Good morning! Paul here. I didn't manage to finish yesterday's report, so thought I'd resume reporting on a few more companies from yesterday. Graham is putting together a separate report for today's results - which will be quite short I think, as there's not much of any interest.

Purplebricks (LON:PURP)

(at the time of writing, I hold a long position in this share)

Audiocast - for a bit of fun, I've decided to record an audiocast today with Lucian Mears, a well-known bear, who I've got a lot of time for. I'll publish it on my QualitySmallCaps.co.uk website later. EDIT: Here is the link.

The share price is certainly dropping heavily at the moment. Although it's difficult to know how much of that is the impact of negative publicity from bears, or how much is due to the general profit-taking in growth shares at the moment?

I feel that the bears do actually have some valid points. Although I remain bullish, because there is no doubt that online estate agents are disrupting the sector greatly. PurpleBricks is by far the market leader in the UK. If its new operations in California start doing well, then the market cap could go through the roof. Although it's already eye-wateringly high.

Going back to some announcements from yesterday, here goes:

FW Thorpe (LON:TFW)

Share price: 347.5p

No. shares: 115.7m

Market cap: £402.1m

Preliminary results - for the year ended 30 Jun 2017.

F W Thorpe Plc, designers, manufacturers and suppliers of professional lighting systems for the specification market

By "specification market", I presume they mean for construction projects?

The company issues very few RNSs, so the last update was the interim results, which I reported on here, on 16 Mar 2017. Interim results were good, and the outlook used the company's usual phrase of being "optimistic of a satisfactory overall result for the year".

There don't seem to be any brokers reporting on this company, which is very surprising for a £402m market cap company. Although it's effectively a family company, which happens to have a listing.

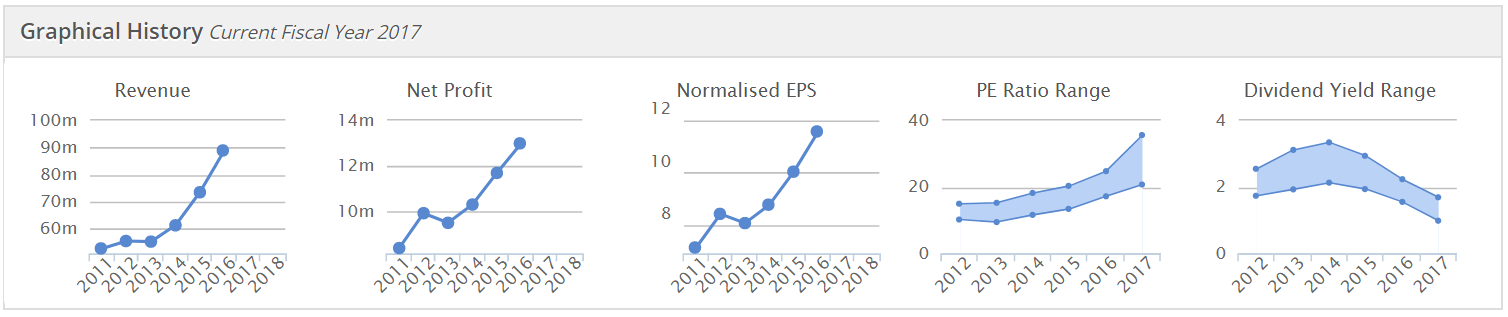

As you can see from the Stockopedia graphical history above, the company has performed well for several years. However, as graphs 4 & 5 show, the PER has gradually been going up, and the dividend yield coming down. So the key question now is surely whether the shares might now be too expensive? It's undoubtedly a good quality company, but everything has a price.

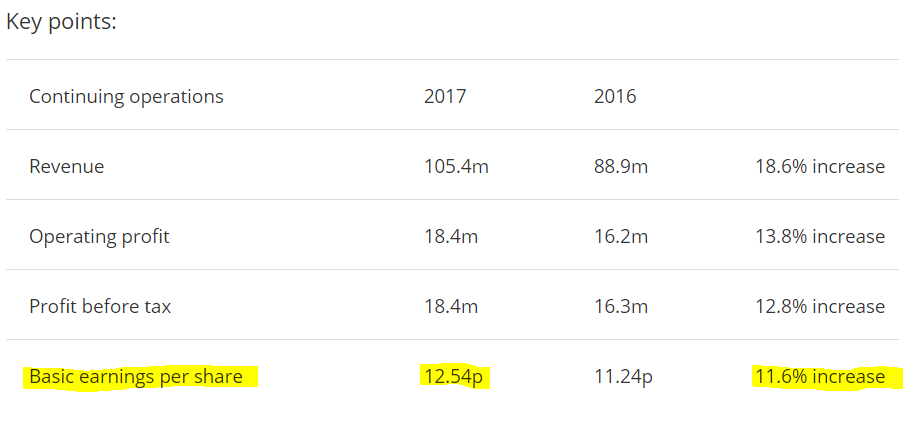

Here are the highlights from today's full year results;

Valuation - with the share price currently at 347.5p, the PER is 27.7 - that strikes me as considerably too high. Does EPS growth of 11.6% justify a PER this high? I don't think so. I imagine that results have probably been helped by favourable forex movements - since its European operations profits would translate into a higher sterling reported amount.

Dividends (interim + final) are up 21% to 4.9p - giving a yield of only 1.4%. The company has also occasionally paid small special dividends. Given that it has so much spare cash on the balance sheet, I cannot understand why the dividends are not more generous? What's the point in hoarding cash, which earns little to no return?

Outlook comments don't sound particularly confident. Although I think the company tends to have an under-stated style of communicating.

This year's excellent performance will be difficult to replicate, as we will have to contend with ongoing economic uncertainty from Brexit, government instability and exchange rate variations.

We see ourselves better placed to respond to these issues nowadays, with manufacturing facilities in the UK and in mainland Europe, as well as revenue generated in a number of different countries from our own local sales offices.

We continue to review options for further acquisitions. We have the financial capacity, so it could be said that it is easy to acquire, and there are indeed frequent options for us to review.

To find the right acquisition - one that meets our criteria and does not become a future liability - is not as easy as it might seem. The general management team remains the same experienced group, and our intention is to continue on the same path of steady, sustainable growth.

Balance sheet - this is very strong indeed.

NAV is £101.3m

NTAV is £85.4m

Current ratio (working capital) is 4.34, which is amazingly high. The company has excess working capital really, which includes £17.0m of "short-term financial assets", which I think are cash term deposits. There's also £24.7m in cash. There's no interest-bearing debt, so net cash is £41.7m, or 10.4% of the market cap.

Acquisition - if, say £30m of the surplus cash was used to make an acquisition on a PER of, say 12, then that would bolt on £2.5m in extra post-tax earnings. 2016/17 earnings were £14.5m, so such an acquisition has the scope to increase earnings by c.17%. This goes some way to explaining why the PER is so high.

The difficulty of course, is finding the right acquisitions. I think the management at TFW are very grounded, and won't risk buying anything unless it fits the bill.

My opinion - this is undoubtedly a very nice, family company, with strong management and a great long-term track record. However, as you probably gathered from the above, I feel that the shares are now significantly over-priced. To my mind, a PER of about 15-18 would be more appropriate, even when you factor in the surplus cash.

Earnings have risen steadily in recent years, but a lot of the share price appreciation has been due to multiple expansion - i.e. the market being prepared to pay a higher & higher PER for the shares. That won't last forever, and would likely go into reverse in a bear market. For that reason, I can't consider this a sensible investment at the current price. It's done very well historically though, but at some point you do have to consider whether the valuation has become too stretched?

Cambridge Cognition Holdings (LON:COG)

Share price: 152p

No. shares: 20.5m

Market cap: £31.2m

Half year report - for the 6 months to 30 Jun 2017.

The neuroscience digital health company Cambridge Cognition Holdings plc, (AIM: COG, 'the Company'), which develops and markets software products to improve brain health...

I've covered this company quite a lot in the past, as it always looked potentially interesting, albeit in a jam tomorrow kind of way. The share price has doubled this year, so the interim results must be good? Sadly no, they're really not.

- H1 2017 revenue down 1.7% to £3.2m

- Still loss-making - with a loss before tax of £386k in H1 (worse than £145k loss in H1 2016)

- Net cash of £1.8m, which looks adequate, providing losses don't worsen

So why have the shares doubled this year? Partly I think because we're in a bull market, where investors are very receptive to positive newsflow from growth companies. Partly also because the outlook seems to be improving, so there might actually be some jam served up in the future, possibly?

Sales order pipeline increased by 65% to record levels

Outlook comments;

With modest investments in commercial infrastructure and R&D activity we have transitioned to an improved blend of product and service revenues. Both the sales pipeline and the innovation pipeline are stronger than in recent history at a time when there is substantial appetite for both neuroscience and digital health solutions.

We expect a strong second half to 2017 as we continue to convert our order pipeline and we are confident in the growth potential of Cambridge Cognition into 2018 and beyond.

I do wonder what the company's idea of "strong" might be? Historically performance has been lacklustre, with only a tiny profit being eked out in good years, and losses the rest of the time.

My opinion - this is a share I held for a while in the past, but got bored at the slow pace of progress, and moved on. There's definitely something good here - the company is highly experienced in its sector. I'm just not convinced that the company can deliver enough scale, or profits, in a reasonable enough timescale, to justify parking some money in its shares again.

That's it for this week, have a lovely weekend!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.