Good morning!

I'm a bit tired this morning, after a hectic week.

There have been plenty of RNS announcements here to keep me busy.

Apart from that, monitoring the fast-moving events at Tesla over the past few days has been as wearing as a part-time job, given the pace of news flow at that stock.

On Monday, the company released a nearly 4-hour video for Investor Autonomy Day.

Then on Wednesday night, it released detailed Q1 2019 financial results, along with the standard quarterly conference call. I listened to the call live.

Yesterday morning, after considering what I had just observed, I increased my position size first thing, when pre-market trading opened.

Something else that happened yesterday morning was that one of my tweets ended up getting retweeted by the #TSLAQ community and then later by Zero Hedge. This tweet is on its way to achieving 150,000 impressions.

When a tweet blows up, the constant stream of notifications is incredibly addictive. Given Elon Musk's addiction to Twitter, I'm sure he feels the same way!

My main point is that staying on top of the analysis, and managing the trade, while also keeping an eye on all of my long positions and the rest of my portfolio, and providing media content too, is a lot of work.

Elsewhere in the last few days, I also had to deal with a malicious GDPR request by an individual who was upset that the writers on my website weren't bullish about a company he is invested in. I resolved the issue as quickly as possible.

This is merely to give you a sense of what's going on behind the scenes. I'm creating financial models, reading company reports, browsing the internet for any additional information that might give me an edge, talking with customers, and handling the occasional malicious attack. There's a lot going on that doesn't get talked about, but it's all part of the large mosaic of information and experience that gets pulled together to form this report.

What's different about this report compared to pretty much everything you would read from the City, is that this report is written by real investors who are putting their money where their mouth is.

That makes the production of this report a lot messier than the content written by sell-side analysts or PR agents. They rarely own any shares in the companies they talk and write about. Unlike those people, Paul and I are dealing with the consequences of our views on a day-to-day basis.

But we wouldn't have it any other way, and we're glad to share the journey with you.

Companies on the radar today:

- AJ Bell (LON:AJB)

- EU Supply (LON:EUSP)

- Allied Minds (LON:ALM)

- Audioboom (LON:BOOM)

- FairFX (LON:FFX)

AJ Bell (LON:AJB)

- Share price: 397p (+5%)

- No. of shares: 407 million

- Market cap: £1,617 million

This is not a small-cap and yet I feel that it deserves a mention.

My friend Andrew Latto has written a lot about this, and called it correctly as an attractive IPO opportunity. The IPO was priced all the way down at 160p in December.

This Q2 update shows customer numbers increasing by 5% in just three months, and assets under administration up by 8% to almost £48 billion (the increase in assets is mostly due to rising markets).

This article by Citywire focuses on the reduction in flows from defined benefit schemes, but underlying (non-DB) flows remained strong and in line with the prior trend. Indeed, CEO Andy Bell says that the H1 result will be slightly ahead of current market expectations.

I have to agree with the consensus view that this is a high-quality company with a serious growth opportunity in front of it, as it appears to be stealing business from the competition and has a lot of market share that it could expand into.

So I do think that it can grow into its valuation. But a lot of patience could be required, as the valuation multiples currently attached to it are very rich indeed. Much easier to hold it than to buy in at the current levels.

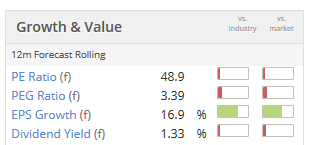

Forecast EPS growth of 16.9% can be contrasted with 11.2% at main rival Hargreaves Lansdown (LON:HL.)

EU Supply (LON:EUSP)

- Share price: 12.2p (+20%)

- No. of shares: 71.7 million

- Market cap: £9 million

This small software company confirms the results it guided for in February's trading update, and provides strong guidance for FY 2019 and the future.

It makes tender management and contract management solutions. In its own words:

The Directors believe that the Group's CTM™ platform is one of the easiest to use and most functionally advanced solutions available in the market. The CTM™ platform is used by over 8,000 European public sector bodies in 9 EU/EEC Member States and has National Procurement System status in four Member States (the UK, Ireland, Norway and Lithuania).

70% of revenues are recurring and the company has now made a healthy operating profit of £650k.

Reasons for caution:

- Top-line growth is modest at 10%

- There is a hefty interest bill, as a convertible loan note charges an interest rate of 10%.

- The company capitalised far more new intangible assets than it wrote off in the period through amortisation (£390k vs. £52k).

- Receivables book approaching £2 million

I'll keep half an eye on this. Management are looking for "stable organic growth" this year, to be followed by "accelerating revenue in 2020 and beyond".

Allied Minds (LON:ALM)

- Share price: 60.9p (-5%)

- No. of shares: 241 million

- Market cap: £147 million

This Neil Woodford-backed investor in US tech start-ups had a market cap of over £1.5 billion and was a member of the FTSE-350 index, back when Woodford mania was at its peak.

But public belief in Woodford's ability to do well in speculative ventures such as this is no longer what it was. The ALM share price reflects this change in perception, along with its own failure to make any real progress.

Huge losses at ALM have been racked up and the activist hedge fund Crystal Amber is now demanding that the vehicle should be shut down and liquidated for shareholders. Nearly 50% of the shares are still held by Woodford Investment Management and his old employer, Invesco.

Today's report from ALM, with the announcement of a new strategy, is a partial admission of defeat by existing management:

Going forward, we will cease new company investments and instead will focus exclusively on funding and operating our existing portfolio with a view to maximising monetisation opportunities...

Upon monetisation events, we expect to return net proceeds to shareholders after due consideration of potential follow-on investment opportunities within our existing portfolio and working capital requirements.

As for the numbers, there is an operating loss of $91.5 million, though for technical accounting reasons, the company reported a profit.

There is cash of $97.5 million on the balance sheet so there remains the possibility of a decent, non-zero outcome for shareholders, if capital is returned and subsidiaries can be sold off for a meaningful amount. Perhaps someone else will be motivated to study it in further detail.

Audioboom (LON:BOOM)

- Share price: 2.35p (-6%)

- No. of shares: 1.3 squillion

- Market cap: £30 million

Statement re Online Commentary

I'm surprised the market cap remains so high with this podcast platform. ShareProphets broke a story about it organising a placing yesterday, to which it has responded today.

The planned use of the proceeds:

It is intended that the proceeds of the proposed fundraising will be used predominantly to sign new third-party podcast talent. The proposed fundraising will enable the Company to offer, where appropriate, competitive financial incentives for leading podcast talent to join Audioboom's platform.

Hmm. This is a strategy which Audioboom has been executing for a while, but it seems totally backwards to me.

Because if Audioboom had a fantastic platform, then wouldn't listeners be begging podcast talent to move onto it? Which would make financial incentives from Audioboom unnecessary. Nobody begs a video blogger to publish on YouTube - video bloggers do that voluntarily, because YouTube is the best place for vlogs.

On the other hand, if Audioboom doesn't have a fantastic platform, then paying talent to publish on it is just a waste of time.

This feels like a bargepole type of stock to me.

Calling it a day there. Have a great weekend everyone.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.