Good morning!

The following stocks are on my radar today (edited @ 14:30):

- Taptica International (LON:TAP) - full year results

- Bioventix (LON:BVXP) - interims

- Spaceandpeople (LON:SAL) - preliminary results

- Satellite Solutions Worldwide (LON:SAT)

- YouGov (LON:YOU)

Taptica International (LON:TAP)

- Share price: 380p (+1%)

- No. of shares: 67.6 million

- Market cap: £257 million

This is a mobile advertising platform based in Israel but with offices around the world.

Facebook

I've just been reminding myself about what it does, looking at the case studies on their website. For example, this one (PDF file) explains how Taptica improved a US company's success in recruiting new users to download an app via Facebook.

Taptica is described as the customer's "Facebook Marketing Partner", and used its custom-built, "Facebook-optimised" platform to run the ad campaign. The Taptica platform was supposed to be a lot smarter than the default Facebook ad manager at the time.

Facebook has been on the receiving end of huge negative press and seen its share price take a tumble as users realise how much data the company has about them.

Its long-term dominance as a social network is certainly questionable, and my guess is that it will be inconvenient for Taptica if Facebook's influence begins to fade away. Facebook is probably one of its biggest venues, since its one of the most heavily-used mobile apps, so there might be a little bit of friction if its app usage suffers and people start using something else.

But Taptica seems be diversified among many advertising venues, mentioning Amazon, Disney, Twitter, Expedia, etc. on its website.

In any case, the uproar over how Facebook apps have used people's data is not directly relevant to Taptica. It says today that recent press coverage "does not affect its business model".

Results

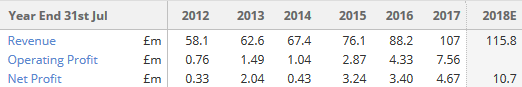

Today's results show massive growth rates. We need to be careful about this, as there were some acquisitions during the year.

"Non-video" revenue growth is 35% - I think this is a bit closer to like-for-like growth, as there was a big video acquisition during the year. Clearly an impressive figure.

Growth was broad-based, with a noteworthy contribution from Asia and within that, the Chinese market. That's exciting - the Chinese are no slouches when it comes to figuring out solutions for within their own internet ecosystem.

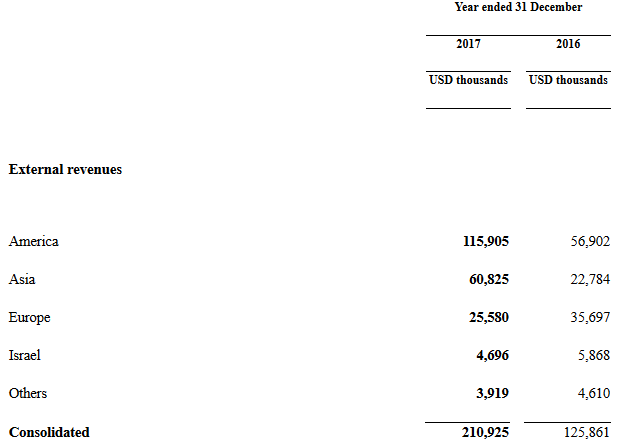

Overall, the US remains most important. Europe and Israel went backwards:

Tremor Video DSP

Tremor Video DSP performed better than anticipated, including achieving profitability during 2017 rather than in 2018 as initially expected.

That's good - this was a $50 million acquisition, and had been loss-making in the previous year.

The long-term benefits of integrating Tremor remain to be seen. I wonder if its standalone financial characteristics are possibly not quite as good as Taptica's pre-existing business lines?

Tremor Video DSP made a significant contribution to the increase in R&D expenses to $17.0 million (2016: $6.1 million) as it is a business that sustains a high level of R&D...

Outlook for 2018 is in line with expectations.

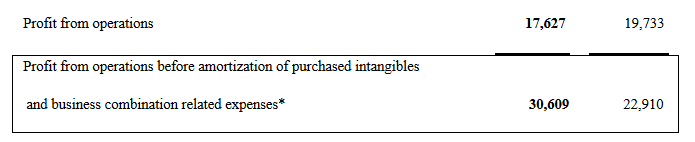

Amortisation was a huge drag on statutory operating profit this year.

I've had a look at the footnotes, and it was an increase in the amortisation of "technology" which made the biggest difference (footnote 6). This cost increased by almost $5 million.

Reading more footnotes helps you to explain how this came about.

The $50 million paid for the acquisition of Tremor resulted in an additional $27.6 million of intangibles landing on Taptica's balance sheet (footnote 16) of which $17 million represented the value of Tremor's technology.

Without going into it any further, we have the gist of an explanation. Tremor has a lot of intangibles, and depreciating them is hurting Taptica's statutory numbers. The $27.6 million of acquired intangibles, excluding the goodwill element, are going to be amortised toward zero quite soon.

Excluding the amortisation, growth was excellent (numbers in bold are this year):

As mentioned above, Tremor also caused a big increase in R&D expenses (expenses which go through the P&L rather than being capitalised).

It's obviously not easy to tell, looking in from the outside, but I think a little bit of scepticism towards the financial merits of this deal might be justified. There is always the possibility that amortisation schedules accurately reflect the loss in value over time as technology and other intangibles age - in which case, the amortisation is a real expense and should not be ignored.

And having raised fresh funds, the company is bullish about finding new takeover targets.

Conclusion

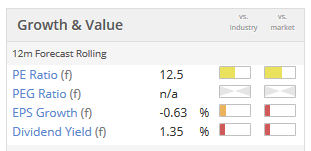

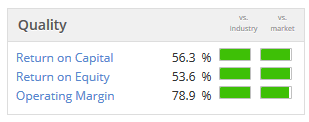

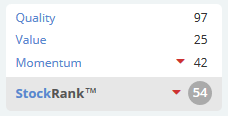

Overall, the company is certainly performing very well, and deserves its big StockRank reflecting strength in value, quality and momentum. Value is as follows:

My job here is pointing out risk factors as well as positive characteristics, and personally I think the biggest risk factor is that the company gets too focused on buying growth rather than making it happen internally. I'm a big believer in companies out-competing their rivals and building new businesses in new industries, rather than buying them up.

But if I simply wanted a portfolio of high-StockRank companies which would probably outperform the FTSE, I would have few qualms about having a small holding in this.

Bioventix (LON:BVXP)

- Share price: 2450p (+19%)

- No. of shares: 5.1 million

- Market cap: £125 million

This company makes antibodies for use in medical diagnostics. I again recommend the 2016 article by VegPatch at this link for background info.

Impressed by its IP, margins and returns on capital when I covered it at its interim results, I said:

New buyers at current levels will need patience, however, because it's unlikely to see much earnings growth in the short-term, and the earnings multiple looks about as high as it can bear. It looks interesting on a 2-3 year horizon.

This was more a comment on how the market would value it, rather than a comment on the underlying business. My reasoning was pretty simple: 2018 earnings were set to have a hiccup, and investors wouldn't give it a huge multiple until they started motoring higher again.

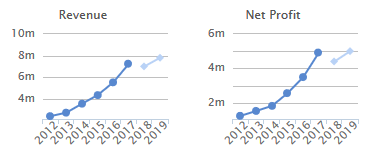

These charts tell the story of what the market had been expecting: a dip in revenues this year, and then growth to c. £8 million in FY 2019:

As it happens, the 2018 result has received the helpful boost of an additional £0.77 million in royalties from a customer.

Bioventix customers are required to self-certify their use of the antibodies, sending royalties to Bioventix depending on how many times they have used them.

One of the customers didn't realise how many times they had used the antibodies over the 2014-2017 period, so they had to send an additional payment shortly after the end of the six-month period to December 2017. The revenue boost is recognised during the six-month period.

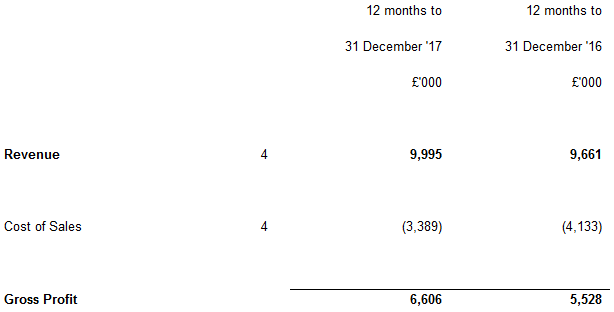

Margins are enormous, so more revenue flows efficiently to the bottom line:

Combining this boost with overall strength in the portfolio performance means that a bunch of forecasts need to be updated.

Instead of showing a slight dip compared to the 2017 result, the current year will now be about 10% higher.

FY 2019 is then forecast to have a flat revenue performance, compared to the current year.

My opinion

I still think it's a super company. Also, I think it's a feature of good companies that they give you positive surprises - expectations are managed at a realistic level, and you get the occasional pleasant surprise instead of the occasional unexpected mishap. It's nice to see this happening here.

Unfortunately for newcomers, it's widely understood that this is a good company, so you have to pay up for these shares:

I think I'll leave my stance unchanged vs. what I said when the share price was 2700p. Despite being a super company, I don't think investors will have the appetite to pay a much higher earnings multiple for it than the current level, especially in a transition period when earnings are set to be flat through FY 2019.

As FY 2020 gradually looms into view, we may see momentum returning here.

Spaceandpeople (LON:SAL)

- Share price: 32p (-4.5%)

- No. of shares: 19.5 million

- Market cap: £6 million

This remains a tiny market cap. It's one we've covered before, so I include it for the benefit of regular readers.

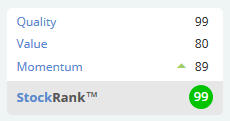

Also, it's extremely highly rated by the algorithms:

To access this StockRank, you have to be willing to buy a tiny market cap with a 31p-33p bid-ask spread (I haven't tested it to see what volumes are available).

The company provides live engagement for brands and retailers with their customers in busy locations like train stations and shopping centres.

Business improved this year, with more favourable mix of "Brand Promotion" rather than retail work, and more income from "Mobile Promotional Kiosks" rather than "Retail Merchandising Units".

This is all part of the shift in consumers preferring experiences over goods, and Spaceandpeople argues that it is comfortable with this trend. Sounds good to me.

It has also managed costs tightly, with a mix of lay-offs and new hires as the business has evolved, and the net result has been a substantial increase in profitability.

Operating profit jumps to £1.2 million, vs. a small loss last year.

Cash Flow/Balance Sheet: excellent recovery.

Dividend: it goes back on the dividend list again.

Outlook: the outlook statement is a bit mixed, and I'm guessing this explains the muted reaction in the share price today.

The UK experiential campaign team has had a slightly slower than expected start to in 2018, due to timing differences on repeat bookings, however, these delayed bookings are currently being worked on. Retail, MPK and regional sales are all performing ahead of this time last year and in line with management expectations

This suggests 2018 might be a bit flat, if not slightly worse than 2017. Indeed, analysts are forecasting a small reduction in operating profit in 2018.

Paul has owned this before and expressed some scepticism that it can scale up to become a much bigger business over time.

That having been said, there is no question in my mind that the share is "value". Some people just want cheap earnings, a sound balance sheet and a nice dividend yield. This offers all of those things.

Satellite Solutions Worldwide (LON:SAT)

- Share price: 8.75p (+3%)

- No. of shares: 682.6 million

- Market cap: £60 million

Satellite Solutions Worldwide Group plc (AIM: SAT), the global leader in delivery of alternative super-fast broadband, announces its audited results for the year ended 30 November 2017.

This company provides fast internet access to businesses and consumers not reached by the major networks. It has been listed since 2014, and is yet to break into profit.

It is growing by acquisition, revenues more than doubling in FY 2017 to £43.9 million.

Outlook is encouraging:

...the hard work during the period means that we have an extremely solid base for further growth with all of our geographic hubs performing well and benefitting from centralised cost bases, ensuring that we are set for another step change in profitability this year.

We have already made a good start to the current year, with strong like-for-like revenue growth for the three months to February 2018.

It must be noted that when the company refers to the prospect of achieving "another step change in profitability this year", it must be referring to another increase in adjusted EBITDA.

Adjusted EBITDA increased from £1.2 million in FY 2016 to £4.7 million in FY 2017, but the statutory pre-tax loss actually widened from £5.4 million to £8.0 million.

If we scroll back up to the financial highlights, the company says:

Gross profit margin increased to 35.5% (FY 2016: 34.0%)

Overheads as a percentage of revenue decreased to 24.8% (FY 2016: 28.3%)

These numbers leave a cushion of 10.7%, after you deduct overheads as a percentage of revenue from the gross profit margin.

However, that cushion is not big enough to take care of a massively increased depreciation and amortisation expense, plus deal costs and share-based payments. Hence, the widening loss.

It reminds me a little bit of the Taptica discussion above. Are investors really willing to forget about depreciation and amortisation expenses? I don't think they should. The burden of proof rests on companies to prove why their depreciation, amortisation and other exceptional costs should be overlooked.

YouGov (LON:YOU)

- Share price: 380p (+4%)

- No. of shares: 105 million

- Market cap: £399 million

I'd be lying if I said I wasn't getting a bit fed up with looking at adjusted profit measurements today!

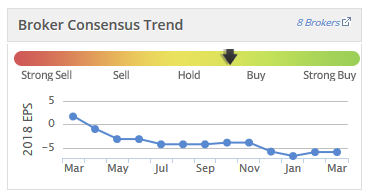

But in the case of YouGov, I certainly knew it was coming. This is very standard for how the company presents itself.

It's a data and analytics company, well known for its public polls.

- Revenue growth of 10% (2017: 24%) - At constant currency growth of 12%

- Adjusted operating profit up by 56% to £8.8m - At constant currency growth of 65%

- Statutory operating profit up 78% to £4.4m

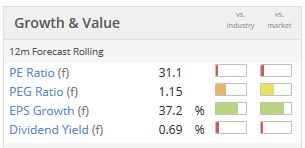

The funny thing about YouGov is that its statutory results are actually very good. It has no need to adjust them to make them look appealing (the adjustments do make the profit figures bigger, of course):

I think it's generating a really nice track record even if you ignore the adjusted numbers completely.

This has fed through to cash flow and cash generation, and the stock now qualifies for one of Stockopedia's dividend screens:

Outlook comments from the CEO sound good too:

By increasing our investment in technology we are getting more out of our data engine and our profit is growing at a higher rate. We have enjoyed a particularly strong first half. Trading during the second half has continued positively, we are accelerating our investment in technology and geographic expansion and remain confident in our prospects for the year.

The US is responsible for c. 40% of sales, so performance would have been even stronger if USD hadn't weakened. US revenues climbed 18% at actual exchange rate, or 25% at constant exchange rates.

It's performing really well, has a strong track record, good reputation and a unique resource in its 5 million-member online panel.

The valuation demands a long time horizon but I would be optimistic about what it could achieve for shareholders in the long run.

Purplebricks (LON:PURP) - I should mention in passing that the hybrid estate Purplebricks fell another 10% today to 280p after announcing that it would issue £100 million in new shares to a new "strategic investor", subject to a shareholder vote. This investor would also buy £25 million of existing shares from directors. This is all taking place at 360p.

In the same announcement, the company blamed macro issues and the weather for 2018 getting off to a poor start, and gave a warning that full-year revenues would be 5% below consensus of £98 million.

The shares were at 426p when I covered them last month and I did check if it was possible to short them. The answer was no.

The valuation still makes no sense to me, and I expect it to return to our SCVR limits. Earnings forecasts have been downgraded many times.

That's it from me today! Paul is somewhere on the west coast of America, I think. So I'll be covering for him tomorrow.

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.