Good morning!

Let's see what's on the RNS feed today:

- Fireangel Safety Technology (LON:FA.) - launch of Connect products. This fire safety company had yet another profit warning last week. Today it offers a rare good news announcement: information on its new product range.

This includes a touch screen smart panel for remote monitoring of devices. It "has been designed specifically to address the needs of housing associations and private landlords".

I was concerned that the company was looking to head into overly speculative territory with its new product range, but this sounds promising. Shares up 4% as I type.

- Gabelli Merger Plus+ Trust (LON:GMP) - statement on current trading. An unusual RNS from an unusual investment trust. It specialises in merger arbitrage, joining the London market last year.

Its share price has taken a beating since the release of a fairly innocuous RNS last month. Weak short-term performance might also be playing a role.

The company affirms today that there has been no material change to cause this sell-off, and instead blames "near term portfolio rebalancing by select shareholders; low August stock market volumes generally; and, lack of liquidity preventing full market price discovery".

I estimate the discount to NAV to currently be c. 12%.

- Chemring (LON:CHG) - incident at Chemring countermeasures. An employee has tragically died and another been badly injured at Chemring's flare manufacturing building near Salisbury.

The impact on the company is as follows: production at the site is suspended and underlying operating profit is expected to be £10 million - £20 million below previous expectations. Shares are down 16%. The company's performance has always been very unpredictable and the shares should be on a cheap rating, in my view.

- DP Eurasia NV (LON:DPEU) (I currently hold DPEU shares.) - no RNS, but the stock has collapsed anyway. It's down by 40% over the past two weeks, in sympathy with the Turkish Lira. The Lira dropped by 18% in a single day last Friday.

President Erdogan of Turkey was reported to have said:

“If there is anyone who has dollars or gold under their pillows, they should go exchange it for liras at our banks. This is a national, domestic battle,”

“Some countries have engaged in behaviour that protects coup plotters and knows no laws or justice,” he said. “Relations with countries who behave like this have reached a point beyond salvaging,” said Erdogan, who warned of “economic war.”

In the New York Times, he threatened to "start looking for new friends and allies" if the United States did not respect Turkey's sovereignty.

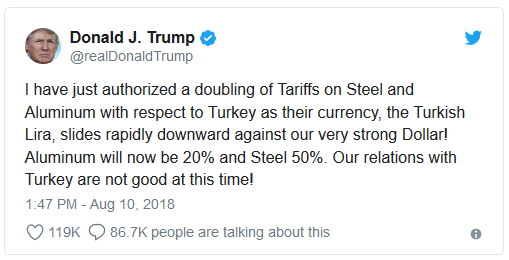

Trump responded as follows:

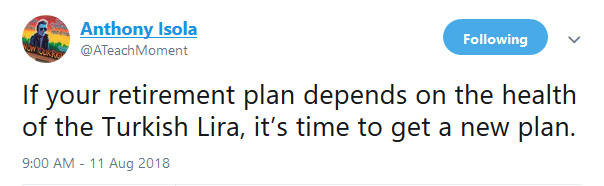

And so we ended up with this funny tweet from a financial advisor at Ritholtz:

Thankfully, my retirement plan depends on a few other factors apart from the Lira.

I entered my DPEU position knowing that

- the company was still early-stage in its expansion plans,

- there were political and currency risks in its markets (Turkey, Russia, etc), and

- it was a relatively recent listing, having only joined the market in 2017, and the probability of an accident was therefore elevated.

For these reasons, I made it my smallest position. It is now even smaller! And while I don't personally plan to sell in the short-term, I think it would rightfully be considered too risky for most investors.

I mentioned this last week, but it's worth repeating that Stockopedia has been nominated at another awards show - at Shares Magazine. It would be great for the team to win some more gold, so please consider voting in Categories 15 and 17. Here's the link.

Mincon (LON:MCON)

- Share price: 145p (+2%)

- No. of shares: 210 million

- Market cap: £305 million

Mincon Group plc (ESM:MIO AIM:MCON), the Irish engineering group specialising in the design, manufacture, sale and servicing of rock drilling tools and associated products, announces its half year results for the six months ended 30 June 2018.

Maybe we should start thinking of this as an Irish Somero Enterprises Inc (LON:SOM) ? Its super results suggest that it's drilling tools have a real competitive advantage (in Somero's case, the competitions appears to be virtually non-existent).

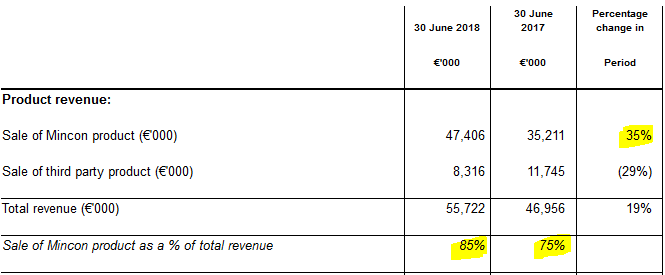

Mincon has been shifting to sell more and more of its own products, rather than 3rd party gear.

Own product sales are up 35% year-on-year, and are now 85% of total revenue:

The following prose hints at a very high-quality business:

Our goal is not revenue growth for its own sake, but sustainable earnings growth, and niche manufacturing to develop defendable intellectual property that underwrites our margins over time. We work to build long term sustainable, defensible market positions by offering value for money rather than price as our central proposition. We see better engineering as core to our product offering.

There was an acquisition in March 2018, so it has had some impact on today's numbers.

Excluding the acquisition, organic revenue growth is 12%.

But the company says the acquisition did not contribute much to the operating profit result (+19% before exceptionals).

It claims to have focused more on internal capex rather than acquisitions for the past two years, due to "aggressive bidding" that took away value opportunities.

All decisions are measured in relation to ROCE, cash flow and long-term returns - excellent.

Cyclical risk - this stock is likely going to be sensitive to changes in economic conditions. It has some international diversification, which does lessen the risk somewhat.

I note that today's statement says the company is experiencing levels of demand it has not encountered before, pushing up its profit margins. So we need to be careful that this high level of performance may not be achievable in future periods, if economic conditions deteriorate, even if it does have competitive advantage over its peers.

Outlook - confident. Conditions remain benign for now, and the company is planning for the long term.

Inventories - this deserves special mention. The company explains its rationale for this in the report, but inventories have increased by €9 million. This alone is sufficient to soak up all of the (pre-working capital movement) operating cash flow.

I am inclined to trust the company's rationale for this (to meet its expanding order book) but it does mean that the company is significantly less cash-rich at this time than it would otherwise be. The acquisition and increased capex have also dragged on the cash balance.

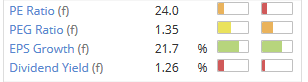

My overall view is that I have a very positive view of everything I've read from this company, and I'm inclined to think that management know what they are doing. The return on capital isn't huge (using Stocko numbers) but an above-average P/E ratio looks justified to me.

This is a stock for me to put on the watchlist, to research some more, and keep an eye out for a possible future buying opportunity.

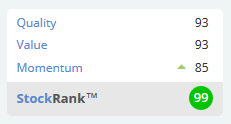

It's an expensive High Flyer:

Ocean Wilsons Holdings (LON:OCN)

- Share price: 1095p (-12%)

- No. of shares: 35 million

- Market cap: £388 million

This is a new one for me - I don't believe I've ever looked at it before.

It was included in the 2018 NAPS portfolio at the start of the year, with the share price around the current level. Here's the relevant article.

So what on earth does it do? It has two subsidiaries

- Wilson Sons is one of the largest providers of maritime services in Brazil. Wilson Sons activities include harbour and ocean towage, container terminal operation, offshore support services, logistics, small vessel construction and ship agency. Wilson Sons has over four thousand employees and operates in nearly thirty locations throughout Brazil. (OCN owns 58% of this.)

- Ocean Wilsons Investments Limited is a wholly owned Bermuda investment company. The Company holds a portfolio of international investments.

Now let's take a look at the interim report.

- Profit down 70% (measured in USD), thanks to a 4% fall in operating profit and a big loss in investment activities.

- Brazilian Real (BRL) currency is down 17% against the US dollar compared to six months previously.

There's a similarity with DP Eurasia NV (LON:DPEU) - a depreciating local currency is making the company's activities less valuable. Revenues are up when measured in BRL but down when measured in USD.

There are also more immediate tactical problems. "Stronger competition" has reduced volumes and pricing for its towage activities.

On the investment side of the equation, the portfolio shrinks just a tad due to a dividend payment it made to its parent, and management costs. A forgettable six months, in other words.

NAV: this is interesting. Ocean Wilson claims to have an NAV of £16.63 per share, using the share price for Wilson Sons on the Brazilian exchange and the value per share of its investment portfolio. So there is arguably a big discount available (made even bigger by recent share price falls).

Such a discount is quite easy to understand, however. We have a stock listed in London but with its main operating subsidiary working out of Brazil. Additionally, we have a large investment portfolio being managed out of a Bermuda subsidiary. It's likely to be too exotic for many people's tastes.

Major shareholders/insiders own most of the shares, and that's another feature that many investors tend to be wary of.

I'm not seeing a huge amount of quality in the returns statistics. Perhaps it's no surprise, given the heavy, industrial nature of maritime services. It's carrying c. $600 million of PPE, with the help of $320 million of borrowings.

I'm not surprised that I've not come across this before, as it's not a stock that would interest me in the ordinary course of events.

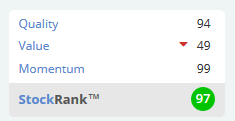

It does have a huge StockRank:

Indeed, the track record in profitability and dividends is pretty good. Despite the exotic locations of its activities and offshore registries, there is no reason to suggest that there is anything "shady" about the company.

But at the end of the day, I don't see much scope for someone on this side of the Atlantic to be able to analyse it properly. I don't think I'm able to, at any rate.

If you're happy to invest purely on the basis of a quantitative screen, that's fair enough. From a fundamental point of view, this feels inscrutable to me.

Plus500 (LON:PLUS)

- Share price: 1694p (-16%)

- No. of shares: 114 million

- Market cap: £1,931 million

I've been tempted to hang up my gloves as far as this stock is concerned.

After all, it's way above our market cap limits, and I've said pretty much everything I've wanted to say about it.

It's not even listed on AIM any more. It now has a premium listing on the Main Market.

At this stage, you have now probably decided whether or not you believe it is engaged in sound risk management. You have now probably decided whether or not you believe it has a sustainable business model.

The numbers continue to roar higher. Revenues are up by almost 150% and EPS up by almost 200% compared to H1 2017.

Revenue per user is up, while the cost of user acquisition is down. A nice combo.

Regulatory highlights

This is interesting. Plus500 previously said that 12% of its EEA customers "may be eligible" for elective professional status (i.e. could keep their current leverage limits), and these contributed about 75% of EEA revenues.

Today it says:

- Approximately 5% of the Company's overall EEA customer base has elected to become EPC to date,representing approximately 20% of Q2 revenues within the EEA.

That leaves a very long way to go to get to the 12%/75% estimates previously given.

Let's compare this to the recent news from IG Group (LON:IGG) (where I have a long position):

- The proportion of IG's UK and EU revenue generated by clients categorised as professional as at 30 June 2018, was over 40% in the preceding 3 months and the Group continues to expect this proportion to rise to 50%.

I believe that IG's customer base is more sophisticated on average than Plus500's, so I was greatly surprised by Plus500's original estimate as to how much of its revenues came from EPC-eligible customers.

The different speeds with which their customers are achieving EPC status leave my suspicions firmly intact.

Plus500 also says:

- Revenue from non-EEA countries represents approximately 29% of the Group's revenues

Pointing out that it has a cushion from the blow of ESMA's regs.

And:

- The EPC categorisation process is progressing broadly in line with the Group's expectations.

Most investors will interpret "broadly in line" to mean "not quite as we had hoped".

Outlook

Yet more interesting nuggets.

The company confirms it is ex-growth in the short-term, like others in the industry:

It is unlikely that the exceptional performance of H1 2018 will be repeated and the impact of rule changes will potentially affect less than half of EEA revenues (30% of Group revenues) in the short term

It phrases the outlook as follows: "Overall, the Group is on track to meet current market expectations for 2018".

It says it will outperform its peers "in what is expected to be a smaller overall market".

It was inevitable that Plus500 would eventually run up against some limits in addressable market in the territories where it has been established the longest. ESMA's new rules appear to have brought forward this day.

My view

It's a stunning H1 result so let's give the company credit for that.

The returns it has generated on its balance sheet are extraordinary. Using just $225 million of equity at the beginning of January 2018, and very little leverage, it generated $260 million of net income.

The cash balance is in excess of half a billion dollars, boosting its ability to withstand market shocks.

This huge cash balance helps to provide me with some reassurance that the risk of "blow-up" is perhaps not as great as I originally feared. All spread betting/CFD companies have implicit leverage, and therefore an implicit risk of catastrophe if their risk management policies aren't up to scratch.

If Plus500 keeps a massive cash balance like this at hand, to cover unexpected losses, then I will be less worried about the chance of a catastrophe. Naturally, there is a competing demand for shareholder dividends from this large pot of money.

The main worry now I would argue is the EPC eligibility of its EEA clients. In particular, how much of a hit is EEA revenue going to take? And will Plus500's unique risk management policies allow for continued strong performance with a much smaller pool of clients who can trade at high leverage?

This is another stock with a huge StockRank, but where I would argue there are unusual risks that are difficult to quantify. You pays your money and takes your choice!

Apologies for the large gap in coverage during the middle of the afternoon - my laptop finally went kaput on the day that my new machine arrived. This is the first SCVR typed up on the new workstation. Hopefully the first of many!

Have a great evening.

Kind regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.