It's Paul here with Monday's SCVR.

Estimated timings: should mostly be finished by 1pm, but I'll carry on writing into the afternoon because I got bogged down in thinking about the possible implications of coronavirus, which I suspect could become quite serious. Fully done by 3pm.

Edit at 15:12 - today's report is now finished.

Red Flag Report

Issued this morning. Click on the heading above (everything in blue is a link, for anyone not aware) to read the latest quarterly report from Begbies Traynor (LON:BEG) - an insolvency practitioner and property services group.

...the number of businesses in significant1 financial distress has risen to 494,000 - the highest number recorded by this research, with the real estate and property, support services, construction and retail the sectors particularly badly affected.

Other points of note;

- Q4 was worse than Q3

- Not clear if this is due to short term confidence (affected by political situation) or more fundamental issues

- Online retail - not immune from sector malaise, with 8% increase in companies suffering financial distress vs last year

- Environmental credentials are becoming more important, to attract customers. BEG suggests that fast fashion such as "BooHoo and Primark models could fall from favour in 2020" - that strikes me as far-fetched. I think it's more likely that they continue taking market share from other retailers.

- Plus some general waffle about the political situation, which doesn't really add any value.

PMI Data

Released late last week, which comes from IHS Markit. This is a widely followed survey of business confidence, because it's a forward-looking indicator - useful for gauging what share prices might do.

The Jan 2020 report is well worth reading, and only 3 pages long. UK PMI rose to a 16-month high, of 52.4 (anything over 50 is net positive). This confirms what the very bullish Deloittes CFO survey said a couple of weeks ago - that business confidence shot up after the decisive general election result.

The big question is whether this is a relief rally, or whether it has legs?

Fundsmith letter to investors

Of all the reading I did last week (thanks to Graham for holding the fort here!), Terry Smith's 10th annual letter to his investors was the best. I strongly urge readers to click on the link above and have a read. It's only 12 pages long, and written in an engaging style.

He makes a brilliant case for the Buffett-style, long term investment approach. Namely buying great quality companies at fair (or even expensive) prices, then holding forever. The results achieved by Fundsmith certainly bear out the wisdom of this approach - up 364% in just over 9 years since inception - impressive stuff.

Although I think it should be noted that expansion of PERs in an environment of ultra-low interest rates have provided something of a one-off boost.

CoronaVirus - China

I was watching the TV coverage over the weekend about this new virus which has struck Wuhan in China, and seems to be spreading.

Then I cast my mind back to Bird Flu, and the SARs virus. I can remember discussing these with investors at various meetings, and plenty of people were very nervous about them. But the crises passed, and now they're barely a blip on the chart.

If I recall correctly, SARS was said to have formed in sewers, and was sucked into Chinese apartments through the drains, caused by extractor fans. Whereas in the past, Chinese cleaned their bathrooms with lots of water, they were now using chemicals and extractor fans. Once that was realised, it could be stopped, and the spread of the virus was contained.

Bird flu, and ebola, were also successfully contained, and the impact on the economy and hence shares was very limited.

Therefore, history shows us that these things tend not to do any lasting damage. Although the short term impact on the economy can be significant, it's only temporary. One article I read over the weekend said that SARS hit the Chinese economy by 5%, but it was quickly recouped as things rebounded.

Having said that, the scale of the problem this time around looks much larger than previous sickness outbreaks, still seems to be in the early stages, and is spreading fast. For that reason, I'm viewing this with some trepidation. I've decided to open some Index shorts, to hedge my illiquid small caps portfolio, in case the situation worsens into an epidemic. Let's hope for everybody's sake that the problem is contained.

Another thing to consider is that SARS happened right at the bottom of a bear market, in 2002-3. As I recall, it was just one factor of many that made people bearish at the time. An article I read this weekend said that airline shares fell by about 30% at the time, although I haven't verified that.

My worry is that the market has had such a boom in recent months especially, that it might be looking for some reason to sell off. If people become more worried about the coronavirus, then it could trigger profit-taking. Sometimes it's an external, unforeseen factor, that triggers the end of a bull market. Also traders start opening short positions, which helps push things down.

I know it sounds grubby to be talking about money when there are human beings suffering, but that's unavoidable I'm afraid. We can't ignore the investment risks when anything bad happens.

On to today's company news;

Safestyle UK (LON:SFE)

Share price: 59p (down 14% today, at 09:19)

No. shares: 82.8m

Market cap: £48.9m

Trading update (profit warning)

Safestyle UK plc (AIM: SFE), the leading retailer and manufacturer of PVCu replacement windows and doors to the UK homeowner market, today issues a trading update in advance of its preliminary results announcement for the year ended 31 December 2019 ("FY19") on 19 March 2020.

This is a turnaround situation. H2 beat prior year comparative;

Turnover for FY19 is expected to be c.£126 million, with the second half of 2019 delivering c.10.7% higher revenue than for the same period in the prior year.

That's great, but I'm more interested in profitability than revenues.

As a result of this investment the Board now expects an underlying loss before tax for FY19 of up to £1.5m.

This looks like a slightly worse outcome than broker consensus - Stockopedia is showing £129.5m revenues (actual is nearly 3% below this). Profit has also undershot forecast.

Outlook - the closing order book is up 24% vs end Dec 2018 - good, but no £ figure given.

Intention to spend £3m more in 2020 on marketing, which won't help profits in the short term.

Broker forecasts - have been slashed today, in one case by 68% from 7.7p EPS to only 2.4p EPS for FY 12/2020.

My opinion - why would anyone want to own shares in a double-glazing company? It's a competitive sector, and the big profits made in 2013-17 could possibly now be a thing of the past? Profits collapsed when some top salespeople jumped ship to a competitor, then had to be enticed back - no doubt on more favourable terms for the employees, hence worse terms for shareholders.

Broker forecasts today have been deeply slashed. As such, I think the muted share price reaction of only down 13% is a selling opportunity. The price should have fallen a lot more, as this is a serious profit warning for FY 12/2020, dressed up in positive-sounding narrative. When that sinks in, I wouldn't be surprised to see this share fall further.

There's been an indiscriminate rise in many shares in recent months, and I think some of these are not justified, as in this case. Hence they could fall back down to more realistic valuations perhaps.

H & T (LON:HAT)

Share price: 390p (up 7% today, at 11:34)

No. shares: 39.7m

Market cap: £154.8m

H&T Group plc ("H&T" or "the Group") the UK's leading pawnbroker, today announces a trading update for the financial year ended 31 December 2019. H&T expects to report its results for the year ended 31 December 2019 on 10 March 2020.

This is an interesting one. The share has now recovered fully from its setback in Nov 2019 (FCA investigation & changes to lending practices). Graham wrote about that here, correctly concluding that only a small part of HAT's business was affected, therefore it wasn't too serious. Good call Graham! Anyone who bought on that spike down to 280p is looking very smart now! Sometimes it can pay to catch a falling knife, just not that often.

Trading for 2019 ended up being good;

Following strong second half-year trading and a positive performance of the recently acquired Money Shop and Speedloan business assets, H&T expects the full-year profit before tax to be at the top end of current market expectations.

The narrative reads well, I won't repeat it here.

FCA - no new information, it's "working closely" to review high cost, short term credit.

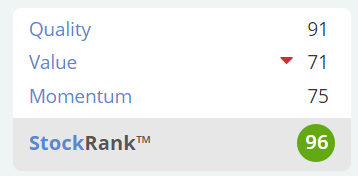

My opinion - the valuation metrics still look great value, even after the recent recovery in share price. StockRank of 96 too - worth a fresh look maybe?

TP (LON:TPG)

Share price: 8.05p (unchanged today, at 12:53)

No. shares: 779.2m

Market cap: £62.7m

2 separate links above to each RNS.

TP Group (AIM: TPG), the providers of mission-critical solutions for a more secure world, announces the following trading update for the year ended 31 December 2019.

What a ridiculous self-description. It's an engineering company, focused on energy & defence sectors.

Trading update - this following bit makes more sense, thankfully!

The Board is pleased to announce another year of substantial growth in both revenue, and adjusted operating profit, with a significant strengthening of the Group's order book.

The Group therefore reports that trading for the year ended 31 December 2019 has delivered revenue and adjusted operating profit in line with market expectations*. This strong performance has been driven by both organic growth and acquired business activities.

*Analyst research is available on the Company website.

Unfortunately, I cannot find the analyst research on TP's website. If any of you have spotted it, please can you post a link in the comments below. I was getting excited when I saw the asterisk, but the moment has now passed.

Cenkos (in which I have a long position) come to the rescue, via Research Tree, with an update note today. Their forecasts are for 0.6p adj EPS in 2019 and 2020, giving a PER of about 13 - which looks about right for this type of business.

Note that the adjusted profit figures that the broker uses are a good bit higher than those used by Stockopedia (which are usually the most conservative). This seems to be because TP is very fond of exceptional costs, which are over £1m for 2017-2020 actuals & forecast. That would need checking out if considering a purchase here.

The group has made a series of acquisitions in recent years, so potential investors would also need to check out those, and to what extent growth is coming by acquisition rather than organic?

Balance sheet - I've had a quick look at the most recent one, dated 30 June 2019, and it looks satisfactory. NTAV is fairly low, but still positive, at £7.7m.

My opinion - this type of sector doesn't really interest me, so I'm neutral on it. To value an engineering company sensibly, investors would need to see all the details of contracts, longevity & margins, etc. Without that information, trying to value the share, and assess its future prospects is really just guesswork.

Amigo Holdings (LON:AMGO) - a quick comment to round off. It's a sub-prime lender. Shares are down 28% today to 49p, due to an announcement that the company is putting itself up for sale. One strategic option being considered is de-listing the shares.

It has not received any approaches so far. It mentions a "challenging operating environment", including from the Financial Ombudsman.

Richmond Group, holding 60.66% is said by Amigo to be a willing seller.

This looks a mess.

That's it from me today. I've been very distracted by the Coronavirus issue, so apologies if individual company reports were not up to scratch, although there wasn't much to report on today.

See you tomorrow morning!

Best wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.