Morning all,

The FTSE closed at 6700 yesterday, down over 200 points.

I am not expecting many updates today from shares within my coverage universe but in the meanwhile, feel free to comment on the stories you're focusing on.

Games Workshop (LON:GAW)

- Share price: 3140p (+5%)

- No. of shares: 32.5 million

- Market cap: £1,020 million

Half year trading update and dividend

This miniatures company jumps back over the £1bn valuation mark after an update that is in line with expectations.

The share price had suffered in October following a cryptic (but typical for the company, I understand) update in which it said "there are some uncertainties in the trading periods ahead" (!).

Numbers today show that H1 sales have improved to £124 million (FY 2018: £109 million) and operating profit has improved to £41 million (FY 2018: £38 million).

The October trading update said that profits were running at "a similar level" to the prior year. The improvement which has actually been achieved in H1 will have come as a pleasant surprise to holders.

It's unorthodox but I find this company's reporting style quite refreshing. It seems as if the CEO isn't terribly interested in providing guidance in terms of financial forecasts, or in predicting the future, full stop.

Forecasts very often turn out to be wrong, anyway - so maybe there is no harm in having a CEO who admits that the future is uncertain and he doesn't really know what the numbers are going to look like a year from now.

Operationally, everything is fine:

These results show the Warhammer Hobby is in great shape in our core markets. We have built on the progress we made last year and the results are considerable given the backdrop of major projects; increasing factory capacity and ERP system implementation.

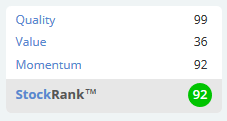

The StockRanks love it:

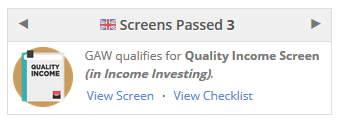

And it passes three screens for Momentum, Income and Growth:

Here's an example of a product displayed prominently on its website today. It's 6 inches tall in real life. Can you guess how much it costs?

£65 for this creature, which is assembled and painted by the customer rather than by Games Workshop!

It's kind of fascinating when you think about it - Warhammer hobbyists enjoy the process of building and painting the figurines, so they do the work that the company would have to do instead!

All that free labour must play a big role in the 70%+ gross margins enjoyed by the company.

It's an amazing franchise and long-term I imagine that Games Workshop will end up in the hands of a major toy company like Hasbro ($HAS).

For example, I always viewed Warhammer as the main alternative to Magic: The Gathering. Magic ended up in the hands of Hasbro following the acquisition of Wizards of the Coast in 1999.

So it would make sense to me that Hasbro, or perhaps someone like the Lego Company, would want to add Warhammer to their stable at some point.

That's not necessary, however - the company doesn't need external help. It has performed very well on its own and generated plenty of surplus cash, which it has been happy to distribute to shareholders. Today there is an announcement of a 30p dividend.

This stock is on my watchlist for a possible purchase at some future date.

S&U (LON:SUS)

- Share price: £21.30 (-1%)

- No. of shares: 12 million

- Market cap: £256 million

I recently interviewed the Chairman of S&U and am reasonably familiar with this company. It provides motor finance in the used car market to less-than-prime customers, trading as Advantage Finance.

Today's update is broadly in line with expectations. This phrase normally indicates a slight miss, so the 1% dip in the share price makes sense.

The used car market is doing much better than the new car market, but new loan agreements are still down by 7%. This is attributed to:

a combination of the slight reduction in the record level of loan applications seen in July, Advantage's prudently tightened under-writing and some recent increase in competitive pressure

This means the customer base and the loan book are growing slower than anticipated - but they continue to grow and to reach new all-time highs.

Impairments seem to be stable and return on capital remains fine at 15%.

S&U's property bridging division also continues to grow and is set to receive more investment from its parent.

My view

I consider this to be a solid financial stock. Probably its key attraction for me is that it is "proprietorial" (Lord Lee's phrase) in the sense that it continues to be owned and managed by the family of the man who founded it in 1938.

Valuation looks about right at current levels, perhaps a little too cheap given the strong track record, stable management and admirable ROCE.

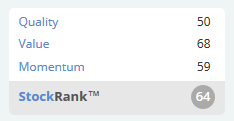

The StockRanks also see some value at current levels:

AJ Bell (AJB)

- Share price: 221p

- Market cap: £900 million

AJ Bell shares have popped up by an amazing 38% compared to their 160p offer price this morning, the first day of conditional dealings.

The shares will officially hit the London Stock Exchange next Wednesday ("unconditional dealing").

I estimate AJ Bell's implied market cap at £900 million. This seems rich versus net income of £22.6 million in FY 2018, perhaps rising to net income in the region of £29 million in FY 2019. We have a P/E ratio >30x.

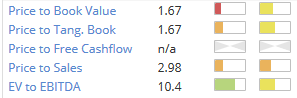

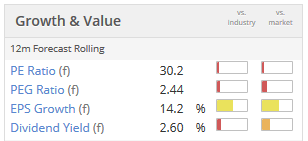

One could argue that it's not a much more expensive rating than Hargreaves Lansdown, which has the following value metrics:

But then Hargreaves Lansdown would be considered the market leader, and has much higher margins than AJ Bell, so surely it deserves a premium?

This froth should die down over the next week or so.

MJ Gleeson (LON:GLE)

- Share price: 678p (+1%)

- No. of shares: 55 million

- Market cap: £370 million

Looking at this in response to a couple of requests. Regular readers will know that I rarely look at a property shares.

MJ Gleeson comprises Gleeson Homes (urban housing regeneration in the North of England and the Midlands) and Gleeson Strategic Land (land trading in the South of England).

The AGM statement was in line with expectations, showing plenty of growth in net reservations, building activity and completions.

I've compared this AGM statement with last year's and confirmed that the pipeline of plots and its gross development value (£1.5 billion) have also increased.

The usual risks faced are:

- legislative - most customers use Help to Buy, so any change could be detrimental

- macro - rising interest rates and recession

- execution risk

I don't have any particular insight into MJ Gleeson but as a general rule, I don't buy into property development companies at a big premium to their book value. According to its most recent results, Gleeson's net asset value per share is 345p.

That could easily be understated but still, the disconnect between the NAV and the share price would be reason enough for me to steer clear.

I admit this this is possibly an ultra-cautious approach to property investing. I just don't want to overpay for real estate. Perhaps someone with keen insights into the company and the property industry would hold a completely different view.

But if you go back to 2012 for example, Gleeson's share price was c. 120p while its NAV per share was 190p. I'd be a lot more interested at that sort of valuation!

All done for now. The equity market has stabilised and recovered today. Get your hard hats ready for next week!

Until then, have a fine weekend.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.