Good morning folks,

Looks like it has been another interesting morning for updates.

I'm looking at the following:

- Carillion (LON:CLLN) (won't spend too long on this, as it's game over)

- Spectra Systems (LON:SPSY)

- Carclo (LON:CAR)

- Caledonia Mining (LON:CMCL)

- Judges Scientific (LON:JDG)

- Watkin Jones (LON:WJG)

- Spaceandpeople (LON:SAL)

This list is provisional. I'll see how things are going as the morning/afternoon progresses!

Also, Paul has written an article discussing how MiFID II has affected him. It's available here:

Cheers!

Graham

Carillion (LON:CLLN)

- Share price: Suspended.

Compulsory Liquidation of Carillion

Putting this here as a full stop for the story, which has reached its conclusion as far as shareholders in the construction support services group are concerned. It had about £900 million in financial debt through 2017, plus a £700 million pension deficit.

Late on Friday evening, an RNS informed us that the company was "in constructive dialogue in relation to additional short term financing while the longer term discussions are continuing".

It was completely out of cash, and needed new funds just to keep the lights on.

The lenders weren't willing to provide such funds, and the gap was too large to be plugged by fresh equity. So as of this morning, the shares are suspended.

Honestly, I'm a little surprised that the end came as abruptly as it did. It looked like there was going to be a conversion from debt to equity, along with a fundraising, so that existing shareholders were reduced to a token percentage holding.

Instead, existing shareholders will be reduced to zero, and the company will cease to exist in its current form. Employees, creditors and customers (including the Government) will need to figure out what happens next for them. The Construction Enquirer (external link) reports that work has temporarily stopped on "scores" of Carillion's former projects.

Pensioners will move to the Pension Protection Fund, meanwhile, which looks like it will be able to take care of most of their entitlements, particularly for those who have already retired.

From an investment point of view, maybe we should take note of the perils of investing in the support services sector, where other high-profile companies have also run into difficulties in recent years (Capita (LON:CPI) and Serco (LON:SRP) spring to mind). On a smaller scale, most SCVR readers will be aware of Lakehouse (LON:LAKE).

The economics of these companies are increasingly unappealing to me: long, uncertain B2B contracts with extremely price-sensitive customers and few sources of long-term competitive advantage. Maybe we are better off avoiding them altogether?

For those who are still interested in the sector, Carillion's joint venture partner Kier (LON:KIE) has seen its shares nudge higher this morning, and trades on less than 9x earnings.

Spectra Systems (LON:SPSY)

- Share price: 97p (+19%)

- No. of share: 45.3 million

- Market cap: £44 million

Licensing Agreement and Supply Agreement

This is a mysterious (to me), US-based security company, with expertise in banknotes.

Today's news concerns the extension of a licensing agreement to one of Spectra's technologies in perpetuity. $11.2 million in royalty payments will be received over the next five years. There is also a new material supply agreement with this licensee.

Royalty payments for intellectual property are the best source of cash - no further investment is required to generate them!

The next paragraph helps to explain today's share price increase:

It is estimated... that the combined licence and supplied material sales will generate a contribution per annum from this product through 2023 which is approximately 2.7 times that of the current agreement, based on the minimum purchase requirements in that agreement and experienced in certain recent years.

If I'm reading this correctly, the new agreement does not have minimum purchase requirements. But based on the minimum purchase requirements in the previous agreement, and trading in recent years, Spectra is expecting that revenues are set to increase 2.7x versus the previous agreement.

As such, results for the current year will significantly exceed market expectations.

This share has come to life in the past few months. Last October, it told us that 2017 would significantly exceed market expectations. And now we find that 2018 is going to do the same.

The company had $9.5 million in cash as of last June, so the balance sheet is super-healthy and the shares are cheaper on an enterprise value basis than they first appear.

Note that the license-related income will only last for the next five years, and then the customer will have the perpetual right to use Spectra's technology. This means we can't attach an earnings multiple to this source of income. We can only value it at $11 million, discounted for the time delay in receiving it.

The high-margin supply of materials to the customer, on the other hand, should hopefully continue. Note that 2017's superb result was due to one of the underlying central bank customers redesigning its notes, producing exceptional demand for Spectra's materials for the period.

The market cap in dollars is $60 million. If I cut a few corners and simply deduct last June's cash balance along with the anticipated royalty income, we are left with a $39 million valuation for the rest of the company.

It's an intriguing situation. The company earned $2.5 million in operating profit in H1 last year, which ordinarily would make a sub-$40 million valuation look rather cheap. It's entirely possible that the shares are still a bargain at this level.

Personally, I'm not entirely sold on the sustainability of earnings yet, so I'll have to put this in the "too difficult" basket for now. Central bank demand, and the banknote industry in generally, is highly unpredictable (just ask De La Rue (LON:DLAR) ).

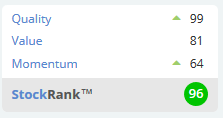

It's still one of the more interesting stocks to have popped up over the last few months. The StockRank is excellent, which is another good reason to investigate it. I don't think any software will be able to differentiate between Spectra's temporary royalty income, versus ongoing material-related sales, so do watch out for that.

Carclo (LON:CAR)

- Share price: 79p (-37%)

- No. of shares: 73 million

- Market cap: £58 million

Trading Update and Board Changes

This is a supplier of technical plastics products and specialist LED lights. Paul briefly covered it in November.

Checking its historic results, it had a great track record of profitability until 2015, when the results were ruined by £31 million in exceptional items, related to the closure of certain activities ("conductive inkjet technology") which it described as non-core.

Today's results are an example of a H2 results weighting failing to materialise in full, and as such performance for the current year will be significantly lower than planned. Profit expectations for 2018/2019 are also affected.

In both the Technical Plastics and the LED divisions, large contracts were delayed. Additionally, an important customer hasn't increased its orders yet despite previously indicating that it would have "a strong second half".

Board Changes - the FD will leave in March after 14 years. As I said with Quartix Holdings (LON:QTX), it's not a red flag for me when somebody leaves after a long stint such as this. The Chairman is also leaving, in July, after 12 years as an NED.

Some people like to keep an eye out for FD movements, and it's worth mentioning that Carclo (LON:CAR) has significant debts: £30 million in net debt as of September, which is forecast to rise by another few million through to this March. The bank requires Net Debt/EBITDA of no more than 2.75x. Carclo reiterates today that it "continues to operate well within its banking covenants".

While the FD leaving is not a red flag on its own, the timing is perhaps unfortunate. It would be a bit more reassuring for shareholders if he had left when news was benign.

Conclusion - the risk is somewhat elevated here, given the debt load which is now more than 50% of the market cap. The enterprise value is in the region of £90 million.

That said, the underlying businesses sound highly investable. The plastics business produces moulded components for medical/electronics products, and the LED business makes exterior lights for supercars.

I'd like to spend some more time understanding exactly how niche these businesses are. Performance over the past few years suggests that the company does enjoy strong pricing power.

Brokers have reduced adjusted PBT forecasts to £9 million (2018) and £11 million (2019). If a multiple of say 11x-12x PBT was justified, then the shares could be worth a purchase. Given the apparent concentration of the company's customer base. I probably couldn't justify an above-average earnings multiple here. 10x PBT might be about right.

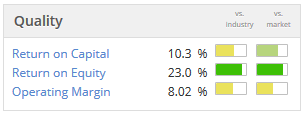

The quality stats are ok. I'm guessing the shares are priced about right for now.

Caledonia Mining (LON:CMCL)

- Share price: 555p (+3%)

- No. of shares: 10.6 million

- Market cap: £59 million

Record Quarterly and Annual Gold Production

We don't typically cover resources here. I just keep a few of them on my watchlist, and Caledonia is one of them.

The important features of Caledonia are:

- 49% ownership of a gold mine in Zimbabwe, which has a new business-friendly government.

- Virtually no share issuance for 10 years.

- Dividends since 2012, now paid quarterly.

- Good track record of meeting forecasts.

Today's update shows 16,400 ounces produced in Q4, a new quarterly record helping to make 2017 a record year. Total 2017 production was marginally above the forecast production range of 54k-56k ounces. The 2018 forecast range is 55k-59k ounces. The plan is to reach 80k ounces by 2021.

I use balance sheets to anchor my valuation of resources stocks; Caledonia had shareholders' equity of $58 million (£42 million) as of last June. Given the company's track record of profitability, the favourable gold price environment, and political developments in Zimbabwe, I would guess that the recent share price increase, and the current valuation, still leave an opportunity for new investors here.

Judges Scientific (LON:JDG)

- Share price: 2200p (+6%)

- No. of shares: 6.1 million

- Market cap: £134 million

Trading Update and Notice of Results

This is a scientific instruments group. It buys and builds small, niche businesses, and then lets them run independently of each other and the parent.

Management must be very disciplined, as the strategy has been executed with only moderate dilution to shareholders over the years.

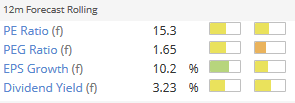

Today's update is ahead of market expectations, thanks to strong orders and an FX tailwind. According to Stockopedia, the expectations were for normalised 2017 EPS of 110p, rising to 124p in 2018. Those are a few percentage points lower compared to forecasts I can see elsewhere. Assuming that 2018 will be at the higher end of expectations, the 2018 PE ratio now appears around 16.5x.

Business is order-driven and can be a bit lumpy, so the order book is a good leading indicator of performance. It finished 2017 at 14.9 weeks of sales, an improvement on last year.

It's a short, neat update which has pushed the shares up in the direction of their all-time highs around £24, originally achieved in 2013 before some of the subsidiaries ran into difficulties.

I've been aware of Judges Scientific (LON:JDG) since it was covered on expectingvalue.com (external link) in 2015. If the management team do continue to compound value for many years, then your initial entry point doesn't matter so much - it will be virtually impossible to do badly with this share.

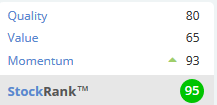

Stockopedia computers agree that it's a high-quality outfit. Value isn't quite so compelling at this point. As Ive hinted at, though, it's probably more worthwhile to think about the position in five or ten years, rather than the exact multiple where you buy in.

Watkin Jones (LON:WJG)

- Share price: 197p (-13%)

- No. of shares: 255 million

- Market cap: £504 million

This is a developer with a particular focus on student accommodation.

I've been urging caution with respect to its shares, and thus far haven't called it particularly well. I reckoned the shares were fairly valued at c. 120p, and overvalued in excess of 180p.

Today's results are in line with expectations.

3,300 beds were delivered on time for the 2017/2018 academic year, as planned.

9,000 student beds are in the pipeline, with 3,400 next year (2018/2019), and 2,700 the year after that (2019/2020). That's an 800-bed reduction for 2019/2020, compared to the estimate which I had previously noted.

The company is also involved with "build-to-rent" residential accommodation, and the management of student accommodation, and these activities appear to be doing well. It has five development sites in the build to rent sector, and is in negotiations with respect to other sites.

CEO Succession - the CEO is the ninth generation of the founding family to manage the company, and he will be moving on in due course. A formal search process begins to find his successor.

The reason given is as follows:

For personal reasons, Mark is not able to undertake a full time executive role over the longer term and he and the Board believe that it is in the Group's best interests to recruit a successor.

The Board will hope to keep him on as an NED. But as with any CEO change, it will be a distraction and a threat to continuity.

From a technical point of view, I wonder how much appetite the family still has to hold on to the shares? There was a very significant share sale at 145p last year, following the 2016 IPO, and it looks to me as if the company still hold 25-30% of the shares. This doesn't change the value of the business, but it potentially means that there will be further supply of shares to the market as a whole.

Having scanned through the results, it looks like the CEO news is responsible for the share price decline today. The outlook statement is entirely confident.

My opinion - I'm happy to admit that I may be unduly sceptical, but I'm still cautious on valuation here.

In student beds, Watkin Jones (LON:WJG) has forward-sold all ten of its developments for completion in the current financial year.

That gives it great visibility and reduces the capital which the company itself (i.e. its shareholders) needs to deploy. On the other hand, we need to remember that there are only ten developments in play this year. The company has executed very well in the past, but the risk of just a handful of projects going wrong is a major risk for shareholders.

And the annual output of beds doesn't look like its going to grow very much from here. So we can't rely on risk reduction via diversification and increased output.

While Watkin Jones (LON:WJG) sees growth opportunities "across all parts of the Group", it sees "greatest upside potential" in build to rent. As I mentioned above, it currently has five development sites in this space.

My concern around the valuation is not because I think the company is likely to execute badly. The track record says that the company is likely to execute very well.

My concern is that the stock market is attaching a significant earnings multiple to earnings which have arisen from success in a very modest number of transactions, and will only be repeated if the limited range of transactions which are in the works over the next few years also turn out to be successful.

Spaceandpeople (LON:SAL)

- Share price: 36.5p (+9%)

- No. of shares: 19.5 million

- Market cap: £7 million

Pre-Close Trading Update and Notice of Results

This is a media company which commercialises high-footfall locations. We regularly covered it before it fell below our £10 million threshold. I'm mentioning it here for completeness.

Revenue is line with expectations. Thanks to a favourable mix, profit before tax will be ahead of expectations at £1.2 million.

The company is now debt-free, wants to pay dividends again, and finished the year with adjusted net cash of £1.9 million. It's a great recovery story, albeit one which is not yet reflected in the share price.

On an ex-cash basis, the valuation is now about 5x PBT. That's after the shares approximately doubled from their lows last year.

Is it still good value here? Probably, yes. But we have to balance that against the company's small size and the illiquidity of the stock. It is cheap because of the extra risk you take when you buy a very small company which has disappointed investors in recent memory.

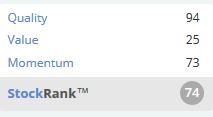

The StockRank is huge, thanks to a perfect ValueRank. If you just want old-fashioned value, and don't care about liquidity, this is worth a look.

I'm out of time for today, thanks for dropping by!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.