Good morning! It's Paul here.

Graham usually does these reports on Fridays, but there are a few things I want to comment on too, so it's 2 reports today. Graham's report is taking shape here.

Please note that I had a late surge yesterday evening, and wrote 4 more sections in yesterday's report, which is here. (covering: Audioboom, Carrs, Mothercare, and Judges Capital)

QUIZ

This is a Glasgow-headquartered fashion retail business - physical stores, and online. It's in the process of floating on AIM, at a £200m market cap. Being my specialist sector, I was keen to meet management. I attended a group meeting earlier this month, and reported on my (mostly positive) thoughts here.

After much pondering, I decided to apply for the Quiz IPO, through my broker. Most placings are only available to investors who are classified as professional investors by their broker, or who meet suitability rules. It seems ridiculous that there are restrictions on who can buy new issues. Yet anyone can buy any share in the aftermarket, without any restrictions applying. Seems daft to me.

Anyway, the good news is that I think this is likely to be a successful new listing. The reason is that the allocations fell within the goldilocks zone - so there was enough excess demand for the new shares to make it a success, but not so much excess demand that allocations were derisory. Mind you, people tend to over-apply for the good placings, expecting to be scaled back.

There is an RNS here giving schedule 1 information. I see that the great & the good of institutional small cap investors are on board - e.g. Hargreave Hale 6.5%, BlackRock 5.0%, and Slater Investments at 3.1%.

The shares start trading on 28 Jul 2017. My hunch is that they're likely to go to a premium, but time will tell.

IQE (LON: IQE)

(in which I hold a long position)

There was a remarkable move up yesterday, on strong trading news, which I reported on here. For anyone (like me) who doesn't really understand what the company does, there is an outstanding video here from PI World, by IQE's CFO, at Mello Beckenham, in Jan 2016.

I think this presentation is an wonderful example of how to explain complicated technical subject matter in a completely accessible way. This should be used as a teaching aid, the presenter is that good.

Arguably I should have done my research before buying the shares!

Retail Sales

I noticed that a lot of retail shares were more perky yesterday. This is because of more positive retail sales data from the ONS. I really must diarise to check this data when it comes out, rather than being behind the curve on it.

Here is the link to the ONS report - well worth a read, and they're straightforward. The main points section is below:

Remember that the above 1.5% is just sales volumes. As prices are 2.7% higher, this means that putting the two together, I make that about +4.2% in overall retail sales terms. That seems pretty good.

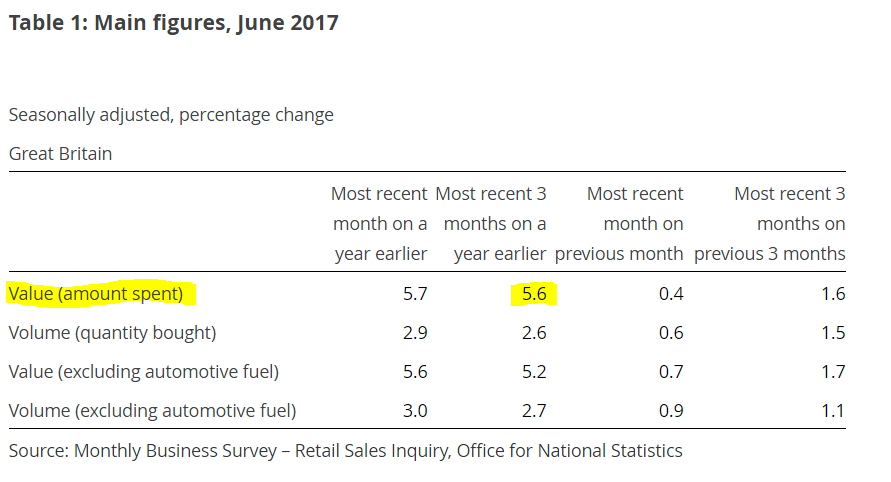

Looking further down the report, that seems to be an under-estimate, see table below:

Total amount spent being up 5.6% on the prior year's Q2. Hmmm. That's actually really good!

So I've decided to close my short positions on retailers. We might even get some strong reports from retailers, maybe it's time to (selectively) go long? I've just bought back into Next (LON:NXT) at about 3820p. It might have another profit warning in it, but this retail sales data looks very good, so I think maybe that risk might be receding?

Good weather has helped the figures, although over a whole quarter, weather shouldn't have that much impact. Not for the first time in the last year, we have to ask ourselves whether all the doom & gloom is actually justified? That said, retailers are under ongoing pressure from growing online competition, plus many cost headwinds. So it probably won't be plain sailing. We shall see.

OK, that's my bonus report done. I'm off out for lunch with a very interesting charity which I support, providing desperately needed aid for the poor in Zimbabwe, called Zane.

Zane is highlighting in particular, how elderly ex-servicemen, and their families, all over the Commonwealth, have been abandoned by the UK Government, despite them having fought for us in years gone by. We need to lobby Government to use some of the bloated overseas aid budget to provide vital support & healthcare, to ex-servicemen in the Commonwealth, not just those in the UK. If people fought for the UK, then the military covenant should extend to them too.

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.