Morning all,

Things I've noticed today:

- Venture Life (LON:VLG) - trading update

- On The Beach (LON:OTB) - acquisition and trading update

- 7digital (LON:7DIG) - preliminary results

- Rank (LON:RNK) - final results

- Ashley House (LON:ASH) - preliminary results

- Filtronic (LON:FTC) - final results

- Tribal (LON:TRB) - half year report

Venture Life (LON:VLG)

- Share price: 47.8p (+3.5%)

- No. of Shares: 84 million

- Market cap: £40 million

We covered this when it did a £19 million placing last month, to acquire Dentyl mouthwash and generally strengthen the company.

It already has the UltraDEX mouthwash brand.

We have 6% organic revenue growth in H1 to £8.3 million and a full-year outlook in line with expectations.

The order book is up 20%. I'm not sure how much to read into that - we don't know how long it will take to realise these revenues. Still good news, though.

UltraDEX is entering Spain, Portugal and Belgium from Q4 2018 and is set to enter Austria and the U.A.E by Q1 2019. The total number of markets where the brand will be "partnered" is set to double from 15 to 30 by the end of 2020.

My view

I wish there were fewer moving parts, as a little bit of guesswork and maths is required to figure out what is going to happen next. We have UltraDEX and Dentyl now and will probably soon have more acquisitions. It's impossible to have much of a clue about whether a future acquisition will work out or not.

Using back of the envelope figures, I think VLG might have c. £10 million of cash left from the placing, after paying down debt and buying Dentyl.

So let's estimate the current enterprise value at £30 million (market cap £40 million minus £10 million cash).

- UltraDEX made operating profit of £600k last year and this is presumably going to show a nice increase.

- Dentyl made PBT of £1.2 million. This has been trending lower but of course VLG's plan will be to turn this around.

If you think about what the combined operating profit of these mouthwash brands could be and compare this to the current enterprise value of £30 million, VLG shares seem to me like they could be reasonable value at current levels.

The brands don't strike me as high-grade, though. Personally, I don't think I would buy UltraDEX or Dentyl mouthwash. I've tried UltraDEX before. Has anybody tried Dentyl?

Also, the 6% organic revenue growth from UltraDEX is good but not exactly earth-shattering. The increased distribution channels should accelerate this, however.

I think I'll sit on the sidelines, as there's not quite enough for me to get overly excited about this yet.

On The Beach (LON:OTB)

- Share price: 479p (+16%)

- No. of shares: 130 million

- Market cap: £624 million

Acquisition and Trading Update

Fantastic share price reaction to this update.

Acquisition

On The Beach is an online travel company that helps people to find holiday flights and hotels. It has been a big success for investors since the company listed in 2015.

Today it announces a small-ish acquisition (£20 million), with a smidgen of dilution for OTB shareholders. The target company packages luxury holidays and sells them via offline travel agencies.

Among other plans, OTB will help its new subsidiary to build an online portal for travel agents to use.

It sounds like a useful little bolt-on acquisition, and OTB's technology will be used to significantly improve its new subsidiary. I approve!

Trading update

Despite the positive acquisition news, I don't think a £20 million acquisition is sufficient to improve a market cap by c. £85 million (that's approximately how much OTB's market cap has increased by today).

We have an accompanying trading update:

As has been widely publicised, the exceptionally hot UK weather that has been prevalent over recent months, combined with the football World Cup, has suppressed holiday demand. This has impacted our headline revenue growth during the period, but the weaker demand has driven a significant reduction in the Group's marketing spend, ensuring growth in revenue after marketing costs has remained strong.

So revenues are down but marketing spend is down too. Adjusted PBT will be broadly in line with expectations.

That would normally be considered a mini-profit warning by me and by others, as "broadly in line" translates to "a slight miss".

It is evident that the market had already priced in a serious profit warning, however. The shares have been drifting lower for months, as the heatwave has persisted. Today's bounce recoups much of these losses.

My view

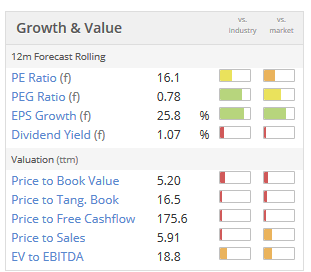

I maintain my positive view of this company and I don't think it is trading at a terribly expensive price, either. The StockRanks give it a poor rating which I think is due to things like its low dividend yield, high price to book value and high price to sales ratio:

I think there may be legitimate explanations for all of these issues.

For example - it's a website, it doesn't need many assets and therefore if people value it on earnings then the price to book value ratio is inevitably going to be expensive.

Similarly, it earns a very high operating margin (24%) so a high price to sales ratio can be justified.

So I can look past the low Value Rank in this case.

The point about the StockRanks is that they work on average. But for any particular stock, there are reasons why it might do a lot better (or a lot worse) than its StockRank suggests.

This is on my watchlist for a purchase, if I can ever find a spot for it in my portfolio.

7digital (LON: 7DIG)

- Share price: 4.5p (-1%)

- No. of shares: 400 million

- Market cap: £18 million

I missed the fact that this stock got suspended last month, for failing to publish 2017 accounts.

The company said that the audit process had been complex because of its rapid growth.

Not sure I can abide that excuse. If the accounting is out of control to such an extent that it takes eight months to report numbers, I would be a bit concerned that other things were out of control, too.

The Chairman apologises for what happened. 7digital has a new, interim CFO who is interested to take the role on a permanent basis and is implementing the recommendations of its new auditors, BDO. So maybe it can put the issue behind it now. The stock is back trading today.

As I described in February, 7digital provides a range of music and audio-related services to businesses.

It has been unprofitable for almost the entirety of the 21st century, and raised nearly £11 million (net of expenses) from investors last year. The CEO promised that it had "the right foundation for full year profitability in 2018".

It does sound like it should be valuable:

7digital is one of only two companies in the world to be able to provide full white-label streaming services to businesses who want to use music as part of their offering. Our product is sought after because of our catalogue of 60m licensed tracks and our platform on which new music services can be built quickly.

I'm looking for some reassurance in today's statement that profitability will be achieved this year.

The CEO says "the Board remains committed to being profitable at PBT level during the second half of 2018" - i.e. we will probably have a full-year loss. This is a downgrading of expectations compared to what the Chairman promised in February.

There has been a big transaction with a big German company called "MediaMarktSaturn" (MMS), with the result that MMS becomes 7digital's largest shareholder. MMS had previously been described as a client.

This means we are going to have a lot of related-party activity. Sometimes that's no problem, but I consider it a source of risk.

I don't feel comfortable yet in terms of my understanding of what 7digital is doing. It is classified as Highly Speculative by the algorithms and has a StockRank of zero. I also think the inability to meet profit forecasts is quite disappointing. So I won't be putting any funds into it at this time!

Rank (LON:RNK)

- Share price: 171p (-3%)

- No. of shares: 391 million

- Market cap: £668 million

We rarely cover this one as its market cap makes it a bit too big for us. I occasionally look in on it to see how it's doing.

It operates bingo halls ("Mecca") and casinos ("Grosvenor") in the UK, having both a physical and online presence.

Bingo halls are considered old-fashioned and indeed are in steady decline as the pool of older women who are interested in them diminishes.

Casinos at Rank aren't doing terribly well, either. They've had a "challenging" year due to "low win margin, enhanced due diligence and extreme weather".

So even though digital revenue is up, total revenues are down.

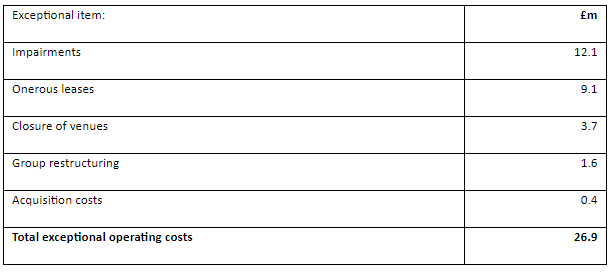

Adding to shareholder woes, there are £22.6 million of exceptional items taking a huge bite out of profits in FY 2018.

Let's dig in to these exceptionals:

Considering them in turn:

- Impairments of £12.1 million. It's fair enough to add this back in to operating profit in my opinion.

- Onerous lease costs of £9.1 million. I would allow this (i.e. I would ignore this cost), but I would also ignore all future releases of this provision, which will be used to increase future net income. I hate these lease provisions - they always feel to me like they are a way of managing the profit figures, rather than reporting them in a straightforward manner.

- Closure of venues, restructuring and acquisition costs. Mixed feelings about this. Aren't these likely to be regular events?

In summary, I am inclined to agree with the majority of the exceptionals as being "exceptionals" which should be added back in to operating profit. So the adjusted operating profit figure of £77 million is not too far from what I would use.

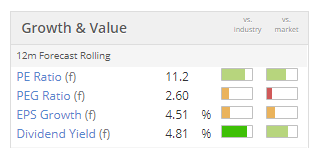

Good value?

It looks superficially cheap:

We need to decide how bad are the prospects for bingo halls and casinos,

Together, these accounted for £77 million of adjusted operating profit, compared to just £21 million from the company's digital activities. So they are still very important to the value of the entire group.

The outlook is in line with expectations. Stocko shows forecast net income for this year of £57.5 million.

I don't hate the idea of owning shares in this business, but I'm not exactly in a rush to buy them, either. Will continue to monitor sporadically.

Ashley House (LON:ASH)

- Share price: 15.3p (+11%)

- No. of shares: 60 million

- Market cap: £9 million

I no longer analyse this type of business. It doesn't strike me as an attractive type of investment, so I'd prefer to just ignore it and focus on sectors I find more promising. So I won't be analysing these results. Ashley House is a niche property developer and property manager working in partnership with local governments and others.

I won't deny that some of them may make for good investments at the right price. If there are enough people like me who aren't studying them. they might end up being completely mispriced from time to time.

Our resident expert on Ashley House, "drvodkaquickstep" (not his real name) has penned some analysis of its FY 2018 results as a comment (#23) on his own Stocko article. So I'd recommend heading over there if you are interested in this share. He own ASH shares, as you might expect.

Filtronic (LON:FTC)

- Share price: 13.125p (-5%)

- No. of shares: 207 million

- Market cap: £27 million

I didn't have much nice to say about this share when I covered it in December (at 10.25p).

Let's remind ourselves what it does:

Filtronic plc is a world leader in the design and manufacture of a broad range of customised RF, microwave and millimetre wave components and subsystems.

The company's products are used in wireless communication equipment, point-to-point communication systems and adjacent defence/security sectors.

Thursday's results aren't bad in historical context. Profits have always been a bit patchy. Operating profit comes in at £1.8 million, beating last year's (2017) £1.7 million.

There is a strange currency effect which then costs the company £0.5 million, thanks to "a US dollar denominated intercompany balance". It has a loan out to its US subsidiary, and the value of this loan has fallen because of the weaker dollar against the pound during the reporting period.

It seems fair enough to classify this as an exceptional item, so long as we do it every year.

The Wireless business has deteriorated, but the Broadband business swang into a profit. From now on these will trade and report as a single entity, as their technologies have converged.

Outlook

The outlook statement affirms the reason why this is too high risk for me. Plaudits to management for being so up front about it:

Whilst progress has been made in diversifying our customer base our sales remain highly concentrated and are still exposed to fluctuations in demand due to the nature of our business and the significant size of projects we supply into.

So while there are positive noises made, it's still very much dependent in the short-term on the outcomes from of a small number of customers and contracts.

Good luck to them.

Tribal (LON:TRB)

- Share price: 91.6p (+2%)

- No. of shares: 196 million

- Market cap: £180 million

Tribal provides "software and services for education management".

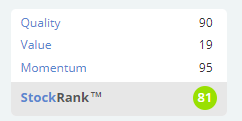

It's a successful turnaround story which has been brought back to life by a new management team.

Even though they have concluded their cost reduction program, they are forecasting more cost savings in 2019 to further improve margins for the business.

Today's results show a £1.7 million reduction in central overheads - not a huge sum in comparison to the market cap but it makes a huge difference to operating profits.

Operating profits increase from £5 million to £6.3 million, i.e. the improvement is more than fully accounted for by the reduction in central overheads.

It's a spectacular improvement and there may be more to come. I'm not familiar enough yet with the company's activities to buy into it, but I do recommend it for further research.

It is a bit pricey now at 23x forecast earnings:

Finally made it to the end of today's list! Thank you for your patience.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.