Good morning!

Mello Trusts & Funds

The first thing I wanted to do this morning was bring your attention to a new Mello event, to be held this year on the day before the main event in London. Mello Investment Trusts & Funds will be of interest not just to those of you who invest in funds, but also perhaps to those of you who invest in the fund management companies themselves. For example, I will be there to hear speakers from Polar Capital Holdings (LON:POLR) and Impax Asset Management (LON:IPX).

It's on Wednesday May 15th at the Clayton Hotel in Chiswick - convenient for Mello 2019 attendees, who only need to arrive one day early to attend.

PI World Interview

I was recently interviewed by Tamzin Freeman at PI World. We started out by discussing the initial steps that people take on the road to being experienced/professional investors, before moving on to discuss some of the things I've learned along the way and how my own strategy has evolved.

The video was published this morning - here's the link.

Right, let's take a look at today's news:

- McColl's Retail (LON:MCLS) - final results

- Victoria (LON:VCP) - trading update

- City of London Investment (LON:CLIG) - final results

- Angling Direct (LON:ANG) -trading update

- Croma Security Solutions (LON:CSSG) - trading update

McColl's Retail (LON:MCLS)

- Share price: 56.8p (+12%)

- No. of shares: 115 million

- Market cap: £65 million

McColl's Retail Group plc, the UK convenience retailer, ("McColl's" or "the Group") today announces its preliminary results for the 52 week period ended 25 November 2018, and a trading update for the 11 week period to 10 February 2019.

Strong share price reaction at McColl's today but we must remember that it's from a very low base - in the good times, it almost reached 300p (see my view when the share price was 280p).

The 2014 IPO was at 191p, so IPO investors are sitting on a 70% loss over 5 years, before we account for dividends.

Paul and I have provided mostly negative coverage, with Paul most recently saying: "I see nothing attractive about this share at all".

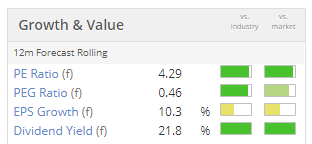

The Value numbers on Stocko (as of last night) signalled that the previous profit and dividend forecasts were unsustainable, with unrealistic metrics:

Let's take the key points from these results:

- Like-for-like sales still falling in FY 2018 but gradually improving throughout the year.

LfLs down 1.4% for the whole year, but had been down 2.7% in H1. Q4 was flat and Q1 FY 2019 LfLs are up 1.2% so far.

- Gross margin down by 80 basis points due to the "supply chain challenges" (supplier Palmer & Harvey going bust) and strong tobacco sales in the mix.

The reduction in gross margin comes despite the company's deliberate efforts to raise it by focusing on food and alcohol.

- Net debt down by over £40 million to £99 million.

- Final dividend is almost cancelled, as Paul predicted and as the unrealistic dividend yield suggested. Reduced to 0.6p from 6.9p last year. A sensible move to preserve the balance sheet.

Some reasons to think the future might be brighter and safer:

- 66 under-performing sites disposed (total portfolio is 1,550 stores).

- Increased comfort with new supplier Morrisons for 1,300 stores.

- banking terms revised.

- New CFO in position as of last month. He was previously CEO at Welcome Break (chain of motorway service stations).

Outlook: adjusted EBITDA for FY 2019 to be a "modest improvement" on FY 2018. Adjusted EBITDA for FY 2018 is £35 million, translating to PBT of £8 million.

My view

As I've said before, I continue to view this as a "no-moat business". Or in Paul's words, it gets pressure from all sides: from suppliers (who have to protect their own margin or else go bust, like P&H), from employee costs (National Living Wage, etc.) and from intense competition in grocery retail.

The company acknowledges that costs aren't going in any direction except up and that grocery will remain "intensely competitive".

Cost pressures are expected to intensify in 2019, with a further increase in wage rates, energy inflation and an increase in our annual rent following our sale and leaseback activity.

Besides the lack of a moat to protect it from all these pricing and competitive pressures, there is also the debt load to consider.

Net debt to EBITDA was 2.8x at the end of FY 2018, not far off the banking covenant of 3.0x.

The bank has agreed to raise the covenant to 3.25x for the test at the end of Q1. It will then reduce to 3x again for the rest of the year.

While McColl's should be able to pass these tests, it shows how strained the balance sheet has become that changing the covenants became necessary.

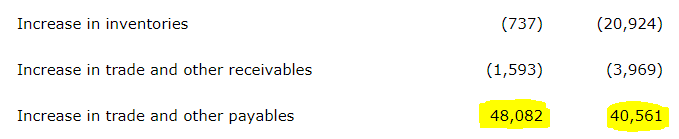

Situation vs suppliers: over the last two years, the company has generated a total of £125 million cash (pre-tax) from operations. This sounds impressive, but £89 million of this amount has come from its suppliers. Trade payable are now an enormous £213 million.

From the cash flow statement:

This is not a sustainable form of cash flow, so I would be cautious that operating cash flow over the past two years has been artificially influenced by this factor.

And while this is perhaps normal for a company in this sector, it creates a financial dependence on its suppliers. The latest current ratio for McColl's is only 0.67 (down from 0.75 last year), and trade and other payables are financing over 40% of the company's entire asset base (up from 35% last year).

The interest bill at the bank has also increased, and the coverage ratio (operating profit divided by finance costs) is now only 2x (down from 4x last year). This means that about half of operating profit was paid out in interest costs.

In conclusion, the company is walking a financial and operating tightrope with winds being blown at it by its bank, its suppliers, employees and competitors. It might pull through but I wouldn't be tempted to bet on it. I just don't think I'd ever be able to sleep soundly if this was in my portfolio.

Victoria (LON:VCP)

- Share price: 373.5p (-13.5%)

- No. of shares: 125 million

- Market cap: £468 million

This flooring company continues its return from the stratosphere, back to the small-cap territory where it arguably belongs.

Today's report confirms that it is continuing to pursue market share in difficult market conditions and at the expense of margins, despite this having unsettled some shareholders.

Financial outlook:

...the Group expects that the current-year to March 2019 EBITDA is likely to be £95m-£97 million (2018: £64.7m), with the Group's 2019 underlying pre-tax profits being around 35-39% higher than 2018 (2018: £40.8m).

For FY 2020, Victoria explains its plans to grow profits in each segment:

- UK & Europe hard flooring: integrating production facilities, administrative functions and procurement in Spain to add €5 - €5.5 million in pre-tax earnings. Another €6 million from owning a recent acquisition for the entire financial year.

- UK & Europe soft flooring: an additional £10 million boost from a new production line, logisitics efficiencies and eliminating >100 full-time employees.

- Australia: AUD $1.5 million in benefits from consolidation.

Cash generation: rather like the company discussed in the previous section, Victoria promises to reduce debt over the next 12 months. Stock levels at the latest acquisition will be reduced, so that it will tie up less capital and enable debt to be paid down (bringing efficiencies like this to its new companies has always been an important part of the investment thesis).

My view

I don't buy anything related to floor coverings any more, having seen too many disasters and having lost good money myself trying to participate in the sector.

There are also some company-specific reasons to be cautious about VCP, namely the massive debt load and the acquisition strategy which has worked out so far but which makes it somethng of a high-risk play.

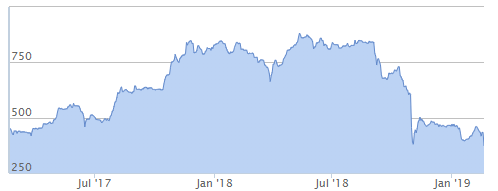

Late last year, it attempted to issue €450 million in BB bonds, but had to abandon this attempt as the yield demanded by bond investors was too high. This helped to collapse the equity market's confidence in the shares, resulting in the following share price chart:

If bond investors weren't willing to finance the company at a reasonable price, it's a good sign to me that prospective equity investors should demand keen pricing, too (i.e. a lower share price).

The company's enterprise value based on the September 2018 debt load is in excess of £800 million, which represents a significant premium to its tangible assets (£520 million) but a discount to its entire asset base (tangible and intangible) of £1 billion.

This is very much a bet on the integrity and the ability of the Executive Chairman, who has been the singular driving force behind the company's strategy. Has he bitten off more than he can chew? Is the relentless pursuit of growth eventually going to come back and bite it? This is what we need to ask.

I can't predict how it's going to work out, but the company goes against several of my rules of thumb, i.e. to avoid:

- floor covering companies

- buy-and-build strategies

- debt-fueled strategies

- companies in non-financial industries being managed by former investment bankers

I'd be very pleased for shareholders if it does work out, but it's not something that I personally would want to own. If it ever issued high yield bonds, they would suit my risk tolerance much more than the equity!

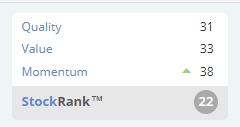

The StockRanks and I are in agreement in this instance, with Victoria being classified as a Sucker Stock:

The Altman Z-Score is also worth noting - according to Stockopedia:

Victoria has an Altman Z1 of 1.34 indicating a serious risk of financial distress within the next 2 years.

If you can believe the story and expect to see the creation of a sustainably profitable group of integrated business, I can see why it might be worth a small punt. Pricing is now much more attractive than it was a year ago, when the share price was around 850p. But betting big on this company seems to me like it would be asking for trouble.

City of London Investment (LON:CLIG)

- Share price: 396p (+3%)

- No. of shares: 27 million

- Market cap: £106 million

Half-year results and dividend declaration

City of London (LSE:CLIG) announces half year results for the six months to 31st December 2018.

This is a fund manger with a niche in emerging-market investment trusts (edit: thanks for the correction - it has nothing to do with City of London Investment Trust (LON:CTY) ).

Key points from today's update:

- Funds under management boosted in January 2019 back up to $5.1 billion, the same level as at the beginning of July 2018. The overall trend in calendar year 2018 was negative.

- H1 PBT is down 21% to £5.2 million.

Note that the broader markets were down 15%-16% in 2018. As such, most of the reduction in fund size and profits is due to market movements. There were also "marginal net outflows" and a reduction in fee margin contributing to the fall in profitability.

- Fund relative returns are mixed, with a small outperformance from CLIG's core strategy, but underperformance from other strategies.

- Interim dividend unchanged, special dividend of 13.5p declared on top. A nice explanation is given that the company agrees it should have a "use it or lose it" attitude to its cash pile!

Outlook statement - nothing too specific, but CLIG is confident that it will battle through the challenging conditions at present.

KPIs - the company is changing its key performance indicators. I wouldn't be a big fan of the previous or the new KPIs, as they are all based on CLIG's share price performance. But at least they do have a good long-term view: they want to compound their share price at 7.5% - 12.5% on a rolling 5-year basis.

Stock overhang - the retiring CEO, who has a 7.5% stake in the business, intends to sell 500,000 shares at each of 450p, 475p and 500p. This might depress the share price in the short and medium term until his share sales are cleared, but I wouldn't let it put me off investing in CLIG. Something similar (but in much larger size) is happening at Ashmore (LON:ASHM).

My view

I am interested in this share. As readers will know, I follow the fund manager stocks and like to keep an eye out for ones which have a niche and are well-managed.

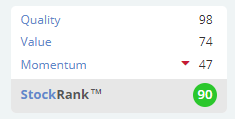

CLIG seems to fit the bill with an attractive long-term track record of profitability and high returns (ROCE is generally extremely high). It also has a StockRank of 90, with a forecast dividend yield of 7% and EB/EBITDA muliple of only 6.4x. Will keep reading about it.

From a timing point of view, sentiment is rather muted at the moment given the sell-offs in various equity indices, so it could also be a good way to bet on a rebound in global equity markets.

I've considered opening a starter position in it this morning. Unfortunately, the bid-offer spread is rather wide (>4%). This means I can't really open a starter position until I have enough conviction to make it a long-term hold. So I'll just keep an eye on it for now.

Angling Direct (LON:ANG)

- Share price: 72p (-1%)

- No. of shares: 64.6 million

- Market cap: £47 million

This is a pre-close update for the financial year ending January 2019.

Key points:

- like-for-like store sales are up 6.2%

- 3 new fishing stores opened

- online sales up 30%

- sales at its international websites almost doubled (from a low base).

Outlook - in line to meet its targets for the year.

My view - Good to see a company using its listing to raise money and expand. That is what the stock market is for, after all! It raised £20 million back in October, with the intention to nearly double its store portfolio and develop the roll-out of its international websites.

The October placing was at 92.5p. That makes for a nice discount at the current level, if you want to get involved.

But consensus forecasts suggest that the company will be loss-making this year. There is going to be some patience required to see it through to profitability.

Personally, while I don't hate the business by any means, I would have to be convinced that it is going to create a valuable customer franchise in order to seriously consider investing in it. It does talk today about positive signs in terms of customer loyalty and repeat business, which is encouraging. I will wish it good luck from the sidelines.

Croma Security Solutions (LON:CSSG)

- Share price: 97p (+9.5%)

- No. of shares: 16 million

- Market cap: £16 million

I mention this as a small but curious security play, that seems to be doing well for its clients.

Croma Vigilant, a security services division with over 1,200 security professionals on its books, is still trading at record levels despite the previous year benefiting from large one-off contracts which were not expected to repeat.

Croma Systems (CCTV, alarms and locks) is also experiencing "good demand".

The Strategy section stands out to me. I won't quote it in full here; essentially, Croma wants to become "the British homeland security brand". It will achieve this through:

- its differentiated, premium guarding services with an ex-military ethos.

- a national network of security centres to retail its products.

I don't normally get involved in support services, but I'd be open to the idea of backing a company that is doing things in a new way and is set to grow.This is a profitable dividend payer which I think deserves additional research.

Going to call it a day there, cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.