Good morning!

It feels like the mad January rush of updates has come to an end. Well done to Paul for his coverage of so many updates last week - a well deserved break for him now!

This list is final:

- Utilitywise (LON:UTW)

- Minds Machines (LON:MMX)

- Porvair (LON:PRV)

- Flybe (LON:FLYB)

- Leeds (LON:LDSG)

- PCI- PAL (LON:PCIP)

Utilitywise (LON:UTW)

- Share price: 2.15p (-60%)

- No. of shares: 78.5 million

- Market cap: £2 million

Strategic Review and Formal Sale Process

The warnings from the bears were sufficient to keep me away from this over the past few years.

It confirms today that it has been unable to attract enough interest in an equity raise to convince its lending bank to extend its facility. So it is putting itself up for sale. The equity appears worthless.

I've just realised the similarities between this business and Yu (LON:YU.), another utility supplier for small businesses which has turned out to be a disaster for investors. It had massively overstated its profitability (it's been making losses, not profits).

Perhaps this is a sector (energy supply for businesses) which is just best avoided?

Opus Energy (a private company) was bought by Drax (LON:DRX) for £340 million, but it has a niche in sustainable energy which may help it to stand out from the crowd. Simply assisting businesses in sourcing and managing their energy doesn't seem to make for a great investment opportunity.

Minds Machines (LON:MMX)

- Share price: 5.9p (+3.5%)

- No. of shares: 925 million

- Market cap: £55 million

This is one of the few "Sucker Stocks" that I find interesting. It helps that I know a little bit about alternative top level domains or TLDs (e.g. .vip or .investments).

This Wikipedia article includes references to Minds + Machines, so you can see which TLDs it owns. The company also presents the list on its own website.

It's easy to imagine that some of the TLDs in MMX's portfolio would be really valuable: .boston, .fashion, .wedding, .yoga. Wouldn't any yoga instructor be interested to have a ,yoga domain? It makes sense!

As a registry, MMX collects small recurring fees from website owners via the registrars such as GoDaddy (though GoDaddy doesn't offer all of MMX's domains).

I like the recurring revenue model. Note however that the fees stop whenever someone abandons their website: so if a couple no longer wish to maintain the website from their wedding, or a yoga instructor retires, that will be the end of MMX's income stream from that customer.

Let's take a look at today's update:

- Revenue up 8% to $15.5 million

- Domains under management are up much faster, by 37%, to 1.8 million.

- "Operating EBITDA" is set to be marginally ahead of expectations

The company then mentions "renewal revenue" - a nice concept. I presume this means repeat orders, where customers have been around for more than a year. This type of revenue is up 20% organically, or much more than that if you include the effect of an acquisition.

- Cash is $11.4 million (25 January)

CEO comment:

Pleasingly, the significant momentum we created last year has continued into the early part of 2019 supported by the strategic acquisition of ICM which is delivering to plan."

My view

I continue to find this one interesting. It's hard to know how big the market for its TLDs might eventually be, or how fast they might grow. Organic growth at the moment is good, though not extraordinarily high.

What I do feel confident about is that the company should be able to generate lots of recurring free cash flow from the small fees it collects on an annual basis.

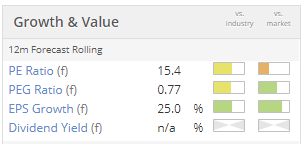

Its track record so far is poor, which helps to explain why it has a poor StockRank. For the risk-tolerant, who can believe its 2019 estimates, it could be worth a look:

Porvair (LON:PRV)

- Share price: 458.5p (+1.4%)

- No. of shares: 46 million

- Market cap: £209 million

Results for the year ended 30 November 2018

A more traditional stock with more solid financial performance, it's hard to get too excited about Porvair. Maybe that's a good thing? Boring is sometimes good when it comes to investing.

Porvair is a filtration specialist, offering a range of products and solutions for aerospace and other industrials, laboratories, and for molten metal. Most revenue is derived from US-based manufacturing.

We have occasionally covered it before - see the archives. I was left with a positive impression of the company when I examined it in June.

Good corporate governance

It releases its results (both interims and final) in a very prompt fashion. That's a lovely green flag for investors.

It also emphasises its return on capital employed - not enough companies do this. Another green flag.

While its ROCE is not enormous, at 15%, the fact that it emphasises this metric should give investors some additional comfort that the company is in safe hands.

Indeed, I've just looked up last year's annual report, to see what KPIs the company uses. Included on the list is ROCE and an adjusted ROCE (excluding goodwill, etc). There are also some non-financial KPIs related to employee safety.

Another nice little snippet from the Annual Report: the Remuneration Committee "prefers Executive Directors to hold the equivalent of at least the value of one year's base salary in Porvair shares. The Executive Directors have exceeded this guideline since April 2013."

Doing a back of the envelope calculation, the CEO holds something like 3x the value of his total annual compensation in shares. Seems good to me.

Healthy condition

When venturing into an industry where I'm not an expert (that would be most industries), I first like to establish that the general signs are positive. My general impression of Porvair, as you can tell from the above, is very positive.

What about the latest business performance, though? Key highlights:

- 11% increase in revenues to £129 million

- small increase in adjusted PBT to £13.5 million

- net cash despite capex & acquisitions

- increased dividend

- healthy order books, up on last year

The pension situation looks manageable: net liability of £12 million, with £27 million in assets and £39 million in liabilities. Given the size of the business, I wouldn't have any major concerns about this.

Conclusion

No change to my view on this stock. If anything, my look at it this morning has helped to affirm my positive view on it.

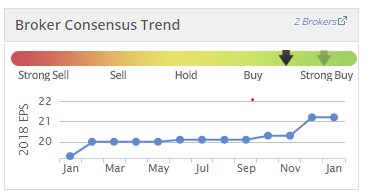

Some nice trends in earnings momentum also worth noting:

The forward P/E rating at 20x is hardly in bargain territory but it could make sense, given the company's excellent track record and highly credible corporate governance regime. It has raised its dividend every year since 2004.

Flybe (LON:FLYB)

- Share price: 4.255p (+25%)

- No. of shares: 217 million

- Market cap: £9 million

The takeover of Flybe at 1p has looked like a fait accompli. But there is an interesting development today.

The shareholders haven't all given up and the biggest shareholder, Hosking Partners, has rolled into action at last.

Sky News reported over the weekend that Hosking, a 19% shareholder, wants to get rid of and replace the current Chairman via an EGM. Flybe confirms today that it has received this request from Hosking.

But is there enough time to cancel the disposal of Flybe's operating business to the acquiring consortium?

On Thursday, Flybe released an RNS entitled "Overview of offer to shareholders". This RNS did not contain any new information, and appears to have been written merely to remind Flybe shareholders that they will be unable to prevent the sale of the company's operating assets.

Isn't it strange that the Board of a company is so determined to convince its shareholders that they have no choice but to go along with its plans? Thursday's RNS did not seem to be written in the spirit of a Board which is acting in the interests of its shareholders.

Time is running out, though. The disposal of the trading subsidiaries is expected by 22 February.

My understanding of EGM rules is that the EGM must take place within 28 days, if it was properly requested.

So if the meeting was called for by Hosking on Friday, then the EGM will have to take place by 22 February - the same day by which the disposal of Flybe's businesses is expected to complete.

So I'm afraid that Flybe shareholders are very likely to lose the airline before the EGM takes place, unless their current Board changes its mind.

Leeds (LON:LDSG)

- Share price: 25p (-7%)

- No. of shares: 27 million

- Market cap: £7 million

I mention this for completeness, as we have mentioned it before.

The main operating subsidiary, based in Germany, can be viewed at this link. It's a textile wholesaler.

It is small and getting smaller in H1, with declining revenues being managed by cost-cutting and efficiency initiatives.

The Chairman is optimistic:

The Board continues to believe that the result for the full year will be at a higher level to last year despite the challenging market conditions.

My view

I don't see what the rationale could be for this to remain a listed entity in the UK. The free float is very small.

Looks like a dangerous small-cap to get involved with. Can't imagine what sort of competitive differentiation it might enjoy.

PCI- PAL (LON:PCIP)

- Share price: 25.5p (+46%)

- No. of shares: 43 million

- Market cap: £11 million

Trading Update & Notice of Results

This sounds like it has potential. It describes itself as "the customer engagement specialist that secures and protects payment card data for companies handling payments by phone". It lists some well-known companies and charities as clients on its homepage.

Its "agent assist" product intercepts the tones when a customer types in their credit card details, so it should be much more secure than having the customer read out their details to the agent. Sounds like a good idea to me.

This update has been very well received:

- contract value of orders in H1 is £3.4 millon, more than the entire value of orders signed last year.

- "recurring annual contract value" of the new contracts is £1.3 million

- like-for-like revenue has grown by at least 25%.

Judging from the financial summary, it looks as if it will be unprofitable this year. Maybe it can reach breakeven in FY 2020:

Stocko computers rate it as a Sucker Stock, with a StockRank of 12. Early-stage companies like this usually fail to make it. But I do like the concept behind this company - reading out my credit card details over the phone never feels terribly secure. So a better solution that achieved wide adoption would be very welcome indeed.

Other snippets:

- TT electronics (LON:TTG) - trading update in line with expectations and finds extra efficiency with a slightly larger redundancy programme at its acquisition, Stadium (SDM).

- Paragon Banking (LON:PAG) - guidance unchanged

- Maintel Holdings (LON:MAI) - trading comfortably in line with expectations

That's it from me today. There are 60 days left until Brexit so I'm expecting lots more turbulence in the weeks ahead - particularly in the currency market. Hang on to your hats!

See you tomorrow

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.