Good morning, it's Paul here.

To get you started today, I finished off yesterday's report in the evening, with a new section (a reader request) on Northern Bear (LON:NTBR) . Here is the link to that report, if it interests you.

At some point this week, I'm wanting to look at results last week from GAME Digital (LON:GMD) , Tracsis (LON:TRCS) , and £GATC

IQE (LON:IQE)

Share price: 67p (down 29% yesterday, at close)

No. shares: 776.0m

Market cap: £519.9m

Profit warning yesterday - thank you to the readers who flagged this up in the comments yesterday. This profit warning was issued at 4:20 pm, i.e. just 10 minutes before the market closed to go into the 5 minute closing auction.

I imagine that the share price is likely to continue falling today, because many private investors won't have seen the profit warning in time to take any action in just 10 minutes. It's just not right that profit warnings can be put out during market hours. That creates a false market, and is unfair to ordinary private investors, who get the news later than city insiders who are screen-watching every second of the day.

Rather than issuing a profit warning during market hours, companies should instead be compelled to temporarily suspend a share, then publish the profit warning after hours. Then resume trading at 8 am in the morning, once everyone has had a fair chance to read the announcement.

The news looks pretty bad to me;

IQE plc issues this trading update in response to reports made by a major chip company in the VCSEL supply chain on 12th November 2018 that they had received notice from one of their largest customers for 3D sensing laser diodes to materially reduce shipments for the current quarter.

The Company is currently assessing the impact of this news but at this stage, it expects there will be a material reduction in its financial performance in the current year.

My opinion - I'm keeping away from this share these days, having realised some time ago that I don't really understand the company well enough to be sure either way. So the profits I made on the share previously were really more luck than judgement.

It's amazing how many high growth, high momentum shares seem to be falling out of bed recently. Not just in terms of deteriorating fundamentals, but also less investor appetite to chase valuations relentlessly higher.

It's becoming increasingly clear that the momentum trade on high growth stocks now seems to have broken down.

Further trading update today - bizarrely, IQE has now issued 2 trading updates in rapid succession. This morning's update gives more detail, compared with last night's brief update.

Key points;

Revenues FY 12/2018 now expected to be £160m. This compares with forecast of £176.5m shown on Stockopedia. Coming late in the financial year, this clearly means a sharp slowdown in Q4, below what was previously expected.

The key VCSEL product (on which face-recognition chips are made) has seen weak demand in Q4, due to previous inventories being used instead - suggesting weaker demand for iPhones & similar consumer products.

Photonics wafer revenues growth for FY 2018, on a constant currency basis, is now expected to be approximately 11% (previous guidance for FY 2018 Photonics wafer revenue: 35% to 50%) and based on early initial indications, is currently expected to return to previously guided levels of 40% to 60% revenue growth in FY 2019.

Revenue growth of 40-60% in 2019 would surely be on a lower 2018 base figure? So to me, this suggests lower actual demand in FY 2019 as well.

Wirelesss & Infrared product sales look to be at or above existing guidance.

Revised EBITDA guidance is given;

As a result, FY 2018 Adjusted EBITDA is now expected to be approximately £31m (FY 2017 £37.1m).

Unfortunately, I cannot access any broker research on this, so am in the dark as to how this EBITDA guidance compares with previous guidance. Clearly though, EBITDA going down by £6.1m compared with 2017, can't be good news, for a supposed growth company.

This company is also capex-intensive, so EBITDA really doesn't show the full picture.

My opinion - I don't understand it properly, so am steering well clear. This share is really only for experts, or punters, in my view. There doesn't seem to be adequate visibility.

The question is whether today's update is better or worse than what investors feared last night? Is this just a bump in the road, with orders delayed, or will the market see something more serious? We'll soon find out. I've got no idea how this one will pan out. The share price has fallen heavily from last year's peaks.

Foxtons (LON:FOXT)

Share price: 51.9p (up 3.8% today, at 08:14)

No. shares: 275.1m

Market cap: £142.8m

London's leading estate agency, issues its trading update for the quarter ended 30 September 2018.

There's been widespread publicity about the London property market cooling, for various reasons, including excessive stamp duty on high value properties, Brexit concerns, and that prices are way too high on traditional metrics like salary multiples.

Therefore it comes as something of a pleasant surprise for shareholders that business in Q3 wasn't actually that bad - flat against last year (revenues) seems respectable, in a tough market;

The Group delivered a solid third quarter performance as the trends set out in July continued through the period.

Group revenue was flat year on year at £35.1m (2017: £35.1m), taking total revenue for the nine months ended 30 September 2018 to £88.1m (2017: £93.7m).

Year-to-date revenues are down 6% on last year. So flat in Q3 is an improving trend.

Lettings - makes up the bulk of revenues now. This is cushioning the business from the downturn in sales.

Lettings revenue was £23.1m (2017: £22.5m), as our enhanced offer and improved resourcing enabled us to capitalise on demand in what remains an attractive market.

Property sales - remains in the doldrums;

Sales revenue in the quarter was marginally lower at £9.9m (2017: £10.3m), which is a solid performance amidst ongoing reduced transaction levels. Revenues in our mortgage broking business, Alexander Hall, were £2.1m (2017: £2.3m).

Cashflow - as expected.

Current trading - October was in line with Q3 levels.

Branches - 6 have been closed, following a review. No more closures planned.

My opinion - current forecasts are for Foxtons to trade at around breakeven. Therefore, the valuation is based on anticipation of a recovery in future profits. That's what's happened in the past - profits here are highly geared to housing market transactions.

The London residential property market has been through a long boom, which seems to have fizzled out now, with prices at stratospheric levels. Who knows what happens next, it's anybody's guess.

There's also internet competition to think about. Foxtons prices are very high, and whether that's sustainable, who knows?

Foxtons' balance sheet is adequate, so I don't see insolvency as a risk here. Unless the London property market completely freezes up.

Possible upside could come from a change in Government policy, after idiotic hikes in stamp duty some time ago - which killed the top end market. A classic case of politicians and civil servants not understanding how markets work. They saw a multi-year property boom, and decided, pretty much at the top of the market, to hike tax on high value property transactions. A similar thing happened in 1988, when double MIRAS tax relief for couples was removed, which triggered a rush to complete transactions, and then a slump.

We also have to consider the impact of higher interest rates. A good element of the property price boom must have been encouraged by ultra-low interest rates. That era seems to be coming to an end - with the USA hiking interest rates, the rest of the world inevitably is likely to follow. That seems likely to negatively affect property prices at some stage.

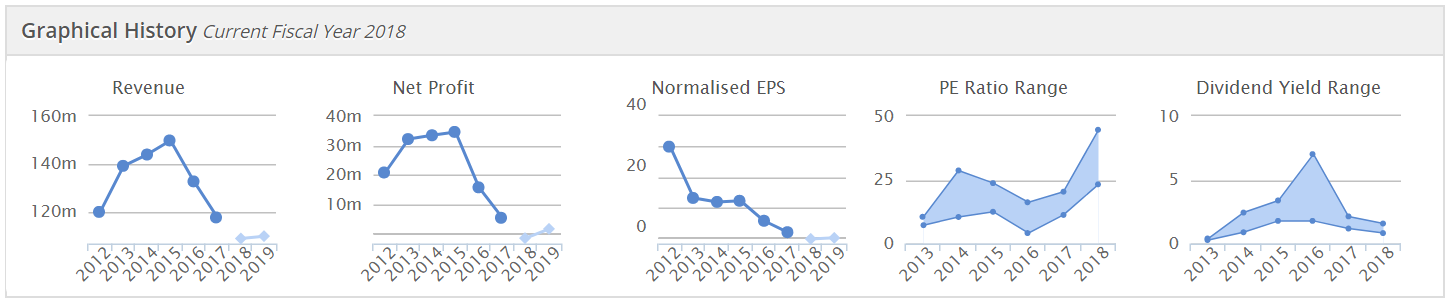

Overall, there are far too many uncertainties to make me want to get involved with this share, at this time. You can see just how geared Foxtons is to the market, from the usual Stockopedia graphs below;

Ideagen (LON:IDEA)

Share price: 141.5p (down 0.7% today, at close)

No. shares: 219.2m

Market cap: £310.2m

Ideagen PLC (AIM: IDEA), a leading supplier of Information Management Software to highly regulated industries, today provides an update on trading for the six months ended 31 October 2018.

There's a lot of positive-sounding stuff in today's update, but the bottom line is that performance is in line with expectations;

The Board is pleased to report that trading has remained strong in the first half of the financial year and that revenue and EBITDA are both expected to be significantly ahead of the same period last year and in line with management's expectations.

This group has been highly acquisitive. This has resulted in a balance sheet that is very top-heavy with intangibles. When last reported, as at 30 April 2018, NTAV was negative at -£9.8m. I prefer to see positive NTAV.

Other points from today's trading update;

SaaS - Transitioning from a licence, to SaaS model - which should increase the proportion of recurring revenues, making revenues & hence earnings more predictable over time

Bookings growth - starting to report this in trading updates, as it's a key KPI. The figures look impressive;

Total like for like bookings growth increased by 34% and total like for like SaaS bookings increased by 80%.

Recurring revenues - this also sounds good;

Given the momentum of our SaaS business the Company now expects to generate 74% of its revenues from recurring contracts by the end of 2020, up from the 70% previously anticipated.

Organic revenue growth in the period was 8% which, in the context of an accelerated SaaS transition, represents a strong performance.

New business - some impressive big client names are mentioned.

Net debt - modest, at only £1.3m

Outlook - strong platform for H2.

My opinion - the above all sounds great. However, I just can't get my head around the valuation here, of £310m. This seems to rest on a lot of accounting adjustments.

On a statutory basis, the group only made a profit before tax of £1.4m last year.

With software companies, I prefer to value them on a multiple of cashflow. In this case, it generated £8-9m in net operating cashflow in the last 2 years. It then capitalised c.£2m each year in development costs. So it's really only generating about £6m p.a. in cashflow. Is that really worth over £300m market cap? Not to me it isn't.

Another thing that bothers me, is that it pays virtually nothing in corporation tax. Maybe there are tax losses brought forward, I don't know. But it's something that I would need to look into, if I intended buying any shares.

Overall, it's not for me. I prefer to see more straightforward accounts, and more obvious cash generation, without lots of adjustments to arrive at that situation.

Shareholders seem to have largely held firm in the recent market sell off. If this was in my portfolio, I'd be tempted to take some money off the table, given wobbly market conditions;

N Brown (LON:BWNG)

Share price: 126p (down 6% today)

No. shares: 284.5m

Market cap: £358.5m

This is a mainly online retail group, specialising in large sized fashion, and offering high-cost customer credit. Brands include SimplyBe, and Jacamo, which you've probably seen advertising on TV.

There has been a dispute between the company and HMRC, concerning what proportion of its input VAT on marketing costs should be recoverable.

The RNS today is a bit complicated, but the standout sentence is this;

The draft ruling has mixed implications for N Brown and we are disappointed by the current outcome.

So it's negative, hence the share price dropping 6% today. N Brown might appeal, and it's only a draft decision anyway, by the VAT Tribunal.

Financial impact - this may change, but it's a hit to future profits. Therefore broker forecasts will be adjusted to show reduced earnings forecasts;

... the Group expects that irrecoverable VAT on its marketing costs will increase by between £6m to £9m per annum on a full-year basis from FY20 ...

My opinion - I'm wary of this share, as the stock market clearly doesn't like it, despite the apparently ludicrously low PER.

The trouble seems to be that the profit mainly comes from high interest charges to customers who pay by instalments. Very little profit seems to be made from actually selling products. Is that sustainable, and therefore is the big dividend sustainable? I simply don't know. The share price seems to be suggesting to us that there could be some doubt over these things.

The group has a high level of debt, but this is more than covered by an enormous customer receivables book, so may not necessarily be a problem. A key issue is whether impairments on the customer receivables book are adequate? As the nature of this kind of customer credit, is that many customers default. Which reminds me of Lily Savage, who always boasted of ordering clothes from the catalogue, and then moving house to avoid paying for it.

I'm tempted to have a bit of a punt here, but due to market uncertainty, probably won't.

The 2-year chart below clearly shows how perception has changed from it being an internet growth company, to being ex-growth and riddled with problems.

I've run out of time now, but a quick comment to finish off with;

Carclo (LON:CAR)

Interim results show adjusted profit down from £4.55m to £3.57m

Outlook comments not bad;

The Board anticipates full year trading will be in line with its expectations and the Group remains on track to grow substantially over the medium term.

Net debt quite high relative to market cap, at £35.9m - so low PER not quite as cheap as it looks. Company says "well within" banking covenants.

Note there is also quite a large pension deficit.

Overall, this could be worth a closer look, as a possible recovery. I'm intrigued by the upbeat commentary about new sales programmes & products in the pipeline.

All done for today, see you in the morning.

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.