Good morning,

This is the placeholder article, but I'd also like to draw your attention to my recent interview with Cerillion (LON:CER), which was originally published to subscribers on my mailing list but can now also be found on Stockopedia at this link.

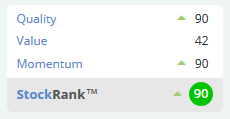

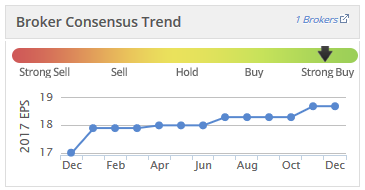

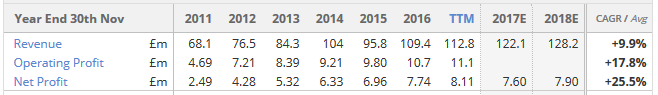

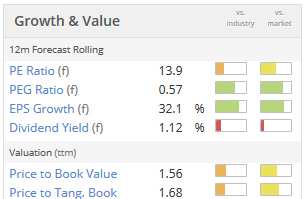

It's a software company which I had already covered a little bit in the SCVR, before realising that the opportunity to interview management would present itself. It's got a StockRank of 90 and a PE ratio of c. 14-15x. So I hope this interview might be of interest to some of you.

Regards,

Graham

Xafinity (LON:XAF)

- Share price: 183.6p (-1%)

- No. of shares: 137 million

- Market cap: £251 million

Proposed acquisition of Punter Southall

This is a mid-tier, domestically-focused pensions consultancy. It listed earlier this year, and this is the first time I've looked at it. Thank you for suggesting it in the comments.

Checking the shareholder register, there are some big names in the investment industry backing it up.

Yesterday it announced interim results and a very big (£153 million) acquisition.

The deal, assuming it goes ahead, will consist of £92 million in cash and up to 32 million shares, along with the sale of an HR trustees business worth £8.5 million.

To find £92 million in cash, Xafinity wants to raise £70 million in New Money and increase its debt facilities.

Its total (gross) debt at end-September was £29 million, offset by some cash. It is now seeking to increase debt facilities to provide a maximum of £80 million in borrowings.

Rationale

The target company is another mid-tier provider of institutional investment advice, so the rationale is as you would expect:

We believe that a successful combination of these two premier mid-tier providers would create the pre-eminent mid-tier firm in the pensions consultancy market, with significantly stronger growth prospects than each business would possess individually.

The "big 3" firms in the space are Willis Tower Watson, Aon Hewitt and Mercer. So the questions now are (1) will Xafinity be better-positioned to compete with them? (2) what about the XAF shares?

Current Trading at Xafinity is fine, with revenues up c. 2% to £26.6 million in H1. Operating profit reduced slightly to £5.3 million, but a much lower interest bill compared to the previous year enabled the final result to improve.

Outlook is positive:

The trading environment for Xafinity remains strong, with our new business performance during the period having undoubtedly been supported by our post-IPO profile. The Company expects strong growth in H2 2018, as the revenues gained from recent contract wins starts to feed through into the business and the pipeline of opportunities strengthens.

My opinion

After raising £50 million at its IPO, the Xafinity balance sheet is now significantly stronger, and the company boasts of its net asset position.

But if you dig into the balance sheet a little bit, you'll find that this includes £57 million in intangibles, so net tangible asset value is minus £25 million.

Intangibles will probably increase again after this deal, and gross debt will go to c. £50 million.

The outcome will be a large firm with something like 1,450 employees and maybe 1,000 pension scheme clients. It could be a serious contender versus the Big 3 in the domestic market.

But whether this translates into shareholder gains is another matter. Maybe I could have shortened this entire report by saying "it's a people business" and leaving it at that, but I wanted to dig into the numbers a little bit more.

Again checking the Xafinity financial statements, the £50 million which it received last year merely plugged the hole caused by its accumulated earnings deficit of £18 million.

But even after plugging that hole, it still had to carry a large net debt position thanks to the £57 million which it has spent on intangibles, as described above.

And the debt and the intangibles will be bigger again after this deal.

For customers and employees, these are successful firms. But from a shareholder point of view, it often seems to me like that there is a lot of money that goes in, and often very little to show for it. And to be honest, I'm not really surprised that this is so often the case.

Remember that there is no heavy equipment to be purchased, and there are no inventories of stock. There is a lot of technical innovation happening inside the firm, but there no copyrighted IP.

Ultimately, I think the shareholder position is too weak here in relation to the employees, to make it suitable for a long-term hold.

That's just my opinion, feel free to make the bullish case in the comments!

Porvair (LON:PRV)

- Share price: 482.5p (+7%)

- No. of shares: 45.3 million

- Market cap: £219 million

Pre-close trading update and acquisition

This company makes filters for industry. It consists of the following divisions:

- Metal Filtration: the filtration and handling of molten metal. Trading as Selee in the USA and China.

- Microfiltration: diverse filtration services. Operations in UK, USA, Germany, China. 500 employees.

Paul covered Porvair's Q3 trading update, which was ahead of expectations. Today's full-year update is also ahead of expectations. There is some nice earnings momentum here:

The good news is delivered like this

Revenue growth for the year ended 30 November 2017 was 6%. Underlying revenue(1) growth was 11% overall, with underlying revenue growth of 13% in the Microfiltration division and 1%in the Metals Filtration Division. Earnings for the year are forecast to be ahead of management expectations.

Underlying revenue is defined as: revenue at constant currency excluding the impact of large projects. There might be some discretion involved in the definition of large projects, but it's certainly helpful to see what the currency effect is.

My opinion

This looks like a good company with a niche offering. The historical performance is excellent, particularly when you consider that the growth over the years has been achieved with minimal dilution to shareholders. The share count has increased only marginally over the past ten years:

The dividend yield is small, barely 1%, but this makes it onto Stockopedia's dividend achievers screen thanks to growing it and consistently paying it, and enjoying a strong balance sheet.

Let's keep an eye on this, going forwards.

PCF (LON:PCF)

- Share price: 28p (-2%)

- No. of shares: 212.2 million

- Market cap: £59 million

Please note that I currently own shares in PCF.

This specialist bank was previously known as Private & Commercial Finance and produced annual results on Tuesday. The results were ahead of market expectations.

I last covered it exactly a year ago, the last time it produced annual results. Here is the link. It offers car finance to individuals, and vehicle and equipment finance to businesses.

Having reviewed the results, I've decided to get my feet wet and buy a few shares, taking a small, starter position for my portfolio.

Bear in mind that I like the financials sector, so was already biased in favour of investing here.

There are a couple of reasons I've invested.

As was flagged for some time, PCF became a bank earlier this year, enabling it to take retail deposits. These retail deposits are much cheaper than wholesale bank finance, enabling PCF to increase profitability and competitively expand its lending operations.

As they said on Tuesday:

The ability to raise significant amounts of retail deposits will support our growth strategy and allow us to scale the portfolio far beyond what could be achieved for a company of our size in the wholesale debt markets.

From initial banking operations in July through to the end of September, PCF took in £53 million in customer deposits. So it has started paying off the more expensive finance it was previously using.

The infrastructure to build a bank, and the process of being granted a license, are the difficult bits. I think PCF is ready now to grow from its existing base. The lending portfolio is £146 million, but the targets are for this to grow to £350 million by 2020 and £750 million by 2022. It probably won't be able to achieve all that growth organically, but hopefully the organic growth will be significant.

Valuation/Performance

PCF has net assets of £39 million, after raising £10 million at 25p earlier this year.

So the current market cap is just over a 50% premium to book value (and a slightly higher premium again to tangible book value).

I generally don't want to pay such a premium to book value for a financial stock, unless I'm confident that the company will generate an attractive return on equity for the foreseeable future.

PCF uses after-tax ROE as its major KPI. It achieved 12.9% last year, which is more than adequate in my book. It dropped to 8.7% in the current year, but that is to be expected since it raised fresh equity and was setting up new operations.

The target is for ROE to recover to 12.5% over the next three years.

Meanwhile, the cost-to-income ratio (administration expenses as a percentage of net interest income), also known as the efficiency ratio for a bank, increased to 59%. But if we exclude bank set-up costs, this ratio fell from 51% to 47%. As bank assets grow, the overall efficiency ratio should improve, too.

Business lending has been growing strongly. Retail car finance has been more difficult, as this is a highly competitive sector and PCF doesn't offer any PCP products. But with its lower cost of funds now from retail deposits, it will hopefully be able to compete a bit more strongly in this segment in the years ahead.

Outlook is great:

The potential for PCF Bank is substantial and our journey has only just begun. We have clear strategic objectives, have confidence in their execution and the growth prospects of the Group are exciting into the long-term.

The StockRanks don't particularly like it, and I'm not expecting the share price to do anything very strong in the short-term. But I've seen enough to be comfortable with making a small investment and continuing to study it in the months ahead.

That might be it for today. Have a good weekend everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.