Good morning, we have Paul & Roland here today, reviewing small cap trading updates & results. Today's report is now finished. We hope you enjoy the long weekend!

Agenda -

Paul's Section:

Begbies Traynor (LON:BEG) - Reuters reported yesterday that insolvencies have soared, as expected, with the withdrawal of covid support measures meaning large numbers of zombie companies are likely to need restructuring or insolvency. I haven't read it yet, but today sees Begbies publish its Q1 Red Flag Alert Report, always an interesting, if depressing read. It strikes me as illogical that BEG shares have sold off along with other small caps lately, given that it is limbering up for a probably multi-year bonanza of work. So at 110p per share, I think readers could do well on this one, and get a 3% divi too. I don't currently hold, due to lack of available funds, unfortunately. [No section below].

Up Global Sourcing Holdings (LON:UPGS) - I have a good rummage through its interim figures out today. Decent results, boosted by a large acquisition last year. I'm not so keen on the big increase in bank debt, which has continued in H1 despite the acquisition financing going through last year's accounts. The low operational gearing is interesting, and should mean profits being resilient, even in a downturn. Very interesting comments about supply chain/shipping improving. Overall, I like it.

Carclo (LON:CAR) - a mixed update, which is in line with exps for FY 3/2022, but with some negatives in the outlook comments. Not enough detail to help me form a firm view. Bank debt & pension scheme are still problems. High risk.

Roland's Section:

M&c Saatchi (LON:SAA) - a strong set of 2021 results from this advertising group. Trading performance seems strong and management have issued confident profit forecasts suggesting double-digit growth in 2022 and 2023. The valuation doesn’t seem unreasonable to me, either.

Ao World (LON:AO.) - a major profit warning from this appliance retailer, as customer demand weakens and the rising cost of living starts to bite. Liquidity concerns are growing and AO’s founder-CEO has decided to start selling his shares. One to avoid, I think.

Explanatory notes -

A quick reminder that we don’t recommend any stocks. We aim to review trading updates & results of the day and offer our opinions on them as possible candidates for further research if they interest you. Our opinions will sometimes turn out to be right, and sometimes wrong, because it's anybody's guess what direction market sentiment will take & nobody can predict the future with certainty. We are analysing the company fundamentals, not trying to predict market sentiment.

We stick to companies that have issued news on the day, with market caps up to about £700m. We avoid the smallest, and most speculative companies, and also avoid a few specialist sectors (e.g. natural resources, pharma/biotech).

A key assumption is that readers DYOR (do your own research), and make your own investment decisions. Reader comments are welcomed - please be civil, rational, and include the company name/ticker, otherwise people won't necessarily know what company you are referring to.

Paul’s Section:

Up Global Sourcing Holdings (LON:UPGS)

143p (pre market open)

Market cap £128m

Ultimate Products, the owner of a number of leading homeware brands including Salter (the UK's oldest houseware brand, est.1760) and Beldray (est.1872), announces its interim results for the six months ended 31 January 2022.

A strong performance in a challenging environment

H1 revenue is £85.7m, growth of 13.7% - mainly due to the acquisition of Salter in July 2021, so it contributes to H1 this year, but was not part of the group in the prior year comparatives. Salter was a sizeable acquisition, at £32m, around a quarter of the current market cap, part-funded with a £15m placing.

Underlying profit before tax is up 28.6% to £9.9m - that’s a decent profit margin of 11.6%, surprisingly high, given the gross margin is low at 24.4% - suggesting that UPGS is efficient at moving things from A to B. Note also that it plans to introduce automation, to improve margins - that’s the sort of thing I’m looking for, i.e. businesses which are responding to higher costs by becoming more efficient using technology.

Seasonality - note that there seems to be an H1 bias to profitability, judging from last year’s numbers. This is confirmed in note 8.

Online - previous company presentations have stressed that online growth (direct to consumers) was a key aim, but there’s been a setback in H1, with negative organic growth of -11.9% (more than offset by the Salter acquisition). This is blamed on shipping disruption causing tighter stock availability. It sees this as a “temporary set-back”.

Outlook -

The Board anticipates a full year performance in line with current market expectations.

Supply chain - since UPGS is a big importer from China, its comments here should be relevant to many other importers, and are a lot more upbeat than I was expecting -

The Group has so far been unimpacted by the recent lockdowns in China, but continues to monitor the situation closely. The Board is confident in the Group's ability to navigate its way through any further lockdowns in the region, having done so successfully at the beginning of the pandemic…

During calendar year 2021 ('CY 21') and calendar year 2022 ('CY 22'), global shipping capacity was severely constrained because of worldwide port congestion. The drop in capacity caused a substantial increase in the cost of shipping, leading to downward pressure on gross margins, albeit we were able to offset this by actions elsewhere (see below for more commentary).

While shipping remains a challenge for the business, there has been an improvement in availability and reliability during CY 22. We believe that the Group has dealt with the shipping crisis and indeed the wider supply chain crisis much better than its peers. As the situation continues to normalise, we see this providing upside to the business in the medium-term through the reversing of the downward pressure on margins that it represented and the additional revenue opportunities that will arise from improved stock availability.

Valuation - thanks to Shore Capital for an update today, on Research Tree, there’s also a note from ED available.

Shore forecasts 13.7p adj EPS for this year (FY 7/2022), which should be fairly accurate as we’re most of the way through this year. At 143p/shares that’s a PER of only 10.4 - seems good value to me, but it depends on how you view the macro picture. If you think a recession is coming, then earnings could fall. Although recessions don’t last long these days, because Govts & central banks are aggressive with their stimulus measures. So company earnings would probably then recover quite quickly.

However, we’re in amazingly short-termist markets, seemingly dominated by traders not investors, so at the moment nobody seems to be thinking about the longer-term. Which provides nice buying opportunities, getting good companies valued on low multiples, if you’re prepared to be patient - which is meant to be the whole point of owning shares. Still, nobody owns the market, and we just have to deal with whatever the flow of money happens to be doing at the time. One person’s panic/despondent selling, might be someone else’s future multibagger, in some cases. The tricky bit is working out which shares fit that profile!

Balance sheet - a key focus at present, as I definitely don’t want to be owning shares in companies with too much bank debt.

UPGS had negligible intangibles on its balance sheet, but that rose to £36.9m in H2 last year, due to acquisitions (mainly Salter). There’s a danger that might weaken the balance sheet by making it top-heavy.

Net bank debt is £30.1m, which feels a bit too high to me, going into a potential downturn.

NAV is £38.2m, reducing to NTAV of just £1.3m if we write-off intangible assets, which I nearly always do.

I’m not ringing the alarm bells, just pointing out that bank debt is quite high for me, and I’d like to see the company retain earnings to reduce debt, just in case there is a recession.

Cashflow statement - isn’t great. A lot of cash has been absorbed into working capital in H1 - with big rises in inventories & receivables, and no corresponding increase in trade payables. It doesn’t look seasonal either, as the prior year H1 comparative was neutral.

I can see the sense in increasing inventories, to ensure decent supply. It’s worth raising this issue with management though, in any discussions.

Note that the large acquisition, and associated funding (debt & equity) went through last year’s numbers. Yet in H1 this year, a further £11.5m net bank debt was drawn down. So there’s a bit of a question mark over bank borrowings.

Going concern note - remember these have to be approved by the auditors, so are very useful, and essential reading.

In this case UPGS says even in a severe but plausible downturn, it would remain within its existing bank facilities and covenants. So that reassures on my above concerns. Although it doesn’t reveal what the assumptions are in that severe but plausible case.

Divis - there's a c.5% yield - maybe too high, given the level of bank debt?

My opinion - I like UPGS, it seems to be well managed, and the valuation looks decent value. My one reservation is that bank debt looks a bit high.

UPGS proved it’s skill at managing supply chain in the pandemic, so there’s no reason to believe it’s likely to come unstuck with current problems seemingly worsening in China, due to its bizarre zero covid policy, causing shutdowns.

We don’t know what impact the disposable income squeeze is likely to have. Although selling mainly small ticket household appliances, which are often bought when the old one breaks (e.g. kettles), I imagine UPGS should do OK in any downturn.

Also, as UPGS’s gross margins are low, there’s not much operational gearing to worry about. If we stress test today’s H1 P&L by reducing revenues by 10% (£8.6m reduction), this would only reduce gross profit by £2.1m. Leaving all other costs the same, would reduce PBT from £9.8m to £7.7m - hardly a disaster.

Try doing that same manual recalculation to businesses with high gross margins, and the results can be horrific! A 10% drop in revenues could wipe out profits entirely at some businesses with high gross margins. That’s why, with uncertain demand, likely to fall, there’s an argument for investing in well managed companies with low gross margins (providing they can pass on price rises), because their profits could be more resilient in a downturn. As always though, it’s not that simple, and every company is unique.

Whilst I’ve been typing this, UPGS shares have risen 8% to 155p, which looks justified. In current market conditions, I’m not inclined to chase it any higher. Long-term though, I reckon this company could continue to do well, so it looks a sensibly-priced long-term hold, providing nothing goes wrong again (look at the chart from 2017-18.

.

.

Carclo (LON:CAR)

24.75p (down 9% at 09:25)

Market cap £18m

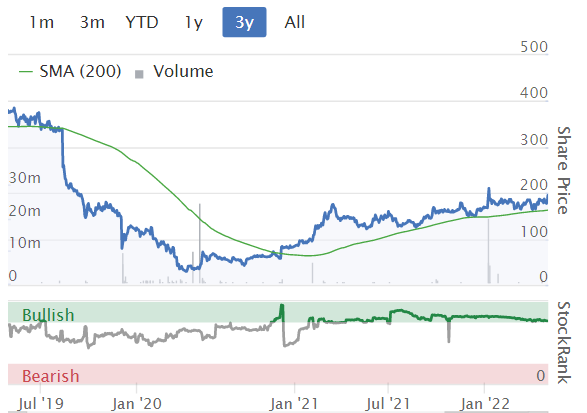

Background - This has been an interesting, very volatile mricro cap. It almost went bust in the pandemic, but staged a convincing recovery, shares then overshot on the upside, and it’s now back down more than half the way, like many other small caps, it has to be said.

I reviewed Carclo’s interim figures here in Nov 2021, noting a good recovery in performance, and lower risk, but a pension fund that was still sucking £4m p.a. out in cashflows for deficit recovery - very big for the size of company, and ruling out divis.

On to today’s update -

Carclo, a global manufacturer, principally of fine tolerance injection moulded plastic parts and aerospace components, today provides an update on trading for the financial year ended 31 March 2022 ("FY 2022").

It’s in line with expectations -

The Board is pleased to report that the business expects to report a strong performance for the year, with revenue growth ahead of, and underlying profits in line with, its expectations despite the challenging macroeconomic backdrop.

In addition, the Group balance sheet has strengthened considerably throughout the course of the year, in part driven by a reduction in the IAS 19 pension deficit. We have continued to invest in capital equipment to support long-term growth, largely financed by an increase in net debt.

Labour shortages & “significant cost inflation”

Cost increases can “largely” be passed on to customers, “albeit with some time lag” - this impacted H2 margins.

“Tripartite Agreement” between the company, Bank, and Pension Trustees - I don't like the sound of this - it's a reminder that equity is the weaker element, and may not necessarily be in control of the outcome here, if attitudes become less co-operative at the bank or pension scheme. So we can’t rule out equity dilution yet.

Outlook - mixed - and this could be interpreted as an H1 profit warning maybe?

Demand in the Group's key markets remains strong coming into the new financial year and this underpins continued confidence in strong underlying revenue growth. However, the Group is seeing significant headwinds largely due to the continued impact of COVID-19, in particular in our China and India operations. In addition, we remain mindful of the general market uncertainty related to the impact of the war in Ukraine.

The margin pressures that have been experienced in the CTP division in the second half of FY 2022 are expected to continue into the new financial year and it is anticipated that trading in the early months of FY 2023 will remain challenging.

A number of initiatives are underway to mitigate these impacts with the benefits of these making an increasing contribution to margins over the course of FY 2023.

For the Aerospace division, the strong order intake in Q4 and the increased focus on business development positions the division well for FY2023, with further growth expected in the current year and beyond.

My opinion - the way I read this, Carclo sounds as if it’s still financially distressed, but has very co-operative pension trustees & bank.

If things work out well, then equity could be a multibagger, as it gets all the upside.

If things turn sour, then equity could be diluted or wiped out - that’s the risk you take with highly geared companies.

Another issue is that the accounting pension deficit might have come down (we’re not told how much though), but that doesn’t necessarily feed through to the actuarial deficit, which is the more important number, because that drives what the cash outflows are.

Overall then, I would need to see the numbers before being able to properly assess this share.

So far, management has done very well to protect equity holders from dilution, with no new equity issued since 2018. If that can be maintained, then the % upside could be large. Risky though. Readers can make up your own mind whether you’re prepared to take on a high level of risk, for a share that could be a potential multibagger if things go well, or a disaster if things go wrong.

.

.

Roland’s Section:

M&c Saatchi (LON:SAA)

Share price: 200p (+12% at 08.40)

Shares in issue: 122.3m

Market cap: £219m

2021 Full-year results & profit forecasts

“The strong trading performance and momentum in 2021 has continued into the first quarter of 2022.”

Advertising group M&C Saatchi appears to be delivering a convincing turnaround. Today’s results show a strong recovery, with record headline profit and an improved net cash position.

New profit forecasts indicate that management expects momentum to remain strong in 2022 and 2023. Let’s take a look.

Financial highlights: Today’s results cover the year ended 31 December 2021.

- Revenue up 22% to £394.6m

- Net revenues (excluding pass-through costs) up 10.6% to £249.3m

- Pre-tax profit of £21.6m (2020: loss of £8.5m)

- Earnings per share of 10.5p (2020: loss of 9.1p)

- Net cash: £34.4m (2020: £32.7m)

Saatchi’s operating profit margin rose from -2.2% in 2020 to 10.9% last year as the group made a strong recovery from the pandemic and its own issues.

Dividends/net cash: The group’s balance sheet appears to be very strong and dividend payments are expected to resume in 2022.

However, I think it’s worth remembering that Saatchi still faces significant potential cash liabilities from historic share-based incentive arrangements with senior management who are minority owners of group subsidiaries.

According to today’s results, potential payouts of between £38m and £67m could be due between now and 2028, depending on Saatchi’s share price.

These payments are now being settled in cash, rather than shares, reducing the risk of dilution. But they place an additional burden on the group’s cash flow.

Trading highlights: The company says it’s won valuable new business and deepened existing relationships. These are some of the examples given:

- New business: PepsiCo, WHOOP and Mondelez

- New campaigns: Uber, De’Longhi and Franklin Templeton

- Expanded relationships: Reckitt, GSK, Lexus and Sonos

- Retained UK and US government contracts

The company’s new structure is based around the idea of specialist areas, all supported by a central core (‘Central Fuel’) that provides data and technology capabilities. All of the group’s divisions reported LFL net revenue growth last year:

- Advertising & CRM: +6% to £121.2m

- Media & Performance: +39% to £32.8m

- Global & Social Issues: +10% to £33.2m

- Brand & Experience: +17% to £30.9m

- Sponsorship & Talent: +35% to £24.5m

Trading update/profit forecasts: Current trading is said to be strong. Somewhat unusually, the company has issued the following profit forecasts today:

- 2022 headline pre-tax profit c.£31m (+15% vs 2021)

- 2023 headline pre-tax profit c.£41m (+32% vs 2022)

The comparative figure for 2021 was £27.3m, so these forecasts appear to suggest double-digit percentage growth over the next couple of years.

Takeover situation: Talks are said to be ongoing with Vin Murria and her vehicle AdvancedAdvT Limited. The deadline for an offer has been extended to 10 May, but no further offer has been made as yet. Paul covered this situation in January.

My view: There are a lot of moving parts here, but my feeling is that CEO Moray MacLennan is making good progress at simplifying and modernising this business. Cash generation seems good and the balance sheet is strong.

Today’s results price Saatchi shares at 16.5 times trailing earnings. Given the rate of growth being forecast by the company, this doesn’t seem unreasonable to me. I suspect that consensus forecasts will be updated following today’s revised guidance – I’ve not been able to find an updated broker note on Research Tree this morning.

One question mark for me is over the broader economic outlook. A widespread slowdown could dampen spending in some areas.

However, Saatchi’s larger FTSE 100 rival Wpp (LON:WPP) also remains positive about the year ahead and recently upgraded its own revenue guidance. So perhaps there is not yet any sign of a slowdown.

I’d need to do more research on M&C Saatchi to form a strong view. But based on today’s results and the company’s guidance, my impression is that the valuation and outlook for this stock could be favourable.

Ao World (LON:AO.)

Share price: 71.7p (-18% at 08.40)

Shares in issue: 479.5m

Market cap: £388m

Today’s full-year trading update from electrical retailer AO World claims a “resilient UK performance against a challenging backdrop”. But this is actually a major profit warning, with cuts to both revenue and EBITDA expectations.

To round things out, AO has also announced that founder-CEO John Roberts plans to start selling his shares.

AO shares experienced a dizzying ascent to mid-cap respectability when online retail boomed during the pandemic, but they have since fallen back to earth.

Today’s statement has left me wondering whether the group’s financial situation could soon start to look precarious as well.

Key financial figures: AO says that full-year revenue for the year to 31 March 2022 is expected to be £1,557m. That’s around 6% below FY21, which included peak lockdown trading.

Today’s FY22 revenue figure is also below consensus estimates of £1,599m.

As a result of reduced revenue, group adjusted EBITDA is now expected to be £8m.

H1 EBITDA was £5m, so this tells us that AO’s EBITDA fell by 40% to £3m during H2.

Today’s figure also appears to be well below previous expectations. One broker forecast I’ve been able to find elsewhere suggests the company was expected to generate around £11m of EBITDA in FY22.

Clearly, AO World will remain loss-making at an operating level and below. I also expect to see negative free cash flow for the year.

Trading summary: To its credit, AO appears to have held on to most of the market share it gained during the pandemic. The company says its share of the major domestic appliance market is now 54%, compared to 43% pre-Covid.

Despite this, revenue is falling as customer shopping habits change in response to the easing of the pandemic and the rising cost of living.

UK: H1 revenue was said to be resilient, but problems emerged in H2. AO says that “customer demand progressively weakened”. This was compounded by supply chain problems which affected stock availability.

A second problem was that extended warranty cancellations have risen as customers have looked for ways to save money. As we’ve discussed here in the past, extended warranty sales have always appeared to be AO’s main source of profit. Margins on its product sales are typically somewhere between wafer thin and non-existent.

Germany: AO says that in Germany, customers have returned to stores to a greater extent than expected. I think it’s interesting to see that shopping habits are still varied across Europe. My understanding is that online retail penetration is still lower in most of Europe than in the UK and USA.

A strategic review of the German business is ongoing.

Net debt/liquidity: AO says its net debt excluding lease liabilities rose from £10m on 30 September to £32.8m at the end of March. Lease liabilities total £101m.

Available liquidity was £50m at the end of March, but this has now reduced due to seasonality. The company says it’s taking steps to improve cash flow in Q2.

This situation does not seem ideal to me, especially as we learn that founder John Roberts has decided that he wants to start exiting this investment.

Founder share sales: CEO John Roberts has decided to start disposing of his shares in AO World. Over the current financial year, he plans to sell £5m of stock from his holding of 107m shares (22.4%).

Outlook: AO says that it’s facing cost inflation, supply chain issues and weakening consumer spending. As a result, management are cautious about the near-term outlook for revenue and profit.

Over the coming year, the business plans to focus on cash generation to strengthen the balance sheet, while cutting costs where possible.

Sightly worryingly, full-year results are now expected to be delayed.

My view: Although I think the group’s pricing and service is attractive as a customer, AO is only a box shifter competing with much larger rivals. Now that revenue growth has stalled, its lack of profitability and cash generation has become a bigger issue.

Mr Roberts says he’s still confident in the long-term prospects of AO’s business model. But his decision to start selling the shares when they are near record lows suggests otherwise to me.

I have never seen much reason to invest in AO World, but after today’s statement I view this stock as uninvestable.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.