Good morning, it's Paul here.

I'm putting in one final & unexpected pre-Christmas appearance here, as I had an interesting company meeting this week. So I offered to write this (Friday's) report, and give Graham the day off, incorporating my company meeting with Ideagen (LON:IDEA) this week. Plus any other company news which might appear on the day itself.

Incidentally, both Graham and I are pleased that the readership count has held up here, in such dire market conditions. You do sometimes wonder if it's worth bothering to write anything, when seemingly everything is tanking every day, regardless of newsflow.

Focusrite (LON:TUNE)

Share price: 472.5p

No. shares: 58.1m

Market cap: £274.5m

Focusrite plc (AIM: TUNE), the global music and audio products company that trades under the Focusrite and Novation brands around the world...

This is a brief, but positive update;

"When we announced our full year results on 20 November 2018, we commented that trading for the year to date was broadly similar to the prior year.

November 2018 was a strong month and our revenue for the financial year to date is now ahead of the comparative period last year."

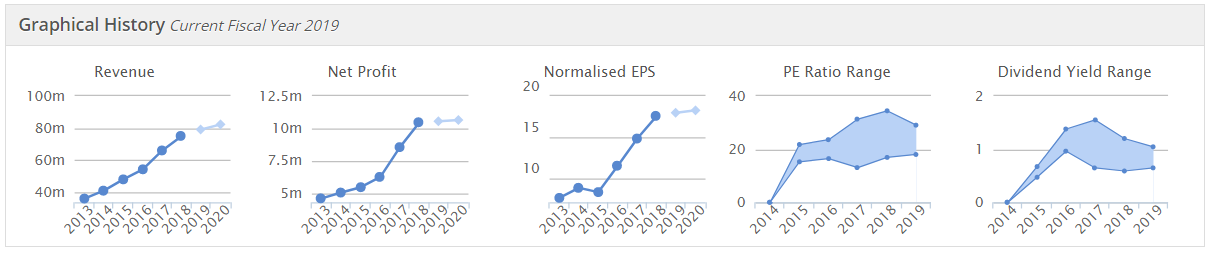

If we look at the Stockopedia graphs, the current forecasts (lighter blue blobs below) show a flattening of revenue & earnings. Clearly that is not enough to justify a forward PER of 26 (which implies much stronger growth);

My opinion - this is a good update, from a good company. However, in current more sceptical markets, the company needs to deliver stronger growth (hence more forecast upgrades) to justify the current valuation, let alone an increase in share price.

I think this is why the share price did not react positively to this announcement - partly due to people winding down for Xmas perhaps, but also that continued good news is already baked into the existing share price.

Craneware (LON:CRW)

Share price: 2305p

No. shares: 26.7m

Market cap: £615.4m

21 December 2018 - Craneware (AIM: CRW.L), the market leader in Value Cycle solutions for the US healthcare market, notes the recent movement in its share price and provides an update on trading to date in the six months ending 31 December 2018.

As you can see from the chart below, this IT company's share price shot up in the autumn, and has recently come back down again to where it started.

Key points;

- Continued to trade strongly

- Good level of sales & customer renewals

- Long-term visibility of sales, due to bookings being recognised in future periods

- Healthy cash reserves

- Cash conversion of over 100%

- Bank facility of $50m - investigating potential opportunities (acquisition(s) maybe?)

- Confident of meeting market expectations for y/e 30/6/2019

The Group expects to report increases in both revenue and adjusted EBITDA in the range of 15% to 20% for the six month period ending 31 December 2018, continuing the double digit growth delivered in prior years.

My opinion - it seems remarkable that a UK (Scottish) based software company is doing so well in providing software for the US healthcare sector.

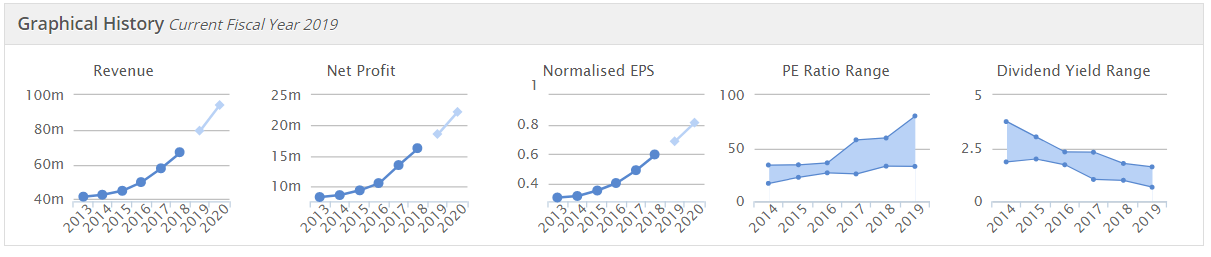

This company has an excellent track record, as you can see below. The shares are not cheap, even after the recent pullback in share price - a forward PER of 38 now. As you can see from graph 4 below, that's actually at the lower band of its PER over the last few years.

My opinion - this does seem to be an exceptional company.

Given strong trading, and the recent share price sell-off, I think this might be worth a closer look. Could it become a takeover target, I wonder, for a larger US corporation?

Note how the cash pile builds each year, and there's not been any shareholder dilution. This really does look a quality outfit.

Ideagen (LON:IDEA)

Share price: 126.5p

No. shares: 219.2m

Market cap: £277.3m

(disclosure: the company paid for our meal, over a working lunch)

Meeting with management

By way of background, Ideagen moved from Plus markets to AIM in 2012. It has been a successful buy & build software group - specialising in highly regulated sectors. The company is rightly proud of its successful track record in creating shareholder value - a >10-bagger on AIM, until the recent market sell-off, but still a great performance;

(insert share price chart here)

The former CEO, recently moved up to Exec Chairman (to focus on strategy & acquisitions), is David Hornsby ("DH"). David is highly regarded in the private investor community, for having created such excellent shareholder value, but also for being very accessible to investors - coming along to Mello and ShareSoc investor events over the years - giving up his spare time to update shareholders, and building long-term relationships with investors.

Both David Hornsby and myself treat Mello events as a mainly social occasion, so we decided to meet up more recently for a serious business lunch, to discuss the business, and the numbers. That is what I am reporting on today.

Acquisitions - the group has grown mainly through acquisitions, and doesn't seem to have put a foot wrong. It was emphasised that this is not easy - a lot of work goes on behind the scenes, both to get deals done, and to integrate companies that are acquired.

There is a proper system for integrating acquired companies, which is controlled on task management software (that's my description, which I hope is accurate).

It is important to not allow a "ghost culture" at acquired companies to persist - acquisitions have to adapt to Ideagen's culture.

Here are some interesting points which I jotted down during my lunchtime briefing;

- Staff incentivised by HMRC approved incentive plan - all levels of staff get £2k free shares per annum. Over 5 years that can be enough for a deposit on a house, so not to be sniffed at

- Other schemes to incentivise top staff

- Note that Exec Chairman does not have an LTIP personally - is happy to share the rewards with the team - seems happy that other Directors & staff are sharing in the group's success

- Software - if it is well designed from the start, then there should not be any over-reliance on key people

- Historically, the group has always hit its forecasts

- Good pipeline of acquisition opportunities

- Weekly board meetings, with a focus on tight control of cash & sales pipeline

- Customer renewals at 90%

- Moving to SaaS, which suppresses organic growth during the transitional period

- Seasonality - there's an H2 weighting

- Free cashflow good & improving - recent acquisitions kicking in, see broker forecasts

Discussion on my previous SCVR comments

I'm perfectly happy to meet management of decent companies, and discuss things that I've written in SCVRs here, to hear their point of view, and to learn more about companies. Graham and I have to cover over 500 companies here, so inevitably we cannot be experts on (m)any of them. I explained this to DH, which he took on board. There's nothing emotional about it, we just report on things as we see them, based on the facts, and give an opinion - which is subject to change at any time, if the facts (or our understanding of them) changes.

I had printed off my SCVR here on 13 Nov 2018 on Ideagen's trading update, and we went through it point by point. Having re-read it on the train into London, my feeling was that it was fair & balanced, and hence I stood by it.

As a general point, the danger of meeting management, is that they can be very persuasive! So having done this for nearly 20 years now, I tend to listen politely, but make sure I have sceptical barriers up in my mind, to avoid having the hind legs of my donkey removed during a discussion!

However, in this case, I think 2 specific points or questions I raised previously, were explained well by DH in our meeting, and I am happy to revise my opinion on these, as follows;

Low tax charge - I had raised an amber flag on this, querying why so little tax is paid? The explanation given makes sense, as follows;

- R&D tax credits reduce the tax charge (makes sense)

- Sometimes there are tax losses at acquired companies, which can be utilised (again, makes sense)

- Share-based payments to staff are tax deductible (again, makes sense)

Overall then, this area of previous query from me, looks OK.

Cash generation - I queried this in my last report. However, looking through the accounts again, it seems to me that the group does genuinely generate decent free cashflow, which it then uses to make further acquisitions.

DH pointed out that, with several recent acquisitions kicking in, in future, then broker forecasts are for cashflow to significantly increase.

Dividends - why pay such a small divi? (forecast yield is only 0.24%). The reason is that Institutions like divis, even if they are small, and some funds are only permitted (internal rules) to invest in dividend paying shares.

One final issue, which was good to discuss & clarify.

Stockopedia figures - DH noted that the Stockopedia figures are based on a conservative accounting basis, of including the amortisation of intangibles in P&L figures. This is detrimental to groups which do acquisitions, as it lowers their quality metrics, such as ROCE, etc.

Whereas broker notes generally tend to strip out P&L charges relating to amortisation of intangibles. I've discussed this many times here in the SCVRs, and indeed Graham and I have a fundamental difference of opinion on this - I am happy to value companies on adjusted figures (providing the adjustments are not silly), whereas Graham seems to prefer the much more conservative statutory profit figures.

Both are correct, they're just different ways of looking at the same numbers.

DH indicated to me that he finds it frustrating that broker notes for Ideagen show high quality metrics such as ROCE, but the more conservative presentation on Stockopedia, shows low quality metrics. This has apparently caused discussion/confusion at investor meetings.

My view is that it's important to understand the basis of calculation of figures, and investors can then make up your own minds as to which basis you prefer. Bear in mind though, that for highly acquisitive groups, the Stockopedia figures will present a conservative view of the numbers. If you want to adjust that manually, but using the company's adjusted figures, then you can do.

I had a chat with the boss about it at Mello, and (from what I can remember), I think Ed indicated that Stockopedia intends to move to an adjusted basis for EPS figures in 2019. That won't affect most companies, but will make a difference to companies which have made lots of acquisitions.

Valuation - my key message from the SCVR of 13 Nov 2018 was that I like Ideagen, but that the valuation seemed a little bit toppy to me, at the time, at 141.5p. I stand by that view, although having chatted to management, I'm also receptive to the idea that the group deserves a premium rating, given its excellent track record.

My opinion - I enjoyed meeting DH of Ideagen, for a serious business meeting, and I learned a lot. He's clearly built a great team around him, and has tremendous flair for acquisitions - the long-term track record & share price is proof of that.

Like a lot of growth companies, the share price got ahead of itself earlier in 2018, but looks to be resetting to a more sensible level in this market shake-out.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.