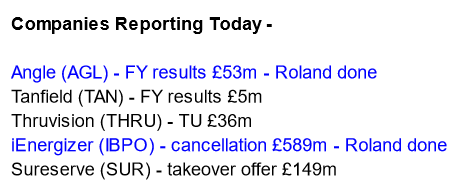

Good morning, it's Roland and Graham here with today's report.

The RNS feed is usually quieter on Friday, so we're hoping to look at some backlog items from earlier in the week in addition to today's news.

Today's report is now finished (10.10). Have a great weekend!

Correction at 14.00: Revenue at Angle was £1.0m in 2022, not £1.1bn as I originally mis-typed. I've amended this below.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Graham's section

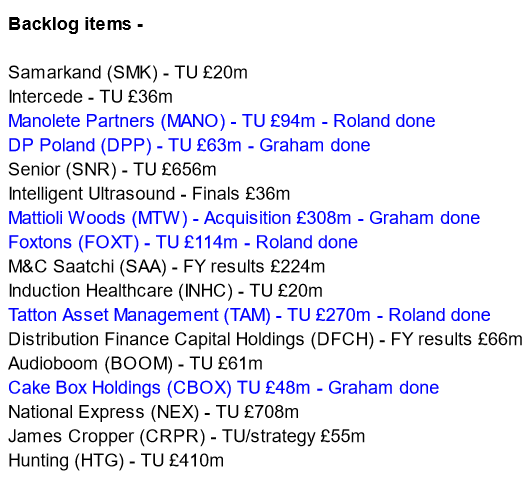

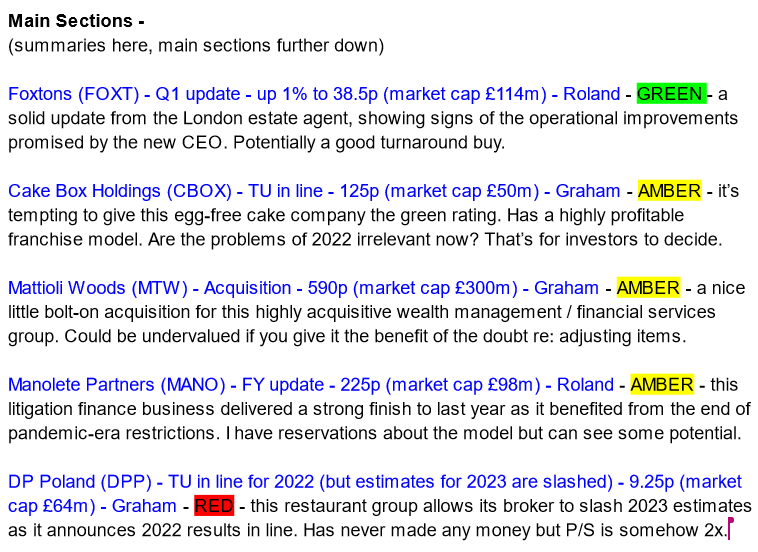

Cake Box Holdings (LON:CBOX)

Share price: 125p

Market cap: £50m

For my first share from the backlog today, I want to look at the full-year trading update issued by Cake Box on Wednesday.

You may recall that this company had some accounting issues in early 2022, that caused the share price to collapse:

Let’s see where trading is currently. This update relates to FY March 2023:

Full-year revenues +5%, adjusted PBT in line with expectations.

Positive like-for-like sales growth.

Group margins improved due to reduced freight rates.

Remember that this is a franchise business; it does not operate any of its own stores. At the franchisee level, inflation is also a challenge:

Franchisees continued to face inflationary pressures but introduced measures to mitigate the impact of increased costs and, with the help of effective marketing initiatives, sales and margin levels were maintained.

Store estate: 10 new stores opened in H2, 20 in the year. Total stores at year-end: 205.

Net cash improves to £6.3m. One of the benefits of the franchise model is that franchisees are on the hook for any leases they sign. CBOX has less than £3m of lease liabilities on its own balance sheet.

Graham's view: as readers will know, I have lots of positive things to say about the franchise business model.

However, we have to treat each case individually, on its own merits.

There was an auditor resignation at CBOX in early 2022 (see coverage here by Paul) which flagged up a range of issues at the company, and the CFO/co-founder left shortly afterwards (see coverage in CityAM).

Interestingly the CBOX share price was much higher, while all of that was happening, than it is today!

Earlier this month, CBOX announced the appointment of another new CFO, Michael Botha. Since 2016, he has been the CFO of one of the largest franchisees of Domino's Pizza (LON:DOM) in the UK. So that is good, relevant experience for CBOX.

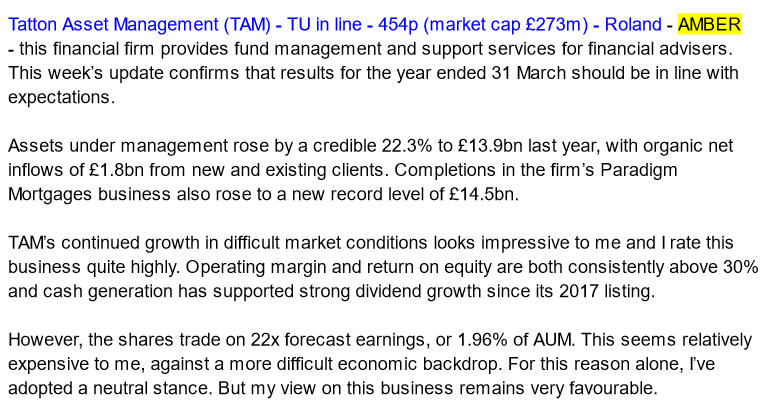

One of the stand-out features of the accounting story was prior share sales by insiders. Stockopedia’s very helpful “Directors Dealing” page shows us the story:

As you can hopefully see from the above image, the CFO/co-founder at the time sold £1.3m in Sep 2021 at 345p.

Additionally, the CEO/co-founder sold £10.5m at 350p in Nov 2021, after already selling £6.4m in Sep 2020 at 170p.

More recently, the CEO has been buying again. His recent amounts bought were c. £275k (Aug 2022) and c. £210k (Sep 2022). I’ll leave it up to you to decide if these amounts are material for him. They may be. But they are also clearly a tiny fraction of the proceeds of his prior sales. He currently owns 25% of the company.

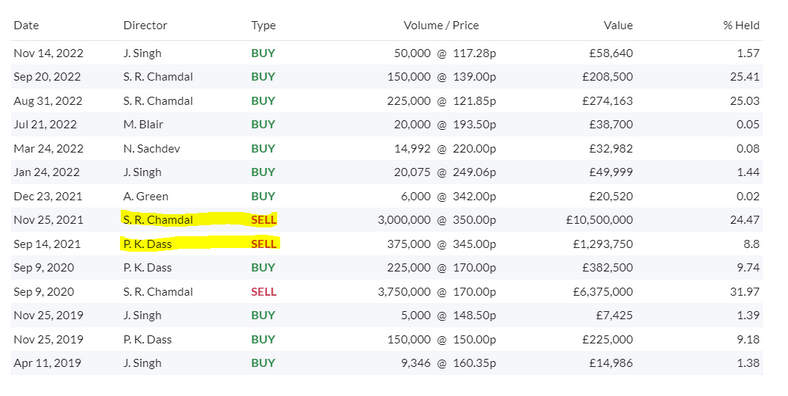

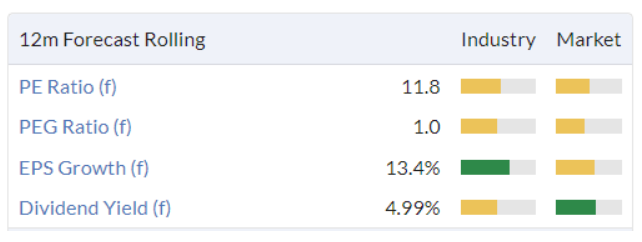

Given everything that happened, my instincts are to not touch this stock. However, it does look like it is probably undervalued relative to its quality and profitability. Stockopedia calculates its return on capital as 30%, and the value metrics look good, too:

For me to give this stock the “green” rating I would need to have faith and trust in the management team, and personally I’m just not there yet. But I can see why other people might think this now represents a good GARP opportunity. It even passes a Philip Fisher growth screen:

Mattioli Woods (LON:MTW)

- Share price: 590p

- Market cap: £300m

This backlog story is a £15m acquisition of Doherty Pension & Investment Consultancy Limited, described as “one of the largest financial planning and wealth management businesses in Northern Ireland”.

The £15m bill is made up of various parts: upfront cash, upfront shares, deferred consideration and contingent consideration.

The acquired company has 28 staff, and assets under advice and administration of £635m+.

For context, MTW recently reported having a total headcount of 877, and assets under management, administration and advice of £14.6 billion. So this looks like a nice little bolt-on acquisition.

Deal terms appear sensible: Doherty generated revenues of nearly £3m and “profit on ordinary activities before taxation” of £1.45m in 2021 (hopefully 2022 was just as good?).

According to MTW, the deal will “strengthen our position as the only SSAS and SIPP operator based in Northern Ireland”.

Equity Development have nudged up their FY May 2024 forecasts, which now suggest adjusted profit after tax of £26.8m, or actual profit after tax of £16.3m.

Graham's view: MTW is a successful consolidator of wealth management businesses that provides a very wide range of financial services to various types of clients.

The adjustments made by Equity Development to its profit forecasts include many of the things that we’ve become accustomed to over the years, for acquisitive companies. MTW is highly acquisitive - and seems to be quite good at buying and integrating business!

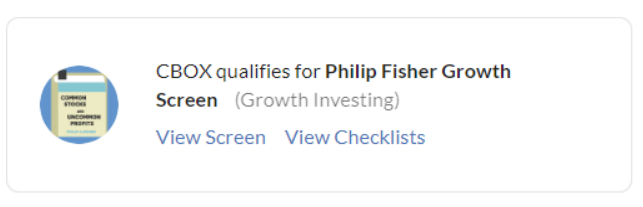

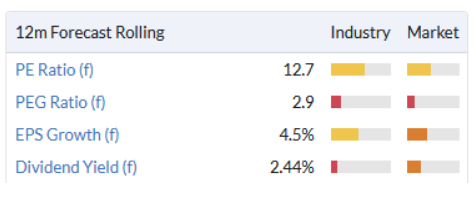

If you are willing to use its adjusted profit figures, you can make a case that this one is undervalued. Using adjusted numbers, this is how Stocko views the P/E multiple and other value metrics:

DP Poland (LON:DPP)

Share price: 9.25p

Market cap: £64m

This company has never made any money:

Let’s check yesterday’s Q1 update, to see if there are any signs of improvement at all:

19% like-for-like sales growth after its first TV advertising campaign in five years.

“First signs of cost pressures reversing on food”.

EBITDA for FY 2022 to be in line with market expectations.

Food price inflation was 24% in Poland in February 2023, which is a critical fact we need to bear in mind when looking at the reported sales growth above.

The company also mentions that demand for dine-in meals was affected by Covid restrictions in Q1 last year, so that’s another reason to expect sales growth in the current year.

Therefore, I’m afraid I don’t think we can get too excited about 19% LfL sales growth. The company does at least say that order counts increased.

Note that this company operates the majority of its sites, rather than using a franchise model.

Graham’s view

I previously gave this company an Amber rating. However, I’ve already given two much more credible companies an Amber rating today, so I’m afraid that DPP is going to have to get the Red.

Having checked the latest broker note, I see that the FY 2023 EBITDA forecast has been slashed from £2.5m to £0.5m. Even £2.5m would have been a poor EBITDA number, in my view. But now it turns out that expenses are higher than previously forecast.

Adjusted EBITDA for 2022 is negative (on a pre-IFRS 16 basis).

The restaurant sector is a risky one, in my experience. Foreign restaurants with extremely poor track records and with more losses coming down the tracks are worth vigorously avoiding, in my view. I see no reason for this to trade at a price/sales multiple of 2x.

Roland's section

Foxtons (LON:FOXT)

Share price: 38.5p (+1% yesterday)

Market cap: £116m

Strong growth in Lettings drives revenues as operational turnaround progresses

We’ve had a run of strong results from estate agency groups recently. Foxtons is still in turnaround mode, but the firm’s Q1 numbers appear to have been in line with expectations.

For background on recent performance, Graham covered Foxtons’ recent 2022 results here.

Let’s take a look at this week’s update, which covers the three months to 31 March 2023.

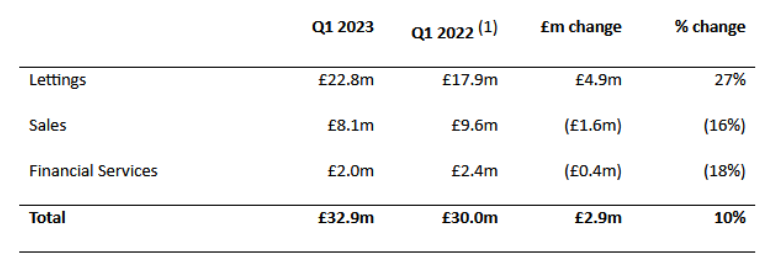

The headline numbers are largely as I’d expect, showing a decline in sales revenue and an increase in income from lettings. Overall, group revenue rose by 10% during the quarter.

Lettings: revenue was boosted by acquisitions in May 2022 and March 2023. On an organic basis (excluding acquired revenue), Foxtons says that lettings revenue rose by 20% during the first quarter.

Lettings now contributes 69% of group revenue, up from 60% last year.

The company reports an increase in average revenue per letting transaction. This is said to be due to an increase in non-cancellable tenancy terms, higher rental values and cross-selling of property management services. That all seems positive to me.

Sales: there was a reduction in sales exchange volumes during the quarter, as a knock-on effect of September’s mini-budget.

However, Foxtons says that its share of new instructions rose during the quarter. Surprisingly (to me!), the company says it completed the highest number of quarterly viewings in five years.

Buyer demand is said to be strong, supporting an increase in the under-offer pipeline.

This commentary suggests to me that Foxtons is improving its operational execution, as promised by newish chief executive Guy Gittins.

Financial services: lower sales market activity was partially offset by an “investment in adviser capacity”, supporting a marginal increase in remortgage volumes. Again, this seems a solid result in the circumstances.

Roland’s view

Foxtons’ shares have yet to return to meaningful growth, after a long-running decline.

However, the business looks reasonably valued to me and appears to be performing well. I’m encouraged by signs of operational improvements that should drive profit growth further down the line.

I think that some of the other listed estate agencies are better quality businesses. But if the turnaround succeeds, then I’d expect Foxtons to do well when London property sales start to improve. I’d view the shares positively at current levels.

Manolete Partners (LON:MANO)

Share price: 230p (unch. yesterday)

Market cap: £98.5m

Having navigated through a very testing last two years due to the unique challenges of Covid-19, we are pleased to see the business drive back into profitability in the second half of FY23

Manolete Partners is one of a number of litigation financing companies that has listed on the London market over the last decade. Manolete listed in 2018 and its main focus is insolvency cases.

Thursday’s trading update provided an update on trading for the year ended 31 March 2023. The company says it achieved a number of new record operating metrics last year, as the pandemic-era restrictions on insolvency proceedings were lifted.

Let’s take a closer look.

Record new case investments: the final number of new case investments in FY23 was 263. This is 65% higher than the 159 new case investments in FY22 and represents an all-time record.

The growth rate accelerated during the second half of last year, as insolvency market conditions returned to normal after “a two-year suppression of the market by the UK Government”.

This suggests there could be an opportunity for Manolete to deliver on its original potential now the pandemic has receded.

Record new case enquiries: new case enquiries rose by 48% to a record high of 798 last year, as market conditions returned to normal in H2.

Record case completions: Manolete completed 192 cases last year, a new record (FY22: 139 completed cases).

Last year’s completions represented an aggregate of £33.7m in legally-binding settlements (FY22: £15.3m).

This record level of completed cases will drive cash income for the foreseeable future, as the Company collects in the cash owed by defendants on these matters.

Record gross cash recoveries: the company achieved gross cash recoveries from previous cases of £26.7m, 72% higher than the £15.5m achieved in FY22.

The £26.7m is spread across 237 completed cases, giving an average of £113k per case (FY22: £85k).

Management say that after all costs, the company generated £1.9m of net free cash flow in FY23, equivalent to a 2% free cash flow yield. This compares to a net cash outflow of £4.4m in FY22.

Cash generation is a crucial metric for these businesses, so this appears to be a (modestly) positive result. But I still have some concerns, as I’ll explain in a moment.

Profit estimate: the company provides a preliminary estimate of pre-tax profits performance for FY23:

H1 FY23: £(5.5)m

H2 FY23: £1.6m

FY23: £(3.9)m

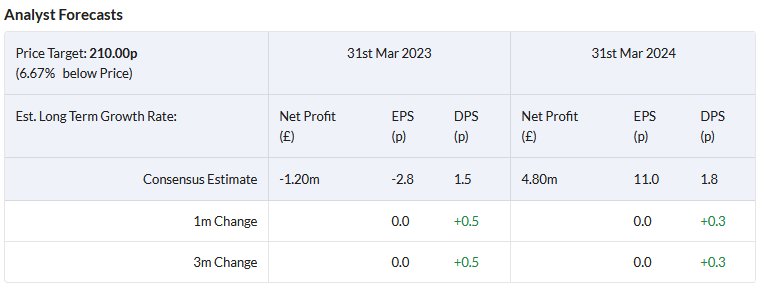

I’ve not been able to find an updated broker note for Manolete on Research Tree, but my feeling is that this is a slightly worse result than the current consensus estimate shown on Stockopedia for after-tax profit. It’s hard to be sure, given the adjustments and tax factors involved.

However, last year is in the past. What matters for shareholders now is whether the improvement seen during the second half of last year can be sustained, now that market conditions are normalising.

Outlook: it’s an ill wind that blows nobody any good. The current weak economic outlook for the UK may well be positive for Manolete Partners. Chief executive Steven Cooklin appears to think so:

With the UK economy facing challenging macro headwinds, particularly high inflation and high interest rates, we expect our market to remain strongly buoyant for the foreseeable future.

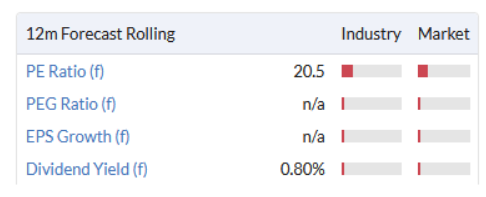

For what they’re worth, consensus forecasts for FY24 show Manolete generating a full-year profit of £4.8m, pricing the stock on 20 times forecast earnings:

Roland’s view: For me, there are two questions to answer here.

First of all, can growth be sustained from the level seen in H2, or does this simply represent a release of pent-up demand?

On balance, I think it’s likely that the company can continue to expand, albeit at a lower rate.

However, the bigger concern for me is whether shareholders will ever share in the proceeds of Manolete’s activities. Like many of its listed peers, Manolete tends to reinvest most of the cash it generates into new cases.

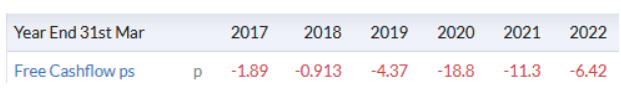

If the company can report genuine free cash flow for FY23, it would be the first time ever in its history as a listed business, according to Stockopedia:

There’s also the question of debt. Manolete reported net debt of £9.4m in its half-year results. We’ll have to wait for the full-year numbers to see how this figure changed during H2, but I’d suggest that borrowing money to make speculative investments (in legal cases) obviously carries a degree of risk.

I don’t find the litigation financing sector attractive as a potential investment.

However, I can see that Manolete’s business benefits from higher volumes and shorter durations than some others. This could potentially make it more predictable and consistently cash generative, I suppose. The shares seem fairly priced to me at the moment, until we learn more about FY24 trading.

On balance, my view is neutral.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.