Good afternoon! It's Paul here.

Today I report on the following announcements;

- Victoria - Reorganisation & trading update

- Warpaint - AGM statement

- Michelmersh - big acquisition

- Avingtrans - trading update & contract extension

- LPA Group - interims

- Surgical Innovations - trading update

Mello Beckenham

Last call for David Stredder's long-running & very popular investment evenings in Beckenham.

Tonight's event has some interesting speakers, and I think there are a few places left.

Contact David here, if you're interested in attending. They're very enjoyable socially too, as everyone has a common interest in shares, and newbies are always welcomed warmly by David, and introduced to a few people.

Victoria (LON:VCP)

Share price: 498.5p (up 1.1% today)

No. shares: 91.0m

Market cap: £453.6m

Manufacturing Logistics Reorganisation Update - this company has been a remarkably successful buy & build of carpet/flooring companies, in the UK & Australia.

The announcement starts by emphasising that this reorganisation is being done for positive reasons;

...today announces that due to rapid growth and continued significant demand for its products, it is reorganising the Group's UK manufacturing footprint and logistics operations principally to increase production capacity and improve service levels for customers. Each of these positive developments will also progressively improve margins for the Group.

Production in Kidderminster is being moved to 2 other UK sites.

As regards logistics, the company says that it will move its distribution centre from another (too small) site, to the larger Kidderminster site. This will give "significantly increased capacity".

It intends opening 2 further new distribution centres (in NW London, and in the North), in late 2018 onwards.

Trading update - this sounds reassuring;

...the Group's underlying profits before tax will be well ahead of last year and the Board is confident of meeting market expectations for the financial year ending 31 March 2018.

Being well ahead of last year is nothing new - that's already baked into broker forecasts. So the bit that matters, is "confident of meeting market expectations".

I like it when companies are confident early in the financial year, as it can sometimes mean that they're heading for an earnings beat, but are not quite ready to say so (just in case something goes wrong later in the year).

Outlook - all sounding confident;

The Board believes Victoria is well placed for further growth given its expanding international operations, which now represent over a third of the business. In addition, reshaping the Group will achieve meaningful cost and margin synergies, freeing up capital for further domestic and international earnings enhancing acquisitions.

The point about freeing up capital is an important one. Part of Victoria's success, is that it buys up private companies with inefficient balance sheets. It then has scope to reduce inventories & debtors, thus unlocking working capital. Combined with increasing profits at the acquired company from efficiency gains, this delivers a very effective acquisition strategy. So companies bought by Victoria have been paid for quite quickly, using their own cashflows to pay down the initial debt. That seems a clever, and successful strategy.

Chairman's comments emphasise that there is more growth in earnings per share & cashflow to come.

My opinion - I've been very positive about this company for some time. It's not one I currently hold, because of worries about consumer big ticket spending in the UK. Hopefully Victoria might continue winning market share, even if big ticket consumer spending does fall.

This company benefits from weak sterling. It's not just exporters who gain from weak sterling, but also UK producers like this one, which are better able to compete against imports from the Benelux countries (which are big carpet producers, apparently).

I feel that the valuation looks about right for now.

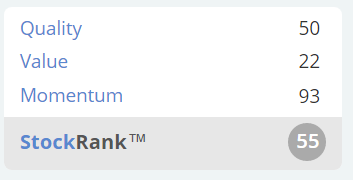

What do the Stockopedia computers think? It's categorised as;

Speculative, Mid Cap, Style Neutral.

The StockRank is fairly middling;

Stockopedia subscribers use the StockRanks in different ways. For me, I like to check the StockRank, to confirm that my own analysis is probably on the right lines. If there's a glaring difference (up or down) between my overall view on a share, and what the StockRank says, then it's a useful pointer that I might have missed something important, so more work needs to be done.

Sometimes I know why the StockRank is low - because the computers haven't yet picked up on some fresh, positive news which I've spotted! It's an exciting challenge, trying to out-perform the computers, and prove that shrewd investors can sometimes perform better than computer algorithms!

Or, if you try, but can't out-perform the computers, then switching strategy to becoming a "farmer" and building a portfolio around high StockRanks (and rebalancing the portfolio every 3 months), might be a better idea, and certainly a lot less work. A high StockRank strategy has been statistically proven to work very well. Although as with any strategy, the future is not guaranteed.

Warpaint London (LON:W7L)

Share price: 214p (down 11.8% today)

No. shares: 64.5m

Market cap: £138.0m

AGM Statement - this is a UK-based cosmetics business, which floated in Nov 2016. It's been a fairly popular recent listing - I've noticed a lot of private investors are talking about this company. For background, if you're interested, I reviewed the 2016 results here on 10 May 2017. My feeling was that the figures looked good, but the share price seemed full, or even toppy, at 224p.

A recent surge in excitement in the shares - doubling from 158p in Apr 2017, to a peak of 307p at the end of May 2017, seems to have largely fizzled out, with the share price now down to 214p.

This could have been exacerbated by liquidity problems. Totting up the list of significant shareholders, it's 87.3% of the total shares in issue. So that leaves a very small free float. Therefore, if a share suddenly becomes popular (e.g. being tipped in SCSW) then lots of people scramble to buy a limited supply of shares. This drives the price up, which then causes many private investors (and momentum traders) to get even more excited, and increase their buy orders, pushing up the price again. This results in the price overshooting on the upside, and then correcting sharply. I've seen this happen a lot lately. So it's a dangerous game, chasing momentum shares, as you could end up significantly over-paying.

I do wish the brokers that float new companies on AIM would try to disperse the shares better. What tends to happen is that founders often retain a big stake, then the IPO shares are just placed with institutions, with the same names cropping up time & again.

The problem is that there's then hardly any after-market in the shares. So companies struggle to generate much liquidity in their shares, resulting in a volatile share price, and wide bid-offer spreads. It would be much better if brokers would allocate say 20% of decent quality floats for private investors to participate. That way there would be decent PI awareness of the company from day one, and a much more liquid share, to the benefit of all. I doubt that will happen though, as brokers just want to earn their fat fees for doing as little work as possible! This looks a good opportunity for someone to come in and disrupt this cosy set-up, with a better offering.

That said, this has still been a very successful float, still more than double the initial 97p IPO price.

Sorry, I'm wandering off the point. Let's get back to today's update from Warpaint.

AGM Statement - it's an in line update;

"I am pleased to report that the Company continues to trade in line with expectations. So far in 2017, we have seen encouraging growth across all our sales territories worldwide, apart from Europe where sales remain similar to the corresponding period in 2016.

I am particularly pleased that our sales strategy for the US, which is the world's largest colour cosmetics market, has delivered double-digit sales growth compared to the same period last year.

Judging from some Tweets I saw earlier, I think the comment about sales in Europe being flat against last year, might have spooked a few people into selling. That could be why the share price is down 11.8% today.

New ranges - "Very Vegan" range - early sales are encouraging, although modest in overall group terms. More new ranges look likely.

E-commerce - growing (but no figures given), and likely to continue growing in importance.

AIM - interesting to read these positive comments about listing on AIM;

I am pleased with the performance of the Group since admission to AIM in November last year. Being quoted on AIM has been a positive experience for the Company, in particular helping the recognition and development of the W7 brand globally.

This confirms my view, that there are plenty of decent companies on AIM. So it's wrong to disparage the whole market. I just wish that the LSE & brokers would stop floating absolute junk on AIM. Things have definitely improved recently, but they need to stop ripping off gullible investors by knowingly floating junk on the AIM market.

In my view, companies like Warpaint, Hotel Chocolat, Gear4Music (in which I hold a long position), and plenty of others, are examples of interesting growth companies that investors want to buy. Their floats have all been a great success. So memo to the City: please float more of this kind of company please, and stop floating junk onto AIM!

Investors do notice which brokers & PR companies are floating & supporting the junk, and gradually build a mental note of which advisers are best avoided. So chasing short term fees, to promote junk, is reputation-destroying stuff. It's also completely dishonest & unethical.

When I talk to decent quality AIM companies, management often say what a benefit it has been to their business, listing on AIM, or the main market. It can greatly enhance relationships with customers & suppliers, who perceive a stock market company as being highly prestigious (little do they know than any old junk can get a listing, lol!)

So it's encouraging to hear Warpaint confirm that their AIM listing has been a benefit to their business.

Valuation - the broker consensus earnings figures on Stockopedia show 9.4p EPS for this year (ending 12/2017) - a PER of 22.8, and 11.9p EPS for 12/2018 - a PER of 18.0

There's no debt here remember, and it has a sound balance sheet, so the PER is a prudent way to value the company. As opposed to using PER at highly indebted companies, which tends to result in investors over-valuing the company, if they ignore debt.

My opinion - Is that a fair valuation or not? It looks about right to me.

It all depends what you think future growth is in prospect? The problem with today's announcement, is that it seems to be pointing towards slower growth in some territories.

Personally, I just don't know enough about this business, or its sector, to form a view. So if you think it's a great company, with strong growth ahead, then this recent dip could be a nice buying opportunity. If like me, you don't know, then it probably just gets filed in the "too difficult" tray.

Michelmersh Brick Holdings (LON:MBH)

Share price: 79.3p (up 10.1% today)

No. shares: 81.5m

Market cap: £64.6m

Acquisition - as the name implies, MBH is a brick manufacturer in the UK. It has today announced a sizeable (relatively) acquisition of Carlton Main Brickworks Ltd, which operates from a 93 acre site in Barnsley, Yorkshire.

There's no point in me reproducing the terms of the deal here, as you can just read the announcement yourself. A couple of comments from me;

Carlton seems to deliver amazingly high profit margins - EBITDA of £5.56m on just £13.1m of turnover. How is that possible? Are those margins sustainable?

This deal is mostly being financed through new debt facilities. So bear in mind that the group is gearing up considerably, which needs to be factored into valuations. Debt-funded deals are obviously going to be earnings enhancing, when interest rates are very low.

Since the UK clearly has a shortage of suitable housing, and housing has moved right up the political agenda after the recent tragedy in Grenfell Tower, then it stands to reason that a brick manufacturer is likely to have a decent future.

The synergies (e.g. cross-selling, efficiency improvements) sound sensible, and on the face of it this deal looks a good fit with Michelmersh.

The acquisition includes freehold land valued at £6.3m - good because banks like freeholds as security to lend against, hence reducing risk for shareholders.

My opinion - this looks a good acquisition, from my limited review of the statement today. Broker earnings forecasts will obviously shoot up now. Although investors should perhaps apply a lower PER to increased earnings, due to the increased debt being used to finance the acquisition. The increased debt might possibly restrict the dividends for a while?

Avingtrans (LON:AVG)

Share price: 216.8p (up 1.3% today)

No. shares: 19.2m

Market cap: £41.6m

Trading update & Sellafield contract extension - this is an engineering group, which has proved adept at buying & selling companies - e.g. its aerospace division was sold off for a good price, leaving behind a much smaller group with pots of cash.

The Sellafield contact looks very important, and has been known about for some time. A further £11m over 3 years to 2021 has been secured. There's more detail in the RNS.

Trading update - this sounds reassuring to me;

In respect of trading for the year ended 31 May 2017, Avingtrans confirms that although revenue was slightly behind management outlook, it closed the year with adjusted profit before tax marginally ahead of internal expectations and net cash of £26.2m.

The Company is also pleased to report a strong current order book for its Energy and Medical division

I don't really care about revenue, it's profit that matters.

Note also the net cash pile of £26.2m, highly material at 63% of the entire market cap!

My opinion - I like it. Management has a good track record of acquiring & disposing of companies at the right price. So I'd be more comfortable than most, at them sitting on a big cash pile. The chances are they're likely to do something smart with the cash, in due course, thus possibly providing future upside.

In the meantime, the existing business seems to be doing alright.

So quite a nice special situation, but one which might require patience perhaps? I'm tempted to have a small dabble here.

The big cash pile means that PER-based valuation isn't terribly meaningful right now.

Stockopedia says that the StockRank is not bad, at 70.

Also the StockRank Styles are favourable, with it being rated as a "High Flyer".

EDIT: please see reader comment no.4 below, where seadoc reminds us that AVG is deciding whether or not to launch a formal bid for Hayward Tyler (LON:HAYT) . I see that HAYT has a market cap of about £25m, pretty similar to AVG's cash pile. Having a quick skim of the RNSs from HAYT, it appears to be in a spot of bother with its bank facilities. That might provide an opportunity for AVG to do a good deal, but not if it over-pays for the equity. So it might be safer to wait until AVGs decision on HAYT is announced. The trouble is, if they announce a smart deal, then people like me on the sidelines would miss out.

LPA (LON:LPA)

Share price: 135.5p (down 7.8% today)

No. shares: 12.4m

Market cap: £16.8m

Half year results - for the 6 months to 31 Mar 2017.

This company is one I'm not familiar with. It describes itself as;

...the LED lighting and electro-mechanical system manufacturer and distributor

Looking back at my historic notes here, this company seems to specialise in lighting for trains. There are some franchise changes happening soon, so maybe that could provide a boost for LPA, if rolling stock is refurbished perhaps?

Looking through today's interim results, they look OK, but not exciting. Here are a few key figures, and my comments;

- Revenue of £10.8m, up 3.1% on H1 last year.

- Pre-exceptional operating profit basically flat against last year's H1, at £772k (LY H: £782k)

- £341k exceptional profit from sale of property, partly offset by £115k other nonrecurring costs

- Order book flat against last year at £22m

- New manufacturing facility provides extra capacity

- The fairly brief narrative & outlook comments sound upbeat.

Balance sheet - there is net debt of £2.8m, although this doesn't seem excessive to me.

Note there is £6.7m in fixed assets, which might include some property - which would be worth checking, if you are considering an investment here.

There is a pension surplus shown under accounting rules, of £1.2m, but the cashflow statement shows £100k p.a. outflows into the pension fund. So it might be one of those that is in surplus under accounting rules, but in deficit under actuarial rules. It's not a deal-breaker thing, but I'm just flagging the issue so readers can investigate more if you wish to.

Overall, the balance sheet looks adequate, but not particularly strong.

My opinion - this looks an OK little business, but I can't really see anything much to get excited about. Why pay a forward PER of 13.1 for something this small & illiquid, when you can buy bigger businesses, paying better divis, on a lower rating?

The only reason to buy this, is if you think it could strongly grow sales & profits.

If you ever wanted to know who makes those door-opening switches on trains, then now we know! As everyone is aware, British etiquette is such that , if you're nearest the door, you must repeatedly press these switches a little early, just before the ping noise, to signal to other travellers that you are on the case, and will limit any delay to 5 milliseconds or less once there is a ping noise!

I like the steady profitability of the company, and regular dividends. Although I can't really see what would be any immediae catalyst for a re-rating. I'm not really keen on buying this share, on the off-chance that it might unexpectedly announce a big surge in orders. Whilst that's possible, it could just as easily announce the opposite, and drop 30% on a profit warning.

Overall then, it's not for me.

I'm flagging now, so just a couple of quickies to round off with:

Surgical Innovations (LON:SUN) - this is a small company £20m mkt cap at 3.75p per share. It makes specialist equipment for minimally invasive surgery, and other precision engineering.

The historical figures show a huge loss in 2014, but a subsequent recovery to modest profitability, so it would be interesting to look into what happened there - possibly the closure of a loss-making division? Looking back in my notes, things looked bad in my last report here, in Oct 2014. However, the company now seems back on track.

The AGM trading update today reads quite well. This bit sounds encouraging;

"Trading performance of the Group for the current financial year to date is in line with the Board's expectations.

Revenues show strong growth compared with the corresponding period in the prior year, with gross margins delivered within the target range.

I've looked at a broker update note, which is on Research Tree today, and the figures don't look particularly exciting. The broker (who usually get a steer from management) are only forecasting 11.5% top line growth this year.

Personally, I would want to see a much faster growth rate to get me excited enough to want to buy the shares. One to go on the watch list though, in case growth accelerates.

Bilby (LON:BILB) - sorry, I've just realised it's one of those building services companies, so am not interested in looking at it. The balance sheet looks rather weak, and the profit margins are thin.

All done for today, see you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.