Morning!

There has been quite a lot of news from some of my portfolio's bigger holdings over the past week or two: Burberry (LON:BRBY) (final results), IG Group (LON:IGG) (trading update) PCF (LON:PCF) (half-year results) and Volvere (LON:VLE) (final results).

As some of you know, I tend to run a more concentrated than average portfolio, and I trade infrequently. This is the style which suits my personality and my (evolving) investment strategy.

To illustrate this, my top four holdings (VLE/BRBY/HAT/PCF) currently account for more than half of the value of my share portfolio. I haven't sold a share of anything at all since last August. I also haven't bought anything since March.

This should serve to give you some insight into how I handle results days. I'm very unlikely to react to the news, but I still tend to be rather nervous in advance!

The full list of stocks which caught my eye today, and are up for coverage (unlikely to get around to all of them, but we'll see):

- Volvere (LON:VLE) - final results

- Surgical Innovations (LON:SUN) - trading update

- Helios Underwriting (LON:HUW) - final results

- Local Shopping Reit (LON:LSR) - half year results

- Draper Esprit (LON:GROW) - final results

- Westminster (LON:WSG) - final results

Volvere (LON:VLE)

- Share price: 975p (unch.)

- No. of shares: 3.7 million

- Market cap: £36 million

(Please note that I own shares in VLE.)

I last covered this investment company in March, at its trading update for 2017. Here's the link. It's a turnaround specialist which finds companies in need of refinancing or some other change.

At the time of the trading update, it said:

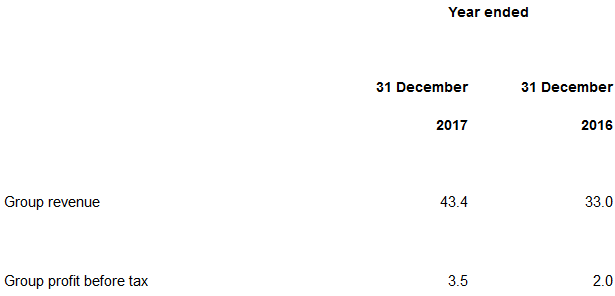

The Group expects to report record revenue of approximately £43.2 million (2016: £33.0 million) and profit before tax of £3.22 million (2016: £1.94 million).

(I think there might possibly be a small typo above - 2016 operating was £1.94 million, but 2016 PBT was actually £1.98 million.)

Today's results are even better than the trading update suggested. Revenue is £43.4 million, while PBT is £3.5 million:

As an investment company, it's important to think about it in book value terms.

Volvere's NAV per share increased by 7% in 2017, from 617p to 659p.

That might not seem terribly impressive, either in terms of the percentage growth rate or the NAV itself (compared to a 950p share price), but the important points for me are:

- There was no disposal in 2017 - so the 7% increase was derived only from profits and share buybacks.

- The value of private company shares can't be marked up in the absence of a disposal. So even though the underlying value of Impetus (the best-performing subsidiary) probably increased in 2017, this is not reflected in the NAV increase.

The performance of the two main subsidiaries was as follows:

- Impetus (consultants to the automotive industry): revenue £27.3 million (up from £17.4 million), adjusted PBT £3.6 million (up from £1.5 million).

- Shire Foods (food manufacturing): revenue £15.9 million (up from £15.2 million), adjusted PBT £0.6 million (down from £1.2 million).

Let's discuss these a little more:

Impetus

This is a consultancy outfit, helping big brand car manufacturers to increase their sales and after-sales. While they do provide useful software and e-commerce tools for clients, my understanding is that much of the work on the ground is quite labour-intensive. So on that basis, it's probably not the sort of company that I would invest in on a stand-alone basis.

It's also rather concentrated in a single customer, who is responsible for 42% of revenues.

However, Volvere only needed to put around £2 million into Impetus to achieve its 83% stake and keep it going, leaving the senior managers with a 17% stake. It has had some tremendous contract wins and as you can see from the summary numbers above (revs £27 million, PBT £3.6 million), the return on Volvere's investment has been tremendous.

It will be interesting to see if/when Volvere decides to dispose of its stake. I can't predict when that might be - whenever it receives a good enough offer, basically. In the absence of a good offer, it can hold on to its stake indefinitely.

Shire

This has been held since 2011, and Volvere has an 80% stake. Trading last year was a bit of a disappointment, and made worse by c. £0.2 million in an exceptional depreciation charge. Conditions are tough for food producers and food retailers, and I would doubt that Shire has enjoyed a particularly strong moat against competition.

It also has a concentrated customer base, with a single customer accounting for 42% of its sales.

So again, I might not be interested in Shire on a stand-alone basis. But Volvere only invested about £2.5 million in it originally, and has achieved a strong ROI on that amount. I'm also encouraged by today's announcement that it is spending £1 million on new equipment, to produce higher-margin products. I believe that Volvere will have done the maths on this and is more likely than not to generate a good return it. We shall see.

There is another Volvere subsidiary ("Sira") which remains too small to discuss.

Overall position

There is no change to overall strategy, and investors are reassured that more buybacks might be coming:

We remain committed to seeking under-performing businesses that we believe we can build into attractive market-leading companies. The Group's recent strong financial performance, coupled with the strength of its balance sheet, mean we will continue buying back the Group's shares when we consider to do so is in the interests of our shareholders.

Cash plus current asset (short-term) investments is £18.4 million, down a few million after £3.5 million of share buy-backs during 2017.

The effect of share buy-backs is illustrated by the fact that Volvere's total net assets went down, but net assets per share went up.

Net assets are now £26.1 million, including £2.6 million (after an upward revaluation) of freehold property at Shire and £18.4 million of cash and current asset investments.

I was curious to see what the company had invested in for its short-term investments, and today we find out in footnote 14:

During the year the Group invested in equity securities pursuant to its treasury management policies. The investments are carried at fair value as stated above. The historic cost of investments held at the balance sheet date was £6,258,000 (2016: £nil).

This is very interesting, and a new development. I'm minded to contact the company and ask for more detail on these equity securities - what are they?

Conclusion

Overall, things are going well at Volvere. NAV per share has increased again, the share count is down, the company has produced record profitability, and the balance sheet remains a fortress.

Valuation is anchored by the £18.4 million in cash and current investments. We can then consider the value of two subsidiaries producing a combined £4.2 million in combined PBT before Volvere's management charges. Volvere directors were paid compensation of about £0.6 million this year.

The market cap of £36 million, after deducting the cash and current investments, assigns a multiple of circa 4x to the latest PBT of the subsidiaries, before management charges.

If we take the management charges and the costs of being listed into account, the multiple assigned by today's ex-cash market cap is about 5x PBT.

I consider this to be a conservative valuation, especially when taking into account the superb track record of management.

I am also very happy with the share buy-back policy, because I prefer capital gains to income and I believe there is value creation in buying back shares at a conservative valuation.

So I'm still not buying or selling any Volvere shares, and haven't done so since May 2016.

Would I buy today, if I had none? I don't know - the margin of safety was particularly strong back in 2016. But I am inclined to think that the outlook remains satisfactory for shareholders today, even from the current level.

If good valuations could be achieved on disposal of Impetus or Shire, Volvere would see an immediate and material increase in reported NAV per share.

It's also possible that a rising interest rate environment and increased business distress (as reported by Begbies Traynor) could lead to attractive new opportunities for Volvere, so that its cash pile could be put to a more productive use. But there's no rush.

My original rationale from 2016 can be read at this link (external website).

Local Shopping Reit (LON:LSR)

- Share price: 31.6p (-4%)

- No. of shares: 82.5 million

- Market cap: £26 million

It took me a few moments to remember why I had been looking at this one recently, and then I remembered: the unusual holding company Thalassa Holdings (LON:THAL) has a 25% stake in it.

LSR in undergoing a disposal program, which was due to complete between H2 2018 and Q1 2019 according to the road map for property disposals set out in the 2016 annual report.

Property sales so far have exceeded all of the targets set out at that time.

According to that road map, by early 2018:

The Company will be left with a ‘core’ portfolio of approximately £55m (based on current valuations), comprising 200 of the larger and better-quality assets in a tighter geographic concentration.

According to today's interim report:

Portfolio valued at 31 March 2018 at £24.81m, reflecting an equivalent yield (excluding the residential element) of 10.67% (30 September 2017: £54.16m, equivalent yield 9.47%). In addition, properties categorised as held for sale valued at £10.8m after sale costs (30 September 2017: £1.3m).

So about £36 million was left by March 2018, of which nearly £11 million was exiting the portfolio.

There is not too much debt left after all these sales. My simple leverage test (assets/equity) shows that the balance sheet is now leveraged 1.37x, i.e. not very much (£44 million of assets versus £32 million of equity).

This is down from a leverage multiple of 2x as recently as September 2017.

The outlook suggests that LSR is making great progress toward returning capital to shareholders:

The property sales described above... puts the Group in a good position to achieve the target we set in December 2017 to dispose of 75% of the then remaining assets by the end of the current financial year. To achieve the remainder of this target, we plan to sell a further 40 assets by 30 September 2018...As soon as we achieve the sales targets set out above, we will turn our attention to the best means of returning cash to shareholders.

Property revaluation

Being able to trust the asset values is crucial. The 46 properties sold in H1 were disposed of 3.1% below their carrying value - not bad.

The portfolio comprises "local shops in urban and suburban areas, as well as neighbourhood and convenience properties throughout the UK", and it is no surprise that the value of these properties is in decline, given conditions in the retail market.

The latest revaluation produced a like-for-like reduction in value of 6.2% versus six months previously. The yield attached to properties at this valuation was 10.7%.

We might cautiously apply a further discount to these remaining assets, if we think their value is likely to continue to slide until they are sold.

Quick capital gain?

I'm curious as to whether there might be an opportunity for a quick capital gain, as LSR's NAV per share is 39p, versus the share price of just 32p, and the disposal programme seems to be going very well.

I don't think it's worth my while engaging in much deeper research for the sake of what could turn out to just be a few pence of gain per share, but it could be a low-risk trade.

It does have implications for Thalassa Holdings (LON:THAL), which might see its cash balance swell as a consequence of events here.

Westminster (LON:WSG)

- Share price: 13.5p (+6%)

- No. of shares: 125 million

- Market cap: £17 million

Extension of Convertible Secured Loan Note

I'm not sure if I can motivate myself to look at this one in much detail.

It has announced an adjusted EBITDA loss from continuing operations of £0.5 million.

Big picture view:

Our vision remains to build a global business with strong brand recognition delivering niche security solutions and long term managed services to high growth and emerging markets around the world, with a particular focus on long term recurring revenue business.

It signed an agreement to provide services at an Iranian airport, which has been delayed by Trump's withdrawal of the US from the Iran nuclear deal:

"...the Iranian airport project in question, which is just one of over 60 airports in the country, would, if it proceeds, add over €24 million Euros annually to our revenue."

So perhaps Westminster was unlucky this year. But it has been around for a long time. 2017 is its eighth consecutive year of losses, and over this time its share count has increased by over 700%. I can't see evidence of it having produced any intellectual property or a valuable brand in all of the time it has been listed. It looks fundamentally unsuitable for a stock market listing and I have no choice but to place it in the Bargepole category.

Helios Underwriting (LON:HUW)

- Share price: 115p (unch.)

- No. of shares: 15.1 million

- Market cap: £17 million

Mentioning insurance is enough to send many people to sleep, so apologies if you are one of them.

I wouldn't have mentioned this except that it claims to have an adjusted NAV per share of 160p. So I'm curious to see if there is some value to be had. I like buying insurance shares at a discount to NAV.

Helios is a passive participant in Lloyd's syndicates, e.g. it holds stakes in syndicates managed by Beazley (LON:BEZ) and Hiscox (LON:HSX).

I say "passive" because, in its own words, "Helios has no active involvement in the underwriting or management of the syndicates in which it participates".

So we can think of it as a fund that selectively invests in insurance policies.

Its track record is apparently rather good:

The underwriting results of the Helios portfolio of syndicates have consistently outperformed the Lloyd's market average both on an annually accounted basis measured by combined ratio and on a three-year account basis, measured by return on underwriting capacity. Helios' calendar year combined ratio (before corporate costs) was 106.9% in 2017 (94.6% in 2016) compared with the Lloyd's combined ratio which was 114% in 2017 (97.9% in 2016).

A combined ratio greater than 100% means losses, but Helios losses in 2017 were lower (relative to its size) than the Lloyd's market as a whole. That's a bit like an equity fund manager whose portfolio goes down but by a smaller percentage than the equity market as a whole.

Three huge hurricanes caused about $92 billion in insured damages, so it was a year to forget for the industry. Helios reports a loss of £1.3 million after booking an £8.8 million increase in its provisions for claims.

In 2016, a better year for insurance companies, Helios was more profitable than the market average.

The four-year track record:

Over the last four calendar years, the average combined ratio of the Helios portfolio was 91.5%, outperforming Lloyd's by six percentage points a year. These incremental returns compared with the Lloyd's market average demonstrate the quality of the syndicates in the Helios portfolio.

I need to do more work, to examine if this really has 160p of value per share.

The shares look very illiquid, so unfortunately it might not be something I could buy very much of, even if I wanted to.

Draper Esprit (LON:GROW)

- Share price: 448p (-0.4%)

- No. of shares: 71.6 million

- Market cap: £321 million

Proposed Placing and Subscription

This listed in June 2016, describing itself as:

one of the leading venture capital investors involved in the creation, funding and development of high-growth technology businesses with an emphasis on digital technologies in the UK, the Republic of Ireland and Europe

The RNS feed has been busy since then with a healthy supply of acquisition and investment news.

Today's results show NAV per share increasing from 370p to 431p (or from 319p to 402p, excluding goodwill).

These are final results for the year to March - great to see a company reporting quickly.

Scrolling through the commentary, I see that it is targeting returns of 20% per annum.

It has stakes in some businesses I've heard of, namely TransferWise and Trustpilot.

in separate announcements today, it announced that it has raised £115 million of new equity at 420p (conditional on shareholder approval). It sounds like investors are very happy with performance.

I don't feel qualified to comment on the prospects for Draper Esprit's underlying holdings but the overall group seems to be firing on all cylinders. In addition, the premium to NAV is not so large that I would automatically rule out investing in it (as I did with Allied Minds (LON:ALM) a few years ago, when it was trading at 720p). So I think this one could be worth a look.

Ok, I'm out of time for today. Have a great weekend.

Best,

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.