Good morning!

There was some discussion in the comment thread last night about the effect of reader suggestions on the SCVR, which I haven't had a chance to respond to yet.

If you do have any comments or suggestions for today, please fire away.

On the macro front, the FTSE-100 closed lower by 1.2% at 6953 yesterday, returning to December 2016 levels, and is set to open lower again today.

Small-caps on my radar today are:

- Robinson (LON:RBN)

- Cenkos Securities (LON:CNKS)

- Henry Boot (LON:BOOT)

- Sprue Aegis (LON:SPRP)

- Quixant (LON:QXT)

There have also been announcements for the big-caps Next (LON:NXT) (which I hold) and £AV.A.

Graham

Macro Thoughts: The market is worried about trade wars after Trump announced $60 billion of tariffs on Chinese steel and aluminium. Do we care about this story at the SCVR? For now, I don't think so. The success or failure of individual companies is still more interesting.

Something I do care about is the level of the FTSE, so to the extent that jitters send the FTSE lower, I do take notice.

Personally, I've been keeping track of the FTSE All-Share Total Return Index against my personal portfolio since 2011.

I also watch the FTSE-100 Index as a measure of how invested I should be. Ideally, I will increase my equity weighting as the index falls. And if the falls become extreme, I would even be willing to take some leveraged long positions in stocks.

Stockopedia has helpfully saved the lines I drew on the FTSE-100 chart the last time I looked at it, during the big fall in early February:

The 7100 level provided support for a while, but is out of the picture now and from a technical point of view we look headed towards the 6600 mark.

If we drift deeper into the 2016 range, we would be headed to 5900 and then the 5500 low:

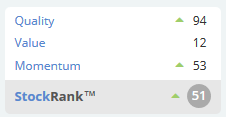

These are the fundamental stats for the FTSE-100, according to Stocko:

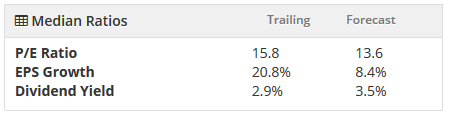

These metrics look fairly moderate, but some would argue that many of the index's heaviest components ought to be on lowly valuations:

Disclosure: I own British American Tobacco (LON:BATS).

A little bit of maths tells me that if the FTSE suddenly reached 5500, all else being equal, that the PE ratio would be 12.5 and the dividend yield would 3.7%.

If earnings and dividends were to take a hit, then of course these metrics wouldn't look quite so good. And everything would remain relative to interest rates, as they always do.

Even still, I think there would be some great value to be had in the market at the 5500 level, and I'd probably be adding a lot of equity exposure there.

For now, I'm just less than 80% invested and comfortable with that. Each person has to find a level appropriate to their risk tolerance, time horizon, liquidity constraints, tax situation, etc!

Robinson (LON:RBN)

- Share price: 81p (-11%)

- No. of shares: 16.6 million

- Market cap: £13 million

This is a family-owned packaging business, with manufacturing facilities in the UK and Poland.

I covered its results last year, when it correctly forecast revenue growth but did not signal that any profit growth would be forthcoming.

At 115p at that time, I thought the shares looked reasonably attractive. But profits have continued to slide, and with them the share price.

Some bullet points from today's results:

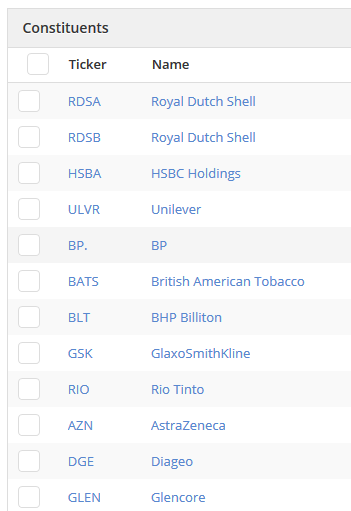

- Revenue up 9% to £29.8 million

- Gross margin falls to 19% from 23%

- Adjusted operating profit falls to £1.3 million from £2.1 million.

As these charts indicate, revenues haven't been doing too badly. But the operating margin has been weakening, and this year the gross margin has also reduced:

The RNS is very short for a final results statement, reflecting the small size of the company, the limited liquidity in the shares, and the general lack of hype surrounding it.

There are glimmers of hope among the commentary. 2017 is regarded as a "year of transition", with new business now replacing contracts which had been lost in 2016.

(As an aside: my personal portfolio is increasingly oriented toward B2C companies. Life is much less stressful as an investor when you don't have to worry about your company winning and losing lumpy contracts.)

On the expenses side of things, there has been a recruitment drive: this has meant higher costs in the short-term, but the purpose is to drive higher sales growth going forward.

My opinion

I don't feel familiar enough with the business at this point to judge whether it has the innovative capabilities to improve margins. An "adverse product mix" is mentioned as a partial explanation for the reduction this year. I wonder if there is a risk that the change in mix is permanent, rather than a temporary blip?

Other factors were beyond its control (e.g. weaker Sterling), so hopefully the margins will improve somewhat in 2018.

As others have noted, the balance sheet is strong, with net assets of £23 million.

There is a material amount of intangibles, however, and it's only right to deduct the intangibles from the balance sheet if the amortisation of intangibles is going to be added back to adjusted profits.

The tangible balance sheet value is £17 million, the same of the value of its PPE. Bank borrowings are used to fund the company's working capital.

On top of this number, we can add the value of surplus land, which I have heard is worth an additional £10 million (can anyone verify this?).

Unfortunately, the prospects for the sale of this land have significantly deteriorated. In August 2017, the company said:

The sale of surplus properties in Chesterfield is progressing and developments for the Walton Mill and Boythorpe Works sites are being discussed with prospective tenants and buyers. This process is likely to take several more months but we do expect some realisations in 2018.

In December, the company added that "progress continues to be made." But today, it says:

Finding suitable buyers for the Boythorpe Works residential site and Walton Works mixed use site has been challenging in the current market. Large retail developments are now in low demand and residential development opportunities in the locality are in good supply.

That must be a big disappointment for value investors who were expecting a property sale, and may explain the share price fall today. It also puts a question mark over how much this land must really be worth.

If the surplus land is indeed worth anything like an additional £10 million, then I can't avoid the conclusion that the shares are in value territory at the current level. But as is often the case with many value investments, the patience required to hold them for long enough to achieve the hidden value can be the biggest challenge.

Stockopedia agrees there is value to be had:

Cenkos Securities (LON:CNKS)

- Share price: 112p (-5%)

- No. of shares: 55.3 million

- Market cap: £62 million

This is an institutional stockbroker and corporate finance house. It acts as NOMAD (Nominated Advisor) to AIM companies.

2014 and 2015 saw it earn bumper profits on the back of a couple of huge one-off deals (2014 revenues were £88.5 million).

2016 was quiet, as revenues almost halved compared to 2014 (£44 million).

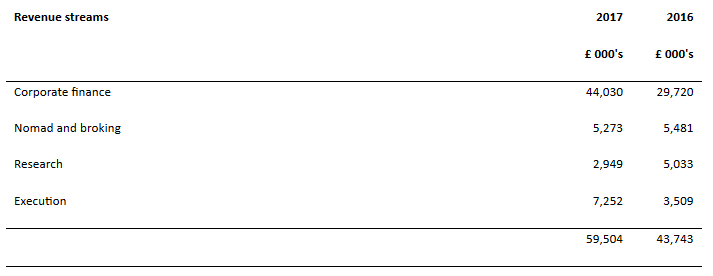

2017 was somewhere in the middle:

I won't repeat my positive comments on how the business is run, as you'll find them in the archives here.

Quindell

Our old friend, Quindell, is mentioned.

In our 2016 Annual Report we reported that, following an investigation by the FCA into our role as sponsor to Quindell plc, we undertook an extensive remediation program. We have worked through 2017 to embed the recommendations and will continue to do so in 2018.

Curiosity got the better of me and I had another look at Rob Terry's latest venture. He is again trying to recruit investors with delusional commentary and talk of fairy-tale returns.

Astoundingly, he refers to prior involvement with The Innovation Group and Quindell as if it reflects well on him and his inner circle (both companies enriched him greatly, but were devastating for many shareholders).

Indeed, events at Quindell were still being investigated by the Serious Fraud Office as of January, according to the FT.

As far as Cenkos is concerned, I think most investors accept or at least are aware that AIM is a lightly regulated marketplace (some would argue that it is not regulated at all), and that it's up to investors to do our own due diligence on the companies and management we put our money in. I don't envisage any further repercussions for Cenkos over this.

Revenue Analysis

Corporate Finance - a really strong improvement this year. Equity finance raised for clients increased by 90% to £2.5 billion, and Cenkos' market share in terms of AIM fundraising increased to 21% from 13%.

Research - the research coverage has been reduced this year. The company acknowledges "there is some uncertainty following the roll out of MiFiDII".

Execution - a very strong performance boosted by exceptional gains on shares received in lieu of cash.

Outlook

Cenkos never enjoys much visibility:

We live in an uncertain geopolitical environment that makes it very difficult to predict either the direction of the markets or health of investor sentiment. There has been significant market volatility leading to a correction in all main global indices.

This market volatility does appear to have had an impact on investor sentiment with a pause in the momentum the Firm experienced in the second half of 2017. Despite this, we remain ranked as one of the leading brokers in London for growth companies, institutional investor appetite to fund high quality companies is likely to return and our business model is resilient. Consequently, we look forward to the future with cautious optimism.

My opinion

I still think this is a nice company, and I'm pleasantly surprised by the results this year.

It's also worth mentioning that it's a financial fortress, now showing net assets of £30 million, most of it liquid or near-cash.

It will probably never generate compound growth, and it's always going to produce lumpy and unpredictable results. But if the ethos remains the same, it will keep paying out lots of cash dividends whenever it can afford to do so (the yield is 5% trailing, or 8% on a forward basis) and treat shareholders well.

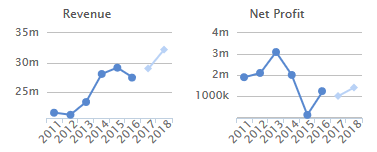

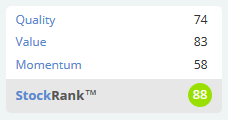

I agree with the StockRank:

Henry Boot (LON:BOOT)

- Share price: 304.5p (+0.5%)

- No. of shares: 133 million

- Market cap: £405 million

I started covering this land development company last year.

My only quibble with it has been on valuation grounds. I rarely pay much more than book value for property companies (e.g. my recent purchases of £INL).

That having been said, Boot is performing really well. NAV increased 15% in 2017, only using about £30 million of debt to achieve this.

And signs remain positive in 2018:

We have made a good start to the 2018 financial year, having already concluded a number of land sales. In addition, we have a strong pipeline of construction work, commercial development projects and strategic land sites working through the marketing process, on which to capitalise through the year.

NAV increased to 203p by year-end. The share price reflects a 50% premium to this.

I guess the market is thinking we could get another very large increase in NAV this year, given the increase in acreage and plots with planning permission. And with a number of deals having already been completed, the NAV is probably higher again now compared to the year-end value.

So I appreciate that the premium to NAV is now probably less than 50%, that the company is performing very well, and that it has an admirable focus on achieving 12-15% ROCE over the business cycle. If I was a shareholder, I probably wouldn't bother selling it out of my portfolio.

For someone like me who's interested in a potential entry price, I would want more of a margin of safety, i.e. the opportunity to buy it at or below NAV.

Sprue Aegis (LON:SPRP)

- Share price: 146p (-23%)

- No. of shares: 46 million

- Market cap: £67 million

DA Termination Notice and Update re final results

This is a home safety company, primarily known for supplying fire alarms.

Relations have broken down with one of its main partners, BRK, with whom it had a distribution agreement (DA)

Under the DA, Sprue paid a fee for the exclusive right to distribute BRK's products in Europe. BRK says that Sprue broke the terms of this agreement, and is ending the agreement immediately. It was due to end at the end of this month, anyway.

Strangely, BRK also happens to be the biggest shareholder in Sprue. They are related parties. BRK even has the right to appoint a member of the Board of Sprue!

As you might have guessed, it's a very complicated set of relationships.

US giant Newell Rubbermaid ($NWL) owns BRK, which owns 23% of Sprue.

Newell also owns DTL, which supplies BRK's smoke and carbon monoxide alarms, and supplied Sprue's own-branded fire alarms under a manufacturing agreement (MA). Newell has been the single largest supplier to Sprue, through a French subsidiary.

Are you confused yet?

My opinion

This problem relates to agreements which were already set to expire, so you could suppose that whatever costs it inflicts will be temporary.

What's bothering me about it is the fact that BRK is a big stakeholder in Sprue, even with Board representation, and yet it has decided to take this potentially damaging action against its investee.

We don't have much of an explanation of what has happened, so it's impossible to tell who is in the right. And potential damage has not been quantified at this early stage.

It's probably just a temporary problem, so the shares should recover in time, but I think the uncertainty and the questions raised by today's announcement easily justify the 23% hit to the share price. today.

Quixant (LON:QXT)

- Share price: 411.5p (up 8% yesterday)

- No. of shares: 66 million

- Market cap: £272 million

Circling back to cover this company, which I missed yesterday.

It creates the hardware platforms for pay-to-play gaming machines. In the words of the company itself, "you simply add the software". Separately to this, it manufactures monitors specifically for gaming.

It claims to be "the highest volume manufacturer of computer platforms for gaming", with 10% market share.

HQ is in Cambridge and manufacturing takes place in Taiwan. There are further offices in Las Vegas, Italy and Tokyo.

Besides posting excellent 2017 results yesterday, it announced that the outlook for 2018 was "ahead of our previous expectations" after a robust start to the year.

It's nice to see that one of the main co-founders is still heavily involved. He owns 18% of the shares and has only recently moved from CEO to Exec Vice-Chairman with responsibility for "technology leadership and product innovation".

His replacement as CEO was hired internally and was also involved with the inception of the company as a design engineer. This also looks positive.

The statement from the new CEO is written in a very clear style, and I haven't come across any standard red flags or other reasons for concern yet.

So I agree with Stockopedia that this is probably very high-quality company:

That was a busy day!

There was strong input yesterday about the role of comments in this report.

My own plan is to choose some stocks myself each day (the ones I'm most interested in), and take requests for a few others. Your requests have been a rich source of investment ideas for me, and I welcome them.

Paul has his own views on this. I'll wait for him to come back instead of putting words in his mouth.

Anyway, that's it for this week. Have a fun weekend and I'll see you next time.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.