Good morning!

Some early comments on Duke Royalty (LON:DUKE), which made a major announcement on Friday evening after the market closed.

Duke Royalty (LON:DUKE)

- Share price: 47.8p (+0.4%)

- No. of shares: 96.9 million (before the fundraising)

- Market cap: £46 million

Fundraising to raise £44 million and notice of EGM

(Please note that I currently own DUKE shares.)

I covered this investment vehicle for the first time last month in response to reader requests, and then subsequently bought shares in it.

It claims to be the first non-resource royalty company to be publicly-listed in the UK.

Royalty investing is a type of mezzanine finance. It is more secure than equity investing, but less secure than traditional fixed income.

The concept makes sense to me and looks attractive as a potential compounder of returns, so I've taken a position. I could be wrong - as usual, remember that everything I say is just my opinion! It's not a recommendation.

The News

A key source of Duke's risk has been its lack of diversification. According to my previous calculations, 50% of its capital was scheduled for just two of its investments. 90% was scheduled for its top four.

A vehicle like this should not be a bet on just a handful of investees. It should exploit a good idea many times and be able to survive a few of its investments going bad.

To diversify quickly, it needs more capital. Therefore, it is now seeking to raise £44 million (gross) through the issue of 100 million new shares at 44p. This is in line with its strategy:

...to continue to build a diversified portfolio of royalty streams from companies ("Royalty Partners"), increasing its short to mid-term dividend yield and de-risking its business.

In previous rounds of funding, it raised £35 million at 40p.

My view

I view it as positive that the next round of funding is planned to go ahead at a higher share price compared to the previous rounds, and at a significant premium to the company's book value.

This bolsters my own suspicion that Duke will prove to be worth more than its book value, with the fundraising also of course having the practical consequence of massively increasing its firepower (more than doubling it).

With the increased firepower comes increased diversification. Based on all of the investments announced so far, I currently estimate that Duke's top two investments will account for c. 39% of capital deployed, while its top four will account for c. 72.5% (compare that with the percentages I gave you earlier). There will still be further capital available to deploy at that point.

Even more diversification will be needed, long-term, to make it a really confident hold for me. We need to be able to comfortably withstand some investments hitting the rocks.

The managers will need to continue to execute well, and perhaps need a bit of luck to see them through the next couple of reporting periods without a major mishap.

If they execute well and have the requisite luck, I think we can safely expect further fundraisings in future. Under this favourable outcome, we can furthermore expect healthy increases in Duke's quarterly dividend stream.

Dilution - Regular readers will know that I hate being diluted. Rules are there to be broken from time to time, however, and in this case I believe that dilution actually improves the risk:reward position of the existing shares.

The fundraising is at a premium to book value, so there is no wealth transfer from existing shareholders, and will help Duke to diversify its portfolio, thereby reducing the level of risk per share. So I'm ok with making an exception, in this case.

An EGM is set for 2nd August to seal the deal.

Remuneration

The latest edition of the UK Corporate Governance Code has been published by the FRC. I've been looking at the FRC's "Guidance on Board Effectiveness" which it publishes alongside the Code.

Most of it is straightforward enough. The section on Remuneration Policies has a few nuggets worth mentioning, namely:

It is important to avoid designing pay structures based solely on benchmarking to the market, or the advice of remuneration consultants, as there is a risk this could encourage an upward ratcheting effect on executive pay.

Indeed! We want independent thinking from Boards when it comes to pay, not just "this is the market rate" or "this is what our consultants advised us".

Other good points on remuneration in the Guidance:

- Incentives should not be detrimental to the long-term success of the company. Packages exposing executives to the company's share price 2-3 years after they leave can help.

- simpler structures can reduce the need for remuneration consultants and make it easier for shareholders to understand.

- for a performance based plan, it's good to use financial, non-financial and strategic measures (GN note: this possibly conflicts with the previous point about the benefits of simplicity - there are no easy answers!)

- Boards should be able to use their discretion, "to override formulaic outcomes". Sounds reasonable.

When it comes to beating the market and getting an edge over the algorithms, I believe that looking into remuneration can be a source of competitive advantages for investors.

We can predict CEO decisions based on a company's remuneration policy: does it reward share price growth, revenues, EBITDA or EPS? Does it take into account balance sheet safety and the company's return on capital? What are the hurdle rates? etc. etc.

The Code and Guidance look sensible to me on the question of remuneration. Let's hope that companies can be incentivised to put it into practice.

Other news: I am looking at company updates from Northern Bear (LON:NTBR) and Inland Homes (LON:INL) today.

Northern Bear (LON:NTBR)

- Share price: 80p (-2%)

- No. of shares: 18.5 million

- Market cap: £15 million

Preliminary Results for the Year Ended 31 March 2018

This is a small building services company with no broker research coverage. It does roofing, solar panels, health & safety, etc. We regularly cover it in the SCVR (see archives).

After a series of positive, ahead-of-expectations trading updates, I thought today's results might end up being even stronger than they have turned out to be.

We have PBT of £2.6 million, up from £2.4 million last year.

This is after charging some transaction costs related to an acquisition. If we add them back in, we get adjusted PBT of £2.75 million.

If we also add back amortisation of acquired intangibles (!), we get adjusted PBT of £2.85 million.

My finger-in-the-air estimate was that Northern Bear might do up to £3 million of PBT, so I suppose it wasn't far off when you look at it that way.

It was a very good performance, especially considering the difficult weather during the winter. The mess at Carillion was another scare.

The Chairman politely suggests that shareholders should relax with their phone calls:

I would like to assure our shareholders that, if the Group's results are likely to be materially affected by any such events, we will make an appropriate announcement immediately as is required by the AIM Rules for Companies. Our policy continues to be to avoid issuing unnecessary market updates, or creating an expectation of providing ongoing commentary, on wider market events when the Board does not expect the Group's performance to be materially affected.

Very sensible!

And it's good that the Chairman clears it up and commits to timeliness with respect to future announcements. Shareholders with bad experience at other companies may justifiably feel paranoid about this.

Special dividend - due to the exceptional performance, shareholders get an extra 1p special divi, on top of a 3p normal divi. Last year, it was a 1.5p special on top of a 2.5p normal. No change in the total, therefore.

Outlook - optimistic. "A high level of committed orders".

Acquisitions - hopefully, the company will remain very disciplined in relation to acquisitions. The Chairman promises that it will.

Cash flow - if you leave out tax, interest and working capital movements, the cash generated from operations is £3.5 million.

That's quite huge, relative to its market cap, and gives an insight into why the company feels confident to pay out special dividends while also looking at fresh acquisition opportunities.

My view

These results don't change my view of the company. It looks like a nice cheap business being managed well and with a bit of trading momentum behind it.

The reason I'm not personally getting involved with it is purely related to the sector that it's in. Building support services, as a sector, doesn't do it for me.

If I had to buy a stock in this sector, though? I would probably buy this one.

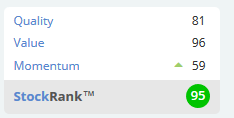

The StockRanks love it, and it's not hard to see why. Small, cheap, growing, profitable companies generally outperform the market. This is classified as a Super Stock.

Addendum: There is lively debate online regarding whether NTBR has engaged well with its investors. Some shareholders did not appreciate the chairman's comment this morning regarding investor inquiries, as they think that the overall level of communication from the company is poor.

I haven't got a dog in this particular fight, and I thought that chairman's comment was sensible in isolation, but I thought I would mention this for completeness.

Inland Homes (LON:INL)

- Share price: 66.5p (+2%)

- No. of shares: 202 million

- Market cap: £134 million

(For the avoidance of doubt, please note that I do not currently hold INL shares.)

Trading at this house builder has been in line with expectations.

I held this stock during H1 of this year, as I felt that it was fairly low-risk. The shares have been trading at a material discount to EPRA NAV, i.e. to net asset value taking into account the updated valuations of its properties.

My view on that hasn't changed.

The operational highlights today show further progress on a range of fronts. Revenues and completions are up significantly (67% and 46%, respectively).

On the negative side, forward sales and the number of plots with consent are both down materially (by 23% and 26.5%, respectively).

Total land bank plots are unchanged at c. 6,800, so hopefully planning consent will come through for the rest of the plots in due course.

The commentary is encouraging. Inland is diversifying into the private rented sector with KCR Residential Reit (LON:KCR) and has submitted its largest ever planning application at a 30-acre site in Cheshunt.

Outlook - very good. Customer demand remains strong. It is in the south/south-east, not in central London, so is not directly affected by price weakness in the capital.

Profitability is underpinned by interest rates and Help to Buy. Those expecting a wider property market crash will of course be staying away from this stock.

My view - Even though I couldn't find a space for it in my own portfolio any longer, I still think this is a reasonable holding, trading at a modest valuation relative to its NAV (which is how I value house builders). The outlook remains very good, albeit with an element of uncertainty over planning consent.

Net debt of £80 million also introduces some financial risk. The amount of gearing used looks ok to me, relative to total assets of £270 million (using its most recent balance sheet).

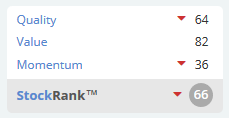

So I retain a warm view of this stock, as does Stocko. The main drag on its StockRank recently has been Momentum, as the share price hasn't made much progress in a while:

Unless something else pops up that I feel compelled to write about, that will be all for today. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.