Good morning!

There's plenty of news to digest today.

I'm going to update this list with planned coverage as the day unfolds:

- InterQuest (LON:ITQ) - proposed cancellation

- Servoca (LON:SVCA) - proposed cancellation

- Park (LON:PKG) - new FD

- Cerillion (LON:CER) - interim results

- Angling Direct (LON:ANG) - full year results

- Petards (LON:PEG) - acquisition

- Tern (LON:TERN) - raises £700k

InterQuest (LON:ITQ)

- Share price: 19.8p (unch.)

- No. of shares: 52 million

- Market cap: £10 million

Proposed cancellation of trading on AIM

The writing is on the wall for this small recruitment company. Insiders had previously tried to take it private at 42p.

The Independent Director advised shareholders to reject that offer, on the basis that it materially undervalued the company.

That was last summer. Since then, the Chairman has increased his stake by getting paid shares in deals Interquest made with another company he is involved in.

We now have another proposed cancellation, and the Chairman's holding company proposes to put a bid in in the market for 4.2 million shares at 24p, before the voting takes place. A huge discount even to the 42p price which the Independent Director believed was an undervaluation.

The announcement was released at 5.22pm on Friday evening. It said:

The Directors consider that the Cancellation is in the best interests of the Company and its Shareholders as a whole and therefore unanimously recommend that you vote in favour of the Resolutions

It would be very interesting to hear the Independent Director's rationale for this recommendation! Since the Chairman's bid at 24p is not mandatory, I suppose we can't object on the grounds that the proposal undervalues the company.

Almost 69% of votes have been pledged in favour of the resolutions. The Chairman plans to start buying shares in the market later this week, and this will bring the concert party's aggregate shareholding closer to if not above the 75% of votes needed to push it through.

Assuming that it goes ahead, if minority shareholders don't want to stay invested in a private company which will be completely dominated by its insiders, they must now either sell in the market for whatever they can get, or else hope that they succeed in connecting with the bid at 24p.

Personally, I think insiders should allow all minority shareholders the chance to exit, by bidding for all of their remaining shares, when they de-list. This probably isn't something that can be legally enforced, but it strikes me as the right thing to do.

After all, minority shareholders are significantly disadvantaged by cancellation. So I hope there are none left holding unwanted private shares if/when ITQ shares are cancelled.

Well done to Paul for predicting that this would happen.

I have some more general thoughts on micro-caps and cancellations, which I will discuss after looking at Servoca.

Servoca (LON:SVCA)

- Share price: 12.75p (-27%)

- No. of shares: 121.7 million

- Market cap: £15.5 million

Proposed cancellation of trading on AIM

Another recruitment company leaving AIM. Servoca has more of a public sector focus (education, healthcare, etc.)

This is simpler to describe than Interquest. Servoca's Board of Directors says that its share price is too low, so it would be unwilling to issue equity to fund growth or make acquisitions. It also says that trading is too illiquid (major shareholders own 80%), so the benefits of the listing don't outweigh the £150k p.a. costs.

I've just checked the volume history, and usually less than 1 million shares have been traded per month. At a share price over the last two years of about 25p, that's £250k of value traded per month, or £3 million per year (please bear with me - these are very rough estimates).

Paying £150k in costs to enable that volume of trading doesn't sound too bad, but the company also points out that it has been the major buyer of its own shares, through a share buy-back programme.

Buy-backs help liquidity in the short-run, but kill it in the long-run. So the situation was probably only going to get worse.

I don't blame the company for leaving AIM, but I do think it should give private shareholders a clean exit at a fair price.

The share price reaction today says it all - private shareholders value the company significantly less (>20%), given the prospect of cancellation.

Again, I don't see any way to legally enforce this, but I think the right thing to do is to give your minority shareholders an exit. A premium to the prevailing share price is a lot to ask, but why not at least offer to pay the weighted average share price over the past three or six months?

The concert party controlling 80% of Servoca's shares would need £4.9 million to buy out the remaining 20%, at a 20p share price. Considering that the minority shareholders have no choice in terms of whether or not cancellation goes ahead, and will be in a worse position afterwards, I would like to have seen a bid for their shares. Unfortunately, I don't think that is going to happen.

Cancellation Risk

This is within the category of liquidity risk - the risk that trading your shares will be difficult, expensive or impossible. When a share is cancelled, it becomes far less liquid, and is less valuable as a consequence.

As we've seen today, it's a very real issue. Especially for small-cap investors.

It's an issue that has affected me, too. Here are some thoughts on how I deal with it:

- Think about investment time horizon. If I don't need to sell my stake for many years or even at all, then liquidity may matter less. If I really like the company, and can afford to be very patient, then maybe I would be happy to hold it even if it's unlisted.

- Be careful as I build my stake. Note how difficult it is to buy a stake. Remember that many micro-caps are lobsters pots - easy enough to get into, but impossible to get out of. If buying in size is awkward, it's prudent to assume that selling in size will be impossible.

As we've seen today, a public listing costs c. £150k p.a. (this varies with the size of the company and its choice of advisers, etc.).

When you're looking at any company, a useful question to ask is why is it listed? This is one of the reasons I like to read about the backgrounds of companies - to learn how and why they came to market.

Good reasons to come to market:

- Size. It's a big company and it has an increasingly diverse shareholder base, who want to have a high-tech facility where they can trade.

- Growth. The company needs capital to fund its expansion, and the public markets offer the best price.

Questionable reasons:

- To raise its profile among customers. Millions of people buy Mars bars even though Mars, Inc. is private. While there may be exceptions, I believe that in general people don't care whether their supplier is a listed or a private company.

- To help founders/private equity to sell out. It's entirely natural that founders and private equity firms would come to the public markets to sell their shares, but their vast informational advantage means that they often do better than the general public in terms of pricing.

Red flags for cancellation risk, off the top of my head, would be:

- Less than £50 million, and especially less than £10 million market cap.

- Small free float (e.g. less than 50%).

- Very few shares trading every month.

- Not much organic growth.

- No plans to expand by raising new capital.

- Share buybacks.

- Not engaging with private investors.

- Poor relationships with private investors.

As usual in small-caps, a lot of the risk can be mitigated by looking into the personalities running your company. If they have a track record of treating shareholders decently, then hopefully there will be a fair outcome even if there has to be a cancellation some day.

It would be nice to read what other people think about this in the comments.

Park (LON:PKG)

- Share price: 77p (unch.)

- No. of shares: 185.6 million

- Market cap: £143 million

(Please note that I own shares in Park.)

Appointment of Group Finance Director

I don't usually comment on FD announcements, but noticed this one as I'm a shareholder. Park is a leader in gift cards, vouchers and Christmas savings schemes.

The current FD has been with the company since 2004. His departure has been flagged since December.

Park is a financial services company at heart so this makes for a particular emphasis on the FD role. I'm pleased to see that the chosen candidate has a background both in insurance and in retail - a good combination of financial services and high street business which should hopefully prepare him well for his new job.

FD departures can sometimes be alarming, but they can also be orderly and well-planned. This looks set to be the latter.

Cerillion (LON:CER)

- Share price: 129.5p (-9%)

- No. of shares: 29.5 million

- Market cap: £38 million

This is a software and services business which has traditionally served the telecoms industry. More recently, it has developed an application ("Skyline") which companies in any industry can use to manage customer subscriptions and payments.

I had a phone call with Louis Hall and Oliver Gilchrist (CEO and CFO, respectively) this morning, and will hopefully publish the transcript soon.

Today's results are in line with management expectations for EBITDA of £1.4 million (down from £1.5 million in H1 2017), as flagged in last month's trading update.

The outlook is positive according to management and yet the share price is lower - I'm guessing that this is due to the weaker net income reported for the period of £435k, vs. £725k last year. EPS is 1.47p, vs. 2.45p last year.

The deterioration is perhaps not as bad as it first appears. £160k of exceptional items are reported in relation to rental costs during the fit out of its new offices in London.

There were no exceptional items reported by Cerillion last year, so maybe it's ok to strip this expense out - I am ok with companies occasionally reporting exceptional items, for valid reasons. It's when exceptionals are reported nearly every year that I get suspicious!

£50k of share-based expenses are also adjusted out by the company. I would be inclined to leave these expenses in, as I view them as an alternative to paying cash bonuses.

I would be ok with using an adjusted operating profit figure of £680k (vs. £785k last year).

There is also a lot of intangible amortisation to consider: £700k during the six-month period. In total, there was £865k of depreciation and amortisation included in expenses. These are non-cash charges, so Cerillion's operating cash flow (before movements in working capital) is significant - £1.4 million (last year: £1.5 million).

Over £1 million was spent developing new intangible assets (£400k) and on PPE (£620k), but overall it's a pretty good cash performance and the company finished the period with £2.5 million in net cash, supporting a 7% increase in the interim dividend.

The main point about the earnings performance is that Cerillion was particularly exposed to the GBPUSD exchange rate, with a heavy weighting in USD income. GBP rallied during H1 and finished the period around $1.40. It's down to $1.35 now. These movements tend to balance themselves out in the long run.

On a constant-currency basis, Cerillion EBITDA would have been 13% higher, rather than falling in H1.

So I think when you take the FX movement and the exceptional property costs into account, this is a respectable H1 performance.

Going forward, results will remain order-driven, though recurring revenue is creeping higher and made it to 30% of the total in H1.

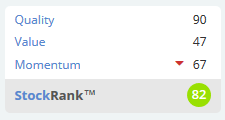

As previously noted, the algorithms quite like this stock. It particularly ticks the boxes as far as Quality is concerned:

Angling Direct (LON:ANG)

- Share price: 104p (unch.)

- No. of shares: 43 million

- Market cap: £45 million

I covered this Norwich-based fishing retailer when it released its pre-close trading update in February. See here.

IPO investors are probably happy so far. Results have been strong and the share price has improved from 67p to 104p.

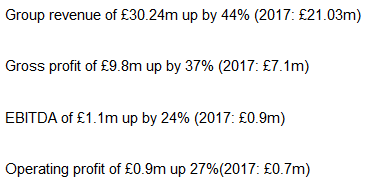

Financial highlights show some big percentage growth numbers, but it's important to remember that these are not same-store sales:

I think the important numbers are:

- Online sales up 54% (more sales online than in stores)

- Like-for-like store sales growth of 9%

Today's results are in line with expectations, and we also have a positive outlook:

We have been pleased to deliver like-for-like turnover growth through our store network and a strong online performance versus the same period last year, despite the year having started slower than anticipated due to the extreme cold winter weather conditions. The Board is confident that the Company will meet its full year growth target this year...

The strategy is to grow market share in a fragmented market:

The fishing tackle marketplace is large and very fragmented, with over 2,000 operators across the UK, which are mainly owner-managed. Given Angling Direct's financial strength and marketing capabilities, we see continued growth opportunities for the Group across our store network and online.

Something which I've come to realise over time is that marketplaces are often fragmented for a good reason. I wonder why fishing tackle has been so fragmented up until now, and why Angling Direct might be the group which finally consolidates it? The best e-commerce/digital marketing infrastructure, perhaps? Or something else?

Inventory turnover (COGS/Average Inventory) is 1.8x, which chucks out an estimate that it takes an average of 200 days to sell everything. We are getting used to seeing this sort of thing in the fishing industry, after witnessing the performance of Fishing Republic (LON:FISH).

Fortunately, there are significant trade payables which help to reduce the working capital requirement at Angling Direct.

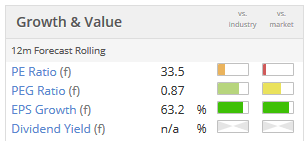

The shares are highly rated, there is no doubt about that:

The reason is that the company is showing signs of life - it's being active and doing things with its new stock market listing. It has strong online sales growth and wants to be the winner in its niche. This is the sort of thing that's worth paying up for (sometimes!)

I need a bit more help to understand the nature of Angling Direct's competitive advantage, but I maintain my positive impression of the stock and keep it on the watchlist.

Quick round-up. The other stocks I might have covered today are Petards and Tern.

Petards (LON:PEG): An acquisition by this rail/traffic solution group. Up to £1.5 million to be paid for a transportation software engineering company. The target made PBT of £262k in FY 2017. A £1.25 million bank loan is being used to help pay for it.

The deal sounds complementary for Petards. Best of luck to holders.

I have no ability to predict contract wins by Petards, so it's not for me.

Tern (LON:TERN): Raises more money at 18.5p. Six days ago, it raised £1.75 million. Today, it raises £700k at the same price.

Apologies to those who have done a significant amount of due diligence into this company. All I will repeat is that the NAV per share was last reported at 7.4p. If the true value is anything close to that, then it makes sense for the company to issue as many shares as possible at 18.5p.

Ok, that's it from me! Thanks for dropping by.

Kind regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.