Good morning!

For a few days last week, there was little else on my twitter feed other than views on the Brexit withdrawal agreement.

That's understandable. It's also rather overwhelming. And I much prefer to look at company news and think about my portfolio holdings instead of reading 600 pages of legalese.

The headlines which I really care about are those relating to the value of the pound. When Mrs. May lost another Brexit secretary on a chaotic Thursday morning last week, the pound weakened considerably against the euro.

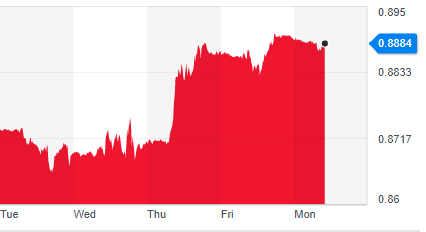

This chart shows the strengthening of the EURGBP exchange rate (i.e. the weakening of the pound) over the past five trading days:

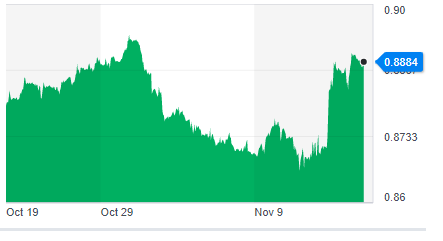

Let's zoom out. Monthly view:

The truth is that little has changed. Optimism that a deal would be reached led to a strengthening of the pound, but this optimism collapsed as of last week. So we are back around where we started.

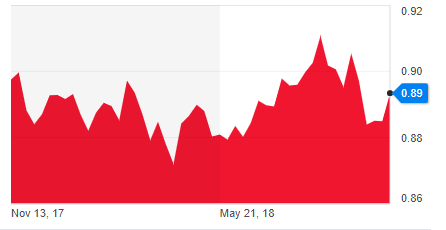

The annual view doesn't provide us with much of a trend either:

So there's been basically nothing in terms of net progress for the pound.

I attended a Jim Mellon talk during my recent trip to Manchester. Among the topics he covered was the outlook for the pound - and I completely agree with him that it is undervalued (granted, I am talking my own book here).

Jim cited the Big Mac Index as evidence for his hypothesis. A Big Mac is cheaper when bought in the UK and this simple metric suggests that GBP is cheap against CHF, USD, NOK, CAD, EUR, DKK and AUD. That's a lot of important exchange rates where the pound could be due for a little bit of strength. The percentage undervaluation that is implied against the euro is 11%.

My stance on GBP has been clear for a long time: I've repeated the mantra that investors hate uncertainty and that the pound will remain "cheap" until there is a resolution to the Brexit negotiations.

Once we have a clear and agreed Brexit outcome, I can see the pound recovering much of its devaluation against the euro. As far as the pound is concerned in the short-term, almost any deal is better than no deal and the continued uncertainty it engenders.

But there are higher goals than short-term currency strength. So I don't think we are going to get a resolution very soon.

Long-term, I don't see why the pound can't recover and be structurally far stronger than the euro, as that strange currency attempts to tape together the economies of Italy, Greece, etc with its Franco-German centre.

Anyway, with the kerfuffle around Brexit rumbling along for the past several years, I think UK shares have been unfairly neglected by international investors. Stockopedia reckons that the median forecast P/E ratio for all shares with estimates is merely 12.1x.

That's a prospective earnings yield of more than 8%. Surely that's a good deal? It seems that way to me, and so while the FTSE stays around the 7000 mark, I intend to continue dripping funds into UK equities.

Last week, I added Rightmove (LON:RMV) to my portfolio. We've covered this a few times in the SCVR (see the archives). I've said before that I like the company and hoped there would be a good time to buy it. At a forecast P/E ratio of 23x, I finally took the plunge.

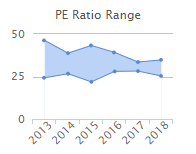

Stockopedia records the historical PE ratio range as follows:

As you can hopefully see, the bottom of the range this year is about as attractive as pricing gets for this share, at least up to now. So I'm happy to have added it.

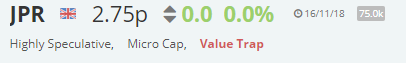

In case you haven't noticed, the RNS feed is rather uninspiring today. But I intend to mention Johnston Press (LON:JPR) and possibly 600 (LON:SIXH).

Johnston Press (LON:JPR)

- Share price: 2.745p (suspended)

- No. of shares: 106 million

- Market cap: £3 million

Multiple announcements by JPR today. In addition to the appointment of administrators, there was a Strategic Review Update, announcing the end of the formal sale process.

My last statement on JPR suggested that the shares were worth buttons. It will be difficult even to get buttons for JPR shares today.

The story ends with a pre-pack administration and the sale of the business, as a going concern, to a group of bondholders. The group pension scheme will probably end up in the taxpayer's hands, i.e. in the Pension Protection Fund, resulting in some reduction in the payouts to staff.

The largest shareholder is Custos, the investment vehicle owned by a Norwegian businessman. He issued a very strong response over the weekend, which is worth putting here as a post-script to the story. Excerpts include:

"... we have been thwarted by a self-serving board which, in clear breach of its fiduciary duties, has only been interested in protecting itself and the bondholders."

"When issuing the bond, the Board included a "poison pill" in its terms, the first of its kind in the UK, which meant that the overall control of the Board was safe gaurded as if that were to be changed, then that would trigger the repayment of the £225 million bond debt."

"According to all the public statements of the Board, Johnston Press has a reasonable cashflow and was not insolvent. Indeed, the bond debt is not due and payable until June 2019 - another 7 months away! We believe this is plenty of time for us to have managed to put in place a refinancing had we only been given the chance.... The strategic review and the formal sale process were nothing more than a complete sham."

I have a little bit of sympathy for this point of view. It's a good point that the bonds aren't due for another 7 months - so why go into administration at this stage?

Perhaps the directors did not want to be accused of wrongful trading. Wrongful trading is when company directors continue trading "beyond a point in time when they knew, or ought to have ascertained, that insolvent liquidation was inevitable." The Directors have said today that they believe the shares are worthless, because refinancing is impossible. If that's their belief, then putting the company into administration is the correct thing to do.

As to whether public statements were misleading, the most recent interim results from JPR acknowledged the material uncertainty around whether the bonds could be refinanced. That uncertainty clearly implies the risk of insolvency, even if the company is profitable on an operating basis and has positive cash flow.

It must be frustrating for Custos if they think a refinancing could have been achieved, and maybe Custos is correct that the Board is incompetent, but these shares were clearly very high-risk.

Stockopedia algorithms correctly identified it as a Value Trap:

Cyanconnode Holdings (LON:CYAN)

- Share price: 10p (-0.5%)

- No. of shares: 182 million

- Market cap: £18 million

Frost and Sullivan Company of the Year Award

I don't know anything about this company, though Paul has rated it uninvestible. It is categorised as a Sucker Stock by Stockopedia. So the signs aren't great, at first glance.

This RNS caught my eye. Frost and Sullivan... haven't I heard of them before?

Ah yes. This is the same group which ranked Naibu as the 10th largest Chinese sportswear brand.

There is no shame whatsoever in making mistakes. Perhaps F&S really did think that Naibu was the 10th largest Chinese sportswear brand. And I'm sure it's their honest opinion that Cyanconnode deserves to be named 2018 Company of the Year for the Global Smart Metering Industry.

But I wonder if Cyanconnode has made a payment to F&S? It would be worth knowing if F&S uses its awards to generate large fees from companies such as Cyanconnode and Naibu. It would be worth knowing if the business model is to allow companies to disclose the wonderful awards they've received from F&S, in exchange for cold hard cash.

AJ Bell

Confirmation of Intention to Float

This will be worth keeping an eye on - I have heard good things about AJ Bell. You can expect me to cover this from now on.

It's worth mentioning that no new money is being raised for the company through this IPO.

600 (LON:SIXH)

- Share price: 17p (-2%)

- No. of shares: 113 million

- Market cap: £19 million

This engineering group has transformed and simplified its financials by farming out its pension fund. This was possible because it was in surplus - a very nice position to be in.

Reflecting confidence, there is an interim dividend of 0.25p per share.

That's a big deal. The company hadn't paid any dividends since 2005, until making a 0.5p payment in September. The yield is therefore between 4% and 5% at the current share price (Stocko thinks the yield is 5% on a forecast basis).

PBT for H1 is $1 million ($1.46 million underlying), versus $2.7 million last year ($1.07 million underlying).

The items excluded from the underlying calculation are largely to do with the pension scheme, so I'd be inclined to allow them a decent weight in my calculation.

Outlook:

Despite certain macro-economic and political uncertainties across our end markets, enquiry and quotation activity remains good with revenue visibility underpinned by an improved orderbook.

My view

Thank you to the reader who reminded us in the comments of the existence of £8.5 million of loan notes, convertible at 20p.

Net debt is $17 million (£13 million) so the enterprise value is c. £32 million.

Taking the convertible debt into account, the shares look fairly valued to me. There is some scope for upward progress, but the convertible debt looks like a serious overhang.

I can't see anything else that I would like to report on, so will leave it there for now. Cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.