Good morning!

Before I get into today's report, I'd just like say how thankful I am for the early comments. Besides alerting me to the stories which you find most interesting, they also help me to spot things I might otherwise have missed. So long may this continue!

Today, the following stories have grabbed my attention so far:

- XLMedia (LON:XLM) - trading update

- Somero Enterprises Inc (LON:SOM) - AGM statement

- Triad (LON:TRD) - final results

- Ranger Direct Lending Fund (LON:RDL) - management review process update

- IG Design (LON:IGR) - final results

XLMedia (LON:XLM)

- Share price: 118p (-31%)

- No. of shares: 220 million

- Market cap: £260 million

Performance has stalled at this Israeli performance marketing group, registered in Jersey.

General thoughts

Can we trust these Israeli (and Greek, Cypriot, etc.) small-caps, listed on AIM? It's difficult to generalise, but my basic point of view is that I always want to feel like the shares I buy have a sturdy relationship between the shareholders, directors and the company itself.

This is related to something I was taught about property investing. From a legal point of view, you can't buy land. You can only buy title to land, i.e. the right to do certain things with a specific piece of land.

It's the same with companies. We don't buy companies, we buy securities (bonds, shares, etc) which give us rights to do certain things (collect coupon payments, collect dividends, vote for Directors, etc). If there is something wrong with the securities themselves, then there is something fundamentally wrong with our investment.

Usually, we don't have to worry too much about the legal integrity of company shares. But sometimes, it matters a great deal.

I currently own shares in just one company not registered in the UK: DP Eurasia NV (LON:DPEU). This is active in Turkey and Russia, and is registered in the Netherlands. I accept that this is a risky stock, and so my position is very small. However, I do take some comfort in the Netherlands registration, since the Netherlands is on a par in legal terms with the UK, the US and other developed markets.

XLM

Ok, let's bring this back to XLM.

It has been trading at quite average P/E multiples, despite stunning growth rates, and I think we can say with some confidence that this is due to a combination of a) its geography, and b) its sector.

a) Geography: this is another Israeli company, listed on AIM (like £PLUS). The official registration is in Jersey. We might ask why not register on the UK mainland, would that be so difficult?

The way this company is set up is as weak as it gets in terms of corporate governance requirements and oversight for UK-listed companies.

b) XLM is in the gambling and internet marketing sector. It is extremely good at these things, and its results over the past several years do speak for themselves. It has a content management system and an advertising capability which are extremely effective at funneling high-value users to lucrative internet destinations.

The difficulty is that this sector is at risk of regulatory attack. Although GDPR (the EU's data protection regulations) aren't mentioned explicitly in today's update:

Underlying trading in the year to date has been stable... The Group has also seen some impact from regulatory changes, namely the closure of the Australian market at the end of 2017 in addition to uncertainty regarding the regulatory status of certain European markets during 2018. These regulatory changes have triggered a re-alignment in how operators and marketers can work which should lead to a clearer and more functional environment.

It's a worrying update on several fronts.

Firstly, the company has lost all of its growth characteristics, at least for now. Underlying trading is only "stable", revenues will reduce from $138 million to $130 million, and adjusted EBITDA will also marginally reduce.

Secondly, the regulatory status of European markets is being questioned.

The XLM business is all about finding and converting high-value users. In a world where the ability of companies to accumulate and exploit customer data is threatened, the value of this activity is threatened, too. And the gambling destinations also tend to be vulnerable to regulatory imposition.

However, everything has a price and I am willing to entertain the idea that XLM shares are back in "cheap" territory, where they are worth a long trade. It's not something that I would personally engage in, but I can see the argument.

The company has been well-supported by shareholders and raised £32 million at 198p in January. Although some of them may be selling now in disappointment, I expect that the company is cash-rich, and the earnings multiple is likely to be back in value territory.

If adjusted EBITDA comes in at $45 million this year, for example (last year it was $47.1 million), that translates to c. £33.5 million and a P/EBITDA multiple of less than 8x. On an enterprise value basis (taking into account the net cash position), it will be cheaper again.

We also can't rule out the possibility that the company's web acquisitions and diversification into the personal finance space will herald a return to growth, perhaps two years from now.

So yes, I think this is back in value territory. There is no growth premium in the shares anymore, despite its track record of excellent returns.

An attractive punt at this price, but not something I would be filing away in the bottom drawer.

Personally, I will be staying away, since my strategy is to find shares I feel I can trust for the long-term.

Somero Enterprises Inc (LON:SOM)

- Share price: 402.5p (unch.)

- No. of shares: 56.3 million

- Market cap: £227 million

Somero, the manufacturer of concrete screeding machines (making concrete surfaces perfectly flat), provides a trading update.

North America and Europe remain "healthy markets with robust activity levels."

I'm still sceptical with regard to the company's push into China:

"...we remain encouraged by the performance in China in the period as we continue to work on gaining traction in this significant market."

I don't believe the company will ever gain serious traction in China, as I suspect that the Chinese will always prefer to copy the machines and figure out how to use them by themselves, even imperfectly, rather than pay for Somero's services.

Still, there is plenty of money to be made in North America, Europe, etc.

Somero tends to be conservative when it comes to development spending, but says it is making good progress in developing a new solution "for concrete leveling in the structural high-rise market segment".

Overall, trading is in line with expectations.

We also have news that there will be a 3-year transition plan for the 71-year old CEO to retire over the next three years. Sounds reasonable.

An excellent US-based company with limited competition, a great StockRank of 94 and reasonable value.

Ranger Direct Lending Fund (LON:RDL)

- Share price: 809p (+2%)

- No. of shares: 16 million

- Market cap: £130 million

Management Review Process Update

(Please note that I own shares in RDL.)

I've decided to get my feet wet and pick up an opening position in this debt vehicle.

However, I'm not expecting a very large return. All I expect is that I will get my money back, plus some decent divis.

I do believe that the news today is very significant in reducing the risk of the trade.

The Board has been forced to give up on the idea of replacing the investment manager with a new one, as its chosen successor has decided that it no longer wishes to proceed.

If you read my recent coverage of this stock, you'll recall that the RDL Board has been under pressure from Howard Marks' Oaktree fund to appoint new directors and wind itself up.

Another fund, managed by LIM advisors, has also been calling for Ranger to stop making new investments and to wind itself up in an orderly manner.

The proposed new investment manager has decided it doesn't want to take on a new mandate against the wishes of a big chunk (at least 29%) of RDL shareholders:

...against the potential backdrop of calls by activist shareholders to change the Board and demands for a winding-up of the Company, which could be reasonably be expected to continue whether or not Ares was appointed, Ares has notified the Board that it does not wish to take up the appointment of investment manager to the Company.

This means that the RDL Board is now waving the white flag, and accepts that a wind-up is inevitable:

the Board has concluded that in the interests of certainty and protecting shareholder value the Company should move to realise its assets in an orderly manner.

The main reason I didn't want to buy shares in Ranger up to now was my concern that it would not be wound up.

But now I am happy to get involved.

The Oaktree/LIM combination controls 29% of shares and I think they have a great chance of getting their nominees on the Board.

Even if they don't get their nominees on the Board, Ranger is set to be wound up, so I think the risk in these shares is very significantly reduced.

Unfortunately, the discount to NAV is not as large as I would have liked, so I don't intend to hold a very large position.

If the very large Princeton investment turns out to be completely worthless, then I think the Ranger NAV is just 846p per share at current exchange rates. So the return from buying at today's offer price from closing the discount is only a few percent per share.

But the non-Princeton assets may chuck out a decent return over the next couple of years (the average maturity in the portfolio is two years).

Last year, Ranger paid out almost 102p in dividends. The year before, it paid out almost 90p.

So I do think I will get a nice interest yield on the existing debt portfolio and then get a capital return as the portfolio is liquidated.

If Princeton turns out not to be worthless, that would be a bonus. But I'm not depending on that. I really just see these shares as an interesting place to park a little bit of money for a while, with limited downside (I think) and the chance of some upside.

The portfolio consists of a range of business loans, consumer debt, real estate, etc. Since the average maturity is short, it should be possible to let many of the loans mature, with no need to sell them.

As always, please do your own research before thinking about buying any shares we mention in this report!

Triad (LON:TRD)

- Share price: 70p (+2%)

- No. of shares: 15.7 million

- Market cap: £11 million

This is a small IT services company which I have covered once before (at the annual results statement last year).

It provides consultancy and software application development to businesses and the public sector. Clients mentioned on its website include the Cabinet Office and the Department of Energy and Climate Change.

The other arm of its business in IT recruitment, both on a contract and permanent basis.

Triad Group is among the top 20 suppliers to Government via the Digital Marketplace.

Today's results are for the period ending March 2018. It's nice to see a micro-cap reporting promptly - that's all too rare! Although there hasn't been a trading update since the half-year results were released last November, so that is a long time to go without any news.

This time a year ago, with the share price at 77p. I thought it looked good value.

It is now trading at 70p, and arguably even better value in quantitative terms:

- Pre-tax profit £1.66 million (2017: £1.52 million) (despite a reduction in revenue, as it had fewer lower margin projects).

- Cash increases to £3.8 million (2017: £2.2 million), c. zero debts.

- Balance sheet equity increases to £5.1 million (2017: £3.6 million), c. zero intangibles.

- Receivables down to £4 million (receivables turnover is about 6x, meaning it takes two months on average to get paid).

So why is it so cheap?

I guess this is one reason. From footnote 4:

46% (2017: 53%) of revenue was generated in the public sector. The largest single customer contributed 28% of Group revenue (2017: 27%) and was in the public sector. Two customers contributed 14% and 10% of Group revenue (2017: three customers contributed 17%, 12% and 11% of Group revenue).

In other words, the top three customers accounted for 52% of revenue, up from 40% in FY 2017. That's a lot of customer concentration risk.

Also, Triad needs to constantly pitch for new business. It reports today that the business environment is "becoming increasingly competitive."

Finally, the outlook statement sounds a bit mixed.

My view - this remains very cheaply priced, and anchored with the value in its balance sheet, including the strong cash position.

I suppose compared to a year ago, I am a little bit more wary now about investing in consulting / professional services / recruitment firms. I'm also more resistant to investing in B2B and contract-driven businesses. So for these reasons, I don't feel particularly tempted to invest in Triad today.

I also think that the 1p dividend declared is not overly generous, given EPS of 10.45p. Although in mitigation, EPS has been artificially boosted by prior loses, and this will be the third dividend since September 2017.

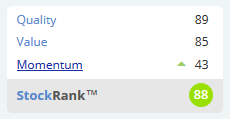

The StockRanks like it very much. The company looks better from a quantitative point of view than it does from a qualitative view, in my humble opinion. But it will be of interest to value hunters in the micro-cap space.

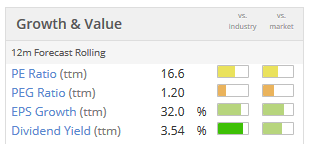

IG Design (LON:IGR)

- Share price: 461p (+6%)

- No. of shares: 64 million

- Market cap: £295 million

IG Design Group plc, one of the world's leading designers, innovators and manufacturers of celebration, gifting, stationery and creative play products, is pleased to announce its results for the year ended 31 March 2018.

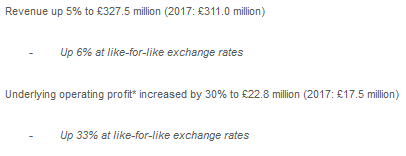

Some nice results:

The adjustments to operating profit are quite mild. Operating profit is £20.6 million, before some exceptional items which increased statutory operating profit to £21.1 million.

All of these numbers are in the same ballpark as "underlying" operating profit of £22.8 million. So we have a good idea about the profitability for the year.

Also worth mentioning that the 30% gain in operating profit is very impressive compared to the 5% increase in sales, and I would expect to see further benefits from operating leverage as sales continue to grow (I estimate the degree of operating leverage for the 2018 income statement to be 3.5x).

The leverage multiple from the balance sheet is 1.7x, stable compared to a year ago although the company notes that average leverage used during FY 2018 was lower compared to FY 2017. The company had a small net cash position at year-end.

Operationally, all is well with sales and profit growth from every region.

The video released on piworld today features the directors talking about fast payback on their latest capex investments. Everything sounds good, with the business said to be "in great shape".

The outlook statement from today's announcement is in a similar tone:

Following the transformation of the Group over recent years, there is considerable scope for further growth across all aspects of the business.... With a strong order book in place and a positive start to the new financial year, we are excited about the opportunities to deliver further growth in 2018/19.

I've failed to spot any red flags from this company yet. With a positive outlook statement and return on capital measured by Stocko at 15.6%, it appears to deserve its PE ratio of almost 19x.

Edit: readers pointed out that receivables and trade receivables past due have both increased.

Receivables are up by £9.1 million, hurting cash flow, and trade receivables past due have increased to £13.5 million (up from £5 million a year ago). It would be worth asking the company for clarification on this, particularly the £2.5 million in receivables which are past due by more than 90 days (up from £0.8 million a year ago).

The most prudent way to deal with this might be to adjust IGR earnings for the period lower by at least 50% of the increase in aged receivables (>90 days old). That way, we assume that most of them will not be collectible (though the company is treating them as unimpaired, so hopefully they will be collected!)

Quindell

A post-script on Quindell (QPP), now trading as Watchstone (LON:WTG).

Thank you to readers for pointing out that KPMG has now been fined by the Financial Reporting Council for its role in the fiasco.

The FRC said KPMG’s fine was related to its “failure to obtain reasonable assurance that the financial statements as a whole were free from material misstatement”.

It also cited “failure to obtain sufficient appropriate audit evidence and failure to exercise sufficient professional scepticism”.

KPMG accepts the findings in relation to two particular areas where it should have done better, but also points out that it was led astray by Rob Terry & Co.

We regret that some aspects of our audit for the year ended 31 December 2013 did not meet the required standards. As we stated in our audit opinion for the following year, certain information given to KPMG contradicted representations previously made by former members of management.

The fine levied by the FRC will strike casual observers as rather large, but we must remember that the scale of shareholder value destruction suffered by Quindell shareholders, and Slater & Gordon shareholders too, is many multiples of this amount.

The FRC and the Serious Fraud Office continue to investigate the matter.

All done for today! Cheers.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.