Morning!

It's a little quiet on the newswires today. I shouldn't complain, as I'm just back from a very busy few days in London! Yesterday, I did some secret shopping at about half a dozen companies whose shares are of interest to me. A very interesting and worthwhile exercise, which I'll write about over the next couple of weeks.

Today's news includes:

- Seeing Machines (LON:SEE) - warning on sales. Share price -9%.

- Gateley Holdings (LON:GTLY) - trading update and proposed acquisition. Share price +5%.

- RM2 - annual results & open offer at 1p. Share price -14% at 1.375p.

- GAN (LON:GAN) - fundraising at 50p. Share price +5% (at nearly 70p!)

Seeing Machines (LON:SEE)

- Share price: 7.75p (-9%)

- No. of shares: 2240 million

- Market cap: £174 million

An unusual title for an RNS. Is this because of the company's Australian origins, I wonder?

Seeing Machines develops technology that can monitor humans, having particular applications in driver and pilot safety.

This is a warning on sales:

The Company has been informed by its manufacturer partner that, owing to a global shortage in traditionally short lead-time parts (capacitors and power supply) which are used in the Company's second-generation fleet product, Guardian Gen 2, production of a number of units that were due to be shipped shortly, will now be delayed by approximately six weeks.

Seeing Machines can't recognise the revenue for these units until they've been shipped to customers, so this revenue will now fall outside FY 2018 (ending in June).

Sales will be A$30 - A$35 million, instead of A$38 - A$43 million.

There has indeed been a general shortage in capacitors, so I'm inclined to think we can give Seeing Machines the benefit of the doubt as far as this particular profit warning is concerned - based on the information in front of me, I don't suspect that there is some other reason for the delay in revenue, other than the parts shortage.

Despite today's gap lower, the shares still sit at a premium compared to a week ago, thanks to the European Commission:

"Europe on the Move" will see all new cars, vans, trucks and buses sold in Europe fitted, as standard, with drowsiness and distraction monitoring, among 11 key safety features.

Seeing Machines' platform technology has the know-how to deliver real-time understanding of drivers and operators through tracking of heads, faces and eyes for DMS across multiple transport sectors to enhance safety.

Excellent news for Seeing Machines, since drowsiness and distraction monitoring is what it does!

The existing sales pipeline in the Fleet division remains large, at $200 million (this represents the value of contracts to be delivered over several years, it's not an annual sales figure).

I had a stab at valuing SEE in March. Drilling into the numbers, I reckoned that the underlying operating loss was much more modest than the reported losses. R&D and marketing costs, for the purpose of driving growth, were the major drag on results.

Having said that, the valuation is highly aggressive even if you ignore the company's losses and think only about its sales. Price to sales is perhaps about 9x (depends on which time period you use), for a serial diluter which has a track record of failing to hit forecasts:

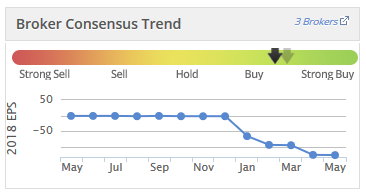

Stocko algorithms think it's a Momentum Trap and it's not something I'd want to own shares in, except perhaps with gambling money.

Gateley Holdings (LON:GTLY)

- Share price: 170p (+5.6%)

- No. of shares: 107 million

- Market cap: £182 million

Proposed Acquisition of GCL Solicitors

This was the UK's first publicly-listed commercial law firm.

The listing might seem to be a major achievement - and it is, in some sense - but why did commercial law firms never list before?

The most straightforward answer is that the public markets would never previously have been willing to pay more for the shares of a law firm, than those shares were worth in the hands of its partners.

It strikes me that a law firm should be owned by its partners and employees, not by outsiders. Can it really compete in the long-run if it has to pay dividends to public shareholders, in addition to salaries and bonuses, while its rivals only have to pay salaries and bonuses?

This is my simple reasoning as to why law firms, and people businesses in general, are best-suited for private ownership. For law firms, there might also have been a reluctance to face the scrutiny of the public which comes with a stock market listing.

Gateley listed in 2015 and IPO investors have done well so far, so what do I know? Maybe this will be the exception that proves the rule.

Today's trading update for the full year says that performance is in line with expectations. 70% of net income will be distributed as dividend, so shareholders are incentivised to continue holding.

Separately, the company's third acquisition has been agreed - a £4 million deal to buy a firm of solicitors which offers advice on land and property. This is line with the strategy given at IPO, to build a collection of legal and related professional services businesses.

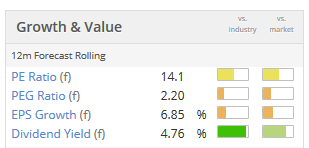

All of the metrics look reasonable and the StockRank is average. It's possible that I'm missing something, but I'm just not comfortable with the notion that firms of this type should be able to capitalise their value by selling to the public. As I was reminded by an astute comment this weekend, they fail an important investment test: scalability.

GAN (LON:GAN)

- Share price: 70.5p (+7%)

- No. of shares: 70 million

- Market cap: £49 million

I'm not familiar with this company but it struck me as an interesting piece of news after the recent bombshell announcement by the US Supreme Court, which means that US states are now free to make their own rules on sports betting.

Apparently, the black market in US sports betting is about 10x larger than the legal market, and much of this could be about to go legal.

Shares in the tiddler Webis Holding (LON:WEB) have been powering higher, and so have shares in GAN (LON:GAN). GAN ("Gameaccountnetwork") is a provider of technologies, platforms and games to online casinos.

Demand for GAN shares from traders is so high that the shares are up at 70p, even as the company raises £7.5 million at 50p.

GAN will be debt-free as a result, and:

The Company plans to use the net proceeds of the Subscription to substantially increase GAN's software engineering resources to better serve existing major US clients' services such as the WinStar.com Overseas Internet Casino, launch new US clients and new services in the US in anticipation of Internet sports betting following the US Supreme Court's decision to lift the Federal Ban on sports betting delivered on May 14, 2018.

The company has been unprofitable in recent years but perhaps it is going to turn the corner soon, with so much new opportunity? Worth investigating.

I have to go out now but will look at one or two other stocks when I get back - cheers.

EDIT: Back now, taking a look at Sigmaroc (LON:SRC) and Andrews Sykes (LON:ASY).

Sigmaroc (LON:SRC)

- Share price: 39p (+2%)

- No. of shares: 137 million

- Market cap: £53 million

This is a new one for me:

The principal activity of the Company is to make investments and/or acquire businesses and assets in the construction materials sector. The principal activity of the Group is production of high quality aggregates and supply of value-added construction materials.

It only arrived on AIM with its current strategy in August 2016, so perhaps that goes some way toward explaining why I haven't seen it before. We have never covered it in the SCVR.

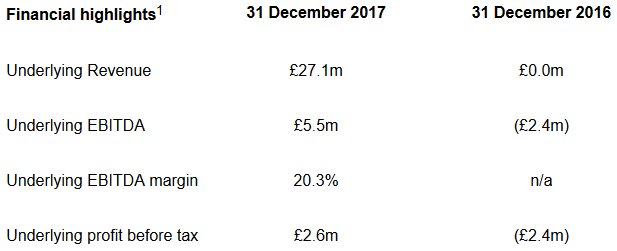

It raised £50 million, most of it via a placing at 40p, and then made a large acquisition in the Channel Islands, in January 2017. Before that, it was just some sort of shell. Nearly all of 2017 revenues are from operations in the Channel Islands:

It made two acquisitions in the UK mainland concrete sector in H2, with the help of a further placing at 41p.

The CEO says: "...significant value creation at SigmaRoc lies with further consolidation of the fundamentally fragmented market of construction materials".

As I've said before in different contexts, investors shouldn't necessarily view a fragmented market as an opportunity - we have to ask ourselves why a market is fragmented in the first place, and then why should it change? What competitive advantage will allow this particular stock to grow market share, where everyone else has failed?

Pre-tax profit for SigmaRoc falls out at a modest £850k, after £1.7 million of non-underlying costs.

Here are the non-underlying costs:

Reasonable adjustments? Except for the share option expense, arguably yes. But the buy-and-build strategy is expensive, and I wager that we will see a lot more acquisition and restructuring expenses in the years ahead, as the strategy is pursued.

I'm not getting involved in any growth-by-acquisition strategies these days, so this one is not for me.

For those who would be willing to give this a second look, there is potential value emerging over the next year or two. The shares are trading at or below the level where money has been raised to fund the strategy, so you don't have to pay any premium to get involved at this level:

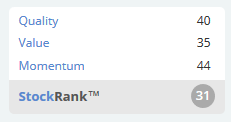

I'm neutral on this stock for now. The algorithms are more cautious:

Andrews Sykes (LON:ASY)

- Share price: 517.5p (+0.5%)

- No. of shares: 42.3 million

- Market cap: £219 million

I see that Andrews Sykes reported last year on 11 May. This year, it left it until 18 May.

It's not the only offender (not by a long shot), but this does introduce another risk element, for me, when a company is slow to report its results. Unless I have access to some other really good sources, it means that I'm almost certainly going to be at a big informational disadvantage, compared to others who might be trading the share.

This particular company issues on average about four RNS statements per annum. The last time it informed shareholders about how the company was doing was back in September. Nearly eight months without any sort of update!

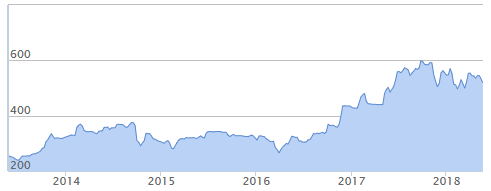

To its credit, Andrews Sykes (LON:ASY) has been a super investment if you've been in it for at least a couple of years, so perhaps we can look past its relaxed reporting style?

It's a rental company, providing air control equipment: ventilation, pumping, heating, cooling etc. It's active in the UK, Western Europe and the Middle East.

Companies which generate cash can often be very quiet in terms of RNS statements. Without any need to raise cash, they don't have any particular need for publicity:

Our policy of returning affordable dividends to shareholders continues and, over the last five financial years, the group has paid £47.8 million in cash to shareholders. This has not been at the expense of our other obligations; the group pays its external creditors in accordance with their agreed credit terms, it operates well within its banking covenants and has paid nearly £1 million into the defined benefit pension scheme during 2017 to eliminate the funding deficit of £0.7 million as at 31 December 2016.

The outlook is "cautiously optimistic":

The group continues to face both challenges and opportunities in all of its geographical markets but our business remains strong, cash generative and well developed, with positive net funds. The Board is therefore cautiously optimistic for further success in 2018, always being mindful of the favourable or adverse impact that the weather can have on our business.

Balance sheet is strong with equity of £53 million. You can even deduct all non-current assets (mostly PPE) and you are still left with NCAV (net current asset value) of £28 million.

This has several of the characteristics I like:

- Long history of operation (>150 years)

- Family business

- High returns on capital and cash generation

- Strong balance sheet

- "Boring" industry

The main drawbacks so far are:

- Slow reporting, as mentioned above.

- Tiny free float.

Only about 14% of the shares aren't owned by the family investment vehicle, leaving about £30 million of shares to trade amongst the general public.

The number of shares has gradually reduced, and Friday's statement mentioned the possibility of further buybacks. The Board is seeking the authority "to make market purchases of up to 12.5% of the ordinary share capital in issue" - that's nearly all of the free float, if the family isn't selling.

So I wonder if the shares will remain listed, or if the family would prefer to buy them all back?

My interest has been piqued. It's only the cancellation risk which would dissuade me from buying too many of this.

All done for today! Thanks for your suggestions.

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.