Good morning!

Some stocks I'm looking at today:

- Volvere (LON:VLE)

- IQE (LON:IQE)

- Redhall (LON:RHL)

- Mothercare (LON:MTC)

- Westminster (LON:WSG)

- Luceco (LON:LUCE)

- Headlam (LON:HEAD)

Politics

There has been some minor political news today regarding the Prime Minister. Markets don't seem to care - it was flagged in advance and has been on the cards for some time.

Volvere (LON:VLE)

- Share price: £11.85 (+7.7%)

- No. of shares: 3.1 million

- Market cap: £37 million

Disposal of Sira Defence and Security Limited

(Please note that I have a long position in VLE.)

Some great news from Volvere last night.

I appreciate the fact that they released it after 6pm, so we had plenty of time to digest it last night. It would be wonderful if more companies did this, wouldn't it? I don't think there's a rule which says that announcements have to be released at 7am!

Anyway. the news is that Volvere has raised £2.55 million (£3 million before bonuses to executives and transaction costs) from the sale of Sira Defence, its small CCTV software subsidiary. The buyer is a large company called NICE.

The multiples achieved by Volvere on exit really astound me. Sira earned revenues of £300k and PBT of £60k last year. Selling it for £3 million tells me that Sira must have developed into a very high-quality business over the years, with a lot of potential, and/or that Volvere is particularly good at finding buyers for its subsidiaries.

You might remember that Volvere's previous disposal generated £31 million (gross), for a consulting company which generated PBT of £3.3 million in the prior year. The multiples for that transaction were impressive, but the Sira multiples are on another level.

The return on investment is also quite good. The RNS yesterday says that Sira was purchased for "£0.005 million". Scrolling back through the archives, the RNS from 2006 says that £30k was the purchase price for Sira and its sister company.

A couple of working capital loans have been extended over the years but the ROI is spectactular whichever way you look at it.

The Future

There is no doubt that Volvere has a superb track record. Can it be continued?

Looking forward, it faces two primary challenges, in my view: 1) how to manage a very large cash pile, which it has never had before, 2) how to find deals in an era when interest rates are low and quality businesses have access to very many sources of capital.

Cash pile - Volvere reported year-end cash of £34.1 million for 2018. There is a £2.55 million boost from the Sira sale, but Volvere also expects to invest £1.5 million this year in its food manufacturing business. So the net result is c. £35 million in cash, before this year's operating cash flows.

Deal flow - Volvere has not made an acquisition since March 2015. While the caution of the executives is to be commended (they prefer to do nothing than to make a mistake), investors should be aware of the lack of purchases.

There is only one remaining subsidiary, in an industry which many investors find unattractive. Perhaps the executives will now have the mental bandwith to look for new deals, but we shouldn't be surprised if they remain extremely cautious. Like Buffett, they might prefer to wait until economic conditions change and it starts to rain gold outside!

My view

I would support another share buyback at the current share price. The cash balance alone (using my estimate above) is worth c. 1135p per share, with the well-invested and property-owning food business thrown in for a very cheap price on top.

My reasoning is that the cash balance is just a bit too large for it to be used within any foreseeable timeframe, so it makes sense to return a bit more of it to shareholders.

Even without a buyback, I'm happy to continue holding as I reckon my funds are in safe hands. As I said yesterday, it's nice to have a couple of counter-cylical holdings. This remains the largest position in my portfolio.

IQE (LON:IQE)

- Share price: 73.65p (unch.)

- No. of shares: 790.5 million

- Market cap: £582 million

Trading Update and comment on US Entity List

Full year guidance remains unchanged at this manufacturer of semiconducter wafers.

The US-China trade war sparked this update, as the Chinese smartphone company Huawei is buyer from some of IQE's customers. These chip companies might be unable to sell to Huawei in future, which in turn could depress the demand for IQE's wafers.

Having analysed the situation, IQE reckons that "its current maximum risk exposure... is less than 5% of total FY 2019 revenue guidance". Since it sees other growth opportunities, it is happy to leave full-year guidance unchanged. So hopefully not a big deal.

I still don't understand IQE's valuation - why would you want to buy a capital-intensive manufacturer from Apple's supply chain at a multiple of 26x, when you can buy Apple itself at 14.5x?

The StockRanks recognise Apple's quality (link). In comparison, IQE enjoys a StockRank of just 18.

Redhall (LON:RHL)

- Share price: 1.6p

- No. of shares: 333 million

- Market cap: £5 million (suspended)

Trading update and suspension of trading on AIM

The StockRanks called this one correctly and I'm pleased to say that your humble writers also made some sensible (albeit brief) comments on it. Commiserations to anyone holding it.

It's an engineering business which has had problems for quite a while. When I covered it way back in December 2016, I noted that it remained significantly indebted, despite diluting shareholders to smithereens in a series of fundraisings.

Today's update says that the company's cash flows "are under pressure, in particular, with regard to certain tax liabilities". It has been discussing the situation with shareholders and creditors.

It is now clear that there is no reasonable prospect that a viable solution for additional funding capacity can be found and the Board is now investigating all alternative options to optimise value for the Company's stakeholders.

This looks like a zero.

Mothercare (LON:MTC)

- Share price: 22.8p (+12%)

- No. of shares: 342 million

- Market cap: £78 million

I might as well save time by pasting Paul's comment in here:

Paul Scott:

Anyone tempted to bottom-fish on Mothercare (LON:MTC) should read the going concern note in today's accounts.

It says that in a reasonable worst case scenario, the business would not be able to continue trading.

Sounds like current trading is OK, but it's very high risk I think.

Balance sheet is very weak - negative NAV of -£49.4m, less £16.3m of intangibles, gives NTAV of -£65.7m.

Note also the substantial provisions on the balance sheet - £21.8m in current liabilities, and £31.6m in long-term liabilities - where is the cash going to come from, to settle these liabilities?

Overall, I'd be very surprised if this company is still going in 1-2 years' time. Looks like the bank(s) is/are managing down their exposure - with the disposal of ELC, and sale & leaseback of its HQ. That's last chance saloon type of stuff.

Best to steer well clear, in my view, as too risky. Although the international operations still seem to be decently profitable.

Graham says:

I'm impressed by the headline reduction in bank debt to just £7 million at year-end. By taking radical actions, including a CVA, the company has avoided turning into a zero (for now!). That is a real achievement.

It will be scant consolation for buyers at 400p or 500p, of course, but buyers at 20p do have some bright points to latch on to.

However, this share is not the sort of thing that I would want to add to my own portfolio, as I only want to own shares in best-in-class retailers (if any).

I also note the going concern paragraphs mentioned by Paul. Net debt as of mid-May has crept back up to £15 million, reflecting "the seasonal working capital cycle and timing of orders placed with our trade suppliers". These paragraphs include clear warnings that bank covenants could be breached again, depending on external conditions and management reactions to those conditions.

Clearly, therefore, concerns around solvency remain valid.

It still has 79 stores, with lease commitments of some £150 million. Bankers and landlords will get their pound of flesh, and I don't know if there will be much left over for shareholders. Like-for-like sales trends have been awful, calling into question the underlying value of the brand.

So while I applaud the progress achieved in preventing insolvency so far, and think that avoiding insolvency remains possible, I have zero temptation to dabble in this.

Westminster (LON:WSG)

- Share price: 7.3p (+10%)

- No. of shares: 135 million

- Market cap: £10 million

This support services business has been promising jam for shareholders for a very long time.

2018 numbers show another loss, including a loss at the EBITDA level.

Outlook - Q1 orders and revenue are "ahead of budget". 2019 revenues to be "significantly ahead of 2018, even without any further new major contract awards".

My view - extreme scepticism is the right approach if you are going to analyse this one.

Luceco (LON:LUCE)

- Share price: 117.1p (+15%)

- No. of shares: 161 million

- Market cap: £188 million

Luceco plc, the manufacturer and distributor of high quality and innovative LED lighting products, wiring accessories and portable power products is issuing the following trading update for the four months ended 30 April 2019...

Almost everything is going Luceco's way at the moment.

- sales to the UK retail channel improved (no destocking this year)

- strong progress overseas

- margins improving further

- profitability & cash management helping the debt situation

As a result of the above, adjusted operating profit for 2019 is set to be materially ahead of expectations.

My view - I can't predict what is going to happen with this share, so I am happy to give it a pass. Well done to anyone who foresaw the recovery.

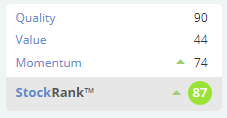

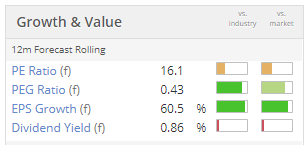

The StockRanks love its Quality and Momentum, but are less enthused about the Value on offer (perhaps this will change after today's earnings upgrade).

For context, it listed at 130p in 2016. Maybe this has been fair value all along?

Headlam (LON:HEAD)

- Share price: 480p (+5%)

- No. of shares: 84.6 million

- Market cap: £406 million

Headlam Group plc (LSE: HEAD), Europe's leading distributor of floorcoverings, provides the following trading update in respect of the first four months of the year (the 'Period')...

This update is in line with expectations. Like-for-like revenues are up 3.5% against "the soft comparatives of the prior year".

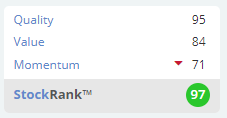

This company has a massive StockRank, which always helps:

Can't see anything else worth commenting on today, so I'll leave it there.

Have a great weekend!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.