Good morning!

The RNS is thin today. I have covered:

- Record (LON:REC)

- Henry Boot (LON:BOOT)

- Miton (LON:MGR)

- Character (LON:CCT)

Record (LON:REC)

- Share price: 28.65p (-9.5%)

- No. of shares: 199 million

- Market cap: £57 million

(Please note that I currently own REC shares.)

This is a niche currency manager, founded by Neil Record.

I covered it during my reflections on 2018, describing it as a mistake and explaining that in hindsight I gave too much weight to its strong balance sheet when I invested in it, and did not give enough weight to its competitive positioning and growth prospects.

The difficult competitive environment continues to make life tough for Record. Performance isn't going anywhere at present, with "assets under management equivalent" (AUME) falling by 4% when expressed in Sterling.

$1.1 billion of client withdrawals were made in the quarter (out of a starting pot of $61.8 billion), and there are another $1.7 billion of withdrawals where clients have notified Record in advance. So maybe the withdrawals will amount to 4%-5% of starting funds over the course of H2.

On the other hand, the reduction in AUME that is attributable to stock market and exchange rate movements doesn’t bother me, since it is unavoidable. It's the poor trend in client flows that is more of a worry.

Fee rates are "broadly unchanged" - the company has ongoing pressure on fees from rival currency managers.

On the positive side, the balance sheet probably remains as strong as ever - net assets of £25 million as of September 2018.

And the CEO continues to talk up the possibility of rolling out new products and services. I remain hopeful that they will succeed.

It has been a close decision in terms of whether or not to sell out of this position. Most people would sell, but I tend to hold on to things for as long as I possibly can.

Henry Boot (LON:BOOT)

- Share price: 254p (+1.6%)

- No. of shares: 133 million

- Market cap: £338 million

This property developer has traded in line with expectations.

It points out that it would have done better than expectations, except for a "one-off" pension-related hit. So it's inviting us to consider that the underlying performance was slightly better than expectations.

Outlook - the company has had a good start to the year, and is positioned "to react to whatever challenges and opportunities arise through 2019".

My view - cheaper than the last time I looked at it, with the premium to June 2018's NAV now just 17%. The real premium (vs. December 2018 NAV) should be materially smaller than this.

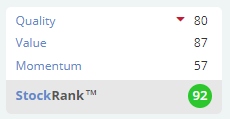

I can see why readers are requesting it, given its massive StockRank:

No reason for me to change my tune on this - if you like property developers, this one looks like it could be a nice choice, with a reasonable valuation and a great track record. But I haven't studied it in detail, since it's not a sector I focus on.

Miton (LON:MGR)

- Share price: 50.5p (-4%)

- No. of shares: 173 million

- Market cap: £87 million

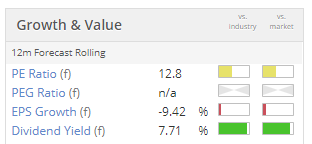

I'm very interested in the fund manager space at the moment, sizing up opportunities in City of London Investment (LON:CLIG), Ashmore (LON:ASHM), Jupiter Fund Management (LON:JUP) and Schroders (LON:SDR).

Miton is the manager which looks most like me, concentrating on the UK and on small-caps.

Let's see how it has performd to year-end 2018:

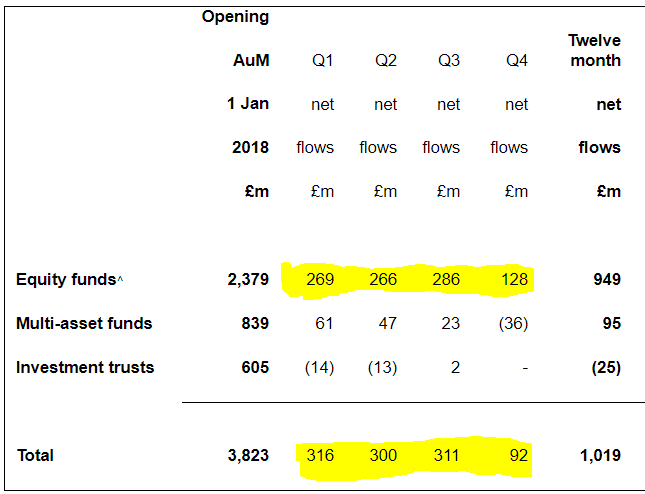

- AUM up 14.5%

- Net inflows were a massive 27% of the starting pot

- "Overall performance in line with market expectations"

A possible concern might be the negative trend from Q1 to Q4 in net inflows:

Q4 was particularly weak. Perhaps that is understandable, given the weakness in equity markets and political uncertainty?

All categories of funds had negative performance during the year.

My crude calculation of the company's equity performance is that it returned minus 11.6% of "average" equity AUM.

Despite that, the company says that 13 of 16 funds were first or second quartile performers since their current managers were hired (underperforming managers tend to leave!)

The UK Multi Cap Income Fund is particularly important, with £1,265 million AUM, and is currently the best performing fund in UK Equity Income.

Outlook - "positive business momentum" and "well placed as we enter 2019, despite uncertainties in global stock markets".

My view - I remain a fan of this business. StockRank is 88. Worth looking into.

Character (LON:CCT)

- Share price: 530p (+1.5%)

- No. of shares: 21 million

- Market cap: £112 million

I'm out of time sadly. A few quick points on Character, the toy designer and distributor.

- strong performance continues in UK

- international doing well, except the USA

- new products lines coming soon (I haven't heard of them, probably less valuable than the core lines Peppa Pig, Pokemon, etc)

Its Danish acquisition has had a setback with a retailer going bust. Nice comment from Character in the context of the Toys 'R Us failure:

"the demise of a major toy retailer creates opportunities for distributors....recent events in the market have shown that the market share of "fallen" retailers is quickly absorbed by other established retailers."

Performance and prospects in line with expectations.

My view

Another decent small-cap, this one has a StockRank of 99. While bearing in mind that it doesn't own the underlying IP of the brands it works for, and therefore is unlikely to ever enjoy a very high valuation multiple, I would be positive about its long-term prospects.

I've got to dash now. Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.