Morning!

Not sure if "good morning" is appropriate on a day like this, as most of us prefer it when stocks are moving upwards rather than getting crushed, as they currently are.

The FTSE is flirting with the 7000 level. This is proper correction territory versus the 7900 high seen in June.

What's most interesting to me is the speed of the rout. The past six sessions, including today's, have seen five dramatic falls, each of them the best part of 100 points (92, 100, 85, 92, and then 130 so far today).

The AIM All-Share Index has been even more dramatic. It's down something like 13% so far this month with some really severe falls along the way.

The NASDAQ 100 finished yesterday's session down 4.4% and looks set to open very weak again today.

I've consistently maintained that the NASDAQ has been home to the worst overvaluations of the long-term bull market we've been living in. So far, it has only returned to the levels from June this year. It has a lot further to fall, in my view.

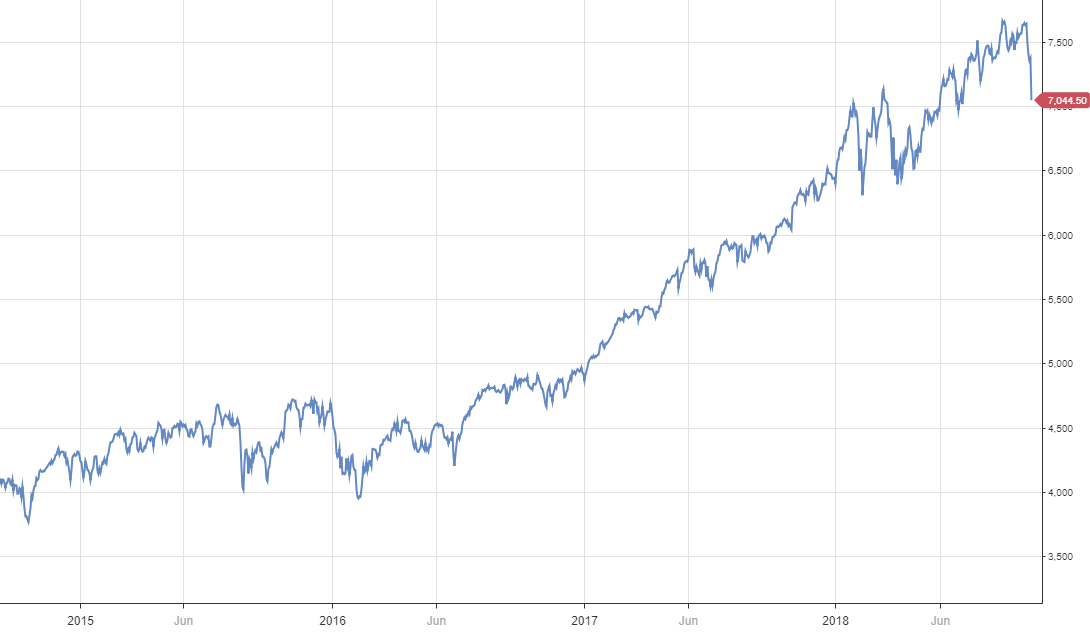

For context, here is the chart going back to 2015:

This index has performed spectacularly since 2009, which is (not coincidentally) around that period of time when interest rates hit rock bottom. At the low point, it nearly hit 1000. It's now at 7000.

Simple rules of finance suggest that when Interest rates return to normal levels, asset valuations should too. Valuations are based on discounted cash flows, after all. I think that normalisation is healthy, but it's undoubtedly going to be painful in the short-term for many.

On a personal note, I made the difficult decision last night to close my leveraged positions: both my Tesla short (which was in profit) and my short FTSE put position (which was in a loss position). In the end, I made a small net profit from these positions.

However, I needed a bit more personal liquidity, so I wanted my collateral back. I'd actually love to open both of these positions (short Tesla and short FTSE puts) again, when my personal circumstances allow. I am now almost completely unleveraged.

These are exciting times. We could get some very attractive buying opportunities in the months ahead - that's particularly exciting for someone like myself, who rarely ever sells anything.

Some shares already look much too cheap to me. For example, I've been thinking about accumulating some more H & T (LON:HAT), which is now trading at a P/E of 8x according to Stocko. But there are lots of others to consider, too.

If you like cheap shares, then corrections and bear markets are the best of times. Let's make the most of it!

Right, onto today's news. Sorry for the slow start - I was up late last night monitoring the situation in the US and figuring out what to do!

There is news today from:

- N Brown (LON:BWNG)

- Norcros (LON:NXR)

- Sanderson (LON:SND)

- Onthemarket (LON:OTMP)

- Patisserie Holdings (LON:CAKE)

- Johnston Press (LON:JPR)

N Brown (LON:BWNG)

- Share price: 108.7p (-21.5%)

- No. of shares: 284.5 million

- Market cap: £309 million

Wow, it's startling to see how low this share price has fallen.

Both Paul and I thought that this fashion retailer looked quantitatively cheap around 200p. But it's not something I've ever studied in much detail, so I've never owned the shares.

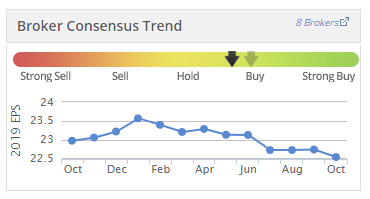

EPS estimates have been weakening:

The valuation just keeps getting cheaper and cheaper. Note that the interim dividend has been halved today:

Let's see what the interim results are telling us:

- revenue +1%, product revenue down 3% but financial services revenue (i.e. from lending to customers) up 12.7%

- adjusted PBT down 5%

- EPS down 22%

The company says it's "continuing our transition into an online retailer" - good. All stores have now closed, with the last 20 stores closed during the period.

More highlights:

- 77% of product revenue is now online, or 84% for new customers.

- operating costs down 1.5%.

- looking for a new CEO though the incumbent remains in place for now.

- full year expectations unchanged.

There is a big loss due to exceptional items of £65 million.

Let's see:

- store closures £22 million, of which £9 million is cash. We already knew this was happening.

- £18 million impairments, including £11 million of wasted resources on an IT platform and £7 million impairment of an acquired brand

- £22 million customer redress provisions. This is related to additional PPI claims.

My view

It's a messy set of results, unfortunately, and I worry that there is something I've missed which makes the shares riskier than they first appear.

The main reason I wouldn't personally be interested to add this company to my portfolio is that it's not focused enough: it has too many brands, operating in too many segments, and I'm sure this creates complexities for management.

And the "secondary brands" and the "traditional segment" appear to be of questionable quality. We received a well-informed comment in June from a reader about this company - see here. He argued that company needed to simplify - I can only agree.

The financial services segment has also disappointed with the latest set of PPI provisions.

It does look undervalued relative to earnings, which on balance I think should recover. I agree that the £65 million of exceptional items won't repeat long-term, so the company should be able to recover to profitability.

If you find the company itself more attractive than I do, it could be worth researching to see if it's really the bargain it appears to be.

Norcros (LON:NXR)

- Share price: 201p (-0.5%)

- No. of shares: 80.2 million

- Market cap: £161 million

This is "a market leading supplier of high quality and innovative bathroom and kitchen products".

H1 underlying profit (for the period ending September) is expected to arrive in line with expectations.

I covered the company in some detail earlier this year, concluding that is was cheap at 225p but that I wouldn't personally invest in it due to its active acquisition strategy and unimpressive like-for-like growth rates.

Today we learn that H1 revenue is flat on a like-for-like constant currency basis. The company points out that this grew 4.4% if you exclude certain divisions, but I still think the organic revenue growth is rather weak.

Net debt is £54 million.

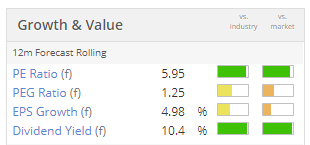

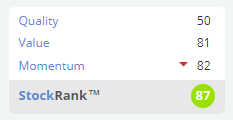

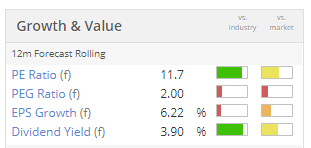

My view: I still think this a very cheap share, with a P/E ratio of 6x and EV/EBITDA ratio of 7.4x, according to Stocko. It's another one that doesn't pass my quality filters, but it could be worth a look for those who prioritise value.

Stocko sums it up like this:

Sanderson (LON:SND)

- Share price: 80.5p (+1%)

- No. of shares: 55 million

- Market cap: £44 million

Pre-Close Trading Update & Notice of Final Results

Sanderson Group plc ('Sanderson' or 'the Group'), the specialist provider of digital technology solutions, innovative software and managed services for the retail, wholesale, supply chain logistics, food and drink processing and manufacturing market sectors

Results for the year ending September are "slightly ahead of expectations".

On a like-for-like basis, excluding the effect of an acquisition, operating profit is "slightly ahead of last year".

So a bit like with Norcros, the organic growth is ok, but nothing to write home about.

Comes across as a decent business, but I don't invest in IT managed services. Could be worth a look if you like this sector. The £6 million cash balance is appealing.

Onthemarket (LON:OTMP)

- Share price: 129.5p (-6%)

- No. of shares: 61 million

- Market cap: £79 million

This agent-backed property portal records an H1 operating loss of £5,7 million.

Great progress in branch numbers listed and in site visits - it's very much in growth mode. It has only been listed since February and is still deploying the funds raised. It had cash of £24 million at the end of July (the relevant date for these results).

I still don't quite understand the rationale as to why somebody who isn't an estate agent would want to own shares in this. As the company reminds us:

"...the Group intends to use more equity incentivisation to encourage agents to join as shareholders in return for committing to long term paying contracts. At Admission, OnTheMarket had authority to issue 36.3 million shares for this purpose, of which substantially all remain available to deploy."

36 million is a lot of shares in comparison to the 61 million currently outstanding.

The previous model - Agents Mutual - made a lot more sense to me. If companies are being run for the benefit of their customers rather than for shareholders, then they should have a mutual structure, because that means (in theory, anyway) that all the profits get redistributed back to customers.

On the other hand, if you're not a customer, then why would you want to own shares in a company that is being run for the benefit of its customers and not for you? Of course, Onthemarket is going to want to provide some return to its shareholders who aren't property agents. But it's also going to be diluting them.

I just don't get it, I'm afraid. I'd 100% prefer to own Rightmove (LON:RMV) rather than this.

Patisserie Holdings (LON:CAKE) (breaking news)

- Share price: 429.5p (suspended)

- No. of shares: 104 million

- Market cap: £446 million

More commiserations are due to CAKE shareholders as things go from bad to worse.

The Board has now reached the conclusion that there is a material shortfall between the reported financial status and the current financial status of the business.

Without an immediate injection of capital, the Directors are of the view that that is no scope for the business to continue trading in its current form.

Shocking news. The black hole must be bigger than £20 million, then? Because it was supposed to have £28 million last March.

Apart from the small issue of HMRC trying to liquidate it, dealing with suppliers, employees, etc. won't be pleasant either. Which can make things go from bad to terrible.

It's grim and it's starting to sound like a zero is possible. I hope nobody is suffering a loss they can't afford with this one.

I also wonder if the events at Patisserie Holdings (LON:CAKE) might have hastened the general loss of confidence across small-caps and AIM over the past few days.

Johnston Press (LON:JPR)

- Share price: 3.5p (+8%)

- No. of shares: 106 million

- Market cap: £4 million

Strategic Review Update - Formal Sale Process

£220 million is coming due in June 2019. In order to "maximise value to stakeholders", the BoD is putting the company up for sale.

Nobody has approached it with an offer yet - and why would they?

The shares are worth buttons.

A bad news day, it can't be helped.

Have a good evening.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.