Morning!

How are we all doing? From a financial point of view, the FTSE All-Share is up well over 7% year-to-date (including today's gains). But I get the sense that those of us in the small-cap space aren't doing quite so well.

The AIM All-Share Index was up 5.4% as of last night (excluding dividends, which don't make much of an impact anyway).

Within AIM, however, there have been many individual casualties and sadly many of them were favourites of the private investor.

I enjoyed this article by timarr: When Stocks Go Bad: Grim Tales from the SCVR. He goes into a great level of detail into popular stocks whose valuations have suffered to one degree or another:

- Revolution Bars (LON:RBG)

- Keywords Studios (LON:KWS)

- Purplebricks (LON:PURP)

- IQE (LON:IQE)

- accesso Technology (LON:ACSO)

- Amino Technologies (LON:AMO)

- Flowtech Fluidpower (LON:FLO)

- Gear4music (LON:G4M)

- Fevertree Drinks (LON:FEVR)

- Restaurant (LON:RTN)

- Plus500 (LON:PLUS)

- XLMedia (LON:XLM)

- Taptica International (LON:TAP)

- XP Power (LON:XPP)

- Air Partner (LON:AIR)

It's a fine list, worthy of dissection.

It turns out that I've never had a position in any of these shares, but perhaps I should have: long-term holders in Fevertree Drinks (LON:FEVR), for example, have done terrifically. A period of share price weakness is inevitable for any company. Fevertree Drinks (LON:FEVR) remains on my watchlist for a potential purchase.

On the other hand, there are some members of the above list which I've written cautiously about: the first four of them in particular and also the three Israeli shares. While acknowledging that I could be unduly cautious, my stance on these seven companies is unchanged.

As a general principle, there is a lot to be said for avoiding "popular" shares, as they do tend to be higher risk and priced unattractively. Like any rule, there are exceptions. But the best investment is probably the one where you are the first, or at least early, to discover it. If it subsequently becomes "popular", I guess that's beyond your control.

This community is special because those shares which become popular here tend to at least have good arguments in their favour. There are other venues, which I won't name, where their popular shares tend to be the most speculative and poorest-quality companies with the fewest redeeming characteristics.

As the Mello slogan goes, "Invest in Good Company".

Mello Trusts & Funds - 15th May

Speaking of Mello, I hope to see many of you at Mello London this year. On 15th May, the companies event will be preceeded by a Trusts & Funds event, the first of its kind. Keynote speakers will include a range of leading experts in the trusts and funds space.

So whether you invest directly in trusts and funds, or are merely a keen watcher of the investment sector, this should be a fantastic occasion.

I have been informed by the organisers that those who wish to attend Trusts and Funds on its own, rather than the full 3-day extravaganza, can enjoy a £20 discount if you use the code Stocko20. You're welcome!

Tesla ($TSLA)

Apologies for mentioning something that is neither UK-listed nor a small-cap, but this is currently my key research focus.

Tesla is the only company I have shorted since Slater & Gordon back in 2015. I have been carefully analysing its financials, trying to understand the likely progression of its cash pile.

Unfortunately, this is a crowded trade on the short side with about 15% of shares currently sold short (25.5 million out of 173 million).

At least this is a material reduction from the short interest around April and May of 2018, when 39 million shares were sold short. That would have taken more than 7 trading days to cover based on volumes at the time.

In hindsight, that short interest looks like it was justified to me. Elon Musk admitted that the company was "within single-digit weeks of death" during the cash burn in early 2018.

Many levers have been pulled to accelerate cash flow since then, and no doubt more levers will be pulled to coincide with the unveiling of the new Model Y.

To avoid any damage from a short squeeze, I have been investigating long-term put options as a means of expressing my view on the situation.

While it's true that the short trade is painfully crowded, what maintains my interest in this opportunity is the company's financial data, specific risks related to Tesla's governance, and the strength of the arguments from the longs (who will be my counterparty, if I execute the trade).

Now let's get down to business and look at some of today's updates:

- Northern Bear (LON:NTBR)

- Xaar (LON:XAR)

- Quarto Inc (LON:QRT)

- Orchard Funding (LON:ORCH)

- Driver (LON:DRV)

Northern Bear (LON:NTBR)

- Share price: 66.34p (-12%)

- No. of shares: 18.5 million

- Market cap: £12 million

It's a short update from this Newcastle-based group of building services companies, so I'll try to keep this brief.

- The group continues to trade well.

- For ten months to January 2019: ahead of expectations, in line with the outstanding prior year.

- Current expectation is that adjusted operating profit for FY March 2019 will be broadly in line with the prior year (GN: this probably means a bit less than the prior year).

There are no numbers given in the update, and no consensus forecasts in the market, either. So we are driving blind as far as market expectations.

For what it's worth, adjusted operating profit was £3.1 million last year. This translated to net income of £2 million.

I retain my positive impression of the management team here. If you are happy to invest in building services, then this seems like one of the better options, albeit at a very small scale.

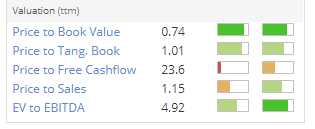

Valuation reduces to c. 6x net income after this slight disappointment, with no further progress made in FY 2019 as far as profitability is concerned.

Investors are right to price this at a cheap multiple, in my view, given the inherent risks. I would view it as fairly priced, offering nice upside if the company gets another fair wind behind it.

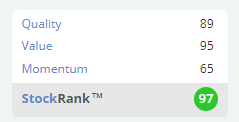

The StockRanks, looking at things purely from a quantitative point of view, adore it:

Xaar (LON:XAR)

- Share price: 125.4p (-7%)

- No. of shares: 78 million

- Market cap: £98 million

Another brief update. Xaar makes industrial printheads and other inkjet technology.

It's amazing how far this share has fallen since its glory years. It was worth about £750 million at the peak. Hopefully it reaches a point where it is fundamentally good value soon!

My suspicion is that competitors in China, where many of Xaar's customers were based, have stolen its thunder. Demand from China was always very unstable. See this story from 2014.

Today's update:

- underlying results for FY 2018 in line with expectations. Revenues £63.5 million, net cash £27.9 million.

- provisions of £7 million relating to inventory and debtors. There is an "unfavourable working capital aging profile".

My view

The company will argue that this £7 million hit does not relate to the current period. To the extent that is true, it means that previous periods were in aggregate £7 million worse than reported.

Looking at the forecasts in the market, I see that Xaar is forecast to make a loss this year and next year, adding to the pain of an expected loss for 2018.

It is looking for "more extensive partnering in the Printhead business unit". Perhaps going one step further and getting a trade sale to one of the big boys is how this will eventually play out? It would seem to be the logical outcome of several years of disappointment, with more losses lined up despite the company's cost-cutting efforts.

To me, the shares are definitely worth something. Xaar has always made sure that it has a big cash pile, and has managed its costs lower in line with falling demand, and I expect it to remain prudent in that regard. And the digital printing technology it offers, while difficult to assess from outside the industry, appears to offer something unique to customers. The company has nearly 300 patents registered or pending.

According to Xaar's interim results for June 2018, it had balance sheet strength as follows:

- net assets of £142 million

- net tangible assets of £104 million

- net current asset value (NCAV) of £75 million

I suppose we need to knock at least £7 million off all of these numbers for the latest provisions.

That leaves NTAV of £97 million and NCAV of £68 million.

This could be completely wrong, but I would have thought that a large competitor would be happy to snap up Xaar (e.g. Konica Minolta?), with tangible balance sheet value providing a floor to the valuation.

Quarto Inc (LON:QRT)

- Share price: 53.5p (-2%)

- No. of shares: 20 million

- Market cap: £11 million ($14 million)

Final Results for the Year Ended 31 December 2018

Another major faller, these shares are now trading like options on the company's $60 million debt pile.

Results are USD-denominated, as more than half of revenues are derived from the US.

Quarto is a global book publisher whose results have been seriously disappointing since 2017.

Let's summarise the latest news:

- revenues down 2% to $149 million

- adjusted PBT $5.9 million, up from $3.9 million

- exceptional costs $5.2 million. After those costs, plus amortisation of intangibles, there is a statutory pre-tax loss of $0.1 million.

The company's ambitions are unbowed: it wants to be "the dominant publisher of illustrated books worldwide".

The Board has been shaken up, costs have been cut, and banking facilities are renewed to 2020.

The CEO (also a major shareholder) acknowledges the priority being given to debt management:

Net debt is still sizeable and remains an immediate focus for the Board.

Outlook - not much change expected in the short-term. "Ongoing soft market conditions" to continue, mostly impacting foreign language markets and Adults books.

(Quarto's top selling product in 2018 was a weird toy, not a book. Source: Amazon)

Exceptional items - reorganisation costs, board changes and refinancing costs. While individually they are one-off in nature, I would expect similar "one-off" costs to occur in many years.

Cash flow: there is some funny accounting, with large "pre-publication costs" of books being capitalised and then amortised or written off.

Quarto enjoyed operating cash flow before movements in working capital of $38 million in 2018, up from $37.3 million the year before.

It then spent about $30 million of cash preparing books, with $32 million in total spent on investing activities. After all was said and done, there was roughly $6 million left over for interest payments and debt reduction.

My view: the enterprise value is c. $74 million. If the company could continue doing what it has just achieved in 2018, earning about $6 million in cash flow after investing activities, then I would think that it is attractively valued.

However, recent events have shown that there is a great deal of uncertainty surrounding the value of the company's investing activities, as huge amounts needed to be written off.

I don't feel qualified to judge its prospects at this point but it does strike me as interesting and worthy of additional research.

Orchard Funding (LON:ORCH)

- Share price: 84.5p (+3%)

- No. of shares: 21 million

- Market cap: £18 million

Half-year Results - six months ended 31.1.19

This specialist lender to professionals reports good results, with the loan book up by almost 10% and PBT up 18% on a like-for-like basis.

Pricing has weakened a little. Average gross rate on loans made is 6.2%, down from 6.5%.

The exciting bit about this company is that it's applying for a banking license, so it could end up being a similar type of story to PCF (LON:PCF) (in which I have a long position).

There is a link with another financial stock I'm involved with: Orchard's CEO and major shareholder is a director of Honeycomb Investment Trust (LON:HONY), the provider of a debt facility to Duke Royalty (LON:DUKE) (in which I have a long position).

Outlook - momentum has "continued to build" in Q3.

My view - I am leaning toward the view that this is undervalued, as it has equity of £14.6 million and seems to be earning a good return on that, even at its current small scale and before any conclusion to the banking license process. So I believe it should be trading at a range of 1.5x - 2x book value.

What's holding me back from getting involved with a starter position is the 6p spread. The free float is less than 10 million shares, so it is probably very illiquid. Apart from that, I quite like this one.

Driver (LON:DRV)

- Share price: 52.1p (-23%)

- No. of shares: 54 million

- Market cap: £28 million

Comment by drvodkaquickstep, who has a long position in DRV. Huge thanks for his input:

------------------------------------------------------------------

As any readers of this investment forum and others such as ADVFN will be aware, I have been a firm supporter of Driver (LON:DRV) since early / mid 2017 when they refinanced and brought new management in. From the 40p placing in Feb 2017 the valuation of the business more than doubled within 18 months; topping out at circa 85p last October.

This morning's Trading Statement noting some deferred and delayed commissions in their Middle East and Asian operations has therefore, not been well received by the market with the valuation down 26% as I write.

Frustratingly, the Trading Update was in mid-February last year and investors can only assume that some of the delayed contracts were hoped by management to be secured prior to the Trading Update but sadly not.

The valuation of the business has in fact been under pressure since the Year End (Sep 2018) and some questions marks have been raised this morning on social media concerning share sales by Directors (or their wives) in November 2018 and earlier this month along with a circa 1% share sale that was printed last Friday.

The weakness in the share price, a reduced cash position and the above noted transactions pre-TS do raise some questions and I have written to management this morning to express my concerns.

All of this said, Driver (LON:DRV) remain a leading expert in their field, are profitable, now pay a divi and have a solid order book.

The market reaction this morning seems unwarranted but current macro issues and perceived nervous investor sentiment means such news will be punished accordingly. Driver are a Top 3 holding for me so not a good start to the week.

And more:

Further to my initial comment above re: Driver (LON:DRV) I have since spoken to Gordon Wilkinson (CEO) and he confirmed his agreement to me relaying the content of our discussion here:

1) Trading Statement date. Gordon noted that whilst the trading statement was in February last year the Board did not want to release an update without the full facts on some of their delayed/deferred contracts and the necessary information to update the market was only recently made fully available to the Board. See 2) below...

2) Cash Collection. I quizzed Gordon re: the narrative in the statement concerning cash collection and he noted that a couple of staff members had had their "knuckles wrapped" re: timeliness of reporting both with respect to timely cash collection and the status of contract awards/delays. From my own professional experience in this sector I am fully aware of the challenges of contract award dates when a client will update you each week saying "yes the paperwork is on its way to you" only to get the same story for the next few weeks and sometime months making it very difficult when trying to forecast. Always better to err on the side of caution.

3) Recent Director / PMDR share sales. Personally I have a fairly relaxed attitude to Director share sales as everyone has their own reasons for selling although clearly it's not a sign of confidence. I questioned the sale (200k shares) in November 2018 by the Regional Director of the MEA business and Gordon noted it was off the back of the positive October trading statement (pre FY) and hence there was no reason for the Board to object to the sale. Equally Gordon was made aware of the intention by the wife of the UK MD to sell 25k shares in early February at which time again the Board had no reason to object to the sale. By the time the transaction was reported it was 1st March 2019 and he noted the timing could have been better.

It should be highlighted that Gordon personally owns and/or has options over circa 2m shares and hence he has some alignment with other shareholders.

4) Cash position. The £5m cash position noted in the TS is net cash (actually £5.1m) and compares to £6.9m net cash at the year end. The reason for the difference (reduction) pertains to the Group's contracts in Oman where the finance ministry are very slow to pay between Nov-Feb each year. The Group hence has to fund its Omani projects until payments are released from March onwards and Gordon noted that a six figure payment had recently been received with further payments due imminently.

5) Share price weakness in 2019. Gordon noted that the Board was made aware in November 2018 of one of their major shareholders wanting to reduce their holdings hence there has been some downward pressure on the share price. This may also possibly account for the large trade on Friday last week although the timing of this specific trade is still questionable.

6) Middle East staff. Some staff have been released in the Middle East due to a slowing workload. Having worked in the Middle East myself for 6 years I know how boom and bust it can be although its hard a strong run since 2010. Things will pick up again as sure as the sun sets and rises. The cost of these redundancies will not be treated as exceptional.

Summary

Gordon summarised our phone call by noting his own frustration given the turnaround of the business since 2017, the order book being at a record level and the core UK business (30% of sales) etc which is doing "very well". It would appear there is scope for the noted contract delays to fall into H2 although clearly nothing is certain.

With 10p a share in cash and assuming diluted EPS of circa 5p puts the Group, which is still on a growth trajectory, on a cash adjusted PE of less than 9.

Whilst this news is disappointing I plan to retain my holding and perceive the Group as increasingly likely to be the subject of future M&A should current prices persist.

END

That's it for today, cheers everyone!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.