Good morning!

Of interest today we have:

- United Carpets (LON:UCG)

- SRT Marine Systems (LON:SRT)

- McColl's Retail (LON:MCLS)

- Begbies Traynor (LON:BEG) (red flag report re: financial distress)

We had in-line-with-expectations updates from Restore (LON:RST), Instem (LON:INS) and Judges Scientific (LON:JDG). Keywords Studios (LON:KWS) announced a small acquisition.

United Carpets (LON:UCG)

- Share price: 7.625p (unch.)

- No. of shares: 81 million

- Market cap: £6 million

(Please note that I currently hold UCG shares.)

This floorcoverings and bed retailer is a legacy holding for me, from the period when I was focused on dirt-cheap micro-caps.

Most of those dirt-cheap stocks have by now exited my portfolio, but I've never quite been able to press the sell button on this one. It has always seemed to be priced at an extraordinarily cheap level.

So even though I'd ideally prefer to own something of higher quality, I've been unwilling to sell this one so far.

When it comes to achieving a higher rating for the stock, the low market cap itself is a problem. Plenty of people don't want to analyse companies worth less than £10 million, and for good reasons.

In addition, the CEO, Commercial Director and Finance Director own nearly 54 million shares between them, so I think there are only about 28 million shares in the free float. That makes for an illiquid stock.

So I may end up being locked up in this one for a while longer yet.

Fortunately, many of the reasons I originally bought into it remain in play.

Let's review.

- Strong balance sheet - despite having paid a very large special dividend (1p per share), UCG finished FY 2018 with net funds of £2.64 million. It has equity of £5.3 million, nearly all of which is tangible.

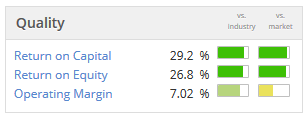

- Strong returns - the capital-light franchise network model has enabled it to earn very high returns. I estimate that return on equity was 25% in FY 2018.

- Stability - the managers have been satisfied to focus on the existing estate, rather than get involved in a risky acquisition or growth strategy in the midst of these difficult conditions. The number of stores increased in FY 2018 by only one, from 57 to 58. Of these, 50 are run by franchisees.

Let's consider today's results in a bit more detail.

Like-for-like sales growth of 3.2% in the period to March 2018. That's a fine result in my book.

In contrast, Carpetright (LON:CPR) recently reported a UK like-for-sales decline of 3.6% for the period to April.

Outlook - UCG is not immune from the "challenging" environment:

Like for like sales for the 16 weeks since the period end to 19 July 2018 are down 1.6%. Warm, sunny weather has a significant adverse impact on our sector and conditions over the important bank holidays were poor for us and have deteriorated significantly over the last 4 weeks of that period as the World Cup added further distractions.

While nobody wants to see a like-for-like sales decline, I still think UCG is performing reasonably well in the circumstances.

To draw another comparison with Carpetright, that company reported like-for-like sales down by 7.8% in the six months ending April. For UCG to be negative 1.6% in the April-to-July period does not seem so bad, in that context.

We are guided that H1 will be poor:

Combined with inflationary pressures impacting on the cost base, the first half of the current financial year is expected to be very challenging and the Board do not anticipate the first half profit levels of the previous year to be achieved.

My view - it looks like I'm going to continue to hold out for this to get a better rating.

As things stand, the enterprise value is a pitiful £3.6 million (versus FY 2018 operating profit of £1.5 million). Granted that earnings are going to be under pressure for at least the next year.

It's always worth remembering the bigger picture for this stock. Back in 2012, its main operating subsidiary had a pre-pack administration (under present management) which saw the rent bill slashed, reduced lease periods and break clauses introduced for many stores, and the number of stores reduced from 85 to 61 over a two-year period.

Six years later, UCG continues to reap the benefits of this deal. And with the number of stores now at 58, we can see that management have tried to be very careful not to bite off more than they can chew this time. The average franchisee has been with the group for 10 years, so the managers on the ground are now highly experienced, too.

From an income point of view, UCG's ordinary dividend has increased again today. The trailing yield is 5.4% against the share price, at the offer.

SRT Marine Systems (LON:SRT)

- Share price: 26p (-1%)

- No. of shares: 140 million

- Market cap: £36 million

Final Results for the year ended 31 March 2018

SRT, the AIM-quoted provider of maritime domain awareness technologies, products and solutions, announces its results for the year ended 31 March 2018.

SRT develops monitoring systems, transceivers etc. for maritime use.

While revenues have been on a mostly upward trajectory over the years, profitability has been highly unpredictable.

Today, we see a huge reduction in revenues thanks to the "Systems" side of the business producing revenues of just £0.3 million (FY 2017: £5.3 million).

The reasons given are: "minimal system project deliverables were completed during the year, and the delay to the timing of the expected new system contract".

This is a good example of a contract-driven business with lumpy sales. Predicting revenues is impossible - see how they can collapse from several millions in one year to almost nothing, the next year!

Investors are promised that various new contracts are close to signing. We are told that the "potential value" of contracts being discussed with governments is in excess of £400 million.

SRT has consistently promised big things.

Last year, it was pleased to tell investors it had a £77 million order book. I cannot find any mention of the order book today.

The balance sheet has suffered from the weak performance, with the consequence that SRT raised £3 million of fresh equity last month, and entered into a loan note programme.

The 2018 report, describing the company's position to the end of March, indicates "a material uncertainty that may cast significant doubt" around SRT's ability to continue as a going concern.

Putting it all together, I see these shares as being valued entirely on hope value.

McColl's Retail (LON:MCLS)

- Share price: 183.5p (-12.6%)

- No. of shares: 115 million

- Market cap: £211 million

This is a chain of convenience stores and local newsagents.

Back in 2014, it listed with an IPO price of 191p - today's share price weakness takes it back below that level. At least investors have banked a generous dividend stream over the intervening years.

It has typically traded at a modest earnings multiple, to reflect the commodity-type nature of the industry and its debt load. Bulls have suggested that its locations and economies of scale are a source of competitive advantage. You can view my analysis of its most recent full-year results in the archives.

Selected highlights from today's H1 results:

- like-for-like sales down 2.7%, and gross margin down 40bps to 25%. Supply chain disruption from the collapse of wholesaler Palmer & Harvey.

- little change in net debt (£112.6 million)

- unchanged dividend

- good progress in increasing grocery sales

Outlook

Like-for-like sales are down by less than 1% in the first part of H2. The supply chain is still in a period of transition:

In light of the challenges we have faced in H1, and planned H2 recovery, we now expect the 2018 full year adjusted EBITDA to be at a similar level to the prior year.

(Adjusted EBITDA was £44 million last year, resulting in pre-tax profit of £18.4 million.)

My view

It seems a very commendable achievement that McColl's managed to fix its supply chain issues without taking an even bigger hit to sales and margins.

Looking ahead, I do wonder if the new wholesale supplier will be able to match the terms of P&H.

Wholesalers have been doing very poorly. Even one of the McColl's interim suppliers went bust, while McColl's was still trying to sort out its long-term arrangements after the P&H collapse.

And the events at Conviviality (delisted:CVR), which bought a newsagent chain from P&H, are still fresh in the memory.

So even if McColl's can keep a steady ship, I would expect that its new supplier(s) will need to protect their own margins better than P&H did, or they too could struggle.

Another challenge is to bed in the stores McColl's purchased from the Co-op. These are making a negative LfL contribution as their range of offerings are reduced.

Balance sheet - it's not too pretty, and I think this is reason enough to put the shares on a modest rating. Net assets of £147 million are outmatched by £250 million of intangibles. £150 million (gross) has been borrowed.

Conclusion - it's not currently distressed, so value hunters may be attracted to this one. When you include the debt load, however, I don't think the valuation is cheap, considering the industry this operates in.

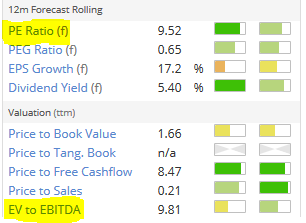

See how the EV to EBITDA multiple is less attractive than the PE ratio:

Finally, it is worth noting that the CFO has resigned after two years at his post, and this introduces another layer of risk for an indebted company.

Begbies Traynor (LON:BEG)

- Share price: 68.9p (unch.)

- No. of shares: 110 million

- Market cap: £76 million

Latest Red Flag Alert Report for Q2 2018

Insolvency specialist Begbies produces an interesting report each quarter, detailing the financial health/distress of UK companies.

Figures for Q2 2018:

472,183 businesses were experiencing 'Significant' financial distress at the end of June 2018, up 9% compared to the same stage last year (Q2 2017: 434,492) but down 1% compared to the previous three months of the year (Q1 2018: 477,183).

Year-on-year distress levels have been powering ahead at rates of between 25% and 36% over the past year, so this 9% year-on-year increase is significantly slower than what we have been used to seeing from these figures.

Despite the slow-down, I tend to agree with the consensus view that we are going to see plenty of insolvencies in the years ahead, as interest rates creep higher.

Microgen (LON:MCGN)

- Share price: 388.5p (+1%)

- No. of shares: 61 million

- Market cap: £237 million

Microgen is a software group comprising two businesses:

- Aptitude (accounting software for Chief Financial Officers of large companies)

- Microgen Financial Systems (wealth management software)

These are some nice results reported today:

- Revenue growth of 11% (constant-currency organic growth) or 23% (total growth).

- Adjusted operating profit up 12%, reported operating profit up 9%.

- Recurring revenues up strongly at Aptitude. Most of Microgen revenues are already recurring in nature.

- Tax has reduced to 21% of PBT (H1 2017: 24% of PBT) thanks to lower tax rates in the US.

Balance sheet: negative NTAV (net tangible asset value) thanks to acquisitions. Net funds remain of £2.8 million.

Thankfully, cash flow generation has been pretty good. The most recent six-month cash performance was held back by a negative working capital movement of almost £10 million. Excluding that, cash generated from operations would have been £8.8 million.

Meanwhile, only £500k needed to be spent investing in PPE (property, plant and equipment).

So assuming that the working capital movements will balance out in future periods, there is scope for plenty of net cash inflows.

My view: I haven't studied this company's products in any detail, and tend to be cautious in relation to companies with lots of intangibles after pursuing an acquisition strategy.

Nevertheless, this appears to be performing solidly, has been generous to shareholders with dividends, and is being managed well. Profit margins and returns metrics are good. So my overall impression is positive.

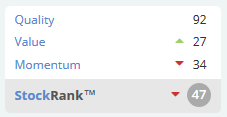

Stocko algorithms recognise the quality, though don't see too much value currently:

That's all for now. I hope your week has got off to a fine start!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.