Good morning!

Today would be a good choice for a duvet day given the lack of news flow, but I will keep the show on the road.

Ryanair Holdings (LON:RYA)

Did anybody notice that Ryanair Holdings (LON:RYA) was fined €3 million by the Italian authorities?

As a frequent flyer and occasional Ryanair customer, it's nice to have a moan about it sometimes.

For context though, I do celebrate the era of cheap air fares which was created and sustained by Michael O'Leary. While it doesn't happen as frequently as it used to, I still fly with Ryanair from time to time, when their offer is too good to pass up.

Indeed, last month they brought me and my lady to Athens for a bargain price - no complaints about that at all!

But where they let themselves down a little bit is that they have turned the booking process into an IQ test and a test of your nerves. Booking a flight is now a game in which they try to tempt you and trick you into buying things you don't necessarily want, and you try to spend as little as possible without making your flight experience completely miserable.

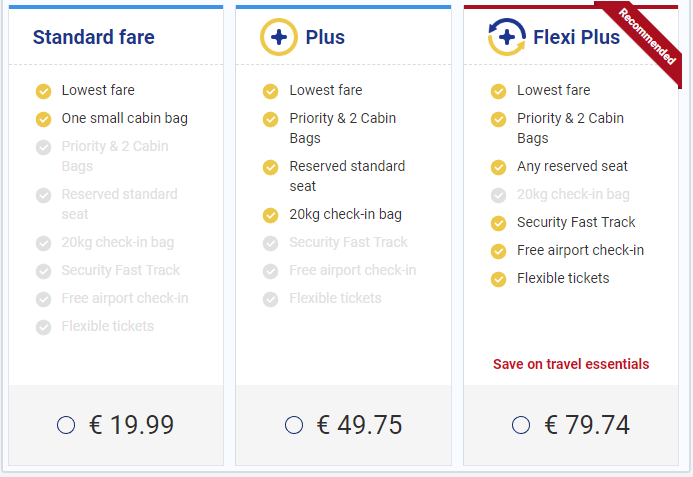

For example, this is what I was greeted with when I put a dummy flight into their system this morning, and clicked on an offer advertised as "from €19.99".

Hmm. This is less attractive than it seemed at first glance!

If I spend €19.99, then I get the "lowest fare" but it looks like I only get to bring "one small cabin bag" on board. How is that going to be appropriate for an international flight?

On the other hand, do I want Priority & 2 Cabin Bags and a 20kg check-in bag, and a reserved seat with the Plus option? Not really.

The way to beat them is to bravely click the cheap Standard Fare option for both the outbound and return flights, then Continue.

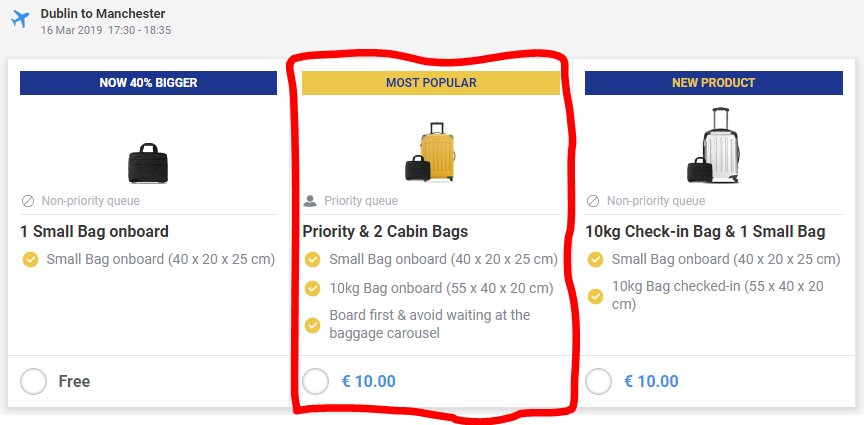

On the next page, Ryanair will give you the option you really wanted: the 10kg cabin bag. It's cheap and it comes with priority boarding for €10.

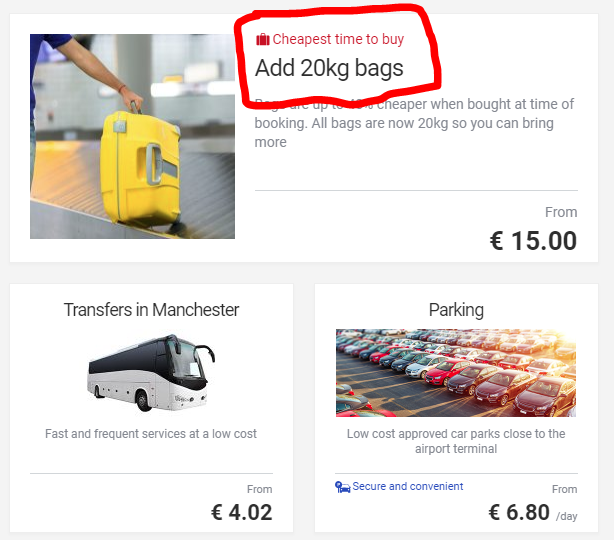

After insisting that you don't want to pay to reserve a seat*, you will finally be given the option for a 20kg bag. Good for holidays and longer trips!

(*Be careful about not reserving a seat if you are travelling with someone or as part of a group. A study has found that there is a 35% chance of being split up by Ryanair, about double the probability at other airlines.)

So whether you want a 10kg or 20kg bag, you can get them cheaply. You just have to proceed bravely through the booking process until you are offered them on a standalone basis.

Italia - Il Rifiuto

Italy has had enough of this, and similar carry-on with carry-on bags at Wizz Air Holdings (LON:WIZZ). Both airlines have been fined, although Ryanair Holdings (LON:RYA) gets the much larger €3 million fine for failing to suspend its baggage policy, as requested.

The Italian regulator has argued that:

"The request for supplementary pay for an essential element of air transport, such as hand baggage, provides a false representation of the real ticket price ... misleading the consumer."

I would have to agree with this. How can it be reasonable to say that the price of an airline ticket is X but you can only bring a small bag with you at that price. Is anybody capable of making a flight with just a small bag? Even if the answer is that 1% of passengers can do it, a headline price should not be unsuitable for 99% of potential passengers. The headline price should be the price with a 10kg bag, and there should be a discount if you don't need it.

From Ryanair's point of view, surely they realise the damage that this practice must be doing to their reputation? On my flight to Athens, there were not one but multiple instances of passengers who had been caught out by the booking process.

They had brought luggage to the gate which they presumed they were entitled to bring on board, only to be told that they had no such entitlement. Some of them had paid for hold luggage, while others had paid for no luggage at all.

And if lots of passengers aren't paying enough, there must be other passengers who are accidentally paying too much. This might seem like a good thing from Ryanair's perspective but why not simplify matters and help people to get the option they really want? Are you listening, Michael O'Leary?

Ok, I should probably look at one two RNS announcements.

- Flybe (LON:FLYB)

- Merlin Entertainments (LON:MERL)

- Non-Standard Finance (LON:NSF) & Provident Financial (LON:PFG)

Flybe (LON:FLYB)

- Share price: 1.49p (-27%)

- No. of shares: 217 million

- Market cap: £3 million

Completion of Sale of Flybe Ltd and Flybe.com Ltd

Most shareholders will have left the building by now but there are still a handful in the Denial phase of the grief cycle, judging by the trades placed this morning.

Management have sold the group's operating subsidiaries, against the wishes of many shareholders, and the deal closed last night.

FLYB shares now represent ownership in a shell whose only asset is a small amount of cash swirling around, and the right to be taken over at 1p by the the buyers of its subsidiaries.

Management are definitive on this:

The Flybe directors strongly advise shareholders to vote in favour of the Scheme at the shareholder meetings on 4 March 2019 in order to receive the consideration under the Scheme of 1 pence per share as otherwise shareholders are likely to receive no value for their shares in the Company.

Given the scale of shareholder dissent, it can't be ruled out that the Scheme could fail and that some sort of legal challenge could be mounted by someone.

I'm not a legal professional, but I don't see what sort of recourse the dissenting shareholders might have. It seems to me that shareholders are overweight anger and frustration, but are underweight any real prospect of a better financial return.

Management are giving notice to the LSE that they wish for the listing of FLYB shares to be cancelled and intend to wind-up the company if the Scheme is not approved.

If I owned FLYB shares today, I would be selling them immediately at any price greater than 1p.

Merlin Entertainments (LON:MERL)

- Share price: 364p (-0.5%)

- No. of shares: 1.02 billion

- Market cap: £3,722 million

Another big-cap gets mentioned in the SCVR but I have a really positive impression of Merlin and have been thinking that it might make for an attractive buy-and-hold, so I noticed when this RNS popped up.

It is selling its Australian ski resorts for £95 million. Proceeds will be used "for general corporate purposes".

The rationale is to enable Merlin to focus on theme parks and Midway attractions (incorporating Madame Tuassauds, The Dungeons, LEGOLAND Discovery, etc.)

It's a green flag for me when a company sells off non-core activities to focus on its core competencies. It's essentially the reverse of when you see companies diversifying into categories where they lack any real expertise.

I have a good impression of Merlin's brands and of management stewardship, with the guidance of the LEGO family who are 30% shareholders. It's a capital intensive business, but a very good one.

Non-Standard Finance (LON:NSF)

- Share price: 62.1p (+8%)

- No. of shares: 317 million

- Market cap: £197 million

Firm offer by NSF for Provident Financial

Response to Offer for Provident Financial

NSF management, led by John van Kuffeler are making a play for the reverse takeover of Provident.

Van Kuffeler was the CEO of Provident from 1991 and Chairman from 1996 (he was Chairman for some 17 years).

The approach for Provident today is scathing of its current management, claiming that it suffers from a long list of problems including the Board's "limited operational experience", "cultural challenges", an "inability to deliver shareholder returns", "regulatory failures", and so on.

The deal will "return Provident's culture to one focused on positive customer outcomes, working closely with regulators". In a letter to Provident employees, van Kuffeler says; "We understand the problems that some of you are facing and have a clear plan to address these." Ouch!

Many Provident shareholders agree and three of the top four holders (Woodford, Invesco and Marathon Asset Management) have provided irrevocable undertakings or letters of intent to vote their shares in favour of the deal. Together, they own just over 50% of total PFG shares outstanding.

This puts Provident directors in a tricky spot. Even if some of them would like to oppose the deal, they can see that there is an uphill battle to be had with their own shareholders.

Indeed, we have confirmation that Provident directors tried to prevent this transaction from happening before:

We have recognised the strong logic and value creation potential of a combination with Provident for some time and hence approached the Provident Board with a proposal in January last year. That approach was rebuffed and since then Provident has further lost its way... I'm delighted that holders of over 50 per cent. of Provident's shares have given their support to our proposal today."

My view

It's an ambitious play. While the combination of the NSF/PFG businesses should lead to material synergies and cost savings, the more important element of the deal might be the change in culture as Provident goes back to its roots.

Provident shareholders would own 88% of the enlarged group, which according to my calculation is perfectly in line with the market caps of the respective companies as of last night. So it's a straightforward merger and a replacement of the bigger company's management team by the smaller company's team. Given their respective performances in recent years, it sounds like a sensible idea.

Have a fine weekend everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.