Morning, it's Paul here for the whole week!

Dialight (LON:DIA)

Share price: 361p (down 7.4% today, at 10:29)

No. shares: 32.5m

Market cap: £117.3m

Dialight plc (LSE: DIA.L), the global leader in sustainable LED lighting for industrial applications, announces its half year results (unaudited) for the six months ended 30 June 2019.

I last looked at Dialight here on 2 July, when it put out a profit warning, and fell sharply.

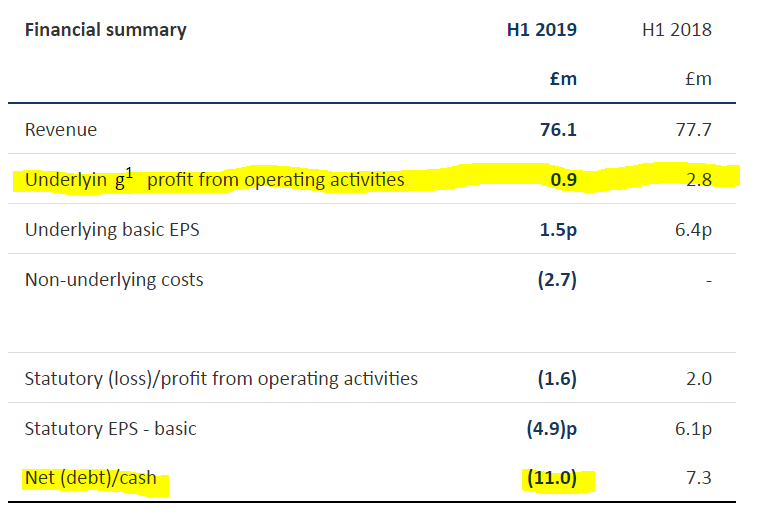

As you can see from today's H1 financial highlights, underlying profitability has almost evaporated. On a statutory basis, it made a pre-tax loss of £2.1m (due to non-underlying expenses of £2.7m);

There seems to be an H2-weighting to profits, judging from last year's results.

Guidance - the last update on 2 July, told us that full year underlying profitability is expected to be £10-13m. Given that H1 has delivered only £0.9m, that leaves a lot of catching up to do in H2.

Today the company says;

Full year guidance for 2019

We expect some gross margin recovery in H2 2019 as we return to more normal levels of service. We continue to expect our capital expenditure for the second half of the year to be in the region of c£2m together with c£4m of capitalised development costs. The tax rate for the year is expected to be c26%, and we are expecting inventory levels to reduce by year end but it will take us to the end of Q1 2020 to fully unwind the excess inventory build up.

The Board's expectations for the year ending 31 December 2019 remain for underlying operating profit within the range of £10-13m, which is before incurring c£4m of non-underlying costs.

This assumes a pickup in orders and sales activity in H2, in part due to new product launches. As in previous years, Q4 is expected to be an especially important period of activity.

It's difficult to interpret these things, but it sounds a bit wobbly to me. Therefore my hunch is that there seems an above average risk of another profit warning to come in H2. Maybe. I don't know, it's difficult trying to predict the future.

Outlook comments - are split into two. Firstly, the CEO says;

We remain confident that the combination of the reputation of Dialight products as the best in the market, our improved operational performance, and the launch of our exciting new products will result in significant long-term growth in revenue and profit.

We are taking all appropriate actions to convert these to improved financial results as quickly as possible. Our full year outlook for 2019 remains unchanged."

There's some good stuff in that excerpt above. Although I do wonder, with both CEO and Chairman stepping down, whether I would want to rely on their comments or not - since they won't be held to account if the guidance is not achieved.

Another outlook section seems to me to introduce doubt about the turnaround;

Medium-term outlook

We have made considerable progress in transforming our operations and continue to work towards industry leading levels of service to our customers. The strong focus on product development lays the foundations to restore our market share and drive future growth. The exact timing of the recovery with our customers is difficult to predict.

Our market proposition remains compelling, with the sustainability benefits of reduced energy usage, lower carbon emissions, reduced maintenance and improved safety offering real value to our customers. We remain excited by the Group's prospects over the medium to long term and are confident of delivering future growth.

I'm not keen on the use of medium to long term. That implies things probably won't be so good in the short term!

Balance sheet - debt has increased sharply, but overall the balance sheet still looks strong.

Inventories are particularly high, at £50.0m, which is mentioned in the commentary above. I wonder if there might be write-downs in the pipeline for excess stock? Reducing inventories to reduce bank debt, looks a key issue to focus on in the full year results.

Chairman steps down - a separate announcement this morning indicates that Wayne Edmunds has stepped down, with immediate effect, from the Chairman role. An existing NED, David Blood, has become the new Chairman.

This is rather unnerving, as it seems to be a sudden change - has something gone wrong, or possibly a Board Room bust up? The new Chairman is also not independent, which is rather unusual;

The Board believes that David is well placed to do so given his knowledge of Dialight, its operations and people. David is co-founder and Senior Partner of Generation Investment Management, a 20.1% shareholder in Dialight, and is therefore not considered "independent" under the UK Corporate Governance Code. However, the Board continues to consider David independent in character and judgement.

I'm not quite sure what to make of this. On balance, personally I would rather have a Chairman with a 20% shareholding, who is properly motivated to make the company work, than a box-ticker with little to no shareholding. Other people might disagree, and prefer having a genuinely independent Chairman.

This comes on top of news on 2 July 2019, that the CEO also plans to step down, shortly after these interim results, to be temporarily replaced by the CFO, who became interim CEO. So there seems to be something of an exodus going on at senior Board level - clearly a worry. Will new management kitchen-sink the full year results, I wonder?

My opinion - there's only one place to file this - in the too difficult tray.

I'm worried that the existing forecasts might prove too challenging, given that H1 was barely above breakeven. Can it really recoup the shortfall in H2?

Both CEO and Chairman departing, doesn't exactly fill me with confidence that things are going well.

On the upside, most of its sales are in the USA. Therefore sterling weakness is a good thing for the share price. Given the takeover frenzy going on at the moment, could Dialight be another share which attracts a premium bid from its main market in the USA? Who knows, but it wouldn't surprise me if someone does swoop for it.

Overall, I'll probably give this one a miss.

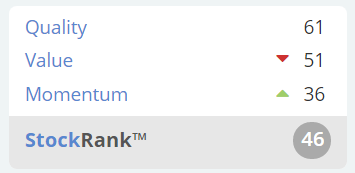

Stockopedia's computers are not madly impressed either;

Belvoir (LON:BLV)

Share price: 108.5p (down c.4% today, at 11:39)

No. shares: 34.9m

Market cap: £37.9m

Belvoir Group PLC (AIM:BLV), the UK's largest property franchise, is pleased to provide the following update ahead of publishing its interim results on 3 September 2019.

Interim results will cover the 6 months to 30 June 2019.

Checking the archive, I made a brief comment here on 16 May, when Belvoir reported a "robust" Q1, and expressed confidence in achieving market expectations for FY 12/2019.

It's more of the same today, the key bit saying;

... the Board is confident of meeting market expectations for the year ending December 2019.

That's exactly the same wording as was used in the last update in May.

Directorspeak today is upbeat - despite the sector challenges. The ban on tenant fees is mentioned, which was introduced in June 2019 - so won't have had much impact in H1. It is not mentioned what impact this is likely to have in H2. Although it must have been baked into the company's forecasts, as a known factor.

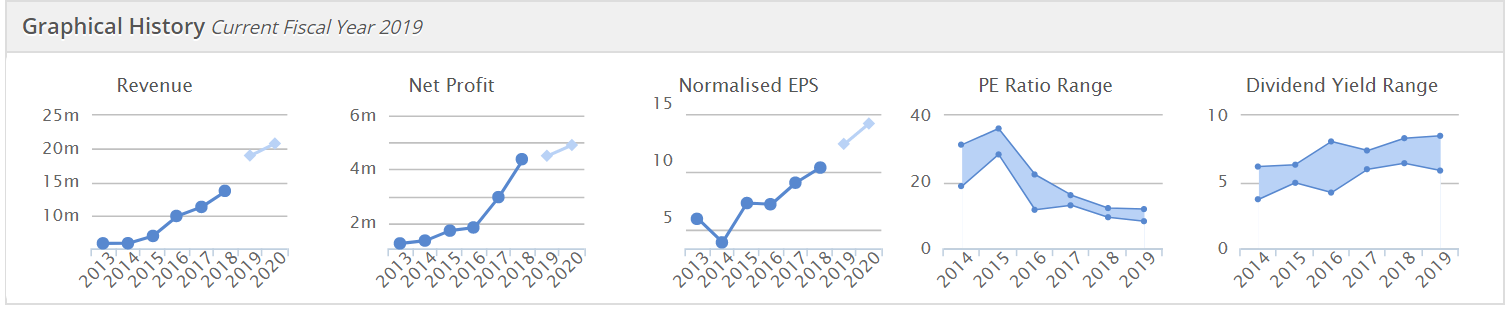

The Stockopedia graphs show very good progression in all metrics;

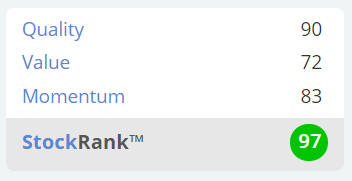

The algorithms love it too;

Dividend yield - is strong, at 6.6%

My opinion - whilst I like the performance of Belvoir, the balance sheet looks too highly indebted for my tastes. Therefore, anyone considering a purchase should probably take a close look at the last balance sheet, to ensure you're comfortable with the level of debt.

NTAV was negative, at £-7.56m as at 31 Dec 2018. I feel that the group has been paying excessive dividends, at the same time as making acquisitions, which has left its balance sheet looking stretched. That's not necessarily a problem though, if it remains as decently cash generative as it has been in the past.

easyHotel (LON:EZH)

Recommended cash offer - at 95p per share. Congratulations to shareholders!

Yet another takeover bid, from overseas. Whilst we're all agonising over Brexit, overseas buyers are hoovering up UK listed companies at quite a remarkable rate. I find this a very peculiar situation. Clearly one side is wrong! Either we (UK investors) are under-valuing UK shares, or the overseas buyers are over-paying. Time will tell who is correct!

To my mind, the surge in takeover bids from overseas is telling me that at least some UK stocks are cheap. That gives me the confidence to hold/buy more, particularly as at least half the shares in my portfolio strike me as potential bid targets.

RTC (LON:RTC)

Share price: 52p (down c.10% today, at 12:55)

No. shares: 14.6m

Market cap: £7.6m

RTC Group Plc (AIM: RTC.L), the engineering and technical recruitment Group, is pleased to announce its unaudited results for the six months ended 30 June 2019.

Profit is slightly down, but note that the divi is up, and the yield looks very attractive (assuming it can be maintained).

As we know already, the recruitment is out of favour with investors at the moment.

Outlook - mentions the "fog" around Brexit, and concludes;

... we remain confident of continuing our satisfactory performance in the second half of 2019 and as such are maintaining our progressive dividend policy.

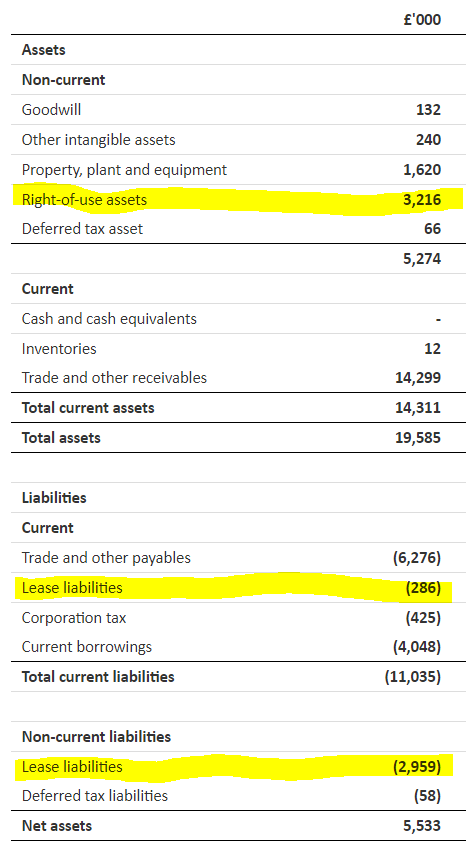

Balance sheet - this is the first balance sheet I can remember seeing which incorporates the ridiculous new rules on lease liabilities.

I've highlighted the entries below - a theoretical asset, offset by the future lease rental payments, shown as liabilities.

I imagine investors are likely to do what we do with goodwill - cross out these book entries, and ignore them.

My opinion - I'm not sure what the rationale is for RTC being a listed company? It strikes me as being too small, and illiquid.

Peel Hotels (LON:PHO)

Share price: 40p (down c.39% today, at 13:50)

No. shares: 14.0m

Market cap: £5.6m

Restoration - the shares of this tiny hotels group were suspended on 29 July 2019, due to late accounts (not able to meet the 6 month deadline for AIM shares). They resumed trading this morning, on publication of those late accounts.

De-listing - today's bombshell announcement is that the company intends to de-list, saying that the costs outweigh the benefits of being listed. The last day of trading is expected to be 26 Sept 2019.

Accounts for FY 01/2019 - not great. A small operating profit of £580k was generated, on £15.6m revenues.

The problem is excessive bank debt. It may not look excessive, relative to the book value of its hotels, but I wonder what the properties are actually worth (as opposed to book value)? Given that they're not generating any meaningful profit, then why are they in the books at an asset value of £33.8m?

A bank covenant has been breached, but the bank is being accommodative.

This could possibly be an interesting special situation, for experts only, who are prepared to hold shares in a private company. The key thing would be to independently value the properties, and ascertain whether there's any value in the equity?

Anyway, bad luck to shareholders.

It's another reminder that tiny companies, which are struggling with trading and/or debt, are prone to de-list. That is usually an instant 50% loss, and that's if you can find a buyer in the market at all. The price quoted on screen is usually in tiny quantity, so not a real price.

Signing off for today!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.