder wealth? I can't see what the long-term strategic direction might be. The investment policy seems random.

- ARL may have a bright future but is undeniably speculative and I expect it to burn cash in the short-term.

- The drag of director remuneration was significant last year. The directors got paid around £1 million. That's quite a lot for what is effectively an investment company - let's call it 4% of NAV. It had been lower in previous years. Maybe it can normalise?

What I'm really lacking is a catalyst to unlock value for shareholders. The buybacks are the most promising sign of progress in this regard, although they also have the drawbacks of reducing liquidity (the bid-ask spread is horribly wide) and increasing the likelihood of an eventual delisting (which may or may not be favourable for small shareholders).

So I'm still on the sidelines and leaving this for others.

It was a quiet day in RNS-land, so I'm going to call it a day there. Have a great weekend.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.