Good morning, it's Paul here, I'm on duty today.

There's literally nothing on today's RNS within my remit. So instead, I'll circle back to some results on Tuesday which I've still got in my pending tray - please see the header above for tickers.

Estimated completion time of today's report: 5pm.

Update at 16:39 - today's report is now finished.

Motorpoint (LON:MOTR)

Share price: 204p (down 15% today, at 11:12)

No. shares: 93.4m

Market cap: £190.5m

Last night this car supermarket announced that the founder, David Shelton, intended to sell at least 8m shares, to fund a divorce settlement.

An update this morning says that 11m shares have actually been sold, at 200p - this is quite a steep 17% discount, to the c.240p price that sells were going through at last night. Note that the company itself bought back 2.575m of the disposal.

Mr Shelton's remaining shareholding is only 2.4m shares, or about 3% of the company.

My opinion - divorce is one of the better reasons for Directors selling lots of shares, as it's a circumstance that is forced upon them by a court order.

Another consideration is that there's often a substantial tax bill associated with a large sale, so this can increase the size of the transaction.

On the other hand, there's no avoiding the fact that this is a founder selling 82% of his holding, at a price discount of 17%, which is clearly negative for the share price.

Both Graham and I consider this a decent company, in a difficult sector. There's an argument that a forced seller might be providing a buying opportunity, perhaps?

Craneware (LON:CRW)

Share price: 1909p

No. shares: 26.7m

Market cap: £509.7m

3 September 2019 - Craneware (AIM: CRW.L), the market leader in Value Cycle software solutions for the US healthcare market, announces its audited results for the year ended 30 June 2019.

This previously high-flying shares was on a lofty rating, but it disappointed investors with a profit warning at the end of June 2019, which I reported on here. Sales growth seemed to have ground to a halt in H2.

The share price has settled at a lower range of 1700-2000p, having previously peaked at 3436p in Oct 2018. Is this previously highly rated share now a bargain or not? Actually, it's still highly rated, with Stockopedia showing a forward PER of 35 - which seems very high for a company whose earnings growth seems to have stalled, at least in the short term.

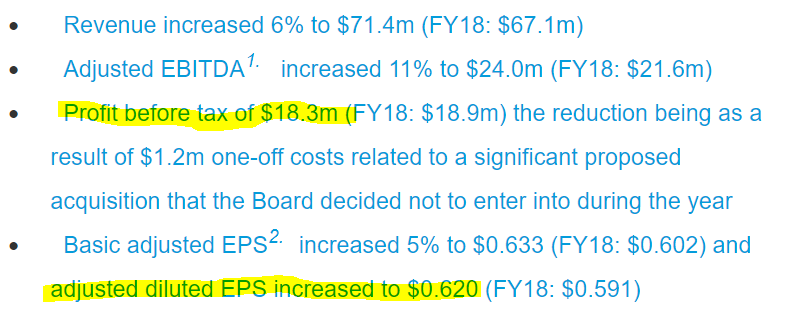

As you can see below, from the first few highlights points, despite the profit warning this is still a very respectable set of figures;

As mentioned in my report in June 2019, I ignore EBITDA for this company (and most software companies) because Craneware capitalises so much development spending.

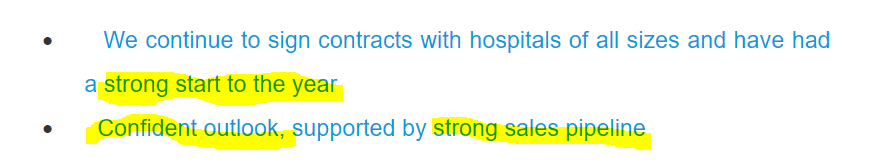

Outlook - comments are key, because the PE rating is still very expensive - which can only be justified if the outlook is very strong;

Balance sheet - looks solid. Note that the $47.6m cash has mainly been derived from up-front fees from clients, of $37.8m (called "deferred income"). Therefore, looking at it conservatively, the company's own cash is really only $9.8m.

Cashflow statement - there was a big drop in cash generated from operations (see note 11), down from $33.1m to $15.1m. This was entirely due to adverse working capital movements of $7.8m this year, as opposed to positive moves of $11.5m last year. This should just be swings & roundabouts from one year to another, but does look unusually large swing, so would need further investigation before making a decision to buy the shares.

Capitalised development spending hugely increased, and is now a big consideration, at $9.8m (up from $4.3m in the prior year). Don't get me wrong, I like development spending, as it should sow the seeds of future progress. However, in this case bear in mind that the amortisation charge of $2.9m is much smaller than fresh capitalisation of $9.8m. This has the effect of boosting profit ahead of cashflow, by $6.9m - a material sum when you consider that operating profit is $18.0m.

Another way of looking at it, is that the amortisation charge will increase each year in future, causing a drag on future profitability.

I'm just flagging up this issue, so that readers can do your own research & form your own judgement on it.

My opinion - I do like this company a lot. It has the feel of something special. However, that is reflected in the still sky-high PER valuation.

That said, PER isn't everything. It wouldn't surprise me if someone were to bid for Craneware, given that it operates in USA. That said, personally I couldn't justify paying a PER of 35, just on speculative hopes of a takeover bid. A PER of about 20 is the maximum I would personally be prepared to pay. On valuation grounds therefore, it's too expensive for me to consider a purchase, especially at a time of great macro uncertainty. Dollar earnings are a plus for anyone concerned about sterling.

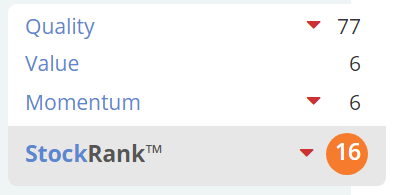

Stockopedia acknowledges the quality, but flags poor value & momentum;

Belvoir (LON:BLV)

Share price: 118p

No. shares: 34.9m

Market cap: £41.2m

Belvoir Group PLC (AIM: BLV), the UK's largest property franchise, is pleased to announce interim results for the six months ended 30 June 2019.

Checking back to my previous notes, I reported here on 5 Aug 2019 on a solid trading update. My conclusion then is that Belvoir is performing well, but paying excessive dividends, which combined with acquisitions has stretched its balance sheet.

These figures look good.

Adjusted profit before tax for H1 rose from £2.4m last year, to £3.0m this year.

About half the increase in profit came from an acquisition called MAB (Gloucester), acquired in Nov 2018, so contributing a full 6 months into the H1 numbers (Jan-Jun 2019).

Interim dividend maintained at 3.4p, twice covered by earnings. This perhaps implies that the full year divi might be maintained at 7.2p, rather than increased to 7.42p forecast? The yield is 6% anyway. I remain of the view that the company should not be paying such large divis, given that it has a considerable amount of debt on the balance sheet. This strikes me as imprudent.

Outlook - sounds solid;

"I am pleased to further report that Belvoir has achieved a promising start to the second half, and as such the Company is on track to meet management expectations for the full year."

Balance sheet - is weak.

NAV: £22.5m. This is overloaded with acquisition-related intangibles of £29.2m. Remove those, and NTAV is negative at -£6.7m.

There's nearly £11m in gross bank debt, less cash, giving net debt of £9.5m - that feels too high to me, given that the macro picture looks rather negative.

Although the group does lend money to its franchisees, at £3.9m, which is money that should come back in at some point - providing no franchisees go bust.

Letting fees - these are banned from 1 June. Belvoir says;

The most significant change for the sector has been the introduction of a ban on tenant fees on 1 June. As a Group, Belvoir has taken proactive measures to enable our franchisees to mitigate the impact of the tenant fee ban by increasing onsite support visits fourfold, delivering growth workshops, providing increased training and introducing new revenue streams. As a result, our assessment of the impact has been borne out by trading since 1 June.

My opinion - the forecast PER of 8.7 looks about right to me, taking into account the weak balance sheet, and the future risk from the ban on letting fees, which looks set to hit the H2 figures.

I'd want to wait 6 months, to see what impact the letting fees ban actually has. It must increase the risk of a profit warning, surely?

The generous divis are being paid at the price of having quite a lot of bank debt on the balance sheet - not a good combination.

Belvoir looks a decent enough business, but I can't see any compelling reason to invest.

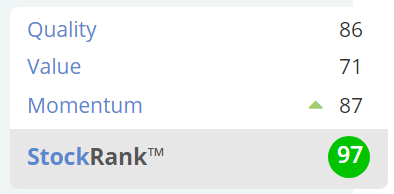

Stockopedia tells me I'm wrong, with a "Super stock" classification, and a StockRank of 97.

Johnson Service (LON:JSG)

Share price: 177p

No. shares: 369.8m

Market cap: £654.5m

I'll keep this brief, as the market cap has now gone above our usual maximum.

Results & outlook look pretty good-

There is good momentum in the Group and we have started the second half strongly. In view of the encouraging performance over the summer months we anticipate that the results for the year will be slightly ahead of current expectations."

Balance sheet - has changed, due to the implementation of IFRS 16 re property leases.

Personally, as mentioned before, I think this new accounting treatment is absolute nonsense, and I'm deleting both the notional asset & notional debt from the balance sheet.

I'm curious, what do subscribers think? How are you treating balance sheets with new IFRS 16 entries on them?

NTAV is only about £25m, which looks a tad on the low side.

My opinion - Stockopedia shows the forward PER as just under 17. That's probably about right.

My main concern here is cyclicality. There's been a huge increase in the number of hotels & restaurants in recent years - over-investment due to ultra-low interest rates. At some point that's likely to lead to recession in those sectors, as weaker & over-indebted players go bust. Surely that must have an impact on JSG - not just in lost business, but also asset write-offs for branded inventories?

With more economic uncertainty around now than at any time since the 2010-2012 Euro crisis, I would want ultra-cheap valuations to tempt me into cyclical stocks like this.

Accrol Group (LON:ACRL)

Share price: 30p

No. shares: 195.2m

Market cap: £58.6m

Accrol Group, the UK's leading independent tissue converter, announces its audited Final Results for the year ended 30 April 2019 ("FY19").

My preconception here is that this share performed so badly after listing (almost going bust) that I wouldn't want to go near it. Having said that, it's always best to approach every set of results with an open mind - because occasionally the companies that everyone hates, can turn out to be hidden gems.

I also recently read an article where a respected fund manager (I can't remember who unfortunately) reckoned that Accrol is a convincing turnaround.

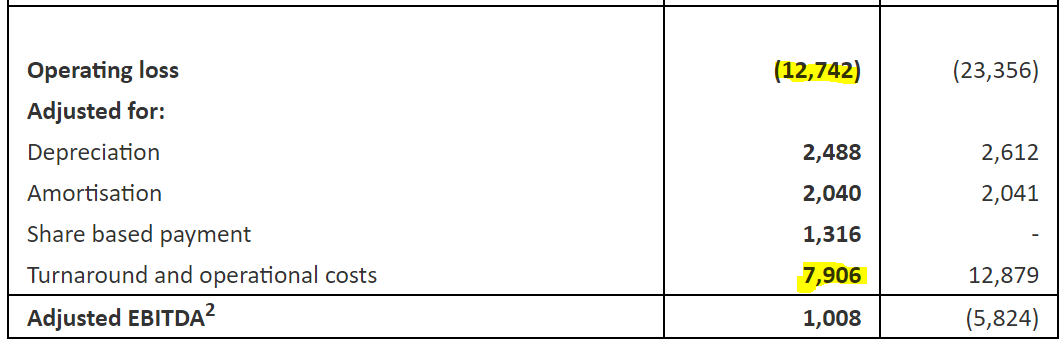

Going through the figures, I can't see anything of interest. It's still heavily loss-making, as you can see below (bold numbers being FY 04/2019, comparatives being for prior year);

The "turnaround and operational costs" line is large, and could have anything in it. Is that line really going to trend towards zero any time soon? I'd be amazed if it did.

Balance sheet - not great, with too much debt still.

This looks a capital-intensive business, with fixed assets of £29.3m, yet it's only generating a gross profit of 18.2%. Are they just busy fools then? i.e. tying up a lot of capital, doing a lot of work, for a paltry return?

Outlook - says the company is on track to meet FY 04/2020 forecasts.

The figure I have is 3.5p EPS for FY 04/2020, for a PER of 8.6 - not expensive, but I can't see any reason why it should be any higher, given the appalling track record.

My opinion - things seem to be improving, which is creditable given how bad the situation looked some time ago.

The business model here strikes me as fundamentally flawed. Profits are heavily dependent on volatile raw materials prices, and forex, against customer contracts which seem to be at fixed prices, and low gross margins. That strikes me as a lousy business model, where customers get the best of both worlds - low prices, and insulation from input price volatility. Meanwhile Accrol seems to take on the risks, for little return.

Why would anyone want to invest in something like that? It's the complete opposite of what I try to look for - i.e. companies with pricing power, high margins, and protection from forex or input price volatility.

I'm nearly out of time, so quick comments to finish off:

Gamma Communications (LON:GAMA)

A reader asked me to look at the interims, but I've just realised the market cap is well above my remit, at about £1bn.

On a quick skim of the numbers;

- Profit growth is strong - organic & acquisitions

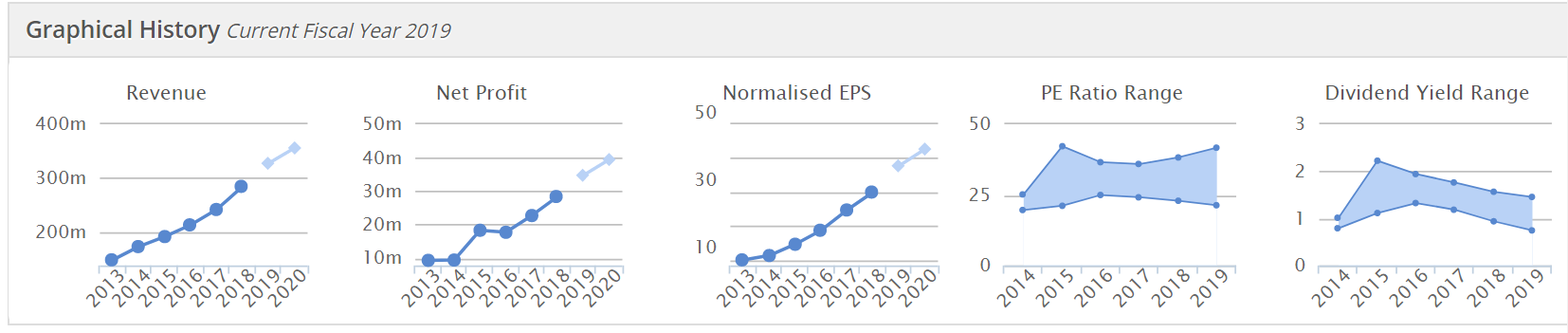

- Strong track record (see graphs below)

- Outlook sounds confident

- Recurring revenues is a positive

- Balance sheet looks fine

- No impact from Brexit is expected

My opinion - none, as I don't know the company. The shares look pricey, but with a strong track record, maybe that's justified?

Victoria (LON:VCP)

Trading update - is good, concluding;

In summary, the Board is pleased with the Group's progress to date and remains confident of meeting market expectations for the full year ending 31 March 2020.

I reported here on 6 Aug 2019 in quite a bit of detail about the new bond financing, which looks much more secure than the previous bank debt.

It sounds like the Board have listened to shareholder concerns about leverage, and are being a bit more cautious now;

There is no shortage of acquisition opportunities but, mindful of financial leverage levels, the Board is proceeding cautiously...

My opinion - with debt funding now secured, in covenant-lite bonds, I'm much happier with this share, and think it looks interesting.

That's it for today, and for the week. Have a lovely weekend all!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.